Rapid Development of AI and ML Enabled Navigation Systems

The technological shift towards adoption of AI and ML in marine navigation system is a key trending factor that accelerates the deployment of collision avoidance and object detection system in the maritime industry which is propelling the market growth. The adoption of AI and ML provides added safety features in the navigation system for marine applications with precise accuracy and efficiency. The associated advantages of using the AI and ML in maritime industry enhances the predictive capabilities and make the operations more efficient. Some implementations include real-time analytics, improved scheduling, automated processes, and among others. The AI optimizes the navigational sense using machinery and engines' data transmitted by connected sensors allowing the predictive maintenance. Machine learning algorithms help optimize routes to minimize fuel consumption, using the vessel'ss information. Furthermore, AI and ML integrated with collision avoidance and object detection systems automatically detects hazardous objects or small vessels in the path of the ship even during times of low visibility. The growing initiatives for development of AI-based navigation system from leading players is anticipated to propel the market growth. For instance, in June 2022, Sea Machines Robotics has unveiled AI-ris, a new marine computer-vision navigation sensor designed to improve safety and performance of vessels. Thus, such advantageous features of using AI and ML enabled navigation systems is anticipated to drive the market growth over the forecast period.Market Overview

South America is segmented into Brazil, Argentina, Colombia, and several small island nations. The strong presence of tourism and commercial marine industries has contributed significantly to the notable number of marine vessels and marinas for sea-related leisure and sports activities. Though, the industry is heavily fragmented, presence of significant number of small players have facilitated in the development of port infrastructure and technological adoption for their seamless operation across prominent commercial ports throughout the Latin American countries. Furthermore, the rising inclination toward advanced technologies such as UAVs is significantly contributing to the market growth. For instance, in June 2022, TASA, a Peruvian fishing company, introduced its first unmanned surface vessel (USV) for oceanographic & marine resource monitoring and fish-finding activities. This UAV is integrated with collision avoidance sensors and object detection technologies to enhance situational awareness and mitigate collision risk. Thus, significant development and adoption of advanced technologies by the marine industry is driving the market.South America Collision Avoidance and Object Detection Maritime Market Segmentation

The South America collision avoidance and object detection maritime market is segmented into by technology, application, end user, and country.- Based on technology, the market is segmented into LiDAR, computer vision, radar, and others. The radar segment held the largest market share in 2022.

- Based on application, the market is segmented into blind spot detection, night vision, and others. The others segment held the largest market share in 2022.

- Based on end user, the market is segmented into unmanned surface vehicle, ships, and autonomous underwater vehicle (AUV). The Ships segment dominated the market share in 2022.

- Based on country, the market is segmented into Brazil, Argentina, and the Rest of South America. Brazil segment dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. South America Collision Avoidance and Object Detection Maritime Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 South America

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. South America Collision Avoidance and Object Detection Maritime Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Rising Number of Ships and Boats

5.1.2 Increasing Research on Autonomous Navigation Systems

5.2 Market Restraints

5.2.1 Integration with Legacy Systems

5.3 Market Opportunities

5.3.1 Rising Demand for Personal Yachts and Recreational Boats

5.3.2 Growing Research on Military Applications of Unmanned Surface Vehicles and Autonomous Underwater Vehicles

5.4 Key Market Trends

5.4.1 Rapid Development of AI and ML Enabled Navigation Systems

5.4.2 Rising Popularity of Expedition Cruises

5.5 Impact Analysis of Drivers and Restraints

6. Collision Avoidance and Object Detection Maritime Market - South America Market Analysis

6.1 South America Collision Avoidance and Object Detection Maritime Market Overview

6.2 South America Collision Avoidance and Object Detection Maritime Market Forecast and Analysis

7. South America Collision Avoidance and Object Detection Maritime Market Analysis - By Technology

7.1 Overview

7.2 South America Collision Avoidance and Object Detection Maritime Market, By Technology (2021 And 2028)

7.3 LiDAR

7.3.1 Overview

7.3.2 South America LiDAR: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

7.4 Computer Vision

7.4.1 Overview

7.4.2 South America Computer Vision: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

7.5 Radar

7.5.1 Overview

7.5.2 South America Radar: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 South America Others: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

8. South America Collision Avoidance and Object Detection Maritime Market Analysis - By Application

8.1 Overview

8.2 South America Collision Avoidance and Object Detection Maritime Market, By Application (2021 And 2028)

8.3 Blind Spot Detection

8.3.1 Overview

8.3.2 South America Blind Spot Detection: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

8.4 Night Vision

8.4.1 Overview

8.4.2 South America Night Vision: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

8.5 Others

8.5.1 Overview

8.5.2 South America Others: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

9. South America Collision Avoidance and Object Detection Maritime Market Analysis - By End user

9.1 Overview

9.2 South America Collision Avoidance and Object Detection Maritime Market, By End user (2021 and 2028)

9.3 Unmanned Surface Vehicle

9.3.1 Overview

9.3.2 South America Unmanned Surface Vehicle: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

9.4 Ships

9.4.1 Overview

9.4.2 Ships: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

9.5 Autonomous Underwater Vehicle (AUV)

9.5.1 Overview

9.5.2 South America Autonomous Underwater Vehicle (AUV): Collision Avoidance and Object Detection Maritime Market Revenue and Forecast To 2028 (US$ Million)

10. South America Collision Avoidance and Object Detection Maritime Market - Country Analysis

10.1 South America: Collision Avoidance and Object Detection Maritime Market

10.1.1 South America: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

10.1.2 South America: Collision Avoidance and Object Detection Maritime Market, by Key Country

10.1.2.1 Brazil: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

10.1.2.1.1 Brazil: Collision Avoidance and Object Detection Maritime Market, by Technology

10.1.2.1.2 Brazil: Collision Avoidance and Object Detection Maritime Market, by Application

10.1.2.1.3 Brazil: Collision Avoidance and Object Detection Maritime Market, by End User

10.1.2.2 Argentina: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

10.1.2.2.1 Argentina: Collision Avoidance and Object Detection Maritime Market, by Technology

10.1.2.2.2 Argentina: Collision Avoidance and Object Detection Maritime Market, by Application

10.1.2.2.3 Argentina: Collision Avoidance and Object Detection Maritime Market, by End User

10.1.2.3 Rest of South America: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

10.1.2.3.1 Rest of South America: Collision Avoidance and Object Detection Maritime Market, by Technology

10.1.2.3.2 Rest of South America: Collision Avoidance and Object Detection Maritime Market, by Application

10.1.2.3.3 Rest of South America: Collision Avoidance and Object Detection Maritime Market, by End User

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Merger and Acquisition

12. Company Profiles

12.1 Benewake (Beijing) Co Ltd

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Raytheon Anschutz GmbH

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Garmin Ltd

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Sea Machines Robotics Inc

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Teledyne FLIR LLC

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Furuno Electric Co Ltd

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

13. Appendix

13.1 About the Publisher

13.2 Word Index

List of Tables

Table 1. South America Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

Table 2. South America: Collision Avoidance and Object Detection Maritime Market, by Technology - Revenue and Forecast to 2028 (US$ Million)

Table 3. South America: Collision Avoidance and Object Detection Maritime Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 4. South America: Collision Avoidance and Object Detection Maritime Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 5. South America: Collision Avoidance and Object Detection Maritime Market, by Country - Revenue and Forecast to 2028 (US$ Million)

Table 6. Brazil: Collision Avoidance and Object Detection Maritime Market, by Technology - Revenue and Forecast to 2028 (US$ Million)

Table 7. Brazil: Collision Avoidance and Object Detection Maritime Market, by Application- Revenue and Forecast to 2028 (US$ Million)

Table 8. Brazil: Collision Avoidance and Object Detection Maritime Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 9. Argentina: Collision Avoidance and Object Detection Maritime Market, by Technology - Revenue and Forecast to 2028 (US$ Million)

Table 10. Argentina: Collision Avoidance and Object Detection Maritime Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 11. Argentina: Collision Avoidance and Object Detection Maritime Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 12. Rest of South America: Collision Avoidance and Object Detection Maritime Market, by Technology - Revenue and Forecast to 2028 (US$ Million)

Table 13. Rest of South America: Collision Avoidance and Object Detection Maritime Market, by Application- Revenue and Forecast to 2028 (US$ Million)

Table 14. Rest of South America: Collision Avoidance and Object Detection Maritime Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 15. List of Abbreviation

List of Figures

Figure 1. South America Collision Avoidance and Object Detection Maritime Market Segmentation

Figure 2. South America Collision Avoidance and Object Detection Maritime Market Segmentation - By country

Figure 3. South America Collision Avoidance and Object Detection Maritime Market Overview

Figure 4. Radar Segment held the Largest Share of South America Collision Avoidance and Object Detection Maritime Market

Figure 5. Brazil to Show Great Traction During Forecast Period

Figure 6. South America - PEST Analysis

Figure 7. Expert Opinion

Figure 8. South America Collision Avoidance and Object Detection Maritime Market: Impact Analysis of Drivers and Restraints

Figure 9. South America Collision Avoidance and Object Detection Maritime Market Forecast and Analysis (US$ Million)

Figure 10. South America: Collision Avoidance and Object Detection Maritime Market Revenue Share, by Technology (2021 & 2028)

Figure 11. South America LiDAR: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 12. South America Computer Vision: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. South America Radar: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. South America Others: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. South America: Collision Avoidance and Object Detection Maritime Market Revenue Share, by Application (2021 & 2028)

Figure 16. South America Blind Spot Detection: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. South America Night Vision: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. South America Others: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. South America: Collision Avoidance and Object Detection Maritime Market Revenue Share, by End User (2021 & 2028)

Figure 20. South America Unmanned Surface Vehicle: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. Ships: Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. South America Autonomous Underwater Vehicle (AUV): Collision Avoidance and Object Detection Maritime Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. South America: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

Figure 24. South America: Collision Avoidance and Object Detection Maritime Market Revenue Share, by Key Country (2021 & 2028)

Figure 25. Brazil: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

Figure 26. Argentina: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

Figure 27. Rest of South America: Collision Avoidance and Object Detection Maritime Market - Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- Benewake (Beijing) Co Ltd

- Orlaco Products BV

- Raytheon Anschutz GmbH

- Garmin Ltd

- Sea Machines Robotics Inc

- Teledyne FLIR LLC

- Furuno Electric Co Ltd

Table Information

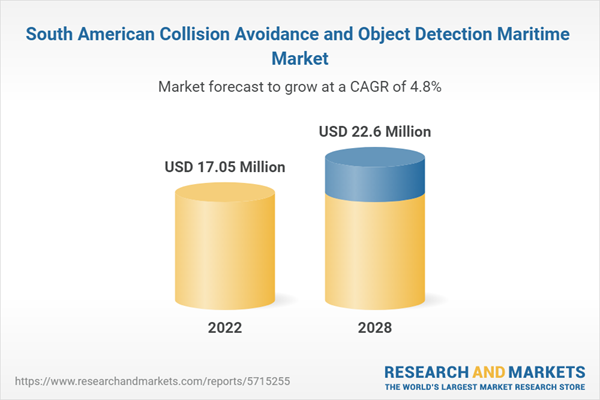

| Report Attribute | Details |

|---|---|

| No. of Pages | 107 |

| Published | December 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 17.05 Million |

| Forecasted Market Value ( USD | $ 22.6 Million |

| Compound Annual Growth Rate | 4.8% |

| No. of Companies Mentioned | 7 |