Progress of Sustainable Low Carbon Range Ready Mix Concrete is fueling the Europe Ready Mix Concrete Market

Ready mix concrete helps save on capital investments by not having to invest in plants and machinery for cement. Thus, ready mix concrete provides an alternative that reduces resource wastage during construction. The Europe construction industry focuses on meeting the growing need for infrastructure development and housing while limiting the impact of its CO2 emissions. Ready mix concrete industries have partially replaced their cement with fly ash and Ground Granulated Blast Furnace Slag (GGBS), which are the by-products of other industries. These products enhance the workability, durability, and sustainability of construction. Owing to the enriched properties (such as quality, availability, and low cost) of these supplementary materials, they are widely used for construction projects. For instance, Heidelberg Cement developed various alternatives to conventional concrete with a reduced environmental impact and improved carbon footprint, as well as building materials with product properties favorable for lower material usage are largely preferred. The products such as EcoPlus (UK) reduce CO2 emissions by 60%. The product contains up to 70% of Portland Cement in the concrete mix are replaced with Hanson Regen (Ground Granulated Blast Furnace Slag). This provides a product with a much lower level of embodied CO2 than if ordinary cement was used, which is more durable and aesthetically lighter in color. Moreover, Nor Lavkarbon (Norway) product contains fly ash as secondary cementitious material to produce low-carbon concrete (CO2 reduction by 20%). Therefore, developing such sustainable products is forecasted to drive the ready mix concrete market.Europe Ready Mix Concrete Market Overview

The market for the Europe region includes Germany, France, Italy, the UK, Russia, and the Rest of Europe. Europe's construction sector has consistently expanded, fueled by a rising population. Also, rapid shifts in the remodeling business trends, such as remodeling for accessibility, style mashing-up, customizations, and technological integrations, are likely to increase the business expansion. Economically strong countries like Germany, the UK, and Russia have witnessed significant growth in the implementation of technologically advanced solutions. Building and construction is the other industry flourishing in the region which is bolstering the growth of ready mix concrete in the region. According to BIBM (Bureau International du Beton Manufacture), buildings account for the largest share of total Europe energy consumption (40 percent) and 36 percent of EU CO2 emissions. Consequently, the construction industry represents an enormous potential in decreasing energy consumption and mitigating climate change. Ready mix concrete solutions highly offer energy-efficient commercial, educational, and healthcare facilities; drinking water, drainage, water sewage, and sanitation systems; communication and transport infrastructure; and shelter and protection against the forces of nature. Thus, these factors boost the demand for ready mix concrete market.Europe Ready Mix Concrete Market Segmentation

The Europe ready mix concrete market is segmented based on end use and country.- Based on end use, the Europe ready mix concrete market is segmented into residential, commercial, and others. The residential segment held the largest market share in 2022.

- Based on country, the Europe ready mix concrete market is segmented into Germany, France, Italy, Spain, the UK, Poland, Netherland, and the Rest of Europe. The Rest of Europe dominated the Europe ready mix concrete market share in 2022.

Vicat SA; LafargeHolcim; Buzzi Unicem S.p.A; CEMEX S.A.B. DE C.V.; and HeidelbergCement AG are the leading companies operating in the Europe ready mix concrete market.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection

3.2.2 Primary Interviews

3.2.3 Hypothesis Formulation

3.2.4 Macro-economic Factor Analysis

3.2.5 Developing Base Number

3.2.6 Data Triangulation

3.2.7 Country Level Data

4. Europe Ready Mix Concrete Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Europe Ready Mix Concrete Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Growth in Commercial and Residential Construction Projects

5.1.2 High Government Spending on Organization Projects

5.2 Market Restraints

5.2.1 Pollution Produced by Commercial Ready Mix Concrete Production Plants in Metro Cities

5.3 Market Opportunities

5.3.1 Progress of Sustainable Low Carbon Range Ready Mix Concrete

5.4 Market Trends

5.4.1 Use of Ready Mix Concrete in 3D Printing Process

5.5 Impact Analysis of Drivers and Restraint

6. Ready Mix Concrete - Europe Market Analysis

6.1 Europe Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

6.2 Europe Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

7. Europe Ready Mix Concrete Market Analysis - By End Use

7.1 Overview

7.2 Ready Mix Concrete Market, By End Use (2021 and 2028)

7.3 Residential

7.3.1 Overview

7.3.2 Residential: Ready Mix Concrete Market - Volume and Forecast to 2028 (Million Cubic Meter)

7.3.3 Residential: Ready Mix Concrete Market - Revenue and Forecast to 2028 (US$ Million)

7.4 Commercial

7.4.1 Overview

7.4.2 Commercial: Ready Mix Concrete Market - Volume and Forecast to 2028 (Million Cubic Meter)

7.4.3 Commercial: Ready Mix Concrete Market - Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Ready Mix Concrete Market - Volume and Forecast to 2028 (Million Cubic Meter)

7.5.3 Others: Ready Mix Concrete Market - Revenue and Forecast to 2028 (US$ Million)

8. Europe Ready Mix Concrete Market - by Country Analysis

8.1 Europe: Ready Mix Concrete Market

8.1.1 Europe: Ready Mix Concrete Market, by Key Country

8.1.1.1 Germany: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.2 Germany: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.2.1 Germany: Ready Mix Concrete Market, by End-Use

8.1.1.3 France: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.4 France: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.4.1 France: Ready Mix Concrete Market, by End-Use

8.1.1.5 Italy: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.6 Italy: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.6.1 Italy: Ready Mix Concrete Market, by End-Use

8.1.1.7 Spain: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.8 Spain: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.8.1 Spain: Ready Mix Concrete Market, by End-Use

8.1.1.9 United Kingdom: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.10 United Kingdom: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.10.1 United Kingdom: Ready Mix Concrete Market, by End-Use

8.1.1.11 Poland: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.12 Poland: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.12.1 Poland: Ready Mix Concrete Market, by End-Use

8.1.1.13 Netherlands: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.14 Netherlands: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.14.1 Netherlands: Ready Mix Concrete Market, by End-Use

8.1.1.15 Rest of Europe: Ready Mix Concrete Market -Volume and Forecast to 2028

8.1.1.16 Rest of Europe: Ready Mix Concrete Market -Revenue and Forecast to 2028

8.1.1.16.1 Rest of Europe: Ready Mix Concrete Market, by End-Use

9. Industry Landscape

9.1 Overview

9.2 Market Initiative

9.3 New Product Development

10. Company Profiles

10.1 Vicat SA

10.1.1 Key Facts

10.1.2 Business Description

10.1.3 Products and Services

10.1.4 Financial Overview

10.1.5 SWOT Analysis

10.1.6 Key Developments

10.2 LafargeHolcim

10.2.1 Key Facts

10.2.2 Business Description

10.2.3 Products and Services

10.2.4 Financial Overview

10.2.5 SWOT Analysis

10.2.6 Key Developments

10.3 Buzzi Unicem S.p.A

10.3.1 Key Facts

10.3.2 Business Description

10.3.3 Products and Services

10.3.4 Financial Overview

10.3.5 SWOT Analysis

10.3.6 Key Developments

10.4 CEMEX S.A.B. DE C.V.

10.4.1 Key Facts

10.4.2 Business Description

10.4.3 Products and Services

10.4.4 Financial Overview

10.4.5 SWOT Analysis

10.4.6 Key Developments

10.5 HEIDELBERGCEMENT AG

10.5.1 Key Facts

10.5.2 Business Description

10.5.3 Products and Services

10.5.4 Financial Overview

10.5.5 SWOT Analysis

10.5.6 Key Developments

11. Appendix

11.1 About the Publisher

11.2 Glossary of Terms

Table 1. Europe Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Table 2. Europe Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Table 3. Germany Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 4. Germany Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 5. France Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 6. France Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 7. Italy Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 8. Italy Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 9. Spain Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 10. Spain Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 11. UK Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 12. UK Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 13. Poland Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 14. Poland Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 15. Netherlands Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 16. Netherlands Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 17. Rest of Europe Ready Mix Concrete Market, by End Use - Volume and Forecast to 2028 (Million Cubic Meter)

Table 18. Rest of Europe Ready Mix Concrete Market, by End Use - Revenue and Forecast to 2028 (US$ Million)

Table 19. Glossary of Terms

Figure 1. Europe Ready Mix Concrete Market Segmentation

Figure 2. Europe Ready Mix Concrete Market Segmentation - By Country

Figure 3. Europe Ready Mix Concrete Market Overview

Figure 4. Europe Ready Mix Concrete Market, By End Use

Figure 5. Europe Ready Mix Concrete Market, By Country

Figure 6. Europe Porter's Five Forces Analysis

Figure 7. Europe Ready Mix Concrete Market - Ecosystem

Figure 8. Europe Expert Opinion

Figure 9. Europe Ready Mix Concrete Market Impact Analysis of Drivers and Restraints

Figure 10. Europe Ready Mix Concrete Market - Volume and Forecast to 2028 (Million Cubic Meter)

Figure 11. Europe Ready Mix Concrete Market - Revenue and Forecast to 2028 (US$ Million)

Figure 12. Europe Ready Mix Concrete Market Revenue Share, By End Use (2021 and 2028)

Figure 13. Residential: Europe Ready Mix Concrete Market - Volume and Forecast To 2028 (Million Cubic Meter)

Figure 14. Residential: Europe Ready Mix Concrete Market - Revenue and Forecast To 2028 (US$ Million)

Figure 15. Commercial: Europe Ready Mix Concrete Market - Volume and Forecast To 2028 (Million Cubic Meter)

Figure 16. Commercial: Europe Ready Mix Concrete Market - Revenue and Forecast To 2028 (US$ Million)

Figure 17. Others: Europe Ready Mix Concrete Market - Volume and Forecast To 2028 (Million Cubic Meter)

Figure 18. Others: Europe Ready Mix Concrete Market - Revenue and Forecast To 2028 (US$ Million)

Figure 19. Europe: Ready Mix Concrete Market, by Key Country - Revenue (2021) (US$ Million)

Figure 20. Europe: Ready Mix Concrete Market Revenue Share, by Key Country (2021 and 2028)

Figure 21. Germany: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 22. Germany: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 23. France: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 24. France: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 25. Italy: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 26. Italy: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 27. Spain: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 28. Spain: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 29. United Kingdom: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 30. United Kingdom: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 31. Poland: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 32. Poland: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 33. Netherlands: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 34. Netherlands: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Figure 35. Rest of Europe: Ready Mix Concrete Market -Volume and Forecast to 2028 (Million Cubic Meter)

Figure 36. Rest of Europe: Ready Mix Concrete Market -Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- Vicat SA

- LafargeHolcim

- Buzzi Unicem S.p.A

- CEMEX S.A.B. DE C.V.

- HeidelbergCement AG

Table Information

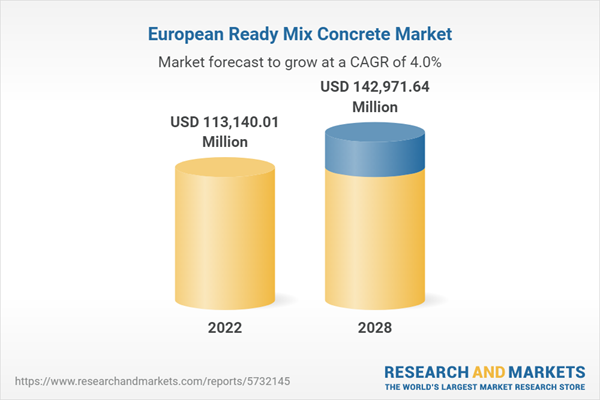

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 113140.01 Million |

| Forecasted Market Value ( USD | $ 142971.64 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 5 |