Speak directly to the analyst to clarify any post sales queries you may have.

An integrated overview of evolving consumer preferences, processing innovations, and channel dynamics shaping the fermented cucumber and gherkin landscape

Fermented cucumbers and gherkins occupy a distinctive niche where culinary tradition meets modern food systems. Over recent years these products have evolved from regional specialty items into globally traded commodities that appeal to both artisanal and industrial consumers. Beyond their sensory attributes, fermented cucumbers and gherkins are influenced by evolving consumer preferences for provenance, clean-label processing, and distinctive flavor variants, driving innovation in recipes, packaging, and retail presentation.

Manufacturers are balancing artisanal fermentation techniques with industrial controls to ensure safety, shelf stability, and consistent organoleptic profiles. Retailers and foodservice operators are experimenting with format diversification, offering chips and sliced formats alongside traditional spears and whole picks to capture varied consumption occasions. At the same time, distribution channels are adjusting to hybrid buying behaviors where online convenience complements brick-and-mortar experiences. Collectively, these dynamics underscore the need for a strategic perspective that links product development, channel strategy, and operational capability to capture growth and maintain resilience in a changing competitive environment.

This introduction frames the subsequent analysis by clarifying how core drivers such as processing technology, flavor innovation, and distribution agility intersect to shape competitive advantage. By focusing on these intersecting trends, stakeholders can better align investments in production, packaging, and go-to-market approaches with consumer and channel expectations.

How technological innovation, tightening regulations, and omnichannel retailing are reshaping production, packaging, and competitive positioning in the fermented cucumber sector

The fermented cucumber and gherkin landscape is undergoing transformative shifts driven by technological adoption, regulatory scrutiny, and changing consumption patterns. Advances in controlled fermentation technology are enabling producers to scale artisanal flavor profiles while enhancing food safety and reducing batch variability. Simultaneously, ingredient innovation-such as precision brine formulations and tailored microbial cultures-is fostering a wider range of flavor variants that appeal to health-conscious and adventurous consumers alike.

On the distribution side, omnichannel retailing has reconfigured how consumers discover and purchase fermented products, increasing the importance of e-commerce and direct-to-consumer strategies without eliminating the role of traditional supermarket and foodservice relationships. In parallel, sustainability considerations are influencing sourcing, packaging, and waste management practices, prompting players to invest in recyclable jars and reduced-salt formulations. Regulatory environments are tightening around labeling and pathogen controls, which is accelerating compliance investments and affecting smaller processors differently than larger, better capitalized firms.

Together, these shifts create a new competitive calculus: firms that combine reliable processing controls, flexible packaging solutions, and a clear narrative around flavor authenticity and sustainability will be positioned to capture premium segments, while others will need to prioritize operational upgrades to remain viable.

Cascading trade policy outcomes and strategic supply chain adjustments that follow tariff shifts and alter sourcing, logistics, and capital allocation across the value chain

Recent tariff actions affecting imported food products have created a cascade of operational and strategic responses across global supply chains, and fermented cucumbers and gherkins are no exception. Tariff adjustments create immediate cost pressures for import-dependent distributors and retailers, incentivizing a reassessment of sourcing strategies and accelerating nearshoring or supplier diversification efforts. Import duties also alter competitive dynamics by narrowing price differentials between domestic producers and foreign suppliers, which can advantage manufacturers with local capacity while pressuring import-reliant brands to absorb costs or reconfigure offerings.

Beyond direct cost impacts, tariffs influence logistical decisions. Importers may shift shipment patterns to consolidate loads, renegotiate contract terms, or invest in longer shelf-life packaging to mitigate frequency constraints. Foodservice operators that source specialty imported varieties may elect to reformulate menu items or promote locally produced equivalents to manage margin risk. Moreover, tariffs can catalyze longer-term investments in domestic fermentation capacity, driving capital allocation toward processing lines, cold chain improvements, and quality assurance systems that reduce reliance on volatile cross-border trade.

In sum, tariff-induced changes are not limited to pricing; they stimulate strategic repositioning across sourcing, product formulation, and capital deployment. Stakeholders will need to weigh short-term mitigation against long-term structural adaptations to maintain supply continuity and preserve customer value propositions.

Deep segmentation analysis linking product formats, channel behaviors, packaging choices, flavor preferences, and fermentation methods to strategic product and go-to-market decisions

A nuanced segmentation lens reveals where growth opportunities and operational pressures concentrate across product attributes, channels, packaging, end uses, flavor profiles, and processing approaches. When examining product type, chips and sliced formats are unlocking new snacking and ingredient occasions while traditional spears and whole varieties continue to serve classic culinary use cases; this divergence requires manufacturers to maintain flexible production lines that can accommodate different size calibrations and brine concentrations. Looking at distribution channel dynamics, convenience stores demand compact, on-the-go formats while supermarkets and hypermarkets prioritize shelf-ready presentations; food service remains an important institutional buyer with distinct procurement cycles encompassing hotels and catering as well as restaurants, and online retail channels-whether company websites or broader e-commerce marketplaces-require tailored packaging and fulfillment strategies to protect product quality in transit.

Packaging format plays a critical role in shelf appeal and logistics: bulk options are favored by industrial buyers and large-scale foodservice operators, jars remain the primary choice for retail trust and visibility, pouches offer lightweight alternatives for emerging markets, and tins provide niche, longer-term storage solutions. End use distinctions between food service and household consumption drive different spec and pricing tolerances, with food service often prioritizing cost efficiency and household buyers valuing convenience and flavor variety. Flavor variant segmentation shows clear consumer differentiation: dill and original profiles serve traditionalists, garlic and herb cater to more savory-forward palates, and spiced variants capture adventurous eaters seeking bold seasoning. Finally, processing type separates players investing in controlled fermentation systems to guarantee reproducibility from those relying on spontaneous fermentation traditions that emphasize terroir and artisanal differentiation. These intersecting dimensions imply that successful strategies will integrate product engineering, channel-specific packaging, and clear storytelling around flavor and process provenance.

How regional consumer preferences, regulatory regimes, and infrastructure differences drive production allocation, channel prioritization, and product adaptation across global markets

Regional dynamics underpin supply chain configuration, consumer preferences, and regulatory frameworks that shape competitive playbooks across the globe. In the Americas, consumer interest in artisanal and craft food products is driving demand for distinctive flavor variants and convenience formats, while robust retail infrastructure supports rapid distribution of jarred and sliced assortments. Producers in this region are increasingly investing in scalable controlled fermentation to meet consistency and safety expectations, and the proximity to major consumer markets enables swift response to promotional cycles and seasonal demand.

Across Europe, the Middle East, and Africa, a mosaic of culinary traditions and regulatory regimes creates both opportunities and complexities. European markets exhibit strong demand for provenance and clean-label claims, encouraging suppliers to emphasize ingredient transparency and fermentation methodology. In parts of the Middle East and Africa, growth pockets favor cost-effective bulk formats and shelf-stable packaging, with emerging retail modernization creating new entry points for imported premium products. In the Asia-Pacific region, diverse consumption patterns range from high-volume household usage to innovative snack applications; evolving cold chain capabilities and significant e-commerce adoption are influencing packaging innovation, while local fermentation traditions coexist with modern controlled processes, producing a wide spectrum of product offerings. Understanding these regional contrasts is essential for allocating production capacity, designing channel strategies, and prioritizing regulatory compliance efforts.

Operational excellence, innovation in fermentation and packaging, and channel-focused partnerships that define competitive differentiation and supplier influence across the value chain

The competitive landscape comprises established food manufacturers, specialty fermenters, and ingredient suppliers who together influence supply reliability, innovation velocity, and commercial relationships. Leading players are investing in process automation and enhanced quality management systems to reduce batch variability and ensure compliance with stricter labeling and safety standards. At the same time, specialized artisans and smaller fermenters are leveraging provenance and unique spontaneous fermentation techniques to command premium positioning among discerning consumer segments.

Strategic partnerships between manufacturers and distribution platforms are becoming more prominent as companies seek to optimize route-to-market efficiency. Suppliers that control critical inputs, such as specific microbial cultures or proprietary brine formulations, are wielding increasing influence on product differentiation. Moreover, channel-focused operators-particularly those with strong e-commerce logistics or foodservice contracting experience-are differentiating by offering flexible pack sizes and tailored servicing models. Capital investment in scalable infrastructure, combined with targeted brand narratives around flavor authenticity and sustainability, distinguishes companies that are expanding distribution footprints from those that are consolidating niche followings. Ultimately, firms that blend operational excellence with distinctive product storytelling will be best positioned to capture a broad set of commercial opportunities.

Practical strategic directives for manufacturers, distributors, and retailers to synchronize fermentation capability, packaging flexibility, and channel-tailored commercialization

Industry leaders should pursue a coordinated strategy that aligns product innovation, supply chain agility, and commercial execution to capture value across channels and regions. First, invest in controlled fermentation systems and quality assurance protocols that enable consistent sensory outcomes at scale while preserving opportunities for limited-edition spontaneous offerings that reinforce brand authenticity. Second, adopt flexible packaging platforms that allow for efficient shifts between jars, pouches, tins, and bulk formats to meet the distinct needs of retail, food service, and online fulfillment. Third, diversify sourcing by cultivating regional supplier relationships and contingency inventory plans to mitigate tariff volatility and logistical disruptions.

Concurrently, prioritize channel-specific go-to-market approaches: tailor product assortments and promotional tactics for convenience stores, supermarkets, foodservice segments like hotels and restaurants, and the unique fulfillment demands of company websites and e-commerce marketplaces. Enhance product differentiation through flavor innovation-balancing classic profiles such as dill and original with garlic and herb and spiced variants-and clearly communicate processing methods to capture both quality-focused and experiential consumers. Finally, embed sustainability metrics into packaging and ingredient sourcing decisions to meet evolving regulatory expectations and consumer preferences. Executing these recommendations will require cross-functional coordination, measurable KPIs, and a disciplined roadmap for phased investment and capability development.

A robust multipronged research approach that integrates stakeholder interviews, technical literature, and comparative analysis to validate strategic insights and scenarios

This analysis draws on a structured research approach that combines primary stakeholder interviews, secondary literature review, and cross-sectional synthesis to produce a rigorous, actionable perspective. Primary inputs include interviews with manufacturers, category buyers across retail and foodservice channels, packaging specialists, and logistics providers to capture firsthand operational constraints, innovation drivers, and channel priorities. Secondary sources encompass regulatory guidance, technical literature on fermentation science, trade publications covering distribution trends, and public disclosures that illuminate capabilities and investment patterns.

Analytical methods employed include qualitative thematic coding to identify recurring strategic themes, comparative process mapping to assess production and supply chain bottlenecks, and sensitivity testing of strategic responses to common market shocks such as tariff changes or ingredient shortages. Where appropriate, the research distilled insights into scenario narratives to help stakeholders evaluate practical tradeoffs. Throughout, the methodology emphasized triangulation across data sources to ensure robustness, and engagement with industry practitioners to validate the relevance and applicability of findings to real-world decision-making.

Closing synthesis on how operational readiness, flavor differentiation, and channel alignment together determine sustainable advantage in the fermented cucumber sector

The fermented cucumber and gherkin sector stands at a strategic inflection point where operational capability, flavor innovation, and channel adaptability determine competitive advantage. Firms that invest in consistent fermentation controls, flexible packaging, and channel-specific commercial models will be better equipped to meet divergent consumer expectations and navigate trade-related disruptions. At the same time, artisanal producers that preserve spontaneous fermentation techniques can sustain premium niche positions by emphasizing provenance and unique sensory profiles.

Looking ahead, the intersection of sustainability priorities, tighter regulatory expectations, and accelerating digital commerce will continue to reshape how products are developed, packaged, and sold. Stakeholders who proactively align capital allocation with product portfolio rationalization, invest in resilient supply chains, and articulate clear brand narratives around flavor and process will be positioned to capture enduring value. The conclusion is straightforward: strategic clarity, operational readiness, and customer-centric innovation are the pillars that will define success in the evolving fermented cucumber and gherkin marketplace.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Fermented Cucumber & Gherkins Market

Companies Mentioned

The key companies profiled in this Fermented Cucumber & Gherkins market report include:- Alnatura Produktions- und Handels GmbH

- AROMA Zemos S.A.

- B&G Foods, Inc.

- Dean Foods Pickles Ltd.

- Develey Senf & Feinkost GmbH

- Gedney Foods Company

- Grillo's Pickles Inc.

- HAK Groenten B.V.

- Hengstenberg GmbH & Co. KG

- Kuhne GmbH & Co. KG

- McClure's Pickles Inc.

- MRS. KLEIN'S PICKLES INC.

- Mt. Olive Pickle Company, Inc.

- NATURKOST SCHLUSSER GmbH

- Spreewaldhof GmbH

- The Gherkin & Pickle Co.

- The Kraft Heinz Company

- Vlasic Foods International Inc.

- Wickles Pickles LLC

- Zwanenberg Food Group B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

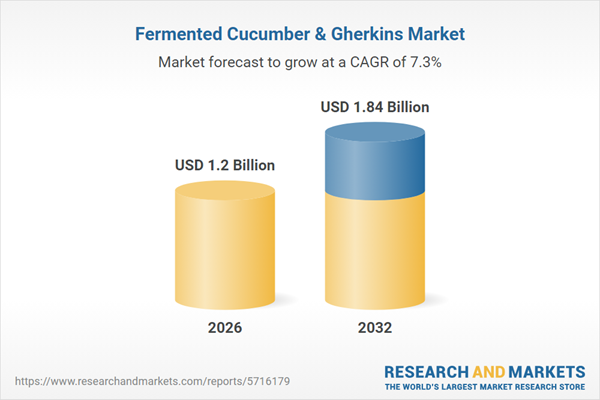

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.84 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |