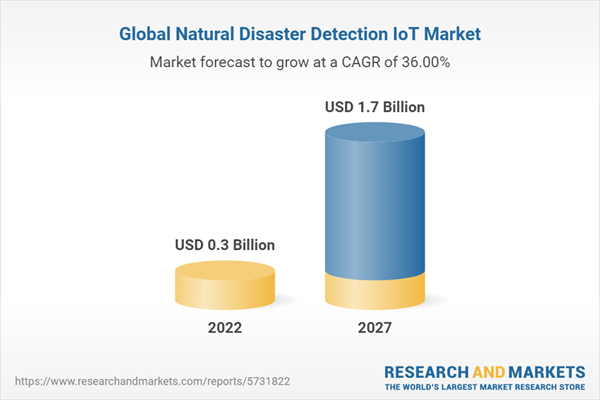

The global natural disaster detection IoT market is projected to grow from USD 0.3 billion in 2022 to USD 1.7 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 36.0% during the forecast period. Collecting near-real-time data by using IoT devices and sensors is driving the natural disaster detection IoT market growth.

Floating sensor networks segment is expected to account for a larger market share during the forecast period

Developed at UC Berkley has launched a new model for gathering information from a river's floating object in a flood situation. It is a compact and commercial floating object, which is outfitted with a camera and accelerated sensor for the Global Positioning System (GPS). The floating object tracks sudden fluctuations or incremental shifts in water and is automatically transmitted through web alerts to local citizens.

Managed services segment is estimated to account for a higher CAGR during the forecast period

The complexities of IoT are handled by IoT-managed services providers with a broad range of services and expertise to simplify the process of procuring, connecting, configuring, and deploying devices worldwide. Connecting with an IoT-managed services provider facilitates businesses to manage risks, reduce costs, and improve time to market. They achieve this through comprehensive device management, wireless connectivity, network management, and forward and reverse logistics.

Satellite Assisted Equipment segment to account for the largest market share during the forecast period

For many years satellite service providers have helped predict, map out, and deliver live information to reduce damage and fatalities during natural disasters and emergencies. The satellite-based disaster management approaches have normally relied on visually assessing the latest images, one area at a time. Hence, the use of AI and satellite mapping techniques by scientists are speeding up the process of disaster management.

Among regions, Asia Pacific recorded the highest CAGR during the forecast period

Asia Pacific constitutes thriving economies, such as Singapore, Japan, China, India, and Australia, which are expected to register high growth rates in the natural disaster detection IoT market. The region faces the worst climatic changes. In the worst-case climate change scenario, the sum of people at high risk in the Asia Pacific region will increase by around one-third. These susceptible people are mainly situated in the Ganges-Brahmaputra-Meghna basin, the Indus basin, parts of South-East Asia, and some Pacific Island countries. These are the emerging and intensifying risks in the region. Industry 4.0 innovations in robotics, analytics, AI, cognitive technologies, nanotechnology, quantum computing, wearables, IoT and big data can be utilized for disaster resilience. Also, governments are increasingly investing in these technologies that will ensure even the poorest countries and most omitted communities can be empowered.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the natural disaster detection IoT market.

- By Company: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 60% and Managers: 40%

- By Region: North America: 30%, Europe: 35%, Asia Pacific: 25%, Middle East and Africa: 5%, and Latin America: 5%

The report includes the study of key players offering natural disaster detection IoT solutions and services. It profiles major vendors in the global natural disaster detection IoT market. The major vendors in the global natural disaster detection IoT market include NEC Corporation (Japan), BlackBerry (Canada), Semtech (US), SAP (Germany), Sony (Japan), Nokia (Finland), Sadeem Technology (Saudi Arabia), Lumineye (US), Venti LLC (US), SimpliSafe (India), One Concern (US), OnSolve (US), Trinity Mobility (India), SkyAlert (Mexico), Serinus (Germany), Knowx Innovations (India), OgoXe (France), Aplicaciones Tecnológicas SA (Spain), Earth Networks (US), Responscity Systems (India), Sensoterra (Netherlands), Intel (US), Grillo (Brazil), Bulfro Monitech (India), and Green Stream Technologies (US).

Research Coverage

The market study covers the natural disaster detection IoT market across segments. It aims at estimating the market size and the growth potential of this market across segments, such as component, application, communication system, end user and region. It includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall natural disaster detection IoT market and its subsegments. It would help stakeholders understand the competitive landscape and gain better insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

Figure 1 Natural Disaster Detection IoT Market Segmentation

1.3.2 Geographic Scope

Figure 2 Market: Geographic Scope

1.3.3 Inclusions and Exclusions

1.3.4 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates, 2019-2021

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 3 Natural Disaster Detection IoT Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews with Experts

2.1.2.2 List of Key Primary Interview Participants

2.1.2.3 Breakdown of Primary Profiles

2.1.2.4 Primary Sources

2.1.2.5 Key Industry Insights

2.2 Market Size Estimation

Figure 4 Market Size Estimation Methodology: Approach 1 (Supply Side) - Revenue of Solutions/Services

2.2.1 Bottom-Up Approach

Figure 5 Bottom-Up Approach

Figure 6 Market Size Estimation Using Bottom-Up Approach (Supply Side): Collective Revenue from Solutions/Services

2.2.2 Top-Down Approach

Figure 7 Top-Down Approach

2.2.3 Natural Disaster Detection IoT Market Estimation: Demand-Side Analysis

Figure 8 Market Size Estimation Methodology: Demand-Side Analysis

2.3 Market Breakdown and Data Triangulation

Figure 9 Data Triangulation

2.4 Factor Analysis

Table 2 Factor Analysis

2.5 Assumptions

2.6 Limitations

2.7 Market: Recession Impact

Figure 10 Market to Witness Decline in Y-O-Y Growth in 2022

3 Executive Summary

Table 3 Natural Disaster Detection IoT Market and Growth Rate, 2017-2021 (USD Million, Y-O-Y %)

Table 4 Market and Growth Rate, 2022-2027 (USD Million, Y-O-Y %)

Figure 11 Subsegments with Highest Growth Rate in Global Market from 2022 to 2027

Figure 12 Market, Regional and Country-Wise Share, 2022

4 Premium Insights

4.1 Natural Disaster Detection IoT Market Overview

Figure 13 Major Developments by Leading Vendors to Drive Market During Forecast Period

4.2 Market, by Component

Figure 14 Solutions Segment to Dominate Market by 2027

4.3 Market, by Solution

Figure 15 Early Warning System to Hold High Growth Rate During Forecast Period

4.4 Market, by Service

Figure 16 Professional Services Segment to Dominate Market by 2027

4.5 Market, by Professional Service

Figure 17 Training and Simulation Segment to Hold High Growth Rate During Forecast Period

4.6 Market, by Application

Figure 18 Flood Detection Segment to Dominate Market by 2027

4.7 Market, by Communication System

Figure 19 First Responder Tools Segment to Hold High Growth Rate During Forecast Period

4.8 Natural Disaster Detection IoT Market, by End-user

Figure 20 Government Organizations Segment to Dominate Market by 2027

4.9 North America: Market, by Communication System and End-user

Figure 21 Satellite-Assisted Equipment and Government Organizations Segment to Account for Significant Market Share in 2022

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 22 Drivers, Restraints, Opportunities, and Challenges: Natural Disaster Detection IoT Market

5.2.1 Drivers

5.2.1.1 Use of IoT Devices and Sensors to Predict Disasters in Advance

5.2.1.2 Reduction in Damage and Economic Loss with Disaster Warnings

5.2.1.3 Increasing Government Initiatives to Use IoT in Emergency Planning

5.2.2 Restraints

5.2.2.1 Vulnerabilities of IoT Devices

5.2.2.2 Inaccurate Data Entering Ai System

5.2.3 Opportunities

5.2.3.1 Growing Adoption of Satellite Remote Sensing and Gis for Disaster Risk Minimization and Prevention

5.2.3.2 Predictive Analysis with Ai and Data Analytics Tools

5.2.4 Challenges

5.2.4.1 Hampered Communications at Area of Disaster

5.3 Industry Trends

5.3.1 Value Chain Analysis

Figure 23 Natural Disaster Detection IoT Market: Value Chain Analysis

5.3.2 Ecosystem Analysis

Table 5 Market: Ecosystem

5.3.3 Disruptions Impacting Buyers/Clients in Market

Figure 24 Market: Disruptions Impacting Buyers/Clients

5.3.4 Case Study Analysis

5.3.4.1 Case Study 1: Contra Costa County Protects People from Earthquakes and Other Calamities

5.3.4.2 Case Study 2: Nec Tests Simulation Technology in Rio De Janeiro That Enables Accurate Warning of Natural Disasters

5.3.4.3 Case Study 3: Early Flood Warning Solution by Intel

5.3.4.4 Case Study 4: IoT-Enabled Flood Monitoring System and Public Safety Monitoring Using Semtech's Lora and IoT

5.3.4.5 Case Study 5: Nokia's Drone Solution for Tsunami Preparedness and Response in Sendai City

5.3.4.6 Case Study 6: Mississippi Emergency Management Agency (Mema) Coordinates to Respond to Crises

5.3.5 Pricing Analysis

5.3.5.1 Average Selling Price, by Key Player

Table 6 Average Selling Price of Key Players

5.3.5.2 Average Selling Price Trend

5.3.6 Porter's Five Forces Analysis

Table 7 Natural Disaster Detection IoT Market: Porter's Five Forces Model Analysis

5.3.6.1 Threat of New Entrants

5.3.6.2 Threat of Substitutes

5.3.6.3 Bargaining Power of Buyers

5.3.6.4 Bargaining Power of Suppliers

5.3.6.5 Intensity of Competitive Rivalry

5.3.7 Technology Analysis

5.3.7.1 IoT

5.3.7.2 Artificial Intelligence/Machine Learning

5.3.7.3 5G Network

5.3.7.4 Cloud Computing

5.3.7.5 Big Data

5.3.8 Patent Analysis

5.3.8.1 Methodology

5.3.8.2 Document Types

Table 8 Patents Filed, 2020-2022

5.3.8.3 Innovation and Patent Applications

Figure 25 Number of Patents Granted Annually, 2020-2022

5.3.8.3.1 Top Applicants

Figure 26 Top 10 Patent Applicants with Highest Number of Patent Applications, 2020-2022

Table 9 List of Patents in Natural Disaster Detection IoT Market, 2020-2022

5.3.9 Key Stakeholders and Buying Criteria

5.3.9.1 Key Stakeholders in Buying Process

Figure 27 Influence of Stakeholders on Buying Process for Top Three Verticals

Table 10 Influence of Stakeholders on Buying Process for Top Three Verticals

5.3.9.2 Buying Criteria

Figure 28 Key Buying Criteria for Top Three End-users

Table 11 Key Buying Criteria for Top Three End-users

5.3.10 Key Conferences and Events in 2022-2023

Table 12 Natural Disaster Detection IoT Market: Detailed List of Conferences and Events

5.4 Regulatory Landscape

5.4.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Row: Regulatory Bodies, Government Agencies, and Other Organizations

5.4.1.1 North America

5.4.1.1.1 US

5.4.1.1.2 Canada

5.4.1.2 Europe

5.4.1.3 Asia-Pacific

5.4.1.3.1 South Korea

5.4.1.3.2 China

5.4.1.3.3 India

5.4.1.4 Middle East and Africa

5.4.1.4.1 Uae

5.4.1.4.2 Ksa

5.4.1.5 Latin America

5.4.1.5.1 Brazil

5.4.1.5.2 Mexico

6 Natural Disaster Management IoT Market, by Component

6.1 Introduction

6.1.1 Components: Natural Disaster Detection IoT Market Drivers

Figure 29 Solutions Segment to Grow at Highest CAGR During Forecast Period

Table 17 Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 18 Market, by Component, 2022-2027 (USD Million)

6.2 Hardware

6.2.1 Wireless Sensor Networks to Detect Natural Disasters

Table 19 Hardware: Market, by Region, 2017-2021 (USD Million)

Table 20 Hardware: Market, by Region, 2022-2027 (USD Million)

6.3 Solutions

6.3.1 Rise in Adoption of Natural Disaster Detection IoT Solutions for Real-Time Data Collection

Table 21 Solutions: Market, by Region, 2017-2021 (USD Million)

Table 22 Solutions: Market, by Region, 2022-2027 (USD Million)

Figure 30 Early Warning System Segment to Grow at Highest CAGR During Forecast Period

Table 23 Market, by Solution, 2017-2021 (USD Million)

Table 24 Market, by Solution, 2022-2027 (USD Million)

6.3.2 Beacon

Table 25 Beacon: Natural Disaster Detection IoT Market, by Region, 2017-2021 (USD Million)

Table 26 Beacon: Market, by Region, 2022-2027 (USD Million)

6.3.3 Floating Sensor Network

Table 27 Floating Sensor Network: Market, by Region, 2017-2021 (USD Million)

Table 28 Floating Sensor Network: Market, by Region, 2022-2027 (USD Million)

6.3.4 Lightning Detector System

Table 29 Lightning Detector System: Natural Disaster Detection IoT Market, by Region, 2017-2021 (USD Million)

Table 30 Lightning Detector System: Market, by Region, 2022-2027 (USD Million)

6.3.5 Acoustic Real-Time Monitoring System

Table 31 Acoustic Real-Time Monitoring System: Market, by Region, 2017-2021 (USD Million)

Table 32 Acoustic Real-Time Monitoring System: Market, by Region, 2022-2027 (USD Million)

6.3.6 Early Warning System

Table 33 Early Warning System: Market, by Region, 2017-2021 (USD Million)

Table 34 Early Warning System: Market, by Region, 2022-2027 (USD Million)

6.3.7 Other Solutions

Table 35 Other Solutions: Market, by Region, 2017-2021 (USD Million)

Table 36 Other Solutions: Market, by Region, 2022-2027 (USD Million)

6.4 Services

Figure 31 Managed Services to Grow at Higher CAGR During Forecast Period

Table 37 Services: Natural Disaster Detection IoT Market, by Region, 2017-2021 (USD Million)

Table 38 Services: Market, by Region, 2022-2027 (USD Million)

Table 39 Market, by Service, 2017-2021 (USD Million)

Table 40 Market, by Service, 2022-2027 (USD Million)

6.4.1 Professional Services

6.4.1.1 Professional Services to Minimize Risk Caused by Natural Disasters and Help in Integration of Proper IoT Devices

Figure 32 Training and Simulation Segment to Grow at Highest CAGR During Forecast Period

Table 41 Natural Disaster Detection IoT Market, by Professional Service, 2017-2021 (USD Million)

Table 42 Market, by Professional Service, 2022-2027 (USD Million)

Table 43 Professional Services: Market, by Region, 2017-2021 (USD Million)

Table 44 Professional Services: Market, by Region, 2022-2027 (USD Million)

6.4.1.2 Consulting

Table 45 Consulting: Market, by Region, 2017-2021 (USD Million)

Table 46 Consulting: Market, by Region, 2022-2027 (USD Million)

6.4.1.3 Deployment and Integration

Table 47 Deployment and Integration: Market, by Region, 2017-2021 (USD Million)

Table 48 Deployment and Integration: Market, by Region, 2022-2027 (USD Million)

6.4.1.4 Support and Maintenance

Table 49 Support and Maintenance: Market, by Region, 2017-2021 (USD Million)

Table 50 Support and Maintenance: Market, by Region, 2022-2027 (USD Million)

6.4.1.5 Training and Simulation

Table 51 Training and Simulation: Market, by Region, 2017-2021 (USD Million)

Table 52 Training and Simulation: Market, by Region, 2022-2027 (USD Million)

6.4.2 Managed Services

6.4.2.1 Streamline Process of Deploying Devices Globally

Table 53 Managed Services: Market, by Region, 2017-2021 (USD Million)

Table 54 Managed Services: Market, by Region, 2022-2027 (USD Million)

7 Natural Disaster Detection IoT Market, by Application

7.1 Introduction

7.1.1 Applications: Market Drivers

Figure 33 Weather Monitoring Segment to Grow at Highest CAGR During Forecast Period

Table 55 Market, by Application, 2017-2021 (USD Million)

Table 56 Market, by Application, 2022-2027 (USD Million)

7.2 Flood Detection

7.2.1 Preventing Floods Using IoT-Based Monitoring and Detection Systems

Table 57 Flood Detection: Market, by Region, 2017-2021 (USD Million)

Table 58 Flood Detection: Market, by Region, 2022-2027 (USD Million)

7.3 Drought Detection

7.3.1 Provide Detailed Updates About Environment-Related Components Using IoT

Table 59 Drought Detection: Market, by Region, 2017-2021 (USD Million)

Table 60 Drought Detection: Market, by Region, 2022-2027 (USD Million)

7.4 Wildfire Detection

7.4.1 Detection of Wildfire in Remote and Unmanaged Areas Using Sensors

Table 61 Wildfire Detection: Market, by Region, 2017-2021 (USD Million)

Table 62 Wildfire Detection: Market, by Region, 2022-2027 (USD Million)

7.5 Landslide Detection

7.5.1 Usage of Natural Disaster Detection IoT Solutions to Reduce Fatalities

Table 63 Landslide Detection: Natural Disaster Detection IoT Market, by Region, 2017-2021 (USD Million)

Table 64 Landslide Detection: Market, by Region, 2022-2027 (USD Million)

7.6 Earthquake Detection

7.6.1 Early Warning System with IoT to Prevent Damage Due to Seismic Events

Table 65 Earthquake Detection: Market, by Region, 2017-2021 (USD Million)

Table 66 Earthquake Detection: Market, by Region, 2022-2027 (USD Million)

7.7 Weather Monitoring

7.7.1 IoT System to Monitor Climate Change and Weather Conditions Continuously

Table 67 Weather Monitoring: Market, by Region, 2017-2021 (USD Million)

Table 68 Weather Monitoring: Market, by Region, 2022-2027 (USD Million)

7.8 Other Applications

7.8.1 Dual Sensor Technology for Storm Detection

Table 69 Other Applications: Market, by Region, 2017-2021 (USD Million)

Table 70 Other Applications: Market, by Region, 2022-2027 (USD Million)

8 Natural Disaster Detection IoT Market, by Communication System

8.1 Introduction

8.1.1 Communication Systems: Market Drivers

Figure 34 First Responder Tools Segment to Grow at Highest CAGR During Forecast Period

Table 71 Market, by Communication System, 2017-2021 (USD Million)

Table 72 Market, by Communication System, 2022-2027 (USD Million)

8.2 First Responder Tools

8.2.1 Usage of IoT, Smart Devices, and Ai Technologies for Victim Detection

Table 73 First Responder Tools: Market, by Region, 2017-2021 (USD Million)

Table 74 First Responder Tools: Market, by Region, 2022-2027 (USD Million)

8.3 Satellite-Assisted Equipment

8.3.1 Ai and Satellite Mapping Techniques to Speed Up Process of Disaster Management

Table 75 Satellite-Assisted Equipment: Natural Disaster Detection IoT Market, by Region, 2017-2021 (USD Million)

Table 76 Satellite-Assisted Equipment: Market, by Region, 2022-2027 (USD Million)

8.4 Vehicle-Ready Gateways

8.4.1 Fast Connection by Deploying IoT Sensors in Vehicle-Ready Gateways

Table 77 Vehicle-Ready Gateways: Market, by Region, 2017-2021 (USD Million)

Table 78 Vehicle-Ready Gateways: Market, by Region, 2022-2027 (USD Million)

8.5 Emergency Response Radars

8.5.1 Synthetic Aperture Radar to be Useful for Mapping and Monitoring Several Natural and Man-Made Disasters

Table 79 Emergency Response Radars: Market, by Region, 2017-2021 (USD Million)

Table 80 Emergency Response Radars: Market, by Region, 2022-2027 (USD Million)

9 Natural Disaster Detection IoT Market, by End-user

9.1 Introduction

9.1.1 End-users: Market Drivers

Figure 35 Rescue Personnel Segment to Grow at Highest CAGR During Forecast Period

Table 81 Market, by End-user, 2017-2021 (USD Million)

Table 82 Market, by End-user, 2022-2027 (USD Million)

9.2 Government Organizations

9.2.1 Government Organizations to Use IoT for Emergency Planning

Table 83 Government Organizations: Market, by Region, 2017-2021 (USD Million)

Table 84 Government Organizations: Market, by Region, 2022-2027 (USD Million)

9.3 Private Companies

9.3.1 Adoption of IoT, Ai, and Sensor Technology to Monitor Disasters

Table 85 Private Companies: Natural Disaster Detection IoT Market, by Region, 2017-2021 (USD Million)

Table 86 Private Companies: Market, by Region, 2022-2027 (USD Million)

9.4 Law Enforcement Agencies

9.4.1 Use of Ai, IoT, and Sensory Applications Transforming Natural Disaster Detection and Management

Table 87 Law Enforcement Agencies: Market, by Region, 2017-2021 (USD Million)

Table 88 Law Enforcement Agencies: Market, by Region, 2022-2027 (USD Million)

9.5 Rescue Personnel

9.5.1 IoT Devices to Help in Search and Rescue Operations

Table 89 Rescue Personnel: Market, by Region, 2017-2021 (USD Million)

Table 90 Rescue Personnel: Market, by Region, 2022-2027 (USD Million)

10 Natural Disaster Detection IoT Market, by Region

10.1 Introduction

Table 91 Market, by Region, 2017-2021 (USD Million)

Table 92 Market, by Region, 2022-2027 (USD Million)

10.2 North America

10.2.1 North America: PESTLE Analysis

10.2.2 North America: Recession Impact

Figure 36 North America: Natural Disaster Detection IoT Market Snapshot

Table 93 North America: Market, by Component, 2017-2021 (USD Million)

Table 94 North America: Market, by Component, 2022-2027 (USD Million)

Table 95 North America: Market, by Service, 2017-2021 (USD Million)

Table 96 North America: Market, by Service, 2022-2027 (USD Million)

Table 97 North America: Market, by Professional Service, 2017-2021 (USD Million)

Table 98 North America: Market, by Professional Service, 2022-2027 (USD Million)

Table 99 North America: Market, by Solution, 2017-2021 (USD Million)

Table 100 North America: Natural Disaster Detection IoT Market, by Solution, 2022-2027 (USD Million)

Table 101 North America: Market, by Application, 2017-2021 (USD Million)

Table 102 North America: Market, by Application, 2022-2027 (USD Million)

Table 103 North America: Market, by Communication System, 2017-2021 (USD Million)

Table 104 North America: Market, by Communication System, 2022-2027 (USD Million)

Table 105 North America: Market, by End-user, 2017-2021 (USD Million)

Table 106 North America: Market, by End-user, 2022-2027 (USD Million)

Table 107 North America: Market, by Country, 2017-2021 (USD Million)

Table 108 North America: Market, by Country, 2022-2027 (USD Million)

10.2.3 US

10.2.3.1 Preparedness for Natural Disasters with Satellite IoT

Table 109 Us: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 110 Us: Market, by Component, 2022-2027 (USD Million)

Table 111 Us: Market, by Service, 2017-2021 (USD Million)

Table 112 Us: Market, by Service, 2022-2027 (USD Million)

Table 113 Us: Market, by Professional Service, 2017-2021 (USD Million)

Table 114 Us: Market, by Professional Service, 2022-2027 (USD Million)

Table 115 Us: Market, by Solution, 2017-2021 (USD Million)

Table 116 Us: Market, by Solution, 2022-2027 (USD Million)

Table 117 Us: Market, by Application, 2017-2021 (USD Million)

Table 118 Us: Market, by Application, 2022-2027 (USD Million)

Table 119 Us: Market, by Communication System, 2017-2021 (USD Million)

Table 120 Us: Market, by Communication System, 2022-2027 (USD Million)

Table 121 Us: Market, by End-user, 2017-2021 (USD Million)

Table 122 Us: Market, by End-user, 2022-2027 (USD Million)

10.2.4 Canada

10.2.4.1 IoT Solutions to Predict Occurrence of New Disasters

Table 123 Canada: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 124 Canada: Market, by Component, 2022-2027 (USD Million)

Table 125 Canada: Market, by Service, 2017-2021 (USD Million)

Table 126 Canada: Market, by Service, 2022-2027 (USD Million)

Table 127 Canada: Market, by Professional Service, 2017-2021 (USD Million)

Table 128 Canada: Market, by Professional Service, 2022-2027 (USD Million)

Table 129 Canada: Market, by Solution, 2017-2021 (USD Million)

Table 130 Canada: Market, by Solution, 2022-2027 (USD Million)

Table 131 Canada: Market, by Application, 2017-2021 (USD Million)

Table 132 Canada: Market, by Application, 2022-2027 (USD Million)

Table 133 Canada: Market, by Communication System, 2017-2021 (USD Million)

Table 134 Canada: Market, by Communication System, 2022-2027 (USD Million)

Table 135 Canada: Market, by End-user, 2017-2021 (USD Million)

Table 136 Canada: Market, by End-user, 2022-2027 (USD Million)

10.3 Europe

10.3.1 Europe: PESTLE Analysis

10.3.2 Europe: Recession Impact

Table 137 Europe: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 138 Europe: Market, by Component, 2022-2027 (USD Million)

Table 139 Europe: Market, by Service, 2017-2021 (USD Million)

Table 140 Europe: Market, by Service, 2022-2027 (USD Million)

Table 141 Europe: Market, by Professional Service, 2017-2021 (USD Million)

Table 142 Europe: Market, by Professional Service, 2022-2027 (USD Million)

Table 143 Europe: Market, by Solution, 2017-2021 (USD Million)

Table 144 Europe: Market, by Solution, 2022-2027 (USD Million)

Table 145 Europe: Market, by Application, 2017-2021 (USD Million)

Table 146 Europe: Market, by Application, 2022-2027 (USD Million)

Table 147 Europe: Market, by Communication System, 2017-2021 (USD Million)

Table 148 Europe: Market, by Communication System, 2022-2027 (USD Million)

Table 149 Europe: Market, by End-user, 2017-2021 (USD Million)

Table 150 Europe: Market, by End-user, 2022-2027 (USD Million)

Table 151 Europe: Market, by Country, 2017-2021 (USD Million)

Table 152 Europe: Market, by Country, 2022-2027 (USD Million)

10.3.3 UK

10.3.3.1 Use of Sensor Technology in Detection of Earthquakes

Table 153 Uk: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 154 Uk: Market, by Component, 2022-2027 (USD Million)

Table 155 Uk: Market, by Service, 2017-2021 (USD Million)

Table 156 Uk: Market, by Service, 2022-2027 (USD Million)

Table 157 Uk: Market, by Professional Service, 2017-2021 (USD Million)

Table 158 Uk: Market, by Professional Service, 2022-2027 (USD Million)

Table 159 Uk: Market, by Solution, 2017-2021 (USD Million)

Table 160 Uk: Market, by Solution, 2022-2027 (USD Million)

Table 161 Uk: Market, by Application, 2017-2021 (USD Million)

Table 162 Uk: Market, by Application, 2022-2027 (USD Million)

Table 163 Uk: Market, by Communication System, 2017-2021 (USD Million)

Table 164 Uk: Market, by Communication System, 2022-2027 (USD Million)

Table 165 Uk: Market, by End-user, 2017-2021 (USD Million)

Table 166 Uk: Market, by End-user, 2022-2027 (USD Million)

10.3.4 Germany

10.3.4.1 Increasing Adoption of IoT Solutions to Detect Natural Disasters

10.3.5 France

10.3.5.1 Favorable French Policy on Handling Major Hazards

10.3.6 Italy

10.3.6.1 Increasing Use of IoT Technology for Wildfire Detection

10.3.7 Spain

10.3.7.1 Increasing Government Funding for Early Detection of Floods

10.3.8 Nordic Region

10.3.8.1 Stable Welfare Society Helps to be Least Vulnerable to Natural Hazards

10.3.9 Rest of Europe

10.4 Asia-Pacific

10.4.1 Asia-Pacific: PESTLE Analysis

10.4.2 Asia-Pacific: Recession Impact

Figure 37 Asia-Pacific: Natural Disaster Detection IoT Market Snapshot

Table 167 Asia-Pacific: Market, by Component, 2017-2021 (USD Million)

Table 168 Asia-Pacific: Market, by Component, 2022-2027 (USD Million)

Table 169 Asia-Pacific: Market, by Service, 2017-2021 (USD Million)

Table 170 Asia-Pacific: Market, by Service, 2022-2027 (USD Million)

Table 171 Asia-Pacific: Market, by Professional Services, 2017-2021 (USD Million)

Table 172 Asia-Pacific: Market, by Professional Services, 2022-2027 (USD Million)

Table 173 Asia-Pacific: Market, by Solution, 2017-2021 (USD Million)

Table 174 Asia-Pacific: Market, by Solution, 2022-2027 (USD Million)

Table 175 Asia-Pacific: Market, by Application, 2017-2021 (USD Million)

Table 176 Asia-Pacific: Market, by Application, 2022-2027 (USD Million)

Table 177 Asia-Pacific: Market, by Communication System, 2017-2021 (USD Million)

Table 178 Asia-Pacific: Market, by Communication System, 2022-2027 (USD Million)

Table 179 Asia-Pacific: Market, by End-user, 2017-2021 (USD Million)

Table 180 Asia-Pacific: Market, by End-user, 2022-2027 (USD Million)

Table 181 Asia-Pacific: Market, by Country, 2017-2021 (USD Million)

Table 182 Asia-Pacific: Market, by Country, 2022-2027 (USD Million)

10.4.3 China

10.4.3.1 Use of Seismic Monitoring and Early Warning System for Natural Disaster Detection

Table 183 China: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 184 China: Market, by Component, 2022-2027 (USD Million)

Table 185 China: Market, by Service, 2017-2021 (USD Million)

Table 186 China: Market, by Service, 2022-2027 (USD Million)

Table 187 China: Market, by Professional Service, 2017-2021 (USD Million)

Table 188 China: Market, by Professional Service, 2022-2027 (USD Million)

Table 189 China: Market, by Solution, 2017-2021 (USD Million)

Table 190 China: Market, by Solution, 2022-2027 (USD Million)

Table 191 China: Market, by Application, 2017-2021 (USD Million)

Table 192 China: Market, by Application, 2022-2027 (USD Million)

Table 193 China: Market, by Communication System, 2017-2021 (USD Million)

Table 194 China: Market, by Communication System, 2022-2027 (USD Million)

Table 195 China: Market, by End-user, 2017-2021 (USD Million)

Table 196 China: Market, by End-user, 2022-2027 (USD Million)

10.4.4 India

10.4.4.1 Focus on Prevention, Mitigation, and Disaster Preparedness

10.4.5 Japan

10.4.5.1 Jma Monitors Earthquakes and Operates Earthquake Observation Network

10.4.6 Australia and New Zealand

10.4.6.1 Heavy Economic Losses Faced by Australia Due to Natural Disasters

10.4.7 Southeast Asia

10.4.7.1 Applications of Big Data for Disaster Management in Southeast Asia

10.4.8 Rest of Asia-Pacific

10.5 Middle East and Africa

10.5.1 Middle East and Africa: PESTLE Analysis

10.5.2 Middle East and Africa: Recession Impact

Table 197 Middle East and Africa: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 198 Middle East and Africa: Market, by Component, 2022-2027 (USD Million)

Table 199 Middle East and Africa: Market, by Service, 2017-2021 (USD Million)

Table 200 Middle East and Africa: Market, by Service, 2022-2027 (USD Million)

Table 201 Middle East and Africa: Market, by Professional Service, 2017-2021 (USD Million)

Table 202 Middle East and Africa: Market, by Professional Service, 2022-2027 (USD Million)

Table 203 Middle East and Africa: Market, by Solution, 2017-2021 (USD Million)

Table 204 Middle East and Africa: Market, by Solution, 2022-2027 (USD Million)

Table 205 Middle East and Africa: Market, by Application, 2017-2021 (USD Million)

Table 206 Middle East and Africa: Market, by Application, 2022-2027 (USD Million)

Table 207 Middle East and Africa: Market, by Communication System, 2017-2021 (USD Million)

Table 208 Middle East and Africa: Market, by Communication System, 2022-2027 (USD Million)

Table 209 Middle East and Africa: Market, by End-user, 2017-2021 (USD Million)

Table 210 Middle East and Africa: Market, by End-user, 2022-2027 (USD Million)

Table 211 Middle East and Africa: Market, by Region, 2017-2021 (USD Million)

Table 212 Middle East and Africa: Market, by Region, 2022-2027 (USD Million)

10.5.3 Middle East

10.5.3.1 Ongoing Developments for Disaster Risk Reduction

Table 213 Middle East: Market, by Country, 2017-2021 (USD Million)

Table 214 Middle East: Market, by Country, 2022-2027 (USD Million)

10.5.3.1.1 Ksa

Table 215 Ksa: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 216 Ksa: Market, by Component, 2022-2027 (USD Million)

Table 217 Ksa: Market, by Service, 2017-2021 (USD Million)

Table 218 Ksa: Market, by Service, 2022-2027 (USD Million)

Table 219 Ksa: Market, by Professional Service, 2017-2021 (USD Million)

Table 220 Ksa: Market, by Professional Service, 2022-2027 (USD Million)

Table 221 Ksa: Market, by Solution, 2017-2021 (USD Million)

Table 222 Ksa: Market, by Solution, 2022-2027 (USD Million)

Table 223 Ksa: Market, by Application, 2017-2021 (USD Million)

Table 224 Ksa: Market, by Application, 2022-2027 (USD Million)

Table 225 Ksa: Market, by Communication System, 2017-2021 (USD Million)

Table 226 Ksa: Market, by Communication System, 2022-2027 (USD Million)

Table 227 Ksa: Market, by End-user, 2017-2021 (USD Million)

Table 228 Ksa: Market, by End-user, 2022-2027 (USD Million)

10.5.3.1.2 Uae

10.5.3.1.3 Rest of Middle East

10.5.4 Africa

10.5.4.1 Need to Enhance Disaster Risk Financing

Table 229 Africa: Market, by Country, 2017-2021 (USD Million)

Table 230 Africa: Market, by Country, 2022-2027 (USD Million)

10.5.4.1.1 South Africa

10.5.4.1.2 Egypt

10.5.4.1.3 Nigeria

10.5.4.1.4 Rest of Africa

10.6 Latin America

10.6.1 Latin America: PESTLE Analysis

10.6.2 Latin America: Recession Impact

Table 231 Latin America: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 232 Latin America: Market, by Component, 2022-2027 (USD Million)

Table 233 Latin America: Market, by Service, 2017-2021 (USD Million)

Table 234 Latin America: Market, by Service, 2022-2027 (USD Million)

Table 235 Latin America: Market, by Professional Service, 2017-2021 (USD Million)

Table 236 Latin America: Market, by Professional Service, 2022-2027 (USD Million)

Table 237 Latin America: Market, by Solution, 2017-2021 (USD Million)

Table 238 Latin America: Market, by Solution, 2022-2027 (USD Million)

Table 239 Latin America: Market, by Application, 2017-2021 (USD Million)

Table 240 Latin America: Market, by Application, 2022-2027 (USD Million)

Table 241 Latin America: Market, by Communication System, 2017-2021 (USD Million)

Table 242 Latin America: Market, by Communication System, 2022-2027 (USD Million)

Table 243 Latin America: Market, by End-user, 2017-2021 (USD Million)

Table 244 Latin America: Market, by End-user, 2022-2027 (USD Million)

Table 245 Latin America: Market, by Country, 2017-2021 (USD Million)

Table 246 Latin America: Market, by Country, 2022-2027 (USD Million)

10.6.3 Brazil

10.6.3.1 Government Initiatives to Adopt Warning Systems

Table 247 Brazil: Natural Disaster Detection IoT Market, by Component, 2017-2021 (USD Million)

Table 248 Brazil: Market, by Component, 2022-2027 (USD Million)

Table 249 Brazil: Market, by Service, 2017-2021 (USD Million)

Table 250 Brazil: Market, by Service, 2022-2027 (USD Million)

Table 251 Brazil: Market, by Professional Service, 2017-2021 (USD Million)

Table 252 Brazil: Market, by Professional Service, 2022-2027 (USD Million)

Table 253 Brazil: Market, by Solution, 2017-2021 (USD Million)

Table 254 Brazil: Market, by Solution, 2022-2027 (USD Million)

Table 255 Brazil: Market, by Application, 2017-2021 (USD Million)

Table 256 Brazil: Market, by Application, 2022-2027 (USD Million)

Table 257 Brazil: Market, by Communication System, 2017-2021 (USD Million)

Table 258 Brazil: Market, by Communication System, 2022-2027 (USD Million)

Table 259 Brazil: Market, by End-user, 2017-2021 (USD Million)

Table 260 Brazil: Market, by End-user, 2022-2027 (USD Million)

10.6.4 Mexico

10.6.4.1 National Risk Atlas Helps in Decision-Making and Disaster Prevention

10.6.5 Rest of Latin America

11 Competitive Landscape

11.1 Introduction

11.2 Strategies Adopted by Key Players

Table 261 Overview of Strategies Adopted by Key Players in Market

11.3 Market Share Analysis of Top Players

Table 262 Market: Degree of Competition

11.4 Historical Revenue Analysis

Figure 38 Historical Revenue Analysis of Leading Players, 2019-2021 (USD Million)

11.5 Competitive Benchmarking

Table 263 Market: Detailed List of Key Startups/Smes

Table 264 Market: Competitive Benchmarking of Key Startups/Smes, by Solution and Region

Table 265 Natural Disaster Detection IoT Market: Competitive Benchmarking of Key Startups/Smes, by Application

Table 266 Market: Competitive Benchmarking of Major Players, by Solution and Region

Table 267 Market: Competitive Benchmarking of Major Players, by Application

11.6 Company Evaluation Quadrant

11.6.1 Stars

11.6.2 Emerging Leaders

11.6.3 Pervasive Players

11.6.4 Participants

Figure 39 Market Key Players: Company Evaluation Matrix, 2022

11.7 Startup/Sme Evaluation Quadrant

11.7.1 Progressive Companies

11.7.2 Responsive Companies

11.7.3 Dynamic Companies

11.7.4 Starting Blocks

Figure 40 Natural Disaster Detection IoT Market Startup/Smes: Company Evaluation Matrix, 2022

11.8 Competitive Scenario

11.8.1 Product Launches

Table 268 Product Launches, 2020-2022

11.8.2 Deals

Table 269 Deals, 2020-2022

12 Company Profiles

(Business Overview, Products/Solutions/Services Offered, Recent Developments & Analyst's View)*

12.1 Major Players

12.1.1 Nec Corporation

Table 270 Nec Corporation: Business Overview

Figure 41 Nec Corporation: Company Snapshot

Table 271 Nec Corporation: Products/Solutions/Services Offered

Table 272 Nec Corporation: Product Launches and Enhancements

Table 273 Nec Corporation: Deals

12.1.2 Blackberry

Table 274 Blackberry: Business Overview

Figure 42 Blackberry: Company Snapshot

Table 275 Blackberry: Products/Solutions/Services Offered

Table 276 Blackberry: Product Launches

Table 277 Blackberry: Deals

12.1.3 Semtech

Table 278 Semtech: Business Overview

Figure 43 Semtech: Company Snapshot

Table 279 Semtech: Products/Solutions/Services Offered

Table 280 Semtech: Product Launches

Table 281 Semtech: Deals

12.1.4 Sony

Table 282 Sony: Business Overview

Figure 44 Sony: Company Snapshot

Table 283 Sony: Products/Solutions/Services Offered

Table 284 Sony: Product Launches

Table 285 Sony: Deals

12.1.5 Nokia

Table 286 Nokia: Business Overview

Figure 45 Nokia: Company Snapshot

Table 287 Nokia: Products/Solutions/Services Offered

Table 288 Nokia: Product Launches

Table 289 Nokia: Deals

12.1.6 Sap

Table 290 Sap: Business Overview

Figure 46 Sap: Company Snapshot

Table 291 Sap: Products/Solutions/Services Offered

Table 292 Sap: Product Launches

Table 293 Sap: Deals

12.1.7 Intel

Table 294 Intel: Business Overview

Figure 47 Intel: Company Snapshot

Table 295 Intel: Products/Solutions/Services Offered

Table 296 Intel: Product Launches

Table 297 Intel: Deals

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments & Analyst's View Might Not be Captured in Case of Unlisted Companies.

12.2 Startup/Smes

12.2.1 Green Stream Technologies

12.2.2 Sensoterra

12.2.3 Earth Networks

12.2.4 Responscity Systems

12.2.5 Grillo

12.2.6 Bulfro Monitech

12.2.7 Sadeem Technology

12.2.8 Lumineye

12.2.9 Venti LLC

12.2.10 Simplisafe

12.2.11 One Concern

12.2.12 Onsolve

12.2.13 Trinity Mobility

12.2.14 Skyalert

12.2.15 SerinUS

12.2.16 Knowx Innovations Pvt. Ltd.

12.2.17 Ogoxe

12.2.18 Aplicaciones Technológicas Sa

13 Adjacent/Related Markets

13.1 Introduction

13.2 Public Safety and Security Market

13.2.1 Market Definition

13.2.2 Market Overview

13.2.3 Public Safety and Security Market, by Component

Table 298 Components: Public Safety and Security Market, 2015-2020 (USD Million)

Table 299 Components: Public Safety and Security Market, 2021-2027 (USD Million)

13.2.4 Public Safety and Security Market, by Solution

Table 300 Solutions: Public Safety and Security Market, 2015-2020 (USD Million)

Table 301 Solutions: Public Safety and Security Market, 2021-2027 (USD Million)

13.2.5 Public Safety and Security Market, by Service

Table 302 Services: Public Safety and Security Market, 2015-2020 (USD Million)

Table 303 Services: Public Safety and Security Market, 2021-2027 (USD Million)

13.2.6 Public Safety and Security Market, by Vertical

Table 304 Verticals: Public Safety and Security Market, 2015-2020 (USD Million)

Table 305 Vertical: Public Safety and Security Market, 2021-2027 (USD Million)

13.2.7 Public Safety and Security Market, by Region

Table 306 Public Safety and Security Market, by Region, 2015-2020 (USD Million)

Table 307 Public Safety and Security Market, by Region, 2021-2027 (USD Million)

13.3 Incident and Emergency Management Market

13.3.1 Market Definition

13.3.2 Market Overview

13.3.3 Incident and Emergency Management Market, by Component

Table 308 Incident and Emergency Management Market, by Component, 2016-2020 (USD Million)

Table 309 Incident and Emergency Management Market, by Component, 2021-2026 (USD Million)

13.3.4 Incident and Emergency Management Market, by Solution

Table 310 Incident and Emergency Management Market, by Solution, 2016-2020 (USD Million)

Table 311 Incident and Emergency Management Market, by Solution, 2021-2026 (USD Million)

13.3.5 Incident and Emergency Management Market, by Service

Table 312 Incident and Emergency Management Market, by Service, 2016-2020 (USD Million)

Table 313 Incident and Emergency Management Market, by Service, 2021-2026 (USD Million)

13.3.6 Incident and Emergency Management Market, by Communication System

Table 314 Incident and Emergency Management Market, by Communication System, 2016-2020 (USD Million)

Table 315 Incident and Emergency Management Market, by Communication System, 2021-2026 (USD Million)

13.3.7 Incident and Emergency Management Market, by Vertical

Table 316 Incident and Emergency Management Market, by Vertical, 2016-2020 (USD Million)

Table 317 Incident and Emergency Management Market, by Vertical, 2021-2026 (USD Million)

13.3.8 Incident and Emergency Management Market, by Region

Table 318 Incident and Emergency Management Market, by Region, 2016-2020 (USD Million)

Table 319 Incident and Emergency Management Market, by Region, 2021-2026 (USD Million)

14 Appendix

14.1 Discussion Guide

14.2 Knowledgestore: The Subscription Portal

14.3 Customization Options

14.4 Related Reports

14.5 Author Details

Companies Mentioned

- Aplicaciones Technológicas Sa

- Blackberry

- Bulfro Monitech

- Earth Networks

- Green Stream Technologies

- Grillo

- Intel

- Knowx Innovations Pvt. Ltd.

- Lumineye

- Nec Corporation

- Nokia

- Ogoxe

- One Concern

- Onsolve

- Responscity Systems

- Sadeem Technology

- Sap

- Semtech

- Sensoterra

- SerinUS

- Simplisafe

- Skyalert

- Sony

- Trinity Mobility

- Venti LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 262 |

| Published | January 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 0.3 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 36.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |