Wood Coating Market Analysis:

Market Growth and Size: The market is witnessing stable growth on account of the increasing number of construction projects, along with stringent environmental regulations.Technological Advancements: Innovations in wood coating technologies, including water-based coatings, ultraviolet (UV)-cured coatings, and nanotechnology-based formulations, benefit in enhancing product performance.

Industry Applications: Wood coatings find application in furniture manufacturing, flooring, cabinetry, architectural woodwork, and exterior cladding.

Geographical Trends: Asia Pacific leads the market, driven by the presence of well-established key players. However, North America is emerging as a fast-growing market due to the rising focus on producing high-performance wood coatings.

Competitive Landscape: Key players are developing eco-friendly and sustainable coatings, such as low-VOC and water-based options.

Challenges and Opportunities: While the market faces challenges, such as meeting evolving environmental regulations, it also encounters opportunities on account of the escalating demand for sustainable and high-performance coatings.

Future Outlook: The future of the wood coating market looks promising, with the rising development of eco-friendly coatings. Additionally, technological innovations in formulations are expected to propel the market growth.

Wood Coating Market Trends:

Growing demand for wooden products

The growing demand for wooden products among the masses across the globe is offering a positive market outlook. In line with this, wood is a preferred material for furniture, flooring, cabinetry, and building construction. Moreover, increasing preferences for wooden furniture, as it offers enhanced aesthetic appeal, is supporting the growth of the market. Besides this, wood is a sustainable and eco-friendly choice and aligns with the sustainability goals. In addition, the rising utilization of wooden materials in commercial and residential spaces is propelling the market growth. Furthermore, wood coatings play a vital role in protecting and enhancing the lifespan of wooden surfaces, ensuring their longevity while maintaining their visual appeal. Apart from this, wood coatings offer a wide range of options for customization, including different finishes, colors, and textures. Additionally, they enhance the appearance of wooden surfaces by providing color, depth, gloss, and protection against wear and tear.Rising infrastructure projects

The escalating demand for wood coatings on account of the rising number of residential and commercial spaces across the globe is bolstering the growth of the market. In line with this, infrastructure projects often rely on wood for its structural and decorative applications. Furthermore, the increasing adoption of wood coatings, as they provide essential protection against environmental factors, such as moisture, ultraviolet (UV) radiation, and wear and tear, is contributing to the market growth. Apart from this, the rising employment of wood coatings to preserve and enhance wooden structures and surfaces is impelling the market growth. Additionally, residential and commercial spaces experience high foot traffic and daily wear and tear. Wood coatings provide a protective layer that safeguards wooden surfaces against scratches and stains. The durability and longevity offered by these coatings are critical factors for property owners, developers, and designers looking to maintain the appearance and value of these spaces over time.Environmental regulations

The increasing adoption of wood coatings due to stringent environmental regulations is strengthening the growth of the market. In line with this, rising concerns about air quality among individuals are propelling the market growth. Moreover, the increasing development of eco-friendly coatings is impelling the market growth. Apart from this, governing agencies of various countries are implementing stringent emissions standards that encourage manufacturers to produce low-volatile organic compounds (VOCs) and eco-friendly coatings, which are supporting the market growth. Furthermore, the rising focus on maintaining environmental sustainability is contributing to the market growth. In addition, individuals and organizations are seeking coatings that meet environmental standards. Besides this, key players are investing in research and development (R&D) activities to create water-based, solvent-free, and low-VOC wood coatings that provide effective protection while minimizing harm to the environment. Additionally, the increasing development of wood coatings with safer chemical compositions and disposal practices is bolstering the market growth.Wood Coating Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on coating type, resin type, formulating technology, and application.Breakup by Coating Type:

- Stains and Varnishes

- Shellac Coating

- Wood Preservatives

- Water Repellents

- Others

Stains and varnishes account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the coating type. This includes stains and varnishes, shellac coating, wood preservatives, water repellents, and others. According to the report, stains and varnishes represented the largest segment.Stains and varnishes are coatings that enhance the visual appeal of wood surfaces by providing color, depth, and gloss. They are commonly used in furniture, cabinetry, flooring, and decorative woodwork applications. In addition, the rising need to protect wooden surfaces from wear and tear is bolstering the market growth.

Shellac coating is known for its natural and glossy finish and is often used in fine woodworking and restoration projects. In line with this, it offers improved adhesion and is favored for its traditional and classic appearance.

Wood preservatives are essential for protecting wood from decay, fungi, and insect damage. They are commonly used in outdoor applications, such as decking, fences, and outdoor furniture. The increasing need to extend the lifespan of wooden structures that are exposed to harsh environmental conditions is impelling the market growth.

Water repellents coatings are designed to protect wood from moisture and prevent swelling, warping, and rot. They are used in exterior applications, including wooden siding and outdoor decks. The growing focus on moisture protection and the durability of wooden structures is offering a positive market outlook.

Breakup by Resin Type:

- Acrylic

- Nitrocellulose

- Polyester

- Polyurethane

- Others

Polyurethane holds the largest market share

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes acrylic, nitrocellulose, polyester, polyurethane, and others. According to the report, polyurethane accounted for the largest market share.Polyurethane coatings are known for their enhanced durability, resistance to abrasion, and UV protection. They provide a high-quality finish and are commonly used in high-traffic areas, such as hardwood flooring and kitchen cabinets. In addition, rising preferences for long-lasting performance and aesthetic appeal are propelling the market growth.

Acrylic coatings are valued for their versatility and water-based formulations. They offer enhanced adhesion, fast drying times, and low VOC content, making them an eco-friendly choice. Acrylic wood coatings are commonly used in both interior and exterior applications, including furniture, doors, and trim. The escalating demand for eco-friendly and easy-to-use coatings is supporting the market growth.

Nitrocellulose coatings are known for their quick drying times and improved adhesion to wood surfaces. Besides this, they are often used in musical instrument finishes and high-gloss furniture applications.

Polyester coatings are known for their high-gloss finish and enhanced chemical resistance. They are used in specialized wood applications, such as kitchen countertops and laboratory furniture. Polyester coatings offer superior protection against chemicals and wear, making them suitable for demanding environments.

Breakup by Formulating Technology:

- Solvent-Borne

- Water-Borne

- UV-Cured

- Others

Solvent-borne represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the formulating technology. This includes solvent-borne, water-borne, UV-cured, and others. According to the report, solvent-borne represented the largest segment.Solvent-borne coatings are formulated with organic solvents, which facilitate the application and drying process. These coatings are known for their improved flow, leveling, and durability. These coatings are used in various applications, including furniture, cabinetry, and high-end architectural woodwork.

Water-borne coatings are formulated with water as the primary solvent. They assist in reducing VOC emissions and promoting a safer working environment. They offer improved adhesion and are suitable for both interior and exterior wood applications. The rising adoption of eco-friendly options is propelling the market growth.

UV-cured wood coatings are cured rapidly using ultraviolet (UV) light, resulting in quick drying times and minimal environmental impact. UV-cured coatings offer improved hardness, chemical resistance, and scratch resistance. They are used in applications where fast production cycles and high-performance finishes are required, such as flooring and cabinetry.

Breakup by Application:

- Furniture

- Cabinets

- Siding

- Flooring

- Others

Furniture exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes furniture, cabinets, siding, flooring, and others. According to the report, furniture represented the largest segment.Wood coatings are used in the manufacturing of wooden furniture, including tables, chairs, dressers, and beds. Coatings benefit in enhancing the appearance, durability, and resistance to wear and tear of furniture pieces. Besides this, rising preferences for aesthetically pleasing and long-lasting furniture products are impelling the market growth.

Cabinets, including kitchen cabinets and bathroom vanities, are prominent applications for wood coatings. These coatings provide protection against moisture, heat, and everyday use, preserving the quality and appearance of cabinets. Wood coatings for cabinets often feature stain resistance and easy cleaning properties.

Siding provides resistance to weathering, UV radiation, and moisture while preventing decay and ensuring longevity. Exterior wood siding coatings are essential for maintaining the structural integrity and aesthetic appeal of buildings. Furthermore, the rising number of renovation projects is bolstering the market growth.

Wood coatings for flooring applications are designed to withstand heavy foot traffic, abrasion, and impact. These coatings offer superior durability and resistance to scratches and stains, making them suitable for both residential and commercial flooring. Flooring coatings contribute to the longevity and appearance of hardwood floors, engineered wood, and laminate flooring.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest wood coating market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to the presence of well-established key players. In addition, the rising focus on environmental sustainability is bolstering the growth of the market. Apart from this, the increasing adoption of water-based and low-VOC wood coatings is impelling the market growth.North America stands as another key region in the market, driven by the growing focus on producing high-performance wood coatings that cater to diverse needs of individuals. Besides this, the rising development of eco-friendly coatings is contributing to the market growth.

Europe maintains a strong presence in the market, with the increasing focus on maintaining environmental sustainability. In line with this, the rising adoption of wood coatings for preserving and beautifying wooden surfaces, such as flooring, cabinetry, and interior decor, is impelling the market growth.

Latin America exhibits growing potential in the wood coating market on account of the thriving construction sector. Apart from this, the increasing development of water-based and low-VOC wood coatings to meet sustainability requirements is propelling the market growth.

The Middle East and Africa region shows a developing market for wood coating, primarily driven by rising construction activities. Besides this, the increasing usage of water-based formulations is supporting the market growth.

Leading Key Players in the Wood Coating Industry:

Key players are creating new and advanced wood coating formulations. They are developing eco-friendly and sustainable coatings, such as low-VOC and water-based options. Besides this, innovation in technologies, such as UV-cured coatings and nanotechnology, assist in providing enhanced performance. Additionally, companies are expanding their product portfolios to cater to a wide range of wood substrates and applications, including furniture, cabinets, flooring, and siding. They are focusing on offering a variety of finishes, colors, and textures to meet the diverse preferences of individuals. Furthermore, major manufacturers are implementing sustainability practices in manufacturing processes and supply chains to reduce their environmental impact. They are ensuring compliance with local and international regulations regarding the use of VOCs and other environmental standards.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- Brillux GmbH & Company KG

- Diamond Vogel Paint Company

- Eastman Chemical Company

- IVM S.R.L.

- Kansai Nerolac Paints Limited (Kansai Paint Co. Ltd.)

- Nippon Paint (India) Private Limited

- PPG Industries Inc.

- RPM International Inc.

- Sirca Paints India Limited

- Stahl Holdings B.V.

- Teknos Group Oy

- Valspar Corporation (Sherwin-Williams Company)

Key Questions Answered in This Report:

- How has the global wood coating market performed so far, and how will it perform in the coming years ?

- What are the drivers, restraints, and opportunities in the global wood coating market ?

- What is the impact of each driver, restraint, and opportunity on the global wood coating market ?

- What are the key regional markets ?

- Which countries represent the most attractive wood coating market ?

- What is the breakup of the market based on the coating type ?

- Which is the most attractive coating type in the wood coating market ?

- What is the breakup of the market based on the resin type ?

- Which is the most attractive resin type in the wood coating market ?

- What is the breakup of the market based on the formulating technology ?

- Which is the most attractive formulating technology in the wood coating market ?

- What is the breakup of the market based on the application ?

- Which is the most attractive application in the wood coating market ?

- What is the competitive structure of the market ?

- Who are the key players/companies in the global wood coating market ?

Table of Contents

Companies Mentioned

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- Brillux GmbH & Company KG

- Diamond Vogel Paint Company

- Eastman Chemical Company

- IVM S.R.L.

- Kansai Nerolac Paints Limited (Kansai Paint Co. Ltd.)

- Nippon Paint (India) Private Limited

- PPG Industries Inc.

- RPM International Inc.

- Sirca Paints India Limited

- Stahl Holdings B.V.

- Teknos Group Oy

- Valspar Corporation (Sherwin-Williams Company)

Table Information

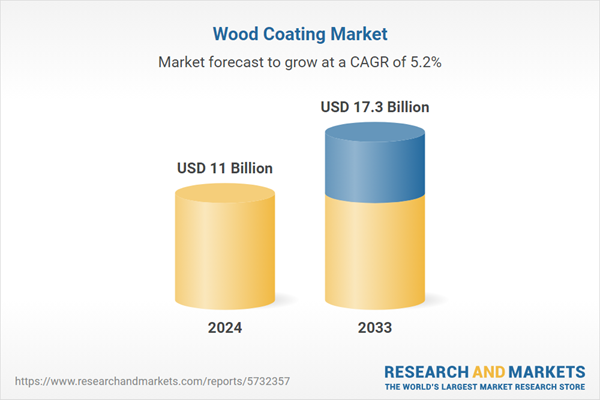

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 11 Billion |

| Forecasted Market Value ( USD | $ 17.3 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |