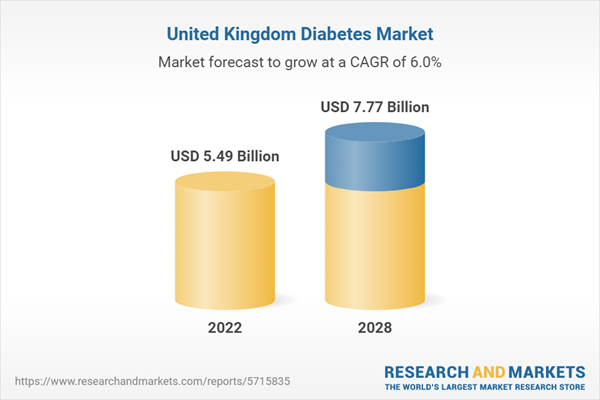

United Kingdom Diabetes Market will reach US$ 7.77 Billion in 2028 according to the publisher. The United Kingdom has the worst diabetes condition in Europe, with the most overweight and obese adults, according to the WHO. As a result, United Kingdom, have more people than ever with diabetes. Diabetes is a chronic disease that happens either when the pancreas does not make sufficient insulin or when the body cannot beneficially use the insulin it produces.United Kingdom Diabetes Market was US$ 5.49 Billion in 2022

United Kingdom Diabetes Industry to expand at a CAGR of 5.96% from 2022 to 2028

One of the biggest health challenges that the United Kingdom is facing nowadays is diabetes. Increasing health problems and complications will raise awareness of the risks, enhance self-management among people with diabetes, bring about wholesale lifestyle changes, and improve access to integrated diabetes care services. According to our research report, United Kingdom Diabetes Market was US$ 5.49 Billion in 2022.1 in 14 people in the UK has diabetes, and the number of people diagnosed has doubled in the last 15 years.

The United Kingdom Diabetes Market is driven by the rise in unit sales and lessened by ASP depreciation. The critical driver of growth will be the upsurge in the diabetic population in the country and the increasing number of patients that require various diabetes care devices to manage their disease daily. There has been a rise in the diagnosis number of people living with diabetes in the U.K. According to the British Diabetes Association Data, diabetes patients increased by over 1.5 thousand in 2020, and the number will rise to 5.5 Million if the current trends continue and warned of a 'public health emergency' by 2030.

More and more People will have Type 2 Diabetes in United Kingdom

The rate of newly diagnosed cases of Type 1 and Type 2 diabetes is seen to increase, mainly due to obesity, unhealthy diet, and physical inactivity. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic care products. According to The British Diabetic Association, Diabetes prevalence 2021 data shows a rise in the number of with a diabetes in the UK. It is estimated that more than 13.6 Million are at increased risk of type 2 diabetes in the UK. At this rate, the number of diabetes people, including the undiagnosed diabetes population, is expected to rise to 5.5 Million by 2030.Insulin Pen dominates the Market due to the High Number of Diabetes Patients

The U.K. diabetes market is classified into Self-Monitoring Blood Glucose Devices, Continuous Glucose Monitoring (CGM) Devices, Insulin pens, and Insulin Pumps. The frequency of occurrence of diabetes patients and the introduction of new and improved technology in the healthcare sector are key elements fuelling growth in the U.K. market for insulin pen production and sales. The other driving forces are the increasing awareness related to needle stick injuries, diabetes monitoring and therapeutics for better disease management, and the rise in the adoption of attached medical devices.The market share for insulin pumps will rise during the forecast period. The factors contributing to this growth are the surging cases of diabetes and awareness regarding the use of insulin pumps in the country. In addition, these pumps also provide distinct clinical benefits paired with new advanced features, like integrated CGM sensors, smartphone connectivity, etc., which fuel the demand for insulin pumps.

Government Initiatives will aid the Market

The National Service Framework (NSF) program improves services by setting national standards to improve the quality of service and tackle variations carefully. In addition, the Association of British HealthTech Industries (ABHI) 2019 launched a diabetes section, allowing diabetes technology companies to work together in one of its forums. The ABHI group is for any health technology company interested in diabetes care, from CGM and insulin pumps to apps.Key Players:

The major players competing in the United Kingdom Market are B. Braun Melsungen AG, Eli Lilly and Company, Terumo Corporation, Becton, Dickenson (B.D.), Novo Nordisk A/S, Ypsomed AG, Medtronic, Insulet Corporation, Abbott Laboratories, DarioHealth Corp., Dexcom Inc., Roche Diagnostic, and Tandem Diabetes Care.In April 2022, Abbott, CamDiab, and Ypsomed announced that they are partnering to develop and commercialize an integrated automated insulin delivery (AID) system. The initial focus of the partnership will be on European countries. The connected, smart wearable solution is designed to monitor a person's glucose levels continuously and automatically adjust and deliver the right amount of insulin at the right time, removing the guesswork of insulin dosing.

In November 2021, ARKRAY, creator of the world's first HLPC HbA1c clinical analyzer, launched its brand in the U.K. and Europe. Its innovative diabetes testing systems are being marketed and supported directly to customers rather than through a distributor.

The report titled “United Kingdom Diabetes Market & Forecast, By Continuous Glucose Monitoring (CGM Market by Components, Glucose Sensor, Transmitter, CGM User, Reimbursement), Self-Monitoring Blood Glucose Device Analysis (SMBG Market by, Test Strips, Lancet, Meter, Blood Glucose Device Users & Reimbursement) Insulin Pen Analysis - (User, Types - Disposable, Reusable and Smart Insulin Pen, Insulin Pen Needle Market, Reimbursement Policies), Insulin Pump Analysis - (Users, Market & Differentiation Points of Insulin Pump Products, Training Model for Patients & HCP, Reimbursement Policies) Companies (B. Braun Melsungen AG, Eli Lilly and Company, Terumo Corporation, Becton, Dickinson (BD), Novo Nardisk, Ypsomed AG, Medtronic, InsuletCorporation, Abbott Laboratories, DarioHealth Crop, Dexcom, Inc, Roche Diagnostic, Tandem Diabetes Care)” provides a complete analysis of United Kingdom Diabetes Industry.

Segments Market based on Devices

1. Continuous Glucose Monitoring (CGM)2. Self-Monitoring Blood Glucose (SMBG)

3. Insulin Pen

4. Insulin Pump

United Kingdom Diabetes Sub-Segment Analysis

1. Continuous Glucose Monitoring (CGM) - United Kingdom Diabetes Market breakup from four viewpoints

1. Glucose Sensor Market & Forecast2. CGM Transmitter Market & Forecast

3. CGM User

4. CGM Reimbursement

2. SMBG - United Kingdom Diabetes Market breakup from five viewpoints

1. Test Strips Market and Forecast2. Lancet Market and Forecast

3. Meter Market and Forecast

4. Blood Glucose (SMBG) Users

5. Blood Glucose Devices Reimbursement

3. Insulin Pen Market - United Kingdom Diabetes Market breakup from six viewpoints

1. Disposable Insulin Pen2. Reusable Insulin Pen

3. Smart Insulin Pen

4. Insulin Pen Needle Market

5. Insulin Pen Users

6. Reimbursement Policies

4. Insulin Pump Market - United Kingdom Diabetes Market breakup from four viewpoints

1. Insulin Pump Market2. Insulin Pump Users

3. Insulin Pump Products

4. Reimbursement Policies

All the 13 Companies Studied in the Report have been Studied from 3 Points

- Company Overview

- Recent Developments

- Financial Insight

Company Analysis

1. B. Braun Melsungen AG2. Eli Lilly and Company

3. Terumo Corporation

4. Becton, Dickinson (BD)

5. Novo Nardisk

6. Ypsomed AG

7. Medtronic

8. InsuletCororation

9. Abbott Laboratories

10. DarioHealth Crop

11. Dexcom, Inc

12. Roche Diagnostic

13. Tandem Diabetes Care

Table of Contents

1. Introduction2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United Kingdom Diabetes Market

6. United Kingdom Diabetes Population

6.1 Type 1 Diabetes

6.2 Type 2 Diabetes

7. Market Share Analysis - United Kingdom Diabetic

7.1 By Types

8. Continuous Glucose Monitoring Market (CGM) - Market & Users

8.1 CGM Market by Components

8.1.1 Glucose Sensor Market

8.1.2 CGM Transmitter Market

8.2 CGM User

8.3 Reimbursement Policies of CGM Devices in United Kingdom

9. Blood Glucose Device (SMBG) - United Kingdom Market & Users

9.1 Market

9.1.1 Type 1 Diabetes Market

9.1.2 Type 2 Diabetes Market

9.2 Test Strips Market

9.2.1 Type 1 Diabetes

9.2.2 Type 2 Diabetes

9.3 Lancet Market

9.3.1 Type 1 Diabetes

9.3.2 Type 2 Diabetes

9.4 Meter Market and Forecast

9.4.1 Type 1 Diabetes

9.4.2 Type 2 Diabetes

9.5 Blood Glucose (SMBG) Users

9.5.1 Type 1 Diabetes

9.5.2 Type 2 Diabetes

9.6 Reimbursement Policies of Blood Glucose Devices in United Kingdom

10. Insulin Pen - United Kingdom Market & User

10.1 Insulin Pen Market

10.1.1 Disposable Insulin Pen Market

10.1.2 Reusable Insulin Pen Market

10.1.3 Smart Insulin Pen Market

10.2 Insulin Pen User

10.2.1 Disposable Insulin Pen User

10.2.2 Reusable Insulin Pen User

10.2.3 Smart Insulin Pen User

10.3 Insulin Pen Needle Market

10.4 Reimbursement Policies of Insulin Pen in United Kingdom

11. Insulin Pump - United Kingdom Market & Users

11.1 Insulin Pump Market

11.1.1 Type 1 Insulin Pump Market

11.1.2 Type 2 Insulin Pump Market

11.2 Insulin Pump User

11.2.1 Type 1 Insulin Pump User

11.2.2 Type 2 Insulin Pump User

11.3 Differentiation Points of Insulin Pump Products in United Kingdom

11.3.1 Animas Vibe

11.3.2 Medtronic 530G with Enlite

11.3.3 Insulet OmniPod

11.3.4 Tandem t: slim

11.3.5 Roche Accu-Chek Combo

11.4 Training Model for Patients & HCP - of Medtronic, Animas, Insulet Corp & Tandem Diabetes Care

11.4.1 Medtronic

11.5 Insulet Corporation

11.5.1 Training Structure for New Patients - Insulet Corporation

11.6 Animas Corporation

11.6.1 Training Modules for New Patients

11.6.2 Training Modules for HCP (Health Care Professional)

11.7 Tandem Diabetes Care

11.8 Reimbursement Policies Insulin Pump

12. Insulin Pen - Company Analysis

12.1 B. Braun Melsungen AG

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 Eli Lilly

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Terumo Corporation

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 BD

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Novo Nordisk A/S

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Ypsomed AG

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

13. Insulin Pump - Company Analysis

13.1 Medtronic

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Insulet Corporation

13.2.1 Overview

13.2.2 Insulin Pump - Product Details

13.2.3 Revenue

14. SMBG - Company Analysis

14.1 DarioHealth Corp

14.1.1 Overview

14.1.2 Recent Development

14.1.3 Revenue

14.2 Abbott Laboratories

14.2.1 Overview

14.2.2 Recent Development

14.2.3 Revenue

15. CGM - Company Analysis

15.1 Dexcom Inc

15.1.1 Overview

15.1.2 Recent Development

15.1.3 Revenue

15.2 Roche

15.2.1 Overview

15.2.2 Recent Development

15.2.3 Revenue

15.3 Tandem Diabetes Care

15.3.1 Overview

15.3.2 Recent Development

15.3.3 Revenue

List of Figures:

Figure 01: United Kingdom - Diabetes Market (Billion US$), 2017 - 2022

Figure 02: United Kingdom - Forecast for Diabetes Market (Billion US$), 2023 - 2028

Figure 03: United Kingdom - Type 1 Diabetes Population (Thousand), 2017 - 2022

Figure 04: United Kingdom - Forecast for Type 1 Diabetes Population (Thousand), 2023 - 2028

Figure 05: United Kingdom - Type 2 Diabetes Population (Thousand), 2017 - 2022

Figure 06: United Kingdom - Forecast for Type 2 Diabetes Population (Thousand), 2023 - 2028

Figure 07: United Kingdom - Glucose Sensor Market Market (Million US$), 2017 - 2023

Figure 08: United Kingdom - Forecast for Glucose Sensor Market Market (Million US$), 2023 - 2028

Figure 09: United Kingdom - CGM Transmitter Market Market (Million US$), 2017 - 2023

Figure 10: United Kingdom - Forecast for CGM Transmitter Market Market (Million US$), 2023 - 2028

Figure 11: United Kingdom - CGM User (Thousand), 2017 - 2023

Figure 12: United Kingdom - Forecast for CGM User (Thousand),2023 - 2028

Figure 13: United Kingdom - Self-Monitoring of Blood Glucose (SMBG) Type 1 Diabetes Market (Million US$), 2023 - 2028

Figure 14: United Kingdom - Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 1 Diabetes Market (Million US$), 2017 - 2023

Figure 15: United Kingdom - Self-Monitoring of Blood Glucose (SMBG) Type 2 Diabetes Market (Million US$), 2023 - 2028

Figure 16: United Kingdom - Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 2 Diabetes Market (Million US$), 2017 - 2023

Figure 17: United Kingdom - Test Strips Type 1 Diabetes Market (Million US$), 2023 - 2028

Figure 18: United Kingdom - Forecast for Test Strips Type 1 Diabetes Market (Million US$), 2017 - 2023

Figure 19: United Kingdom - Test Strips Type 2 Diabetes Market (Million US$), 2023 - 2028

Figure 20: United Kingdom - Forecast for Test Strips Type 2 Diabetes Market (Million US$), 2017 - 2023

Figure 21: United Kingdom - Lancet Type 1 Diabetes Market (Million US$), 2023 - 2028

Figure 22: United Kingdom - Forecast for Lancet Type 1 Diabetes Market (Million US$), 2017 - 2023

Figure 23: United Kingdom - Lancet Type 2 Diabetes Market (Million US$), 2023 - 2028

Figure 24: United Kingdom - Forecast for Lancet Type 2 Diabetes Market (Million US$), 2017 - 2023

Figure 25: United Kingdom - Meter Type 1 Diabetes Market (Million US$), 2023 - 2028

Figure 26: United Kingdom - Forecast for Meter Type 1 Diabetes Market (Million US$), 2017 - 2023

Figure 27: United Kingdom - Meter Type 2 Diabetes Market (Million US$), 2023 - 2028

Figure 28: United Kingdom - Forecast for Meter Type 2 Diabetes Market (Million US$), 2017 - 2023

Figure 29: United Kingdom - Self-Monitoring of Blood Glucose (SMBG) Type 1 Users (Thousand), 2017 - 2022

Figure 30: United Kingdom - Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 1 Users (Thousand), 2023 - 2028

Figure 31: United Kingdom - Self-Monitoring of Blood Glucose (SMBG) Type 2 Users (Thousand), 2017 - 2022

Figure 32: United Kingdom - Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 2 Users (Thousand), 2023 - 2028

Figure 33: United Kingdom - Disposable Insulin Pen Market (Million US$), 2017 - 2023

Figure 34: United Kingdom - Forecast for Disposable Insulin Pen Market (Million US$), 2023 - 2028

Figure 35: United Kingdom - Reusable Insulin Pen Market (Million US$), 2017 - 2023

Figure 36: United Kingdom - Forecast for Reusable Insulin Pen Market (Million US$), 2023 - 2028

Figure 37: United Kingdom - Smart Insulin Pen Market (Million US$), 2017 - 2023

Figure 38: United Kingdom - Forecast for Smart Insulin Pen Market (Million US$), 2023 - 2028

Figure 39: United Kingdom - Disposable Insulin Pen User (Thousand), 2017 - 2022

Figure 40: United Kingdom - Forecast for Disposable Insulin Pen User (Thousand), 2023 - 2028

Figure 41: United Kingdom - Reusable Insulin Pen User (Thousand), 2017 - 2022

Figure 42: United Kingdom - Forecast for Reusable Insulin Pen User (Thousand), 2023 - 2028

Figure 43: United Kingdom - Smart Insulin Pen User (Thousand), 2017 - 2022

Figure 44: United Kingdom - Forecast for Smart Insulin Pen User (Thousand), 2023 - 2028

Figure 45: United Kingdom - Insulin Pen Needle Market Market (Million US$), 2017 - 2023

Figure 46: United Kingdom - Forecast for Pen Needle Market for Market (Million US$), 2023 - 2028

Figure 47: United Kingdom - Insulin Pump Market for Type 1 Diabetes Market (Million US$), 2017 - 2023

Figure 48: United Kingdom - Forecast for Insulin Pump Market for Type 1 Diabetes Market (Million US$), 2023 - 2028

Figure 49: United Kingdom - Insulin Pump Market for Type 2 Diabetes Market (Million US$), 2017 - 2023

Figure 50: United Kingdom - Forecast for Insulin Pump Market for Type 2 Diabetes Market (Million US$), 2023 - 2028

Figure 51: United Kingdom - Insulin Pump Type 1 Users (Thousand), 2017 - 2022

Figure 52: United Kingdom - Forecast for Insulin Pump Type 1 Users (Thousand), 2023 - 2028

Figure 53: United Kingdom - Insulin Pump Type 2 Users (Thousand), 2017 - 2022

Figure 54: United Kingdom - Forecast for Insulin Pump Type 2 Users (Thousand), 2023 - 2028

Figure 55: B. Braun Melsungen AG - Global Revenue (Billion US$), 2017 - 2022

Figure 56: B. Braun Melsungen AG - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 57: Eli Lilly - Global Revenue (Billion US$), 2017 - 2022

Figure 58: Eli Lilly - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 59: Terumo Corporation - Global Revenue (Billion US$), 2017 - 2022

Figure 60: Terumo Corporation - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 61: BD - Global Revenue (Billion US$), 2017 - 2022

Figure 62: BD - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 63: Novo Nordisk A/S - Global Revenue (Billion US$), 2017 - 2022

Figure 64: Novo Nordisk A/S - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 65: Ypsomed AG - Global Revenue (Billion US$), 2017 - 2022

Figure 66: Ypsomed AG - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 67: Medtronic - Global Revenue (Billion US$), 2017 - 2022

Figure 68: Medtronic - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 69: Insulet Corporation - Global Revenue (Billion US$), 2017 - 2022

Figure 70: Insulet Corporation - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 71: DarioHealth Corp - Global Revenue (Billion US$), 2017 - 2022

Figure 72: DarioHealth Corp - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 73: Abbott Laboratories - Global Revenue (Billion US$), 2017 - 2022

Figure 74: Abbott Laboratories - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 75: Dexcom Inc - Global Revenue (Billion US$), 2017 - 2022

Figure 76: Dexcom Inc - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 77: Roche - Global Revenue (Billion US$), 2017 - 2022

Figure 78: Roche - Forecast for Global Revenue (Billion US$), 2023 - 2028

Figure 79: Tandem Diabetes Care - Global Revenue (Billion US$), 2017 - 2022

Figure 80: Tandem Diabetes Care - Forecast for Global Revenue (Billion US$), 2023 - 2028

List of Tables:

Table 01: United Kingdom - Diabetes Market Share by Type (Percent), 2017 - 2022

Table 02: United Kingdom - Forecast for Diabetes Market Share by Type (Percent), 2023 - 2028

Companies Mentioned

- B. Braun Melsungen AG

- Eli Lilly and Company

- Terumo Corporation

- Becton, Dickinson (BD)

- Novo Nardisk

- Ypsomed AG

- Medtronic

- InsuletCororation

- Abbott Laboratories

- DarioHealth Crop

- Dexcom, Inc

- Roche Diagnostic

- Tandem Diabetes Care

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 5.49 Billion |

| Forecasted Market Value ( USD | $ 7.77 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 13 |