Venture capital generally comes from well-off investors, investment banks, and other financial institutions. However, it does not always take a monetary form and also be provided in the technical or managerial expertise form. Venture capital is typically allocated to small companies with exceptional growth potential or that grow quickly and appear poised to continue expanding. COVID-19 slashed the number of VC rounds in the US by 44%. VC funding to US-based companies thrived, hitting new highs in 2020 and then again in 2021 YTD.

Venture capital funds are run similarly to private equity funds, where the portfolio of companies invests in a specific sector specialization. For instance, a venture capital fund specializing in healthcare may invest in a portfolio of ten companies focused on disruptive healthcare technologies and equipment. A venture capital fund is usually structured as a partnership, where the venture capital firm serves as the general partners and the investors as the limited partners.

United States Venture Capital Market Trends

Healthtech trends toward record-breaking year

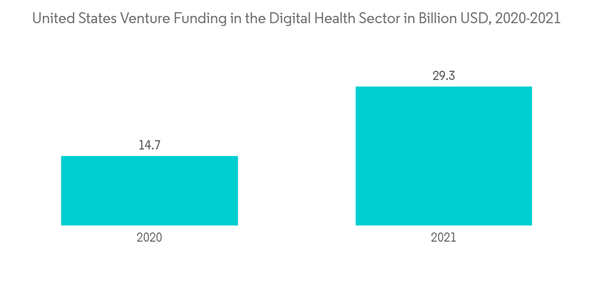

At the intersection of health care and technology, health tech innovators include a unique place in the Future of Health. Investors, especially CVCs, can support innovators and the industry in general. Innovators could bring transformative business models and a consumer-centric approach. It is imperative for investors, including industry incumbents, to coach innovators and support them with industry and regulatory expertise and capital to accelerate toward the future of health together.Growth in venture capital funding for health tech innovators, at record levels in Covid year, continued unabated in 2021. The previous year, venture funding for health tech innovators crossed a record-breaking revenue. Even as the economy and industries, including the healthcare industry, reel under the impact of the COVID-19 pandemic, venture funding for these innovators nearly doubled in previous years.

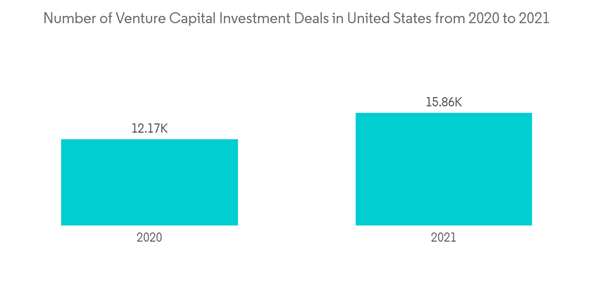

Increasing Number of Venture Capital Investment Deals all time high in 2021

Venture capital is a temporary equity investment in young, innovative, non-listed companies that stand out. Although the companies lack the current earning power, they include above-average growth potential, which makes them an attractive investment opportunity. Investment stages shifted recently. In many cases, seed, early, and late-stage investing are now distinct subindustries within VC. A successful VC ecosystem requires healthy activity at each investment stage since each plays an integral role in a company's growth. The VC investment landscape transformed over the past 20 years.VC mega-deals more than doubled in 2021 compared to 2020. Many of these mega deals are for unicorns since these companies tend to skew larger and are often later in their growth cycle.United States Venture Capital Industry Overview

The United States Venture Capital market is highly competitive, with the presence of both international and domestic players. The market studied presents opportunities for growth during the forecast period, which is expected to drive the market competition further. With multiple players holding significant shares, the market studied is competitive. The major market players include Intel Capital, Tiger Global Management, Bessemer Venture, Kleiner Perkins, New Enterprise Associates (NEA), Accel Partners, Sequoia Capital, and Khosla Ventures.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Intel Capital

- Tiger Global Management

- Bessemer Venture

- Kleiner Perkins

- New Enterprise Associates (NEA)

- Accel Partners

- Sequoia Capital

- Khosla Ventures*