Medical gases are specialized gases that are used in various medical and healthcare applications to support patient care, diagnosis, treatment, and medical procedures. These gases are essential in medical facilities such as hospitals, clinics, ambulatory care centers, and home healthcare settings. They are carefully produced, stored, and distributed to ensure safety and purity for use in medical environments. Medical gases are administered to patients in a controlled manner to ensure their safety and well-being during medical treatments and interventions.

The ongoing COVID-19 pandemic has escalated the need for oxygen gas, an essential and effective treatment for patients struggling with respiratory issues. This urgency has prompted numerous governments to prioritize the import and local production of medical oxygen gas, ensuring a continuous supply to healthcare facilities treating COVID-19 cases. Beyond this, medical gases like oxygen also play a pivotal role in addressing specific health conditions such as pneumonia, malaria, sepsis, and meningitis. Moreover, the administration of medical oxygen remains vital for vulnerable populations, particularly children and mothers, during precarious medical interventions.

Additionally, the rising prevalence of cancer and the demand for surgical procedures are fueling the requirement for liquid nitrogen, which acts as a cryogen to preserve biological specimens, freeze blood, tissue, and eliminate diseased tissue in fields like dermatology and cryosurgery. Furthermore, the introduction of premium-grade medical gases and gas mixtures is poised to propel market growth. These specialized offerings cater to specific medical needs, affirming the evolving landscape of medical gas applications and driving innovation in the sector.

Medical Gases Market Trends/Drivers:

Rising prevalence of chronic diseases such as respiratory and cardiovascular diseases

The rising incidence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, and interstitial lung diseases, demands medical gases like oxygen for respiratory support. Patients experiencing breathing difficulties require oxygen therapy, which is essential for maintaining adequate oxygen levels in their bloodstream and alleviating symptoms.Besides, cardiovascular disorders, including heart failure, coronary artery disease, and hypertension, often require medical gases for diagnostic purposes and during medical interventions. Nitrous oxide is utilized as an anesthetic agent during cardiovascular surgeries, ensuring patient comfort and stability. Moreover, medical gases are indispensable in providing palliative care to patients with advanced stages of chronic diseases.

Various advancements in medical technology

Technological advancements have led to the development of minimally invasive surgical procedures, such as laparoscopy and endoscopy. Medical gases like carbon dioxide are used to create a clear operating field, enabling surgeons to perform procedures with smaller incisions, reduced tissue trauma, and faster patient recovery. Moreover, advancements in respiratory therapy equipment have enabled more targeted and personalized treatment for respiratory disorders.Medical gases like oxygen are administered through advanced oxygen therapy devices, including oxygen concentrators and portable oxygen delivery systems. Besides, various advances in cryosurgery and dermatology have expanded the use of medical gases like liquid nitrogen for freezing and destroying abnormal or diseased tissue. Cryotherapy devices offer controlled and targeted treatment, minimizing damage to surrounding healthy tissue, thus propelling the market.

Increasing trend toward home healthcare and telemedicine

Home healthcare often involves the provision of medical gases like oxygen to patients in their own residences. Patients with chronic respiratory conditions such as COPD require oxygen therapy to manage their symptoms and improve their quality of life. The trend toward home healthcare allows patients to receive oxygen therapy without the need for prolonged hospital stays, leading to increased demand for medical oxygen gases. Moreover, medical gases have various applications beyond oxygen therapy, such as nebulization, pain management, and respiratory treatments. The expansion of home healthcare and telemedicine allows patients to receive a wider range of medical gas treatments in the comfort of their homes, further driving the demand for medical gases.Medical Gases Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global medical gases market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on gas type, application, and end user.Breakup by Gas Type:

- Pure Gases

- Medical Air

- Medical Oxygen

- Nitrous Oxide

- Nitrogen

- Carbon Dioxide

- Helium

- Gas Mixtures

- Aerobic Gas Mixtures

- Anaerobic Gas Mixtures

- Blood Gas Mixtures

- Lung Diffusion Mixtures

- Medical Laser Mixtures

- Medical Drug Gas Mixtures

- Others

Pure gases (medical oxygen) represent most used gas type

The report has provided a detailed breakup and analysis of the market based on the gas type. This includes pure gases (medical air, medical oxygen, nitrous oxide, nitrogen, carbon dioxide, and helium) and gas mixtures (aerobic gas mixtures, anaerobic gas mixtures, blood gas mixtures, lung diffusion mixtures, medical laser mixtures, medical drug gas mixtures, and others. According to the report, pure gases (medical oxygen) represented the largest segment.Pure gases are essential for medical applications that require precise concentrations and accurate dosages. Medical procedures such as anesthesia, respiratory therapy, and diagnostic testing necessitate gases with consistent and known compositions to achieve reliable results. Moreover, many medical procedures require a controlled environment to achieve desired outcomes.

Pure gases provide the necessary control over variables like gas composition and pressure, ensuring optimal conditions for treatments, surgeries, and therapies. Besides, medical equipment and devices are calibrated and designed to work with specific gas compositions. Pure gases maintain the integrity of medical equipment and help prevent malfunctions that could impact patient care.

Breakup by Application:

- Therapeutic

- Diagnostic

- Biotechnology and Pharmaceutical Industry

- Others

Therapeutic applications hold the largest market share

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes therapeutic, diagnostic, biotechnology and pharmaceutical industry, and others. According to the report, therapeutic applications accounted for the largest market share.Medical gases, especially oxygen, are extensively used to manage respiratory conditions such as chronic obstructive pulmonary disease (COPD), asthma, and respiratory distress syndrome. Therapeutic oxygen delivery supports patients with compromised breathing and improves their quality of life. Besides, medical gases are indispensable in critical care units and emergency settings.

They are administered to stabilize patients with acute respiratory distress, trauma, cardiac arrest, and other life-threatening conditions, playing a pivotal role in preventing further complications. Moreover, these gases are integrated into various rehabilitation and physiotherapy programs. They assist patients recovering from injuries, surgeries, or neurological disorders, aiding in improved breathing and overall well-being.

Breakup by End User:

- Hospitals

- Home Healthcare

- Academic and Research Institutions

Hospitals account for the majority of market share

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes hospitals, home healthcare, and academic and research institutions. According to the report, hospitals accounted for the largest market share.Hospitals provide a wide range of medical services, including surgeries, emergency care, critical care, diagnostics, and treatments. Medical gases are utilized extensively in these diverse medical applications, such as anesthesia during surgeries, oxygen therapy for patients with respiratory conditions, and medical gas mixtures for diagnostic procedures. Moreover, hospitals perform a multitude of surgical procedures, ranging from routine surgeries to complex operations.

Medical gases like oxygen and anesthetic gases are crucial for ensuring patient safety, comfort, and successful outcomes during surgical interventions. Besides, diagnostic imaging procedures, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans, often involve the use of medical gases. These gases can be used to create contrast agents for enhanced imaging accuracy.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America boasts advanced healthcare infrastructure, including well-established hospitals, clinics, research centers, and medical facilities. This robust infrastructure creates a high demand for medical gases for various medical procedures, surgeries, diagnostics, and patient care. Moreover, the region is a hub for medical research and technological innovation.

Technological advancements in medical treatments, procedures, and diagnostic tools often require specialized medical gases for accurate diagnostics and efficient interventions, further driving the demand for these gases. Besides, the high prevalence of chronic diseases in North America, such as respiratory disorders, cardiovascular diseases, and diabetes, drives the demand for medical gases for treatments, therapies, and life support systems.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of multiple players that include established brands, emerging startups, and specialty manufacturers. Presently, leading companies are focusing on innovating their medical gas offerings by introducing advanced gas mixtures, specialized formulations, and new delivery methods to cater to evolving medical needs and treatment modalities.They are also forming strategic partnerships with healthcare providers, hospitals, clinics, and research institutions to establish a strong network and secure long-term contracts. Besides, companies are expanding their market presence through geographical expansion, entering emerging markets with growing healthcare infrastructure, and establishing new distribution channels to reach a wider customer base.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Air Products and Chemicals Inc.

- Airgas Inc. (Air Liquide S.A.)

- Ellenbarrie Industrial Gases Ltd

- Linde plc

- Matheson Tri-Gas Inc. (Mitsubishi Chemical Holdings Corporation)

- Messer Group GmbH

- SCI Analytical Laboratories Inc

- Sharjah Oxygen Company

- SOL Spa

Key Questions Answered in This Report:

- What are medical gases?

- How big is the medical gases market?

- What is the expected growth rate of the global medical gases market during 2025-2033?

- What are the key factors driving the global medical gases market?

- What is the leading segment of the global medical gases market based on the gas type?

- What is the leading segment of the global medical gases market based on application?

- What is the leading segment of the global medical gases market based on end user?

- What are the key regions in the global medical gases market?

- Who are the key players/companies in the global medical gases market?

Table of Contents

Companies Mentioned

- Air Products and Chemicals Inc.

- Airgas Inc. (Air Liquide S.A.)

- Ellenbarrie Industrial Gases Ltd

- Linde plc

- Matheson Tri-Gas Inc. (Mitsubishi Chemical Holdings Corporation)

- Messer Group GmbH

- SCI Analytical Laboratories Inc

- Sharjah Oxygen Company

- SOL Spa

Table Information

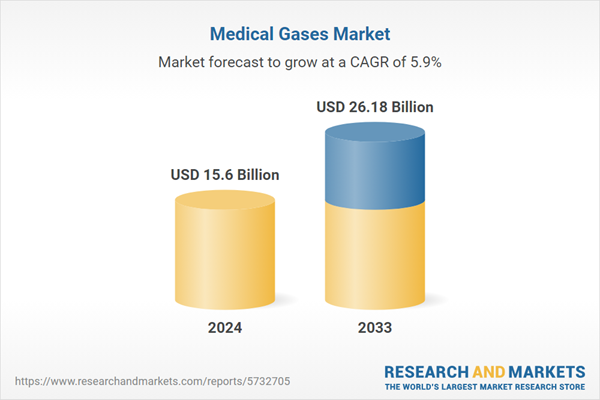

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 15.6 Billion |

| Forecasted Market Value ( USD | $ 26.18 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |