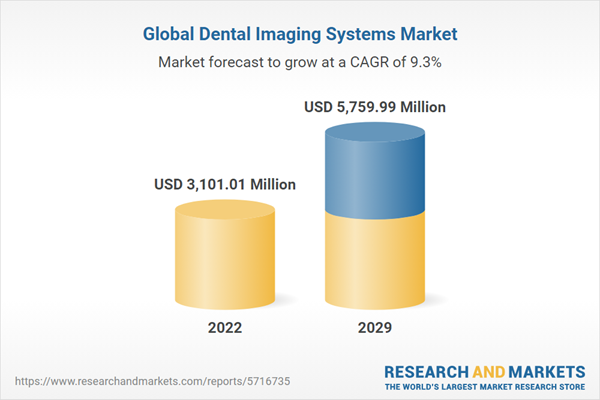

The dental imaging systems market is evaluated at US$3,101.012 million for the year 2022 and is projected to grow at a CAGR of 9.25% to reach a market size of US$5,759.989 million by the year 2029.

Dental imaging systems are advanced medical technologies used by dentists and oral healthcare professionals to capture detailed images of a patient's teeth, jaws, and oral structures. These systems encompass various modalities, such as digital radiography, Cone Beam Computed Tomography (CBCT), and intraoral scanners, providing high-quality diagnostic images essential for detecting and diagnosing dental conditions, planning treatments, and monitoring oral health.Click here

MARKET TRENDS:

Major companies like Dentsply Sirona and Planmeca play a significant role in the dental imaging systems market competing to provide cutting-edge technology and solutions to dental professionals worldwide. These companies not only innovate in terms of imaging quality and features but also ensure strict adherence to regulatory standards to maintain product safety and effectiveness.Furthermore, the future of the dental imaging systems industry is poised for further advancement. Integration of artificial intelligence (AI) is expected to play a pivotal role, allowing for automated image analysis, faster diagnoses, and more precise treatment planning.

MARKET DRIVERS:

Growth in the prevalence of dental diseases is anticipated to drive the dental imaging systems market.

The growth in the prevalence of dental disease serves as a pivotal and enduring growth factor for the dental imaging systems market due to the increasing demand for accurate diagnosis and treatment of conditions like cavities, gum disease, and oral cancers. As the global population ages and preventive dentistry gains importance, dental imaging systems play a crucial role in early intervention and treatment planning. Patient awareness and expectations for comprehensive dental care further boost the adoption of these systems.The data from the World Health Organization's Global Oral Health Status Report for the year 2022 reveals a substantial increase in the estimated impact of oral diseases on a global scale. In 2022, the number of people suffering from oral diseases has risen significantly to nearly 3.5 billion people worldwide.

Technological advancements in dental imaging may positively impact the market.

As dental imaging approaches undergo rapid technological innovation, industry players are developing and introducing new products that are anticipated to support the expansion of the dental imaging systems market in the United States. Athlos Oy, for instance, received 510(k) acceptance in July 2021 for DC-Air, a new generation of intraoral X-ray imaging sensors that opens new possibilities for X-ray imaging.Additionally, the Midmark Extraoral Imaging System (EOIS), a new product line from dental solutions provider Midmark Corp, was introduced in September 2022. It consists of 2D panoramic and 3D cone-beam computed tomography (CBCT) imaging X-ray instruments. Moreover, Preva from Midmark Corporation offers a 0.4-mm focus point for well-defined and sharp details, making pathology detection with film and digital sensors simple. There are 30 pre-programmed options for technique and large icons on the LCD control panel display that make it possible to distinguish the receptor type, patient size, and target tooth.

MARKET RESTRAINTS:

The dental imaging systems market has several obstacles that limit its expansion and general uptake. The most important of these is the considerable initial outlay needed to acquire and use cutting-edge imaging technology. The initial cost may be too much for dental offices, especially those that are smaller or located in underdeveloped countries, making it difficult for them to invest in or upgrade to state-of-the-art imaging equipment. To add to the financial strain of these systems are continuous operating costs for things like software upgrades, maintenance, and training.Furthermore, patients' and practitioners' anxiety over radiation exposure from conventional X-ray equipment and CBCT scanners may hinder the adoption of these technologies. Restraints related to regulations and compliance are also problematic, especially when it comes to patient privacy and safety regulations.

North America is predicted to account for a significant share of the dental imaging systems market.

The prevalence of dental issues is increasing in North America, dental imaging systems industry players are launching more products and doing more strategic actions, and research and development are receiving more attention. All these factors support the dental imaging systems market expansion.Furthermore, several industry participants take part in strategic projects that aid in dental imaging systems market expansion. For instance, the administrative support team for the ClearChoice Dental Implant Center network, ClearChoice Management Services (CCMS), inked a new contract with Planmeca and Henry Schein in March 2022 to enhance the patient experience with superior digital imaging technologies.

The United States is anticipated to be the fastest-growing market in the North American region.

The United States dental imaging systems market is expanding because of the country's rapidly aging population, which has a high prevalence of dental problems, as well as rising public awareness of the need for restorative and oral preventive treatments. Furthermore, the high demand for cosmetic dentistry, rising rates of tooth loss, rising per-person healthcare costs, and the introduction of numerous technologically improved items are further driving the dental imaging systems market in the nation.Further, increased dental imaging technology and rising demand for cosmetic dentistry are contributing to dental imaging systems market expansion. For example, according to a research study titled "Update on the prevalence of untreated caries in the US adult population, 2017-2020" which was published in the Journal of the American Dental Association in December 2021, the prevalence of coronal and root caries was 17.9% and 10.1%, respectively, and that it was most common in men and women in the age groups of 30-39 and 40-49.

Market Developments:

- In January 2024, In the US, Calcivis introduced a revolutionary new preventative dental technology. The company submitted a PMA supplement to the FDA in 2023 to improve its imaging system, and the new ergonomic, wireless, portable imaging equipment has been given the go-ahead to be sold.

- In November 2023, the leading provider of sensors, intraoral scanning, CBCT systems, and dental imaging technology, DEXIS announced its participation at the Greater New York Dental Meeting (GNYDM) in 2023. DEXIS OP 3D LX and DEXassist Solution, two of its most anticipated new products, were made available for hands-on testing during the event.

Segmentation:

By Technology Type

- 2D Imaging

- 3D Imaging

By Type

- Intraoral

- Extraoral

By Application

- Implantology

- Oral & Maxillofacial Surgery

- Forensics Dentistry

- Others

By End-User

- Dental Clinics & Centers

- Hospitals

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Dentsply Sirona

- Midmark Corporation

- Planmeca Group

- Owandy Radiology

- VATECH

- Ray Medical

- Planet DDS

- Genoray Co. Ltd

- Align Technology Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | February 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 3101.01 Million |

| Forecasted Market Value ( USD | $ 5759.99 Million |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |