Despite the negative market effects of COVID-19, research indicates that flexible office spaces will likely grow in popularity in Bahrain as a result of the pandemic. As companies try to figure out how to handle in-office work post-pandemic, landlords and developers across the country are dealing with rising vacancy rates and declining asking rents. Low-end offices have struggled to compete the most with a 10.1% rental price decline y-o-y in Q3 2020. It must be noted that the lower end of the market has witnessed rental rates similar to those offered in the industrial market which highlights the stress level the market is facing.

In Bahrain, the start-up scene is exploding, and there is an incredible support network and ecosystem for new businesses. Bahrain has a strong entrepreneurial culture, which is bolstered by Tamkeen, the government-funded business support system. In addition to co-working spaces, there are a number of other accelerators and incubators that provide assistance. These are typically for start-ups that have received funding.

In the region, flexible office spaces, such as co-working, are still in their early stages. Some major global brands have yet to enter the market, while others have yet to launch full-service offerings. On the other hand, occupants are thinking about the regulatory and other implications of flexible spaces on their daily operations.

Occupiers are expected to analyze their office requirements with a strong probability of downsizing as more flexible working conditions are offered to employees.

Bahrain Flexible Office Space Market Trends

Rise in Startups Driving the Market

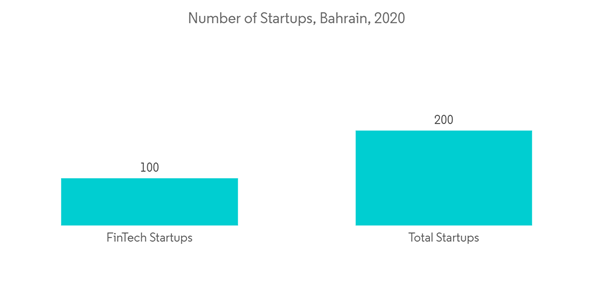

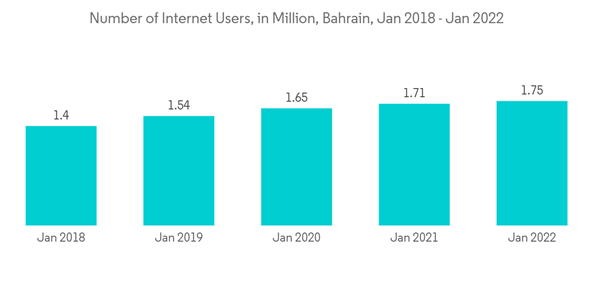

Bahrain's fast-growing start-up scene has been aided by the country's initiative to connect its citizens to the internet. According to the World Economic Forum, 98% of Bahraini citizens use the internet, placing Bahrain third in the world.In StartupBlink's 2021 Global Startup Ecosystem Index, Bahrain has risen nine places to 66th place globally. The country is ranked fourth in the Middle East, demonstrating its regional strength, with growth expected to continue through 2020.

Bahrain also ranks 64th in the world in the 'Software & Data' vertical, while Manama, the kingdom's capital, rose 103 places to 337th in the world among cities. StartUp Bahrain, Tamkeen, and Bahrain FinTech Bay are among the country's other initiatives.

According to the latest World Investment Report (WIR 2021) from the United Nations Conference on Trade and Development, Bahrain saw FDI inflows of $1.007 billion in 2020, according to GDN (Unctad).

FinTech has become more competitive in recent years, with several individuals and organizations launching industry-disrupting projects.

Digital Transformation in the Country

Bahrain's Economic Vision 2030, an ambitious national development plan based on the principles of sustainability, competitiveness, and fairness, includes digital transformation as a pillar. Furthermore, the government's Digital Government Strategy 2022 highlights the government's commitment to transforming its services through emerging technologies, thereby assisting citizens and residents in living better lives.The government is constructing a robust digital infrastructure and ensuring that everyone has access to the Internet. This is extremely crucial given that Internet usage is expected to increase by 400% by 2025.

Bahrain was the first GCC country to issue IoT connectivity standards and to support the use of the frequency band for IoT (NB-IoT) systems in international mobile communications networks. The Information & eGovernment Authority (iGA) has provided frequency bands to government entities in order to support the Kingdom's Digital Transformation and Vision 2030 goals for smart cities, IoT, and Machine-to-Machine (M2M) communication.

Amazon Web Services (AWS) opened its Middle East (Bahrain) Region office in 2019, putting the Kingdom in a strong position to take advantage of cloud computing's benefits. Developers, start-ups, and enterprises, as well as government, educational, and non-profit organisations, can use the infrastructure to run their applications and serve end-users from data centres in the Middle East, as well as leverage advanced technologies from the world's leading cloud, to drive innovation. In 2021, AWS predicts a demand for 10,000 data solution architects in the region over the next five years, with over 2,300 young Bahrainis enrolling in the AWS Educate programme.

Improved connectivity, such as faster WiFi and VPNs, which allow employees to work remotely in a secure manner, is paving the way for more businesses to adopt flexible working - and flexible space - policies.

Meanwhile, in the coming years, 5G ultra-high-speed internet may enable the rise of augmented-reality video conferences or AI-powered hot-desk assignments, making it even easier for employees to work from anywhere.

Bahrain Flexible Office Space Market Competitive Analysis

The market is relatively fragmented with a large number of local and international players, including Regus, Savills, WeWork, Servcorp, etc. as the major players. Fragmentation in the market is expected to increase with independent companies in the space actively increasing and developing new spaces in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Regus

- Servcorp

- Diwan Hub

- Space 340

- Letswork

- Spire Hub

- Brilliant Lab

- Alfanar

- The Startup Factory

- Brinc Batelco IoT Hub*