A microcatheter is a single luminal catheter with a tiny diameter that is used in minimally invasive procedures. These tiny veins in the human body make up a vast network that these microcatheters are perfect for navigating. These gadgets are widely used in the medical device and healthcare sectors.

The market is projected to grow in the prevalence of cardiac illnesses, government measures to support better facilities, and an increase in the use of microcatheters. The primary drivers anticipated to propel the market are the increase in chronic diseases including cancer, neurovascular disorders, cardiovascular disorders, and other such diseases, along with the increased use of minimally invasive procedures.

Microcatheters are utilised in many different diagnostic and therapeutic treatments. They are designed to deliver different interventional equipment to the blood arteries. The artery microcatheter, neurovascular microcatheter, urinary microcatheter, and peripheral microcatheter are the most frequently utilised microcatheters.

Microcatheters can be used to access even the most complex venous network. As a result of improved technology development and growing adoption of minimally invasive procedures, it is anticipated that the market will grow faster than average in the coming years.

COVID-19 Impact Analysis

The COVID-19 pandemic increased people"s awareness of the importance of maintaining good physical, mental, and emotional health. This has led to a rise in the use of medical devices like microcatheters. However, the introduction of multiple COVID-19 vaccinations has made it easier for individuals to seek medical attention for disease diagnosis, which is projected to lead to an increase in the need for microcatheters for disease detection and treatment. Additionally, delayed procedures are now being conducted, which boosts demand for microcatheters and propels the industry"s expansion.Market Growth Factors

Significantly Rise In Prevalence Of Cardiovascular Disease

The leading global cause of morbidity and mortality is cardiovascular disease (CVD). Cerebrovascular disease, rheumatic heart disease, coronary heart disease, and other conditions may fall within the category of CVDs. The main lifestyle variables contributing to CVDs and the challenges they cause include tobacco chewing, inhalation, or consumption, an unhealthy diet and obesity, increasing alcohol use, and a lack of physical activity. The need for cardiovascular devices is projected to rise due to the significantly increased prevalence of CVDs worldwide, which will drive the microcatheter market"s expansion during the upcoming years.The population is getting older

One of the main concerns facing emerging nations globally is the growing older population. It is also projected that the prevalence of chronic conditions in the aged, like heart disease, peripheral arterial disease, and venous thromboembolism, would fuel market expansion for catheters. According to the Centers for Disease Control and Prevention, peripheral vascular disease will affect more than 19.1% of persons aged 55 to 65 by 2020, with nearly 27% of men and more than 21% of women being impacted. The market for micro catheters is expanding as there are more elderly people.Market Restraining Factors

Issues Related To The Use Of Catheters

Patients with bladder catheters may experience cramp-like contractions. It hurts when the balloon has been compelled out of the bladder. To lessen the frequency and severity of the spasms, patients may need medication. Another issue with indwelling catheters is catheter leaking. This could happen as a result of bladder spasms or faeces. Furthermore, it"s important to check if the catheter is draining because leaks could indicate a plugged catheter. An indwelling catheter might also result in blood or debris getting into the catheter tube. The use of catheters might spread a lot of bacteria that can lead to serious illnesses and impede market expansion.Product Outlook

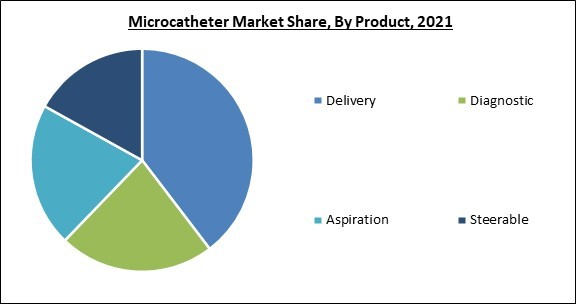

Based on Product, the Microcatheters Market is classified into Delivery, Aspiration, Diagnostic, and Steerable segments. The delivery segment dominated the market with the largest revenue share in 2021. Compared to other microcatheters, delivery microcatheters are readily available and simple to use. They function effectively and have had favourable results in patients receiving delivery microcatheters.End-user Outlook

Based on End-user, the Microcatheters Market is classified into Hospitals, Surgical Centers and Specialty Clinics, and Ambulatory Care Centers. Hospitals, Surgical Centers and Specialty Clinics accounted for the highest revenue share in the market in 2021. Because hospitals, surgical centres, and specialty clinics execute the majority of minimally invasive treatments. More and more cardiovascular and neurovascular treatments are being performed, mostly in hospitals where skilled surgeons carefully and minutely carry out the minimally invasive technique.Product Design Outlook

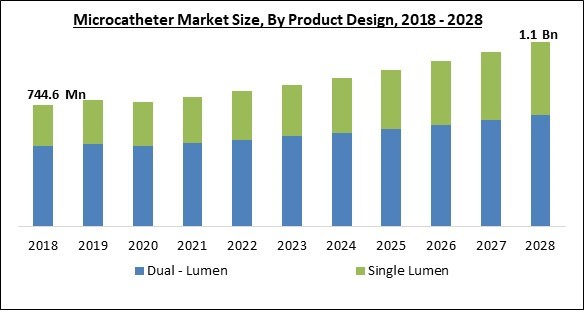

Based on Product Design, the Microcatheters Market is classified into Dual - Lumen and Single Lumen segments. In 2021, the single lumen sector will hold a sizable market share. A single lumen balloon-tipped micro catheter with the shaft strengthened at the distal end and extending into the balloon to prevent sharp changes in stiffness. A thermoplastic polyisoprene rubber with improved performance and manufacturing characteristics, such as hydrogenated polyisoprene, may be used to make the balloon.Application Outlook

Based on the Application, the Microcatheters Market is classified into Cardiovascular, Neurovascular, Peripheral Vascular, and Oncology. During the projection period, the neurovascular segment is anticipated to increase at the highest rate. According to estimates from the WHO, ischemic strokes account for 60 to 80 percent of all strokes and are estimated to be the second most prevalent cause of death and disability worldwide in 2016. The three main risk factors for stroke are diabetes, hypertension, and smoking. Thus, the demand for microcatheters is rising as a result of a rise in neurological treatments.Regional Outlook

Based on the geography, the Microcatheters Market is classified into North America, Europe, Asia Pacific, and LAMEA. North America dominated the market in 2021 as a result of the region"s established healthcare infrastructure, expanding government efforts, campaigns to increase public awareness of chronic illnesses, and high incidence of heart disease and stroke. The regional market is growing for a variety of reasons, including the accessibility of high-tech goods and the increase in demand for minimally invasive procedures.The Cardinal Matrix - Microcatheter Market Competition Analysis

The major strategies followed by the market participants are Acquisition. Based on the Analysis presented in the Cardinal matrix; Johnson and Johnson is the forerunners in the Microcatheter Market. Companies such as Boston Scientific Corporation, Terumo Corporation and Medtronic Corporation are some of the key innovators in Microcatheter Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Johnson & Johnson, Becton, Dickinson and Company, Boston Scientific Corporation, Terumo Corporation, Teleflex, Inc., Stryker Corporation, Merit Medical Systems, Inc., Cardinal Health, Inc., and Cook Medical, Inc. (Cook Group).

Strategies Deployed in Microcatheter Market

Product Launches and Product Expansions:

- Jul-2021: Terumo Medical Corporation unveiled AZUR™ Vascular Plug, a plug compatible with a microcatheter to occlude arteries up to 8mm in diameter. The product shows a balance of properties - accuracy, stability, and reliable occlusion. The technology has specific merits which make it market first in embolotherapy aimed to provide better economic benefits and clinical outcomes.

Acquisitions and Mergers:

- Nov-2022: Johnson & Johnson signed an agreement to acquire Abiomed, a medical device technology company. This acquisition broadens Johnson & Johnson"s offerings as well as helps patients.

- Aug-2022: Boston Scientific Corporation took over Obsidio, Inc., a company engaged in the development of the Gel Embolic Material (GEM™) technology utilized in the embolization of blood vessels in the peripheral vasculature. Through this acquisition, Boston Scientific Corporation enhances its interventional oncology and embolization suite with an evolved solution for physicians and their patients suffering from hemorrhages, cancer, and other debilitating conditions.

- Feb-2022: Boston Scientific Corporation completed the acquisition of Baylis Medical Company Inc., a company engaged in providing modern transseptal access solutions as well as sheaths, dilators, and guidewires, utilized for supporting catheter-based left-heart procedures. Through this acquisition, Boston Scientific Corporation becomes the only company to combine a complete access suite with available left-heart therapies including atrial fibrillation ablation and left atrial appendage closure, delivering physicians with a comprehensive toolbox to treat patients with efficiency, safety, and efficacy.

- Feb-2022: Stryker announced the acquisition of Vocera Communications, Inc., a company engaged in digital care communication and coordination. Through this acquisition, Vocera provides a supportive and advanced suite to Stryker’s Medical division that would improve Stryker"s Advanced Digital Healthcare suite and accelerate Stryker’s focus on preventing adverse events across the cycle of care.

- Sep-2021: Boston Scientific Corporation signed an agreement to acquire Devoro Medical, Inc., a developer company of the WOLF Thrombectomy® Platform. This acquisition aligns with the advanced technology of Devoro Medical, Inc. and broadens Boston Scientific Corporation"s portfolio of interventional strategies for thromboembolic which consists of the AngioJet™ Thrombectomy System and EkoSonic™ Endovascular System.

- Dec-2020: Teleflex Incorporated acquired Z-Medica, LLC, a manufacturing company of hemostatic products. Under this acquisition, Teleflex boosts its strength in military call points, hospitals, and EMS, with the advanced product that aligns with EZ-IO and EZPLAZ 1 product offerings.

- Jul-2020: Terumo Corporation acquired Quirem Medical B.V., a healthcare startup with expertise in the development of next-generation microspheres for Selective Internal Radiation Therapy (SIRT), a treatment for liver tumors. The acquisition of Quirem Medical boosts its business, broadens its manufacturing and clinical development activities, and aligns its complete portfolio to support its customers.

Approvals and Trials:

- Apr-2022: Boston Scientific Corporation received an FDA approval for EMBOLD™ Fibered Detachable Coil, indicated to obstruct or decrease the rate of blood flow in the peripheral vasculature. The multi-catheter compatibility delivers the adaptability of catheter choice and helps decrease the possible number of device exchanges to enhance procedure productivity and allow improved patient outcomes.

- Feb-2022: Medtronic plc received FDA approval for Freezor™ and Freezor™ Xtra Cardiac Cryoablation Focal Catheters, an ablation catheter used to treat the rising prevalence of pediatric Atrioventricular Nodal Reentrant Tachycardia. The product enables the youngest of cardiology patient access to a life-enhancing, safe technology that will help advance cardiac care for Atrioventricular Nodal Reentrant Tachycardia.

Scope of the Study

By Product

- Delivery

- Diagnostic

- Aspiration

- Steerable

By Product Design

- Dual - Lumen

- Single Lumen

By End-user

- Hospitals, Surgical Centers & Specialty Clinics

- Ambulatory Care Centers

By Application

- Cardiovascular

- Neurovascular

- Peripheral Vascular

- Oncology

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Medtronic PLC

- Johnson & Johnson

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Terumo Corporation

- Teleflex, Inc.

- Stryker Corporation

- Merit Medical Systems, Inc.

- Cardinal Health, Inc.

- Cook Medical, Inc. (Cook Group)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Microcatheter Market, by Product

1.4.2 Global Microcatheter Market, by Product Design

1.4.3 Global Microcatheter Market, by End User

1.4.4 Global Microcatheter Market, by Application

1.4.5 Global Microcatheter Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition & Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Approvals and Trials

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Acquisitions and Mergers : 2019, Jan - 2022, Nov) Leading Players

Chapter 4. Global Microcatheter Market by Product

4.1 Global Delivery Market by Region

4.2 Global Diagnostic Market by Region

4.3 Global Aspiration Market by Region

4.4 Global Steerable Market by Region

Chapter 5. Global Microcatheter Market by Product Design

5.1 Global Dual - Lumen Market by Region

5.2 Global Single Lumen Market by Region

Chapter 6. Global Microcatheter Market by End User

6.1 Global Hospitals, Surgical Centers & Specialty Clinics Market by Region

6.2 Global Ambulatory Care Centers Market by Region

Chapter 7. Global Microcatheter Market by Application

7.1 Global Cardiovascular Market by Region

7.2 Global Neurovascular Market by Region

7.3 Global Peripheral Vascular Market by Region

7.4 Global Oncology Market by Region

Chapter 8. Global Microcatheter Market by Region

8.1 North America Microcatheter Market

8.1.1 North America Microcatheter Market by Product

8.1.1.1 North America Delivery Market by Country

8.1.1.2 North America Diagnostic Market by Country

8.1.1.3 North America Aspiration Market by Country

8.1.1.4 North America Steerable Market by Country

8.1.2 North America Microcatheter Market by Product Design

8.1.2.1 North America Dual - Lumen Market by Country

8.1.2.2 North America Single Lumen Market by Country

8.1.3 North America Microcatheter Market by End User

8.1.3.1 North America Hospitals, Surgical Centers & Specialty Clinics Market by Country

8.1.3.2 North America Ambulatory Care Centers Market by Country

8.1.4 North America Microcatheter Market by Application

8.1.4.1 North America Cardiovascular Market by Country

8.1.4.2 North America Neurovascular Market by Country

8.1.4.3 North America Peripheral Vascular Market by Country

8.1.4.4 North America Oncology Market by Country

8.1.5 North America Microcatheter Market by Country

8.1.5.1 US Microcatheter Market

8.1.5.1.1 US Microcatheter Market by Product

8.1.5.1.2 US Microcatheter Market by Product Design

8.1.5.1.3 US Microcatheter Market by End User

8.1.5.1.4 US Microcatheter Market by Application

8.1.5.2 Canada Microcatheter Market

8.1.5.2.1 Canada Microcatheter Market by Product

8.1.5.2.2 Canada Microcatheter Market by Product Design

8.1.5.2.3 Canada Microcatheter Market by End User

8.1.5.2.4 Canada Microcatheter Market by Application

8.1.5.3 Mexico Microcatheter Market

8.1.5.3.1 Mexico Microcatheter Market by Product

8.1.5.3.2 Mexico Microcatheter Market by Product Design

8.1.5.3.3 Mexico Microcatheter Market by End User

8.1.5.3.4 Mexico Microcatheter Market by Application

8.1.5.4 Rest of North America Microcatheter Market

8.1.5.4.1 Rest of North America Microcatheter Market by Product

8.1.5.4.2 Rest of North America Microcatheter Market by Product Design

8.1.5.4.3 Rest of North America Microcatheter Market by End User

8.1.5.4.4 Rest of North America Microcatheter Market by Application

8.2 Europe Microcatheter Market

8.2.1 Europe Microcatheter Market by Product

8.2.1.1 Europe Delivery Market by Country

8.2.1.2 Europe Diagnostic Market by Country

8.2.1.3 Europe Aspiration Market by Country

8.2.1.4 Europe Steerable Market by Country

8.2.2 Europe Microcatheter Market by Product Design

8.2.2.1 Europe Dual - Lumen Market by Country

8.2.2.2 Europe Single Lumen Market by Country

8.2.3 Europe Microcatheter Market by End User

8.2.3.1 Europe Hospitals, Surgical Centers & Specialty Clinics Market by Country

8.2.3.2 Europe Ambulatory Care Centers Market by Country

8.2.4 Europe Microcatheter Market by Application

8.2.4.1 Europe Cardiovascular Market by Country

8.2.4.2 Europe Neurovascular Market by Country

8.2.4.3 Europe Peripheral Vascular Market by Country

8.2.4.4 Europe Oncology Market by Country

8.2.5 Europe Microcatheter Market by Country

8.2.5.1 Germany Microcatheter Market

8.2.5.1.1 Germany Microcatheter Market by Product

8.2.5.1.2 Germany Microcatheter Market by Product Design

8.2.5.1.3 Germany Microcatheter Market by End User

8.2.5.1.4 Germany Microcatheter Market by Application

8.2.5.2 UK Microcatheter Market

8.2.5.2.1 UK Microcatheter Market by Product

8.2.5.2.2 UK Microcatheter Market by Product Design

8.2.5.2.3 UK Microcatheter Market by End User

8.2.5.2.4 UK Microcatheter Market by Application

8.2.5.3 France Microcatheter Market

8.2.5.3.1 France Microcatheter Market by Product

8.2.5.3.2 France Microcatheter Market by Product Design

8.2.5.3.3 France Microcatheter Market by End User

8.2.5.3.4 France Microcatheter Market by Application

8.2.5.4 Russia Microcatheter Market

8.2.5.4.1 Russia Microcatheter Market by Product

8.2.5.4.2 Russia Microcatheter Market by Product Design

8.2.5.4.3 Russia Microcatheter Market by End User

8.2.5.4.4 Russia Microcatheter Market by Application

8.2.5.5 Spain Microcatheter Market

8.2.5.5.1 Spain Microcatheter Market by Product

8.2.5.5.2 Spain Microcatheter Market by Product Design

8.2.5.5.3 Spain Microcatheter Market by End User

8.2.5.5.4 Spain Microcatheter Market by Application

8.2.5.6 Italy Microcatheter Market

8.2.5.6.1 Italy Microcatheter Market by Product

8.2.5.6.2 Italy Microcatheter Market by Product Design

8.2.5.6.3 Italy Microcatheter Market by End User

8.2.5.6.4 Italy Microcatheter Market by Application

8.2.5.7 Rest of Europe Microcatheter Market

8.2.5.7.1 Rest of Europe Microcatheter Market by Product

8.2.5.7.2 Rest of Europe Microcatheter Market by Product Design

8.2.5.7.3 Rest of Europe Microcatheter Market by End User

8.2.5.7.4 Rest of Europe Microcatheter Market by Application

8.3 Asia Pacific Microcatheter Market

8.3.1 Asia Pacific Microcatheter Market by Product

8.3.1.1 Asia Pacific Delivery Market by Country

8.3.1.2 Asia Pacific Diagnostic Market by Country

8.3.1.3 Asia Pacific Aspiration Market by Country

8.3.1.4 Asia Pacific Steerable Market by Country

8.3.2 Asia Pacific Microcatheter Market by Product Design

8.3.2.1 Asia Pacific Dual - Lumen Market by Country

8.3.2.2 Asia Pacific Single Lumen Market by Country

8.3.3 Asia Pacific Microcatheter Market by End User

8.3.3.1 Asia Pacific Hospitals, Surgical Centers & Specialty Clinics Market by Country

8.3.3.2 Asia Pacific Ambulatory Care Centers Market by Country

8.3.4 Asia Pacific Microcatheter Market by Application

8.3.4.1 Asia Pacific Cardiovascular Market by Country

8.3.4.2 Asia Pacific Neurovascular Market by Country

8.3.4.3 Asia Pacific Peripheral Vascular Market by Country

8.3.4.4 Asia Pacific Oncology Market by Country

8.3.5 Asia Pacific Microcatheter Market by Country

8.3.5.1 China Microcatheter Market

8.3.5.1.1 China Microcatheter Market by Product

8.3.5.1.2 China Microcatheter Market by Product Design

8.3.5.1.3 China Microcatheter Market by End User

8.3.5.1.4 China Microcatheter Market by Application

8.3.5.2 Japan Microcatheter Market

8.3.5.2.1 Japan Microcatheter Market by Product

8.3.5.2.2 Japan Microcatheter Market by Product Design

8.3.5.2.3 Japan Microcatheter Market by End User

8.3.5.2.4 Japan Microcatheter Market by Application

8.3.5.3 India Microcatheter Market

8.3.5.3.1 India Microcatheter Market by Product

8.3.5.3.2 India Microcatheter Market by Product Design

8.3.5.3.3 India Microcatheter Market by End User

8.3.5.3.4 India Microcatheter Market by Application

8.3.5.4 South Korea Microcatheter Market

8.3.5.4.1 South Korea Microcatheter Market by Product

8.3.5.4.2 South Korea Microcatheter Market by Product Design

8.3.5.4.3 South Korea Microcatheter Market by End User

8.3.5.4.4 South Korea Microcatheter Market by Application

8.3.5.5 Singapore Microcatheter Market

8.3.5.5.1 Singapore Microcatheter Market by Product

8.3.5.5.2 Singapore Microcatheter Market by Product Design

8.3.5.5.3 Singapore Microcatheter Market by End User

8.3.5.5.4 Singapore Microcatheter Market by Application

8.3.5.6 Malaysia Microcatheter Market

8.3.5.6.1 Malaysia Microcatheter Market by Product

8.3.5.6.2 Malaysia Microcatheter Market by Product Design

8.3.5.6.3 Malaysia Microcatheter Market by End User

8.3.5.6.4 Malaysia Microcatheter Market by Application

8.3.5.7 Rest of Asia Pacific Microcatheter Market

8.3.5.7.1 Rest of Asia Pacific Microcatheter Market by Product

8.3.5.7.2 Rest of Asia Pacific Microcatheter Market by Product Design

8.3.5.7.3 Rest of Asia Pacific Microcatheter Market by End User

8.3.5.7.4 Rest of Asia Pacific Microcatheter Market by Application

8.4 LAMEA Microcatheter Market

8.4.1 LAMEA Microcatheter Market by Product

8.4.1.1 LAMEA Delivery Market by Country

8.4.1.2 LAMEA Diagnostic Market by Country

8.4.1.3 LAMEA Aspiration Market by Country

8.4.1.4 LAMEA Steerable Market by Country

8.4.2 LAMEA Microcatheter Market by Product Design

8.4.2.1 LAMEA Dual - Lumen Market by Country

8.4.2.2 LAMEA Single Lumen Market by Country

8.4.3 LAMEA Microcatheter Market by End User

8.4.3.1 LAMEA Hospitals, Surgical Centers & Specialty Clinics Market by Country

8.4.3.2 LAMEA Ambulatory Care Centers Market by Country

8.4.4 LAMEA Microcatheter Market by Application

8.4.4.1 LAMEA Cardiovascular Market by Country

8.4.4.2 LAMEA Neurovascular Market by Country

8.4.4.3 LAMEA Peripheral Vascular Market by Country

8.4.4.4 LAMEA Oncology Market by Country

8.4.5 LAMEA Microcatheter Market by Country

8.4.5.1 Brazil Microcatheter Market

8.4.5.1.1 Brazil Microcatheter Market by Product

8.4.5.1.2 Brazil Microcatheter Market by Product Design

8.4.5.1.3 Brazil Microcatheter Market by End User

8.4.5.1.4 Brazil Microcatheter Market by Application

8.4.5.2 Argentina Microcatheter Market

8.4.5.2.1 Argentina Microcatheter Market by Product

8.4.5.2.2 Argentina Microcatheter Market by Product Design

8.4.5.2.3 Argentina Microcatheter Market by End User

8.4.5.2.4 Argentina Microcatheter Market by Application

8.4.5.3 UAE Microcatheter Market

8.4.5.3.1 UAE Microcatheter Market by Product

8.4.5.3.2 UAE Microcatheter Market by Product Design

8.4.5.3.3 UAE Microcatheter Market by End User

8.4.5.3.4 UAE Microcatheter Market by Application

8.4.5.4 Saudi Arabia Microcatheter Market

8.4.5.4.1 Saudi Arabia Microcatheter Market by Product

8.4.5.4.2 Saudi Arabia Microcatheter Market by Product Design

8.4.5.4.3 Saudi Arabia Microcatheter Market by End User

8.4.5.4.4 Saudi Arabia Microcatheter Market by Application

8.4.5.5 South Africa Microcatheter Market

8.4.5.5.1 South Africa Microcatheter Market by Product

8.4.5.5.2 South Africa Microcatheter Market by Product Design

8.4.5.5.3 South Africa Microcatheter Market by End User

8.4.5.5.4 South Africa Microcatheter Market by Application

8.4.5.6 Nigeria Microcatheter Market

8.4.5.6.1 Nigeria Microcatheter Market by Product

8.4.5.6.2 Nigeria Microcatheter Market by Product Design

8.4.5.6.3 Nigeria Microcatheter Market by End User

8.4.5.6.4 Nigeria Microcatheter Market by Application

8.4.5.7 Rest of LAMEA Microcatheter Market

8.4.5.7.1 Rest of LAMEA Microcatheter Market by Product

8.4.5.7.2 Rest of LAMEA Microcatheter Market by Product Design

8.4.5.7.3 Rest of LAMEA Microcatheter Market by End User

8.4.5.7.4 Rest of LAMEA Microcatheter Market by Application

Chapter 9. Company Profiles

9.1 Medtronic PLC

9.1.1 Company overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Approvals and Trials:

9.1.5.2 Product Launches and Product Expansions:

9.1.6 SWOT Analysis

9.2 Johnson & Johnson

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expenses

9.2.5 Recent strategies and developments:

9.2.5.1 Acquisition and Mergers:

9.2.6 SWOT Analysis

9.3 Becton, Dickinson and Company

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expense

9.3.5 SWOT Analysis

9.4 Boston Scientific Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expense

9.4.5 Recent strategies and developments:

9.4.5.1 Approvals and Trials:

9.4.5.2 Acquisition and Mergers:

9.5 Terumo Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Regional Analysis

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.5.2 Acquisition and Mergers:

9.6 Teleflex, Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 Recent strategies and developments:

9.6.5.1 Acquisition and Mergers:

9.7 Stryker Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 Recent strategies and developments:

9.7.5.1 Acquisition and Mergers:

9.8 Merit Medical Systems, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expenses

9.8.5 Recent strategies and developments:

9.8.5.1 Acquisition and Mergers:

9.9 Cardinal Health, Inc.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.10. Cook Medical, Inc. (Cook Group)

9.10.1 Company Overview

9.10.2 Recent strategies and developments:

9.10.2.1 Product Launches and Product Expansions:

Companies Mentioned

- Medtronic PLC

- Johnson & Johnson

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Terumo Corporation

- Teleflex, Inc.

- Stryker Corporation

- Merit Medical Systems, Inc.

- Cardinal Health, Inc.

- Cook Medical, Inc. (Cook Group)