Food packaging refers to the process of enclosing food products for protection, preservation, and distribution. It plays a crucial role in maintaining the quality and safety of food items from the point of production to consumption. Food packaging serves multiple purposes, such as preventing contamination, extending shelf life, and providing information to consumers. Modern food packaging is designed to meet a variety of requirements. It should provide a barrier against external factors like moisture, air, light, and microorganisms that could potentially degrade the quality of the food. Additionally, it must ensure that the product remains intact during transportation and storage, reducing the risk of damage.

Busy lifestyles and on-the-go consumption patterns have led to a surge in demand for convenient, easy-to-open, and portable food packaging solutions. Additionally, increasing awareness of foodborne illnesses and contamination risks has led to a demand for packaging materials and technologies that enhance food safety and maintain product integrity. Other than this, growing environmental consciousness has propelled the adoption of eco-friendly packaging materials and practices, such as biodegradable, compostable, and recyclable options. Besides this, packaging technologies such as modified atmosphere packaging (MAP) and vacuum packaging help extend the shelf life of perishable foods, reducing food waste and enhancing product availability. In line with this, the rise of urbanization and the expansion of convenience store formats have increased the demand for single-serving and portion-controlled packaging formats. Furthermore, stringent food safety regulations and labeling requirements imposed by governments and international organizations drive the adoption of packaging solutions that meet compliance standards. Moreover, packing serves as a crucial tool for brand differentiation and product positioning, encouraging companies to invest in visually appealing and unique packaging designs.

Food Packaging Market Trends/Drivers

Consumer Demand for Convenience

Changing consumer lifestyles, characterized by busy schedules and the rise of on-the-go consumption, have significantly influenced the global food packaging market. Consumers seek packaging solutions that align with their convenience-oriented preferences. This driver has prompted the development of packaging formats such as single-serve portions, resealable pouches, and microwave-safe containers. These options cater to the need for quick and easy consumption, reducing the time and effort required for food preparation. As a result, packaging manufacturers are continuously innovating to create packaging designs that simplify handling and storage, enhancing the overall convenience factor for consumers.Rising Concerns about Food Safety and Hygiene

The global food packaging market has responded by adopting materials and technologies that safeguard the quality and integrity of food products. Packaging solutions with built-in barriers to external contaminants, such as moisture and air, help prevent spoilage and maintain product freshness. Additionally, advancements in antimicrobial packaging materials contribute to reducing the growth of harmful microorganisms, thereby enhancing food safety. The emphasis on food safety has prompted collaboration between packaging manufacturers and food producers to develop packaging that meets stringent hygiene standards and minimizes the risk of foodborne illnesses.Growing Sustainability Concerns

Consumers are increasingly conscious of the environmental impact of packaging waste, prompting them to favor products that come in packaging made from renewable resources or materials that can be recycled or composted. This sustainability driver has prompted packaging manufacturers to explore alternatives to traditional plastics, such as bioplastics and plant-based materials. Additionally, efforts to reduce packaging waste and adopt circular economy principles are driving innovations in packaging design, encouraging the use of minimalist packaging and optimizing material usage. As sustainability becomes a defining factor in consumer purchasing decisions, the global food packaging market is witnessing a notable transition towards greener and more environmentally responsible packaging options.Food Packaging Industry Segmentation

This report provides an analysis of the key trends in each segment of the global food packaging market report, along with forecasts at the global and regional levels for 2025-2033. The report has categorized the market based on packaging type and application.Breakup by Packaging Type

- Flexible

- Paper and Paperboard

- Rigid Plastic

- Glass

- Metal

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes flexible, paper and paperboard, rigid plastic, glass, metal, and others. According to the report, flexible packaging represented the largest segment.

Flexible packaging is lightweight and easily transportable, reducing shipping costs and environmental impact. Its flexible nature allows it to conform to various product shapes and sizes, accommodating a wide array of items from snacks to liquids. This adaptability extends to design, enabling eye-catching graphics and convenient features like resealable closures. Additionally, its material efficiency and lower production costs appeal to manufacturers aiming to optimize resources and minimize expenses. As sustainability gains prominence, flexible packaging's lightweight construction and recyclability resonate with environmentally conscious consumers, aligning with sustainability goals. Moreover, flexible packaging enhances shelf life by providing excellent barriers against moisture, air, and light, preserving product freshness. Its user-friendly attributes, cost-effectiveness, and ability to cater to evolving consumer preferences position it as the preferred packaging solution, thus securing its place as the largest segment in the market.

Breakup by Application

- Bakery, Confectionary, Pasta, and Noodles

- Dairy Products

- Sauces, Dressings, and Condiments

- Snacks and Side Dishes

- Convenience Foods

- Meat, Fish, and Poultry

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes bakery, confectionary, pasta, and noodles, dairy products, sauces, dressings, and condiments, snacks and side dishes, convenience foods, meat, fish, and poultry, fruits and vegetables, and others. According to the report, bakery, confectionary, pasta, and noodles accounted for the largest market share.

These food categories are widely consumed globally, enjoying consistent demand across diverse cultures and regions. Bakery products, confectionary items, pasta, and noodles are staple foods for many, ensuring a stable market base. Additionally, these products often require packaging solutions that maintain freshness, texture, and taste. Flexible packaging, modified atmosphere packaging (MAP), and vacuum-sealed options are tailored to address these preservation needs, ensuring that these goods reach consumers in optimal condition. Moreover, the visual appeal of packaging is crucial for products in this segment, as consumers are drawn to aesthetically pleasing designs. Packaging plays a significant role in attracting attention on store shelves, fostering brand recognition, and communicating product quality.

Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The well-established and technologically advanced food processing infrastructure across the region enables efficient production, processing, and distribution of a wide range of food products. This infrastructure enhances the competitiveness of North American food processors on a global scale. Additionally, a diverse and affluent consumer base in North America demands a variety of processed foods to meet their changing dietary preferences and busy lifestyles. This drives innovation and investment in food processing technologies to cater to evolving consumer demands. Furthermore, the region's stringent food safety regulations and quality standards instill consumer confidence in processed food products. Compliance with these regulations fosters trust in the safety and quality of the food processing industry. Moreover, the strong emphasis on research and development in North America, as well as collaborations between academia, industry, and government, promotes technological advancements and the adoption of cutting-edge processing techniques.

Competitive Landscape

Leading companies allocate significant resources to research and development activities, focusing on developing new products, enhancing existing ones, and introducing innovative processing techniques. These efforts result in improved product quality, nutritional value, and consumer satisfaction. Additionally, numerous key players are actively addressing environmental concerns by implementing sustainable practices in their operations. This includes reducing waste, minimizing energy consumption, and adopting eco-friendly packaging solutions to reduce their carbon footprint. Other than this, strategic collaborations between food processing companies, suppliers, and research institutions facilitate the exchange of knowledge and expertise. Such partnerships drive innovation, accelerate the development of new technologies, and contribute to the growth of the entire industry. Besides this, key players are embracing digital technologies such as automation, data analytics, and artificial intelligence to streamline processes, enhance quality control, and optimize supply chain management. These technologies improve efficiency, reduce costs, and enhance the overall competitiveness of the industry. Moreover, recognizing changing consumer preferences, food processing companies are diversifying their product portfolios to include healthier, organic, and functional foods. This enables them to tap into new market segments and cater to consumers seeking nutritious and customized options.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amcor PLC

- Crown Holdings Incorporated

- Owens-Illinois Inc.

- Tetra Pak Ltd.

- American Packaging Corporation

- Ball Corporation

Key Questions Answered in This Report

1. How big is the food packaging market?2. What is the future outlook of food packaging market?

3. What are the key factors driving the food packaging market?

4. Which region accounts for the largest food packaging market share?

5. Which are the leading companies in the global food packaging market?

Table of Contents

Companies Mentioned

- Amcor PLC

- Crown Holdings Incorporated

- Owens-Illinois Inc.

- Tetra Pak Ltd.

- American Packaging Corporation

- Ball Corporation

Table Information

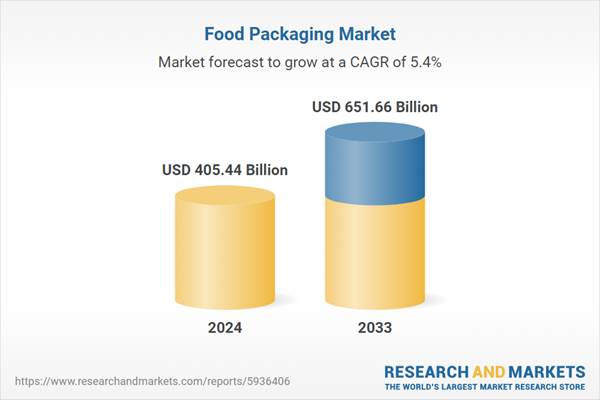

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 405.44 Billion |

| Forecasted Market Value ( USD | $ 651.66 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |