Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for a New Era in Alzheimer’s Disease Diagnostics and Therapeutics: Context, Challenges, and Emerging Priorities

The quest to comprehend and confront Alzheimer’s disease has reached an inflection point, driven by breakthroughs in diagnostic precision and therapeutic innovation. As global populations age and the demand for effective interventions intensifies, organizations across research, clinical practice, and industry must align around a shared understanding of emerging priorities. This report opens by charting the historical evolution of Alzheimer’s disease management, emphasizing how incremental discoveries in biomarkers and imaging have set the stage for transformative change.

The introduction highlights the dual imperatives of accurate early detection and the development of disease-modifying therapies. It examines how genetic testing and advanced neuropsychological assessments are converging to redefine patient stratification, while novel imaging techniques provide unprecedented clarity into disease progression. In parallel, therapeutic strategies are moving beyond symptomatic relief to target underlying pathophysiological mechanisms. By framing these developments within broader demographic trends and evolving healthcare infrastructures, this section establishes the strategic context needed to evaluate subsequent insights. Transitional commentary underscores the report’s commitment to delivering actionable guidance for stakeholders seeking to navigate a landscape where scientific discovery and commercial opportunity intersect.

Revolutionary Advances and Disruptive Innovations Reshaping the Global Alzheimer’s Diagnostic and Therapeutic Landscape with Lasting Impact

In recent years, the landscape of Alzheimer’s disease management has undergone a seismic shift, propelled by a series of technological, regulatory, and collaborative breakthroughs. Advances in blood-based biomarkers have accelerated the transition from invasive cerebrospinal fluid analysis, enabling more accessible screening initiatives. Simultaneously, next-generation genetic testing platforms are illuminating predispositions and enabling precision medicine approaches previously confined to theory.

On the imaging front, hybrid modalities that combine PET with high-resolution MRI have elevated clinicians’ ability to detect amyloid and tau pathology with exceptional sensitivity. At the same time, digital neuropsychological tools and mobile cognitive assessments are reshaping how longitudinal data is captured and interpreted, fostering earlier intervention opportunities.

Therapeutic innovation has mirrored these diagnostic strides. Monoclonal antibodies targeting specific protein aggregates are reaching new clinical milestones, while combination regimens pair cholinesterase inhibitors with NMDA receptor antagonists in novel dosing paradigms. Behavioral interventions and cognitive stimulation therapies are increasingly recognized for their capacity to synergize with pharmacological approaches. This transformation is underpinned by robust public-private partnerships that are streamlining clinical trial design, expediting regulatory review, and facilitating real-world evidence generation. Collectively, these shifts are redefining how Alzheimer’s disease is understood, diagnosed, and treated worldwide.

Assessing the Multifaceted Consequences of 2025 United States Tariffs on Alzheimer’s Disease Diagnostics and Therapeutics Supply Chains

The implementation of new tariffs by the United States in 2025 has rippled across the global Alzheimer’s diagnostics and therapeutics supply chain, impacting the cost, availability, and collaboration structures that underpin innovation. Diagnostic reagents, particularly those used in advanced imaging tracers and specialized biomarker assays, have experienced elevated import duties, prompting some manufacturers to reevaluate production footprints and distribution strategies.

As a result, providers are exploring regional manufacturing partnerships to mitigate logistical bottlenecks and cost escalations. In parallel, pharmaceutical companies developing monoclonal antibody therapies have encountered increased expenses for raw materials sourced from international suppliers, leading to renegotiations of long-term vendor contracts. These adjustments, while initially disruptive, have spurred new alliances between U.S. firms and foreign entities, aiming to localize critical components and stabilize supply pipelines.

On the clinical side, tariff-driven pricing variability has influenced trial site selection and patient enrollment dynamics, particularly in cross-border studies. Organizations are increasingly prioritizing sites with robust infrastructure and domestic sourcing capabilities to hedge against volatility. In this context, heightened emphasis on digital trial methodologies and decentralized models has emerged as a strategic response, ensuring continuity while navigating evolving trade policies. Through these adaptive measures, stakeholders are forging resilient frameworks to sustain progress in Alzheimer’s research and patient care.

Unveiling Critical Segmentation Perspectives Spanning Product, Drug Class, Patient Demographics, Disease Stage, End User, and Distribution Channel Nuances

Understanding the Alzheimer’s disease diagnostics and therapeutics market requires an integrated exploration of multiple segmentation dimensions, each revealing unique drivers and challenges. From a product standpoint, the diagnostic arena spans a spectrum of biomarker detection methods, genetic testing platforms, advanced imaging modalities, and standardized neuropsychological assessments. Innovations in blood-based biomarker assays are enhancing early detection efforts, while cerebrospinal fluid analysis continues to provide critical confirmatory insights. In imaging, the combination of CT scans, EEG monitoring, MRI, and PET imaging techniques offers layered clarity on structural and molecular pathology. Neuropsychological testing frameworks such as dementia screening questionnaires and comprehensive cognitive batteries remain vital for assessing functional status and tracking disease progression. Mirroring this, the therapeutics domain encompasses pharmacological treatments, including cholinesterase inhibitors and NMDA receptor antagonists, alongside monoclonal antibody interventions, complemented by non-drug therapies such as targeted behavioral interventions and structured cognitive stimulation programs.

When examining drug classes, the market is defined by well-established cholinesterase inhibitors like donepezil and rivastigmine, emerging NMDA receptor antagonists, and the advent of monoclonal antibodies including aducanumab and lecanemab. Each category reflects distinct efficacy and safety profiles, informing personalized treatment pathways. Patient demographics further underscore the importance of age-specific strategies, as cohorts between 65 to 74, 75 to 84, above 85, and under 65 present divergent clinical needs, comorbidity profiles, and caregiving requirements. Disease stage segmentation reveals the imperative of tailored interventions: early-stage patients benefit most from biomarker-driven therapies, while middle and late stages prioritize symptomatic relief and quality-of-life measures. End users in academic and research institutes, diagnostic centers, homecare settings, and hospitals and clinics each navigate unique operational constraints, from laboratory accreditation to caregiver coordination. Finally, distribution channels through hospital pharmacies, retail outlets, and online platforms shape accessibility and patient adherence, highlighting the need for cohesive supply strategies across all touchpoints.

Exploring Regional Dynamics and Opportunities Across Americas Europe Middle East & Africa and Asia-Pacific Markets in Alzheimer’s Disease Domain

Regional dynamics in the Alzheimer’s disease diagnostics and therapeutics landscape reveal divergent growth trajectories, regulatory frameworks, and healthcare infrastructure maturity. In the Americas, a robust ecosystem of private payers and government-funded programs supports widespread adoption of advanced imaging and genetic testing services. The United States leads with an extensive network of academic medical centers conducting pivotal trials and deploying next-generation diagnostics, while Canada increasingly leverages digital health initiatives to expand home-based cognitive assessments.

Across Europe, the Middle East, and Africa, heterogeneous reimbursement policies and regulatory environments shape market entry strategies. Western European nations benefit from centralized health technology assessment bodies, fostering streamlined access for novel therapies, whereas certain Eastern European and Middle Eastern markets face logistical and funding constraints that necessitate adaptive distribution models. The region’s emphasis on public-private partnerships has catalyzed multicenter studies, integrating local research capabilities with global development programs.

In the Asia-Pacific region, demographic trends of rapidly aging populations drive urgent demand for both diagnostics and therapeutics. Countries such as Japan and Australia exhibit high penetrations of MRI and PET imaging facilities, while emerging markets in Southeast Asia are progressively enhancing laboratory infrastructure for biomarker analysis. Government initiatives in China and India are prioritizing Alzheimer’s research funding, creating fertile ground for international collaboration. Digital health platforms are also gaining traction, enabling remote neuropsychological screening and telemedicine-based care coordination. Collectively, these regional insights underscore the necessity for strategies tailored to varying regulatory, reimbursement, and cultural landscapes.

Profiling Pioneering Companies Driving Progress in Alzheimer’s Diagnostics and Therapeutics through Strategic Collaborations and Technological Innovation

Leading companies in the Alzheimer’s diagnostics and therapeutics sphere are distinguished by their commitment to innovation, strategic alliances, and clinical rigor. Biotech organizations with pioneering monoclonal antibody pipelines are collaborating with academic institutions to refine target validation, while diagnostic firms are forging partnerships with imaging hardware manufacturers to integrate AI-driven analytics for enhanced interpretation. Pharmaceutical giants are consolidating their portfolios through acquisitions of early-stage biotech innovators, ensuring a continuum of pipeline diversity from small molecule therapies to biologics.

Contract research organizations are also evolving, offering end-to-end clinical trial services that encompass patient recruitment, decentralized monitoring, and real-world data integration. Diagnostics providers are collaborating with technology companies to develop digital cognitive assessment tools that feed directly into cloud-based platforms, enabling longitudinal patient monitoring and adaptive trial designs. Across the board, successful players are those that align R&D investments with regulatory milestones, maintaining transparent dialogue with oversight agencies to expedite approval pathways.

Furthermore, cross-industry coalitions are emerging, uniting pharma, diagnostics, and technology stakeholders to develop comprehensive care models. These coalitions aim to integrate early detection protocols with therapeutic interventions and long-term disease management plans. By leveraging combined expertise, leading companies are not only advancing individual product offerings but also shaping holistic frameworks for patient-centric care, driving improvements in clinical outcomes and operational efficiencies alike.

Delivering Actionable Strategic Recommendations for Industry Leaders to Accelerate Innovation Collaboration and Market Impact in Alzheimer’s Solutions

Industry leaders must prioritize a multifaceted strategic agenda to navigate the evolving Alzheimer’s landscape effectively. First, investing in modular diagnostic platforms that can incorporate emerging biomarker assays and imaging protocols will ensure adaptability to future scientific breakthroughs. Secondly, forging joint ventures with regional manufacturing partners can mitigate supply chain exposure to geopolitical and tariff-related disruptions.

Moreover, aligning R&D investments with precision medicine initiatives-such as genotype-driven patient stratification and digital phenotyping-will enhance clinical trial efficiency and accelerate regulatory approval. Leaders are encouraged to deepen collaborations with regulatory authorities through early engagement in parallel scientific advice procedures, creating transparent pathways for novel therapeutic classes. In parallel, developing integrated care pathways that combine pharmacological regimens with structured non-drug interventions can maximize patient adherence and long-term outcomes.

From an organizational perspective, building cross-functional teams that unite drug developers, diagnostics experts, and data scientists will foster agile decision-making and streamline product development cycles. Finally, embedding real-world evidence collection into post-launch activities will generate the longitudinal data necessary to demonstrate value outcomes to payers and healthcare systems. By adopting these recommendations, industry leaders will be well-positioned to deliver impactful solutions and sustain competitive advantage.

Illustrating Comprehensive Research Methodology Employed to Generate Robust Insights into the Alzheimer’s Disease Diagnostics and Therapeutics Sector

This analysis is grounded in a rigorous, multi-pronged research framework that integrates primary and secondary data sources. Expert interviews with neurologists, clinical trial investigators, and regulatory specialists provided qualitative insights into current challenges, unmet needs, and adoption barriers. These inputs were complemented by a systematic review of peer-reviewed literature, conference proceedings, and patent filings to track technological trajectories and intellectual property developments.

Quantitative data was sourced from publicly available regulatory filings, company disclosures, and clinical trial registries. Advanced analytical methods, including cross-sectional trend analysis and scenario mapping, were employed to evaluate the influence of trade policies, demographic shifts, and healthcare infrastructure on market dynamics. Validation protocols included triangulation of data points across multiple sources and peer review by external advisors with domain expertise.

Furthermore, a detailed segmentation framework was constructed to ensure comprehensive coverage of product categories, drug classes, patient cohorts, disease stages, end-user profiles, and distribution mechanisms. The regional landscape was assessed through local regulatory documentation, reimbursement guidelines, and direct input from in-market stakeholders. This methodological rigor underpins the report’s actionable insights, ensuring they reflect current realities and anticipate near-term developments.

Concluding Reflections on the Strategic Imperatives Challenges and Future Pathways in Alzheimer’s Disease Diagnostics and Therapeutics

In summary, the Alzheimer’s disease diagnostics and therapeutics landscape stands at a pivotal juncture characterized by remarkable scientific advances, shifting regulatory paradigms, and complex market forces. Early detection technologies and targeted therapies are converging to offer genuinely transformative patient outcomes, while adaptive strategies are emerging to mitigate geopolitical and economic uncertainties. Segmentation analysis illuminates diverse stakeholder perspectives, from product-specific innovation through to regional infrastructure considerations.

Leading organizations are distinguished by their ability to integrate cross-disciplinary expertise, leverage strategic partnerships, and harness real-world evidence to validate clinical and economic benefits. As industry participants implement the recommended best practices-ranging from modular diagnostic investments to precision medicine alignment-they will be better equipped to address unmet needs, navigate policy shifts, and deliver sustainable value.

Ultimately, the journey toward effective Alzheimer’s management demands unwavering commitment to collaboration, data-driven decision-making, and patient-centric innovation. By embracing these guiding principles, stakeholders can drive the next wave of breakthroughs, fostering a landscape where timely diagnosis and effective treatment are accessible to all.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Alzheimer's Disease Diagnostics & Therapeutics Market

Companies Mentioned

The key companies profiled in this Alzheimer's Disease Diagnostics & Therapeutics market report include:- Abbvie Inc.

- AC Immune SA

- Alector, Inc.

- Alzheon, Inc.

- Amylyx Pharmaceuticals, Inc.

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Biogen Inc.

- BioXcel Therapeutics Inc.

- Bristol-Myers Squibb Company

- Cognoptix Inc.

- Corium Inc.

- Danaher Corporation

- Denali Therapeutics Inc.

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- GE Healthcare

- Grifols, S.A.

- H. Lundbeck A/S

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Luye Pharma Group Ltd.

- Merck & Co. Inc.

- Muna Therapeutics

- Novartis AG

- Quest Diagnostics Incorporated

- Sanofi S.A.

- Siemens Healthineers AG

- Takeda Pharmaceutical Company Limited

- TauRx Therapeutics Ltd.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- Voyager Therapeutics, Inc.

- Zydus Lifesciences Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

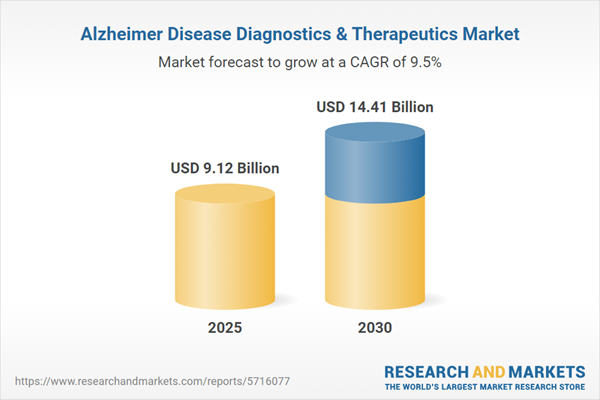

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 9.12 Billion |

| Forecasted Market Value ( USD | $ 14.41 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |