The technology used for food processing that sterilizes liquid food, generally milk, by heating it above 135C for a short time (two to five seconds) to kill the microbial spores is known as Ultra- High-temperature processing (UHT). UHT milk was first developed in the late 1960s and was available for general use in the 1970s.

The process can be enhanced to minimize the change of color or taste of the milk with accordance to the need. Also, the UHT milk can be utilized as the base for the colored or flavored milk products. If left sealed, the UHT milk has a life of around six to nine months, which is a massive gain over pasteurized fresh milk.

UHT milk is usually more popular in countries with higher temperatures where the cost of refrigeration is a more prominent barrier to the consumption of fresh milk. UHT machines can utilize indirect or direct heating to increase the temperature of the product, both of which uses steam as the primary heating element. UHT is generally used for sterilizing milk but nowadays it is also being used for sterilizing yogurt, honey soup, cream, stew, wine, juices, and tomato paste.

COVID-19 Impact Analysis

Sourcing of essential electric components and their small parts became difficult in the early phases of lockdown due to the closure of supply chains. However, the UHT processing industry did not see any noticeable difference in sales due to the COVID-19 pandemic. Additionally, the rise in the demand for safe food that is free from bacteria and microorganisms led to many manufacturers" greater adoption of UHT technology. Dairy products were recognized as a part of the healthy diet, which helps enhance the body"s immune system and prevent infection. All these elements aided in the expansion of the UHT processing market.Market Growth Factors

Rise In The Demand For Food & Beverages With Extended Shelf Life

The concept of milk’s extended shelf life, popularly known as ESL milk, was developed in response to consumer demand for products with higher life and a wider distribution of chilled milk products. This concept has now become a significant role in the dairy industry’s dynamics, jointly with the fast development of new packaging and processing concepts. Each food item has a different shelf life, which is highly affects how food is stored, the type of storage containers, oxygen, moisture exposure, and storage temperature.Elimination Of Microbes

UHT (Ultra High Temperature) processes is well recognized to eliminate most of the microorganisms, including pathogens and inactive spores. In addition, UHT is known to attain a 12-log reduction to control the Clostridium botulinum and allow safe storage of food products at room temperature whereas other food processing methods fail to do so. UHT-processed milk is considered commercially sterile and is always packed aseptically. It is tested under extreme conditions to ensure zero deterioration of the product. Samples usually spend 15 days in a closed container at a temperature of 30 °Celsius, and if felt necessary, a 7-day provision can also be made at a temperature of 55 °Celsius.Market Restraining Factors

High Capital Requirement

For the installation and procurement of the UHT processing equipment, food & beverages processing enterprises must make significant capital expenditures. The high installation and recurring maintenance costs of specific equipment types impact the operating margins and profits of food & beverage processors and manufacturers. This is why many manufacturers avoid installing UHT processing equipment and utilize other more cost-effective options.Operation Outlook

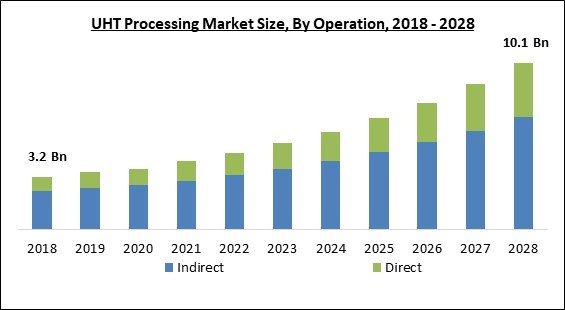

Based on the operation, the UHT processing market is segmented into direct and indirect. The direct segment acquired a significant revenue share in the UHT processing market in 2021. This is because of the high product quality attained as the steam is directly injected into the product, which is rapidly followed by flash cooling, and the treatment"s brevity. In UHT treatment, the main objective is to minimize the presence of microorganisms while ensuring minimal chemical changes in the product.End Product Form Outlook

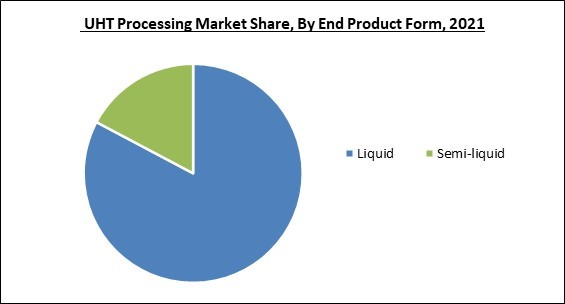

On the basis of end product form, the UHT processing market is divided into liquid and semi-liquid. The liquid segment recorded a prominent revenue share in the UHT processing market in 2021. This is due to the high use of UHT processing for sterilizing liquid foods and beverages like dairy beverages and milk alternatives. The liquid products have low viscosity, which enables them to pass through the heat exchangers. Process control, such as flow rates, can be handled for a liquid product to maintain the product temperature.Application Outlook

By application, the UHT processing market is classified into milk, dairy desserts, juices, soups, dairy alternatives and others. The juices segment registered a substantial revenue share in the UHT processing market in 2021. This is because the UHT heats the raw materials to 135C to 140C and keeps them for 3-5 seconds. This short time protects the drink from any nutrition loss. In addition, pasteurization can eliminate inhibit enzymes and harmful bacteria which increases the product’s shelf life.Regional Outlook

Region-wise, the UHT processing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the Europe region dominated the UHT processing market with the maximum revenue share. This is because UHT milk is one of the most preferred choices of processed milk in European countries. Europe also has one of the largest dairy corporations, which provides higher efficiency due to their hi-tech machines. With the presence of prominent market players, high demands, and robust infrastructure, the market in the European segment is expected to grow.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Tetra Laval International S.A., GEA Group AG, Alfa Laval AB, SPX Flow, Inc., ProXES Gmbh (Capvis AG), Neologic Engineers Pvt Ltd, Reda SpA, Elecster Oyj, Shanghai Triowin Intelligent Machinery Co., Ltd., and MicroThermics, Inc.

Strategies Deployed in UHT Processing Market

- May-2022: Capsugel introduced titanium dioxide-free (TiO2-free) white hard gelatin capsule under its already existing titanium dioxide-free capsule range. The new titanium dioxide-free capsule is based on crystallized salts to deliver the same masking and whiteness as capsules with TiO2. The product features superb opacity and light protection.

- Jan-2022: Rousselot, part of Darling Ingredients partnered with Terasaki Institute for Biomedical Innovation (TIBI), a US-based research institute. The partnership involves working together on the advancement of gelatin-based therapies. Moreover, Roussselot’s X-Pure modified gelatin range would be the perfect fit for biomedical research and the following clinical translation.

- May-2021: Rousselot, a brand under Darling Ingredients introduced X-Pure® GelDAT, the first phenol-functionalized and purified gelatin. The new product expands Rousselot"s gelatin product offerings, and further opens up opportunities for innovations.

- Jan-2021: Nitta introduced international standard gelatin intended for food fanatics. The fine-quality gelatin is based on Japanese technology and caters to the needs of the Hotel/Restaurant/Catering (HoReCa) sector.

- Dec-2020: GELITA acquired 65% ownership in SelJel, a Turkish producer of gelatine. This acquisition strengthens Gelita"s market position and complements Gelita"s product portfolio. The acquisition further enables Gelita to serve the growing demand for products with halal status.

- Oct-2020: Catalent introduced OptiGel® DR technology intended for manufacturing delayed/enteric release soft gels. The OptiGel DR technology allows soft gels to be formed by integrating pectin, and gelatin. The OptiGel DR capsules feature reduced gastric reflux effects and eradicate the processing and performance challenges. Additionally, the innovation of OptiGel DR technology enables innovators to design efficient products and further reduces yield loss and time-related to coated softgels.

- Sep-2020: Gelita came into partnership with Azelis, a Belgium-based service provider for the food ingredients and specialty chemicals industry. The partnership involves entrusting Azelis with the distribution of all gelatin products in France. Additionally, the partnership benefits Gelita by cashing on Azelis" large customer base.

- May-2019: Tessenderlo Group launched ClaroBGI600, the first product in the Claro series. ClaroBGI600 is a gelatin intended to use in bio-ink formulations and comes with a verified printing time of up to 2 hours. The new product solves printer clogging issues and reduces the cost of designing 3D-printed tissues.

Scope of the Study

By Operation

- Indirect

- Direct

By End Product Form

- Liquid

- Semi-liquid

By Application

- Milk

- Dairy Desserts

- Juices

- Soups

- Dairy Alternatives

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Tetra Laval International S.A.

- GEA Group AG

- Alfa Laval AB

- SPX Flow, Inc.

- ProXES Gmbh (Capvis AG)

- Neologic Engineers Pvt Ltd

- Reda SpA

- Elecster Oyj

- Shanghai Triowin Intelligent Machinery Co., Ltd.

- MicroThermics, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global UHT Processing Market, by Operation

1.4.2 Global UHT Processing Market, by End Product Form

1.4.3 Global UHT Processing Market, by Application

1.4.4 Global UHT Processing Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market composition and Scenarios

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Global UHT Processing Market by Operation

3.1 Global Indirect Market by Region

3.2 Global Direct Market by Region

Chapter 4. Global UHT Processing Market by End Product Form

4.1 Global Liquid Market by Region

4.2 Global Semi-liquid Market by Region

Chapter 5. Global UHT Processing Market by Application

5.1 Global Milk Market by Region

5.2 Global Dairy Desserts Market by Region

5.3 Global Juices Market by Region

5.4 Global Soups Market by Region

5.5 Global Dairy Alternatives Market by Region

5.6 Global Others Market by Region

Chapter 6. Global UHT Processing Market by Region

6.1 North America UHT Processing Market

6.1.1 North America UHT Processing Market by Operation

6.1.1.1 North America Indirect Market by Country

6.1.1.2 North America Direct Market by Country

6.1.2 North America UHT Processing Market by End Product Form

6.1.2.1 North America Liquid Market by Country

6.1.2.2 North America Semi-liquid Market by Country

6.1.3 North America UHT Processing Market by Application

6.1.3.1 North America Milk Market by Country

6.1.3.2 North America Dairy Desserts Market by Country

6.1.3.3 North America Juices Market by Country

6.1.3.4 North America Soups Market by Country

6.1.3.5 North America Dairy Alternatives Market by Country

6.1.3.6 North America Others Market by Country

6.1.4 North America UHT Processing Market by Country

6.1.4.1 US UHT Processing Market

6.1.4.1.1 US UHT Processing Market by Operation

6.1.4.1.2 US UHT Processing Market by End Product Form

6.1.4.1.3 US UHT Processing Market by Application

6.1.4.2 Canada UHT Processing Market

6.1.4.2.1 Canada UHT Processing Market by Operation

6.1.4.2.2 Canada UHT Processing Market by End Product Form

6.1.4.2.3 Canada UHT Processing Market by Application

6.1.4.3 Mexico UHT Processing Market

6.1.4.3.1 Mexico UHT Processing Market by Operation

6.1.4.3.2 Mexico UHT Processing Market by End Product Form

6.1.4.3.3 Mexico UHT Processing Market by Application

6.1.4.4 Rest of North America UHT Processing Market

6.1.4.4.1 Rest of North America UHT Processing Market by Operation

6.1.4.4.2 Rest of North America UHT Processing Market by End Product Form

6.1.4.4.3 Rest of North America UHT Processing Market by Application

6.2 Europe UHT Processing Market

6.2.1 Europe UHT Processing Market by Operation

6.2.1.1 Europe Indirect Market by Country

6.2.1.2 Europe Direct Market by Country

6.2.2 Europe UHT Processing Market by End Product Form

6.2.2.1 Europe Liquid Market by Country

6.2.2.2 Europe Semi-liquid Market by Country

6.2.3 Europe UHT Processing Market by Application

6.2.3.1 Europe Milk Market by Country

6.2.3.2 Europe Dairy Desserts Market by Country

6.2.3.3 Europe Juices Market by Country

6.2.3.4 Europe Soups Market by Country

6.2.3.5 Europe Dairy Alternatives Market by Country

6.2.3.6 Europe Others Market by Country

6.2.4 Europe UHT Processing Market by Country

6.2.4.1 Germany UHT Processing Market

6.2.4.1.1 Germany UHT Processing Market by Operation

6.2.4.1.2 Germany UHT Processing Market by End Product Form

6.2.4.1.3 Germany UHT Processing Market by Application

6.2.4.2 UK UHT Processing Market

6.2.4.2.1 UK UHT Processing Market by Operation

6.2.4.2.2 UK UHT Processing Market by End Product Form

6.2.4.2.3 UK UHT Processing Market by Application

6.2.4.3 France UHT Processing Market

6.2.4.3.1 France UHT Processing Market by Operation

6.2.4.3.2 France UHT Processing Market by End Product Form

6.2.4.3.3 France UHT Processing Market by Application

6.2.4.4 Russia UHT Processing Market

6.2.4.4.1 Russia UHT Processing Market by Operation

6.2.4.4.2 Russia UHT Processing Market by End Product Form

6.2.4.4.3 Russia UHT Processing Market by Application

6.2.4.5 Spain UHT Processing Market

6.2.4.5.1 Spain UHT Processing Market by Operation

6.2.4.5.2 Spain UHT Processing Market by End Product Form

6.2.4.5.3 Spain UHT Processing Market by Application

6.2.4.6 Italy UHT Processing Market

6.2.4.6.1 Italy UHT Processing Market by Operation

6.2.4.6.2 Italy UHT Processing Market by End Product Form

6.2.4.6.3 Italy UHT Processing Market by Application

6.2.4.7 Rest of Europe UHT Processing Market

6.2.4.7.1 Rest of Europe UHT Processing Market by Operation

6.2.4.7.2 Rest of Europe UHT Processing Market by End Product Form

6.2.4.7.3 Rest of Europe UHT Processing Market by Application

6.3 Asia Pacific UHT Processing Market

6.3.1 Asia Pacific UHT Processing Market by Operation

6.3.1.1 Asia Pacific Indirect Market by Country

6.3.1.2 Asia Pacific Direct Market by Country

6.3.2 Asia Pacific UHT Processing Market by End Product Form

6.3.2.1 Asia Pacific Liquid Market by Country

6.3.2.2 Asia Pacific Semi-liquid Market by Country

6.3.3 Asia Pacific UHT Processing Market by Application

6.3.3.1 Asia Pacific Milk Market by Country

6.3.3.2 Asia Pacific Dairy Desserts Market by Country

6.3.3.3 Asia Pacific Juices Market by Country

6.3.3.4 Asia Pacific Soups Market by Country

6.3.3.5 Asia Pacific Dairy Alternatives Market by Country

6.3.3.6 Asia Pacific Others Market by Country

6.3.4 Asia Pacific UHT Processing Market by Country

6.3.4.1 China UHT Processing Market

6.3.4.1.1 China UHT Processing Market by Operation

6.3.4.1.2 China UHT Processing Market by End Product Form

6.3.4.1.3 China UHT Processing Market by Application

6.3.4.2 Japan UHT Processing Market

6.3.4.2.1 Japan UHT Processing Market by Operation

6.3.4.2.2 Japan UHT Processing Market by End Product Form

6.3.4.2.3 Japan UHT Processing Market by Application

6.3.4.3 India UHT Processing Market

6.3.4.3.1 India UHT Processing Market by Operation

6.3.4.3.2 India UHT Processing Market by End Product Form

6.3.4.3.3 India UHT Processing Market by Application

6.3.4.4 Australia UHT Processing Market

6.3.4.4.1 Australia UHT Processing Market by Operation

6.3.4.4.2 Australia UHT Processing Market by End Product Form

6.3.4.4.3 Australia UHT Processing Market by Application

6.3.4.5 South Korea UHT Processing Market

6.3.4.5.1 South Korea UHT Processing Market by Operation

6.3.4.5.2 South Korea UHT Processing Market by End Product Form

6.3.4.5.3 South Korea UHT Processing Market by Application

6.3.4.6 Malaysia UHT Processing Market

6.3.4.6.1 Malaysia UHT Processing Market by Operation

6.3.4.6.2 Malaysia UHT Processing Market by End Product Form

6.3.4.6.3 Malaysia UHT Processing Market by Application

6.3.4.7 Rest of Asia Pacific UHT Processing Market

6.3.4.7.1 Rest of Asia Pacific UHT Processing Market by Operation

6.3.4.7.2 Rest of Asia Pacific UHT Processing Market by End Product Form

6.3.4.7.3 Rest of Asia Pacific UHT Processing Market by Application

6.4 LAMEA UHT Processing Market

6.4.1 LAMEA UHT Processing Market by Operation

6.4.1.1 LAMEA Indirect Market by Country

6.4.1.2 LAMEA Direct Market by Country

6.4.2 LAMEA UHT Processing Market by End Product Form

6.4.2.1 LAMEA Liquid Market by Country

6.4.2.2 LAMEA Semi-liquid Market by Country

6.4.3 LAMEA UHT Processing Market by Application

6.4.3.1 LAMEA Milk Market by Country

6.4.3.2 LAMEA Dairy Desserts Market by Country

6.4.3.3 LAMEA Juices Market by Country

6.4.3.4 LAMEA Soups Market by Country

6.4.3.5 LAMEA Dairy Alternatives Market by Country

6.4.3.6 LAMEA Others Market by Country

6.4.4 LAMEA UHT Processing Market by Country

6.4.4.1 Brazil UHT Processing Market

6.4.4.1.1 Brazil UHT Processing Market by Operation

6.4.4.1.2 Brazil UHT Processing Market by End Product Form

6.4.4.1.3 Brazil UHT Processing Market by Application

6.4.4.2 Argentina UHT Processing Market

6.4.4.2.1 Argentina UHT Processing Market by Operation

6.4.4.2.2 Argentina UHT Processing Market by End Product Form

6.4.4.2.3 Argentina UHT Processing Market by Application

6.4.4.3 UAE UHT Processing Market

6.4.4.3.1 UAE UHT Processing Market by Operation

6.4.4.3.2 UAE UHT Processing Market by End Product Form

6.4.4.3.3 UAE UHT Processing Market by Application

6.4.4.4 Saudi Arabia UHT Processing Market

6.4.4.4.1 Saudi Arabia UHT Processing Market by Operation

6.4.4.4.2 Saudi Arabia UHT Processing Market by End Product Form

6.4.4.4.3 Saudi Arabia UHT Processing Market by Application

6.4.4.5 South Africa UHT Processing Market

6.4.4.5.1 South Africa UHT Processing Market by Operation

6.4.4.5.2 South Africa UHT Processing Market by End Product Form

6.4.4.5.3 South Africa UHT Processing Market by Application

6.4.4.6 Nigeria UHT Processing Market

6.4.4.6.1 Nigeria UHT Processing Market by Operation

6.4.4.6.2 Nigeria UHT Processing Market by End Product Form

6.4.4.6.3 Nigeria UHT Processing Market by Application

6.4.4.7 Rest of LAMEA UHT Processing Market

6.4.4.7.1 Rest of LAMEA UHT Processing Market by Operation

6.4.4.7.2 Rest of LAMEA UHT Processing Market by End Product Form

6.4.4.7.3 Rest of LAMEA UHT Processing Market by Application

Chapter 7. Company Profiles

7.1 Tetra Laval International S.A.

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Regional Analysis of Tetra Pak

7.1.5 Regional Analysis of Sidel

7.1.6 Regional Analysis of DeLaval

7.2 GEA Group AG

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segmental and Regional Analysis

7.2.4 Research & Development Expense

7.3 Alfa Laval AB

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Segmental and Regional Analysis

7.3.4 Research & Development Expense

7.4 SPX Flow, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 Research & Development Expense

7.5 ProXES GmbH(Capvis AG)

7.5.1 Company Overview

7.6 Neologic Engineers Pvt Ltd

7.6.1 Company Overview

7.7 Reda S.p.A.

7.7.1 Company Overview

7.8 Elecster Oyj

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Research & Development Expenses

7.9 Shanghai Triowin Intelligent Machinery Co., Ltd.

7.9.1 Company Overview

7.10. MicroThermics, Inc.

7.10.1 Company Overview

Companies Mentioned

- Tetra Laval International S.A.

- GEA Group AG

- Alfa Laval AB

- SPX Flow, Inc.

- ProXES Gmbh (Capvis AG)

- Neologic Engineers Pvt Ltd

- Reda SpA

- Elecster Oyj

- Shanghai Triowin Intelligent Machinery Co., Ltd.

- MicroThermics, Inc.