An inferior vena cava (IVC) filter is a medical device that is designed to prevent the migration of blood clots from the lower body to the lungs and reduce the risk of pulmonary embolism. It is a small and cage-like structure that is manufactured from metal or synthetic materials. It is inserted into the inferior vena cava vein that carries deoxygenated blood from the lower body to the heart. It acts as a physical barrier by trapping blood clots and preventing them from reaching the lungs.

At present, the increasing adoption of IVC filters among patients who are at high risk of developing blood clots is contributing to the growth of the market. Apart from this, the rising utilization of IVC filters on account of favorable reimbursement policies by healthcare providers is propelling the growth of the market. Moreover, the increasing adoption of IVF filters among the geriatric population, as they are more prone to venous thromboembolism, is bolstering the growth of the market. Additionally, the growing demand for IVC filters due to the increasing preference for minimally invasive surgical procedures among the masses around the world is positively influencing the market. Furthermore, the rising adoption of medical treatment solutions due to the improving healthcare infrastructure is strengthening the growth of the market.

Inferior Vena Cava (IVC) Filter Market Trends/Drivers:

Rising prevalence of deep vein thrombosis (DVT) and pulmonary embolism (PE)There is a rise in the demand for IVC filters due to the increasing prevalence of deep vein thrombosis (DVT) and pulmonary embolism (PE) among the masses across the globe. Deep vein thrombosis usually occurs when blood clots form in deep veins, often in the legs. Moreover, if these clots break loose and travel to the lungs, then they can cause a life-threatening condition known as pulmonary embolism.

People are increasingly facing DVT and PE cases due to sedentary lifestyles, obesity, improper physical activity, and other lifestyle-related issues. Additionally, there is an increased chance of the development of DVT among the geriatric aging population. Furthermore, healthcare providers are increasingly adopting IVC filters as a preventive measure for high-risk patients to reduce the occurrence of PE and its associated morbidity and mortality.

Increasing consumer awareness about the risks and consequences of diseases

There is an increase in the demand for IVC filters due to the rising awareness about the risks and consequences of DVT and PE among healthcare professionals and the general population.Governing agencies of various countries are encouraging the adoption of IVC filters by spreading awareness, organizing campaigns, and taking educational initiatives to focus on venous thromboembolism prevention. Moreover, rapid advancements in diagnostic capabilities allow more accurate and timely detection of DVT and PE cases that enhances patient outcomes. In addition, early diagnosis allows healthcare professionals to identify individuals who could benefit from IVC filter placement. The rising utilization of IVC filters to provide a reliable and effective solution for preventing pulmonary embolism is contributing to the growth of the market.

Advancements in IVC filter technology

Various manufacturers are rapidly advancing IVC filter technology to provide improved safety and efficacy of the product. In addition, the rising introduction of retrievable IVC filters, which can be removed once the risk of pulmonary embolism has settled. These retrievable filters provide healthcare professionals with more flexibility and options for managing patients effectively, which is offering a positive market outlook. Additionally, various technological advancements in filter design and materials assist in enhancing biocompatibility and reducing the risk of adverse reactions and long-term complications. Apart from this, the rising adoption rates of IVC filters for appropriate cases due to their enhanced effectiveness.Inferior Vena Cava (IVC) Filter Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global inferior vena cava (IVC) filter market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, material, application and end user.Breakup by Product:

- Retrievable IVC Filter

- Permanent IVC Filter

Retrievable IVC filter represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the product. This includes retrievable IVC filter and permanent IVC filter. According to the report, retrievable IVC filter represented the largest segment.Retrievable IVC filters are medical devices that are designed to be implanted temporarily in patients at high risk of pulmonary embolism. They can be removed once the risk of clot migration has subsided or when the condition of the patient is improved. In addition, the retrievable IVC filter placement procedure is minimally invasive and typically performed by an interventional radiologist. The rising adoption of retrievable IVC filters, as they offer flexibility to healthcare providers in treatment options, is propelling the growth of the market.

Breakup by Material:

- Non-Ferromagnetic Material

- Ferromagnetic Materials

Non-ferromagnetic material accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material. This includes non-ferromagnetic material and ferromagnetic materials. According to the report, non-ferromagnetic material represented the largest segment.Non-ferromagnetic materials are those that do not contain iron and do not exhibit magnetic properties. They are used to construct filter devices and offer enhanced biocompatibility. They can withstand the physiological environment within the human body without causing adverse reactions. In addition, they are widely used in medical settings where the presence of magnetic materials could interfere with imaging techniques, such as magnetic resonance imaging (MRI). Non-ferromagnetic materials are utilized in the construction of IVC filters that allow patients to undergo MRI scans without any concerns about potential complications or distortions in the images.

Breakup by Application:

- Treatment Venous Thromboembolism (VTE)

- Prevent Pulmonary Embolism (PE)

- Others

Treatment venous thromboembolism (VTE) holds the biggest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes treatment venous thromboembolism (VTE), prevent pulmonary embolism (PE), and others. According to the report, treatment venous thromboembolism (VTE) represented the largest segment.In the treatment venous thromboembolism (VTE), the IVC filters are placed in the inferior vena cava that carries deoxygenated blood from the lower body to the heart, to trap blood clots and prevent their migration to the lungs. They assist in reducing the risk of pulmonary embolism and its potential consequences in the body. They also provide an additional layer of protection against blood clot migration in high-risk patients. In line with this, VTE treatment provides enhanced patient outcomes and improved overall safety in managing VTE cases.

Breakup by End User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Others

Hospitals dominate the market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgical centers (ASCs), and others. According to the report, hospitals represented the largest segment.Hospitals are the primary end-users of IVC filters, as they provide enhanced treatment options to patients with various medical conditions, such as those at high risk of venous thromboembolism (VTE). In hospitals, IVC filters are widely utilized in patients undergoing surgical procedures or those admitted for trauma or critical care, and individuals with known risk factors for developing deep vein thrombosis (DVT) or pulmonary embolism (PE). In addition, hospitals are equipped with advanced medical technologies and experienced healthcare professionals that benefit in managing VTE cases effectively. Interventional radiologists or vascular surgeons often perform the minimally invasive procedure of inserting IVC filters in hospital settings.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest inferior vena cava (IVC) filter market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America held the biggest market share due to the presence of well-established healthcare infrastructure and facilities. In addition, the rising prevalence of obesity among individuals is contributing to the growth of the market in the region. Apart from this, the increasing utilization of IVC filters as a preventive measure among patients is supporting the growth of the market. In line with this, the rising adoption of IVC filers due to favorable regulatory framework and reimbursement policies is bolstering the growth of the market in the North America region.

Competitive Landscape:

Key players in the industry are investing in research and development (R&D) activities to improve the design, materials, and safety features of IVC filters. In line with this, they are developing retrievable filters, enhancing the biocompatibility of products, and exploring innovative filter designs to reduce complications and enhance patient outcomes.Apart from this, many companies are launching new IVC filter products or introducing upgraded versions of their existing products to address specific clinical needs. They are also conducting clinical trials and research studies to gather more data on the safety and efficacy of their IVC filter products. In addition, major manufacturers are working to address safety concerns related to IVC filters, such as filter migration, fracture, and perforation.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- ALN Implants Chirurgicaux

- Argon Medical Devices Inc.

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Braile Biomédica

- Cook Group Incorporated

Key Questions Answered in This Report::

- How has the global inferior vena cava (IVC) filter market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global inferior vena cava (IVC) filter market?

- What is the impact of each driver, restraint, and opportunity on the global inferior vena cava (IVC) filter market?

- What are the key regional markets?

- Which countries represent the most attractive inferior vena cava (IVC) filter market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the inferior vena cava (IVC) filter market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the inferior vena cava (IVC) filter market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the inferior vena cava (IVC) filter market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the inferior vena cava (IVC) filter market?

- What is the competitive structure of the global inferior vena cava (IVC) filter market?

- Who are the key players/companies in the global inferior vena cava (IVC) filter market?

Table of Contents

Companies Mentioned

- ALN Implants Chirurgicaux

- Argon Medical Devices Inc.

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Braile Biomédica

- Cook Group Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | April 2025 |

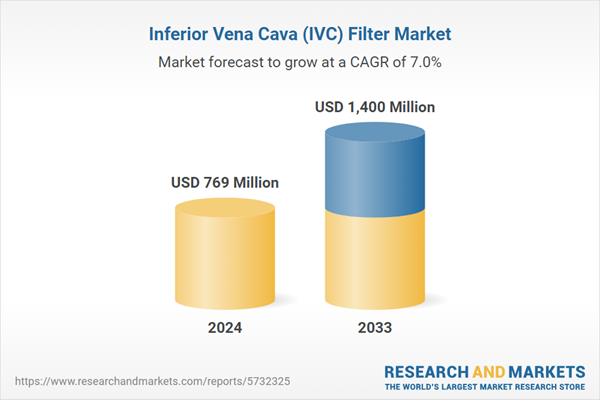

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 769 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |