Speak directly to the analyst to clarify any post sales queries you may have.

An essential primer on how automated liquid handling systems are redefining laboratory throughput, reproducibility, and strategic R&D priorities across life sciences

Automated liquid handling technologies have become foundational to modern laboratory operations, enabling consistent, high-throughput workflows across research, diagnostics, and biomanufacturing. As organizations pursue faster discoveries, reproducible results, and scalable pipelines, automated systems reduce manual variability while optimizing throughput and resource utilization. The convergence of mechanical precision, software control, and consumables innovation has elevated these instruments from optional conveniences to strategic assets that underpin experimental fidelity and operational efficiency.

In addition, laboratories are increasingly integrating automation to address skill shortages, minimize repetitive pipetting errors, and support complex protocols that would be impractical at scale by hand. Consequently, decision-makers are evaluating not only instrument performance but also the broader ecosystem: software interoperability, consumable standardization, service agreements, and the capacity for future upgrades. Transitional investments must therefore be considered in light of total cost of ownership, workflow compatibility, and downstream analytical pipelines.

Looking forward, stakeholders should anticipate a landscape where automation supports distributed and modular laboratory architectures. These changes will influence procurement priorities, experimental design, and talent development, as labs reconfigure around capabilities that enable reproducibility, regulatory compliance, and faster translational timelines. The introduction of new dispensing and sensing modalities will continue to reshape how teams design experiments, interpret data, and accelerate innovation.

Evolving modalities, integration standards, and service-centric models are driving rapid reconfiguration of lab workflows and procurement priorities across the automation ecosystem

The landscape for automated liquid handling is undergoing transformative shifts driven by technological innovation, evolving laboratory practices, and changing regulatory expectations. Miniaturization and precision advances have enabled acoustic dispensing and pipetting technologies to handle smaller volumes with greater accuracy, thereby unlocking new assay formats and cost efficiencies. At the same time, improvements in liquid level sensing and integrated feedback control are reducing failed runs and improving sample integrity, which in turn elevates the reliability of downstream data.

Beyond hardware, software architecture and open integration standards are accelerating the adoption of modular workflows. This shift allows laboratories to assemble best-of-breed components-such as colony pickers, microplate processors, and labware dispensing systems-into cohesive, automated pipelines. Concurrently, the emphasis on data provenance and auditability has placed connectivity and metadata capture at the core of purchasing criteria. Vendors that provide robust APIs, validated software stacks, and secure cloud or on-premise data management are gaining preference among institutions seeking operational transparency and regulatory readiness.

Operationally, there is a trend toward service-led models that combine instrumentation with consumable supply assurance, preventive maintenance, and application support. These arrangements reduce downtime risk and enable laboratories to scale without proportionately expanding internal technical maintenance burdens. Consequently, strategic partnerships and ecosystem plays are becoming as important as product specifications in shaping long-term adoption.

How tariff-induced cost pressures and supply chain recalibration in 2025 are reshaping sourcing strategies, contractual risk allocation, and regulatory compliance across laboratory automation

The introduction and escalation of United States tariff measures in 2025 have had a multi-faceted cumulative impact on the automated liquid handling supply chain, procurement strategies, and operational planning across laboratories and vendors. Tariff pressures have amplified cost sensitivities for components sourced internationally, prompting manufacturers to reassess sourcing geographies and to reconfigure supply chains to mitigate exposure. Consequently, many original equipment manufacturers are accelerating regionalization efforts, moving critical manufacturing steps closer to key end markets to reduce landed costs and lead-time risks.

These shifts have influenced procurement behavior among clinical labs, academic institutions, and contract research organizations, which now weigh total procurement cost against performance and service guarantees. In response, procurement teams are increasingly negotiating bundled service agreements that lock predictable maintenance and consumable supply terms to offset initial instrument price pressures. Similarly, distributors and resellers are adjusting inventory strategies to preposition critical spares and consumables, thereby maintaining continuity for customers facing longer global transit times.

Regulatory compliance and documentation requirements have also gained prominence, as tariff-driven supplier realignments necessitate updated supplier qualification records and conformity assessments. This has placed additional administrative burdens on quality and procurement functions that must validate alternate suppliers or requalify components. Overall, tariffs have catalyzed a renewed focus on supply chain resilience, supplier diversification, and contractual mechanisms to share and manage economic risk.

How nuanced product, technology, application, and end-user distinctions determine procurement trade-offs, integration complexity, and workflow scalability for laboratory automation

Product type differentiation remains a central axis for purchasers assessing automation investments, with distinct operational needs driving preference for colony pickers in microbial and cellular workflows, labware dispensing systems for reagent and media handling, microplate processors for integrated assay automation, and pipetting systems for flexible liquid transfer across diverse protocol requirements. Each product category carries unique integration demands and consumable footprints, which influence total workflow design and lab layout planning. Moreover, the choice among these product types often depends on throughput targets, assay complexity, and available bench space, requiring a careful alignment of instrument capabilities with process objectives.

Technological segmentation further determines how laboratories achieve precision and adaptability. Acoustic dispensing offers contactless, highly accurate low-volume transfers suitable for miniaturized assays and compound management, whereas liquid level sensing enhances reliability in varied labware formats by preventing aspirate/dispense errors. Pipetting technology platforms provide a balance of throughput and flexibility, enabling protocol customization and method portability. In practice, labs combine these technologies to optimize cost per test, experimental fidelity, and automation footprint.

Application-driven considerations also shape procurement decisions. Drug discovery workflows emphasize throughput and compound handling robustness, genomics applications demand precise workflows for library preparation, next generation sequencing setups, and polymerase chain reaction preparation, with NGS platforms further differentiated between compatibility with Illumina and Ion Torrent ecosystems. In vitro diagnostics prioritize assay validation, reproducibility, and regulatory traceability, while proteomics workflows require integration with downstream sample prep and separation systems. End users-ranging from academic research institutions to clinical diagnostics laboratories, contract research organizations, and pharmaceutical and biotech firms-evaluate solutions based on long-term supportability, data integrity, and the capacity to scale from benchtop experiments to production processes.

Regional variations in adoption, support infrastructure, and regulatory requirements are driving differentiated strategies for vendors and purchasers across global automation markets

Geographic dynamics continue to influence adoption rates, procurement models, and support ecosystems for automated liquid handling, with regional market characteristics shaping vendor strategies and deployment patterns. In the Americas, demand is frequently driven by large-scale pharmaceutical hubs, leading to strong adoption in drug discovery and biomanufacturing contexts and a mature aftermarket for service and consumable supply. The region often prioritizes rapid deployment timelines, comprehensive service coverage, and integration with established laboratory information management systems, which in turn favors vendors with robust local support networks and field engineering capabilities.

Across Europe, the Middle East & Africa, regulatory diversity and heterogenous healthcare infrastructures require flexible commercial approaches and localized validation workflows. Adoption in academic research centers emphasizes open-platform compatibility and grant-driven procurement, while clinical diagnostics facilities focus on certified workflows and traceable performance. Vendors operating in this region must balance cross-border logistical complexity with tailored support offerings to address varied national regulatory regimes.

In Asia-Pacific, rapid expansion of biotech clusters and government-supported genomics and diagnostics initiatives are accelerating uptake, with emphasis on cost-effective automation, localization of manufacturing, and partnerships that support technology transfer. Markets within the region differ notably in their emphasis on domestic manufacturing capability versus imported advanced systems, prompting a mix of global vendor presence and growing local OEM capacity. Across all regions, service availability, lead times for consumables, and the ability to provide regulatory documentation remain primary determinants of long-term vendor selection.

How technology differentiation, service-led offerings, and partnership-led solution strategies are reshaping competitive advantage and customer retention in the automation landscape

Competitive dynamics in the automated liquid handling sector are increasingly defined by a blend of technological differentiation, service models, and strategic partnerships. Leading players are investing in integrated software ecosystems that facilitate protocol transfer, remote monitoring, and data capture to address customers' needs for traceability and ease of validation. Meanwhile, smaller innovators and academic spinouts are contributing disruptive capabilities in areas such as acoustic dispensing, microfluidics, and novel sensing modalities, often establishing niche positions that larger vendors seek to acquire or partner with to broaden their solution stacks.

Service and consumables strategies are an important competitive lever. Firms that combine predictable consumable supply chains with robust preventive maintenance and field service operations can command stronger customer loyalty and lower total downtime for end users. Additionally, companies that offer flexible deployment options-ranging from bench-top instruments suited for academic labs to fully integrated automation lines for CROs and biopharmaceutical production-tend to capture a wider set of enterprise accounts.

Collaborations between instrument manufacturers, software providers, and third-party integrators are becoming more common, enabling turnkey solutions that accelerate customer adoption. Intellectual property in precision engineering and validated software platforms remains a key differentiator, while the ability to provide regulatory support documentation and method transfer services strengthens competitive positioning among purchasers with strict compliance requirements.

Practical strategic moves for vendors to enhance interoperability, supply chain resilience, and service-driven differentiation to capture sustainable growth opportunities

Industry leaders should act decisively to align product roadmaps, service models, and supply chains with evolving laboratory needs, focusing on actions that deliver immediate operational value while positioning for long-term resilience. Prioritize modular, interoperable architectures that enable customers to integrate colony pickers, microplate processors, labware dispensers, and pipetting systems into coherent workflows without vendor lock-in. Providing validated software interfaces and robust APIs will reduce integration friction and accelerate customer deployment timelines.

Concurrently, invest in diversified sourcing and regional manufacturing capabilities to mitigate tariff exposure and logistic disruptions. Strengthening local service footprints and offering outcome-oriented maintenance contracts will reduce downtime for end users and create recurring revenue streams. Leaders should also develop clear pathways to support genomics applications-including library preparation, next generation sequencing workflows, and PCR setup-ensuring compatibility with prevalent platform ecosystems and offering method transfer assistance for complex assays.

Finally, cultivate strategic partnerships with reagent suppliers, software integrators, and academic centers to co-develop validated protocols and training programs. These collaborative initiatives can shorten time-to-value for customers, increase stickiness of deployed solutions, and create joint go-to-market opportunities that broaden addressable end-user segments across academia, clinical diagnostics, contract research, and pharmaceutical biotechnology sectors.

A rigorous mixed-methods research framework integrating primary stakeholder interviews, technical validation, and supply chain and policy analysis to ensure actionable insights

This analysis synthesizes a mixed-methods research approach combining primary interviews with laboratory decision-makers, procurement officers, and technical managers, alongside secondary review of publicly available technical literature, regulatory guidance, and product specifications to ensure technical fidelity. Primary engagements targeted end users across academic research institutions, clinical diagnostics laboratories, contract research organizations, and pharmaceutical and biotech companies to capture firsthand insights on workflow priorities, integration challenges, and service expectations.

Secondary analysis included a systematic review of product manuals, patent filings, and technology white papers to verify claims related to acoustic dispensing, liquid level sensing, and pipetting technologies, as well as to map functional overlaps among colony pickers, labware dispensing systems, microplate processors, and pipetting platforms. For application-level insights, the methodology prioritized direct verification of genomics workflows-library preparation, next generation sequencing, and PCR setup-and cross-checked compatibility notes with prevalent sequencing platforms to ensure relevance for operational planning.

The research also incorporated supply chain and policy analysis to assess the practical implications of tariff measures, logistics constraints, and regional support capabilities. Findings were validated through iterative cross-checks with multiple stakeholders to reduce bias and to ensure that recommendations reflect operational realities and technical constraints faced by laboratories across distinct geographic regions.

Synthesis of technological, operational, and policy forces that will determine which vendors and solutions deliver reproducible, scalable, and resilient laboratory automation outcomes

In conclusion, automated liquid handling is evolving from a convenience into a strategic cornerstone of modern laboratory operations, with implications for throughput, data integrity, and operational resilience. Technological advances in acoustic dispensing, liquid level sensing, and pipetting systems are enabling new assay formats while reducing error rates, and modular integration of colony pickers, labware dispensers, and microplate processors is creating more cohesive and scalable workflows. As labs confront fiscal pressures and regulatory requirements, vendors that emphasize interoperability, validated software, and comprehensive service models will be best positioned to capture long-term partnerships.

Tariff dynamics and regional supply considerations have underscored the importance of diversified sourcing, strong regional support, and contractual mechanisms that mitigate economic exposure. End users across academic, clinical, contract research, and pharmaceutical sectors will prioritize solutions that deliver reproducibility, documented validation pathways, and predictable consumable supply. Finally, strategic collaboration between instrument manufacturers, software providers, and application specialists will accelerate method standardization and shorten time-to-value, helping laboratories transform automation investments into sustained scientific and operational outcomes.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Automated Liquid Handling Technologies Market

Companies Mentioned

The key companies profiled in this Automated Liquid Handling Technologies market report include:- Agilent Technologies Inc.

- Analytik Jena AG

- Beckman Coulter Life Sciences

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Eppendorf AG

- Formulatrix Inc.

- Gilson, Inc.

- Hamilton Company

- HighRes Biosolutions LLC

- Hudson Robotics Inc.

- INTEGRA Biosciences AG

- Mettler-Toledo International Inc.

- Opentrons Labworks Inc.

- PerkinElmer Inc.

- Sartorius AG

- SPT Labtech Ltd

- Tecan Group Ltd

- Thermo Fisher Scientific Inc.

- Waters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

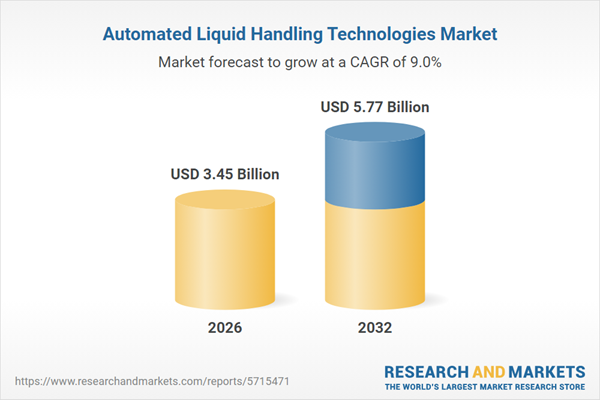

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.45 Billion |

| Forecasted Market Value ( USD | $ 5.77 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |