Key Highlights

- The United States accounts for the highest share of the CEP industry in the North American region, with a highly integrated supply chain network that links producers and consumers through multiple transportation modes.

- Due to the COVID-19 pandemic, there was an increase in online shopping. Such a rapidly growing adoption of online shopping across the country increased the volume of express deliveries and parcels. New technologies and changing customer demands have seen a dramatic shift in the strategic priorities of all post and parcel players in the United States. Digital transformation is a driver impacting the delivery demand, supply, returns, and cross-border e-commerce. Technological developments like the introduction of drone delivery services and e-locker delivery systems are further creating opportunities for startups to enter the market.

- Additionally, the increasing customer expectations for quicker and faster delivery have led to the growth of on-demand courier companies like UberRUSH and Postmates, which offer quick delivery services, thereby positively impacting the market growth. The market is further bolstered by the rising customer expenditure capabilities in the region.

- The new approaches, such as Crowdsourcing Courier Service, are serving new consumer demands, such as faster deliveries at lower prices. The country is experiencing rapid growth in the B2C market compared to the B2B market, mainly due to the growth of the e-commerce market. This growth has caused the carriers to expand their product portfolios to cater to various consumer requirements, such as instant deliveries and locker services. The market is further spurred by the rising customer expenditure capabilities in the country.

US International Courier, Express, And Parcel (CEP) Market Trends

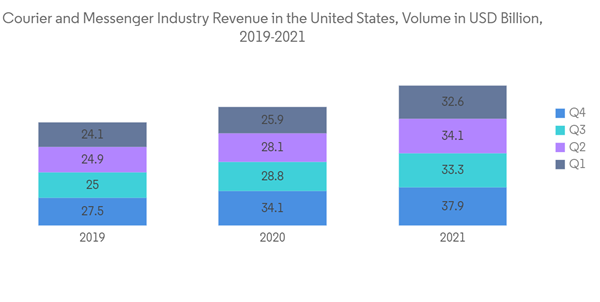

Courier Industry Witnessing Lucrative Growth

E-commerce growth is fueling the parcel shipping market, as consumers are ordering more online. With more consumers moving from offline to online shopping, courier companies have witnessed a rise in businesses delivering goods amid social restrictions, especially during festivals and holidays. Delivery companies have managed to book growth amid the pandemic-induced economic downturn.The US shipped, received, and returned 21.2 billion parcels in 2022, 1.1 billion more than anticipated by pre-pandemic forecasts. The latest Index shows 58 million parcels were shipped in the US each day in 2022 – totaling around 674 parcels per second. Per capita parcel volume for the US declined nominally from 65 to 64 with an average of 162 parcels shipped per US household during 2022.

US parcel volume declined by 3% in 2022, with parcel volume reaching 21.4 billion in 2022, down from 21.7 billion in 2021. Carrier revenues exceeded all previous years’ figures totaling USD 198 billion, an increase of 6.5% from USD 186 billion in 2021.

Rising E-commerce Sector to Boost the International CEP Market in the United States

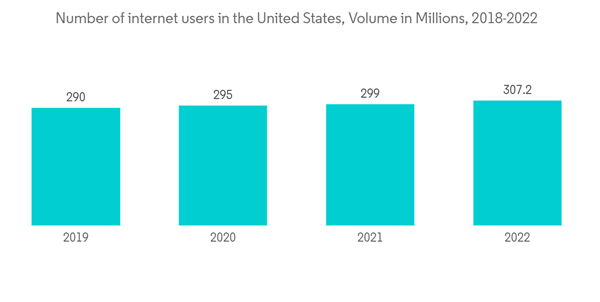

The US e-commerce market has evolved over the past decade. Retail e-commerce sales in the United States are projected to grow rapidly in the coming years, going from USD 470 billion in 2021 to over USD 560 billion in 2025.Customer satisfaction with online retail in the United States is relatively high. However, online sales still represent only a small share of all retail sales in the United States. Meanwhile, the country had more than 307.2 million internet users in 2022, and eight out of every 10 users made online purchases. Online retailers and brand websites are popular e-commerce channels. However, online marketplaces and social media are gaining relevance among online shoppers.

A growing trend within the US e-commerce market is the increasing presence of mobile shopping. Smartphones are mostly used for online shopping in the United States. This large base of mobile buyers has an impact on mobile commerce revenue. The average value spent per order while shopping from a cellphone is also increasing compared to a desktop, even though conversion rates still lag in the mobile segment.

US International Courier, Express, And Parcel (CEP) Industry Overview

The US international CEP market is relatively fragmented. Many new startups based in the United States or other countries entered the market to leverage the rapidly growing CEP industry. Due to the increasing market activity, the industry observes high competition among the players. Major players are United Parcel Service Inc., FedEx Corporation, DHL, Aramex New York Ltd, and TForce Logistics.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- United Parcel Service Inc.

- FedEx Corporation

- DHL

- Aramex New York Ltd

- Tforce Logistics

- Express Courier International Inc.

- Prestige Delivery Systems LLC

- International Bonded Couriers Inc.

- Fusion Logistics Inc.

- Stat Overnight Delivery LLC*