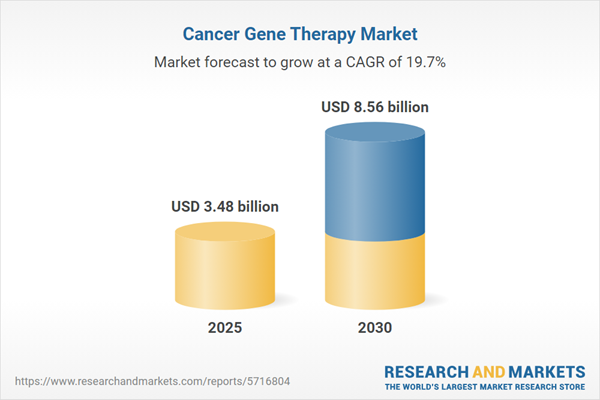

The cancer gene therapy market is projected to experience robust growth from 2025 to 2030, driven by increasing research and development (R&D) investments and the rising global incidence of cancer. This innovative field focuses on modifying genetic material within cancer cells to correct defective genes, introduce therapeutic genes, or enhance immune responses, offering potential for long-term remission in advanced cancers. The market is propelled by advancements in gene editing, oncolytic virotherapy, and immunotherapy, supported by favorable regulatory environments and significant funding. North America, particularly the United States, dominates due to its advanced healthcare infrastructure and high cancer prevalence. Challenges include high treatment costs and complex regulatory frameworks.

Market Drivers

Increasing Research and Development Investments

Significant R&D investments are fueling advancements in cancer gene therapy. In 2023, the National Institutes of Health (NIH) allocated over $1 billion for gene therapy research, reflecting strong confidence in its potential to address unmet cancer treatment needs. Collaborations, such as the partnership between Xcell Biosciences and aCGT Vector in October 2023 to develop and test gene therapies, are enhancing innovation and scalability. Additionally, funding from programs like the European Innovation Council (EIC) Accelerator, which provided Elicera Therapeutics AB with $2.67 million in 2023, supports clinical development, particularly for oncolytic virotherapy and chimeric antigen receptor (CAR) T-cell therapies.Rising Cancer Incidence

The global cancer burden is escalating, driving demand for innovative therapies. In the United States, new cancer cases rose to 1.92 million in 2023, underscoring the urgent need for effective treatments. Gene therapies, such as CAR-T and oncolytic virotherapy, target advanced-stage tumors and offer personalized solutions, enhancing remission rates. The growing prevalence of cancer, combined with the limitations of conventional treatments, positions gene therapy as a transformative approach, particularly for cancers like non-muscle-invasive bladder cancer (NMIBC) and hematological malignancies.Favorable Regulatory Environment

Supportive regulatory frameworks, particularly in the United States, are accelerating market growth. The FDA's approval of therapies like Adstiladrin in December 2023 for NMIBC and Vyjuvek in May 2023 for dystrophic epidermolysis bullosa demonstrates a commitment to expediting innovative treatments. The FDA's fast-track designations, such as for REGENXBIO's RGX-202 for Duchenne muscular dystrophy in April 2023, further streamline development, encouraging market expansion.Market Restraints

High treatment costs, such as the $2.8 million price tag for Bluebird Bio's gene therapy approved in August 2023, pose significant affordability challenges, limiting access for patients and healthcare systems. Complex regulatory frameworks and ethical concerns surrounding genetic modifications also hinder progress, requiring extensive clinical validation and compliance. Additionally, supply chain pressures, including tariffs on critical raw materials like lipid precursors and plasmid DNA, increase production costs and may delay scalability.Market Segmentation

By Therapy Type

The market includes gene-induced immunotherapy, oncolytic virotherapy, and gene transfer therapy. Immunotherapy dominates due to its effectiveness in enhancing immune responses, with CAR-T therapies like Kymriah and Yescarta leading in hematological cancers. Oncolytic virotherapy is gaining traction for its dual action of destroying cancer cells and stimulating immunity.By Vector Type

Viral vectors, particularly adeno-associated viruses (AAV) and lentiviruses, lead due to their high efficacy in gene delivery. Non-viral vectors, such as oligonucleotides, are emerging but hold a smaller share.By Geography

North America, led by the United States, holds the largest market share, driven by a 36.5% valuation of $1.3 billion in 2023, robust R&D, and high cancer prevalence. Asia-Pacific is the fastest-growing region, with a projected CAGR of 27.2% in 2025, fueled by increasing healthcare investments in China, Japan, and India.The cancer gene therapy market is set for significant growth from 2025 to 2030, driven by rising R&D investments, increasing cancer incidence, and supportive regulations. Despite challenges like high costs and regulatory complexities, advancements in immunotherapy and oncolytic virotherapy, coupled with strategic collaborations, are reshaping cancer treatment. North America leads, while Asia-Pacific's rapid growth signals global expansion. Industry players must focus on cost-effective innovations and scalable manufacturing to meet rising demand.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Segmentation:

By Therapy Type

- Immunotherapy

- Oncolytic Virotherapy

- Gener Transfer

- Others

By Vector Type

- Viral

- Non-Viral

By Cancer Type

- Breast

- Lungs

- Pancreas

- Prostate

- Others

By End-User

- Hospitals & Clinics

- Diagnostic & Research Institutes

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Shanghai Sunway Biotech Co. Ltd

- Amgen Inc.

- Novartis

- Gilead Sciences, Inc.

- Bluebirdbio, Inc

- Bristol Myers Squibb

- GlaxoSmithKline plc

- ElevateBio

- Sangamo Therapeutics

- BeiGene Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.48 billion |

| Forecasted Market Value ( USD | $ 8.56 billion |

| Compound Annual Growth Rate | 19.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |