Speak directly to the analyst to clarify any post sales queries you may have.

In 2022, the major economies in APAC, including China, Japan, and India, witnessed increasing commercial construction activities due to an expanding number of companies in various sectors setting up their offices in distinct regions to capture the target and potential customer base. In the APAC region, the increasing demand for energy-efficient HVAC systems and stringent regulations for the use of explosion-proof HVAC equipment is boosting the adoption across industries. It will offer enormous growth opportunities in the HVAC market. Further, Middle East countries are witnessing drastic climate changes. Rising temperatures and heat waves increased the demand for HVAC systems in commercial and residential buildings to control indoor climate conditions, further propelling the HVAC market growth. Along with providing residents with comfort, filtering can also improve indoor air quality. Hence these factors propel sales growth across the Middle East & Africa region during the forecast period.

MARKET TRENDS & DRIVERS

Replacement of Existing Equipment with Energy Efficient Products

In 2020, the commercial sector experienced the steepest decline due to the hard-hit hotel & motel industry and sports & convention centers. The commercial sector has witnessed constant growth since 2021, with the recovering economy. Energy-efficient HVAC technologies for residential and commercial buildings have the potential to provide environmental and economic benefits. They are optimizing energy-efficient HVAC technologies, and proper installation planning help to reach energy-saving potential by up to 40%. Therefore, replacing existing equipment with energy-efficient HVAC technologies will boost the growth rate of the HVAC market in the future.Rising Construction Industry

In the long run, the construction industry globally is expected to experience steady growth due to low-interest rates in a few European countries and stable economic growth. The construction of hotels, amusement parks, private & government offices, and sports & convention centers is growing, thereby supporting the HVAC market in the construction sector.The global HVAC market is highly dependent on the construction industry for revenue through new installations, whether residential or commercial. The refurbishment of buildings provides massive revenue to the HVAC industry. The industry witnessed an increased inflow of public and private investments, mainly in countries, such as Spain, Cyprus, Italy, and the Netherlands. In 2022, The Construction Intelligence Center (CIC) revised the growth forecast for the European construction industry. This was because of the improved performance of some significant developed city markets and a brighter outlook for the European economy.

SEGMENTATION ANALYSIS

INSIGHTS BY EQUIPMENT TYPE

HVAC commonly refers to heating, ventilation, cooling, collective heating, and cooling technologies used at commercial, residential, industrial, and public utility buildings. The heating equipment segment in the global HVAC market was valued at USD 91.06 billion in 2022 and is expected to reach USD 123.85 billion by 2028. The heating equipment industry is characterized by intense competition. The heating equipment is generally fragmented. Hence, the industry is characterized by many local/domestic vendors.The air conditioning industry is characterized by the presence of many domestic and multinational vendors, and the industry is seasonal and characterized by modern technology. Air-conditioners are in the fastest-growing segment and have a vast addressable industry in developed and developing economies. APAC, Europe, and North America are expected to witness rapid growth in Air-conditioners by value because of higher construction activity and the demand for renovation activities.

Segmentation by Equipment

- Heating

- Heat Pump

- Boiler Units

- Furnaces

- Others

- Air Conditioning

- RAC

- CAC

- Chillers

- Heat Exchangers

- Others

- Ventilation

- Air Handling Units

- Air filters

- Humidifiers & Dehumidifiers

- Fan Coil Units

- Others

INSIGHTS BY END-USER

The global residential sector HVAC market was valued at USD 135.63 billion in 2022 and is growing at a CAGR of 4.99% during the forecast period. The demand from the residential sector grew by over 5.63% due to an increase in the refurbishment of houses and stable residential new construction activities. The shift in housing preferences to large homes and the low-interest rates resulted in the increased demand for home improvements and new constructions. Many construction projects in the US provide the highest revenue to HVAC systems, and the demand is expected to increase during the forecast period. In Europe, climatic variations led to high demand for all product categories of HVAC in 2022. The demand for HVAC equipment in the Nordics varies drastically from mainland Europe. Construction activities in the region are highly concentrated in Western Europe, with a high demand for replacement.Segmentation by End-user

- Residential

- Commercial

- Office Spaces

- Airport & Public Utilities

- Hospitality

- Hospitals

- Industrial & Others

GEOGRAPHICAL ANALYSIS

- The APAC region holds the most extensive global HVAC market share. It is expected to witness a CAGR of 6.44% during the forecast period, buoyed by spiking demand from the residential sector, commercial offices, and buildings. The major economies in APAC, including China, Japan, and India, are witnessing increasing commercial construction activities due to an expanding number of companies in various sectors setting up their offices in distinct regions to capture the target and potential customer base. In 2022, China accounted for the largest revenue share of 43.73% of the APAC HVAC system market. It is estimated to witness an incremental growth of USD 21.81 billion during the forecast period. The China market is witnessing a spurt in multiple real estate projects and public-private investments in various residential, industrial, and commercial development zones because of the boom in urbanization.

- The Europe HVAC Market was valued at USD 61.2 billion in 2022 and is expected to reach USD 86.49 billion by 2028, registering a CAGR of 5.92 % during the forecast period. This growth is mainly driven by Western European, the two largest economies. France and Germany account for one-third of the market and experienced annual growth rates of 4.72% & 5.93%, respectively, in the forecast period. Major factors spiking the sales rate for HVAC equipment in Europe are rising average construction spending, increasing retail building construction projects, rising government spending on sustainable building development, industrial developments, rapid urbanization, changing climatic conditions, and growth in disposable income across European countries.

Segmentation by Geography

- APAC

- China

- India

- Japan

- Australia

- North America

- US

- Canada

- Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Netherlands

- Nordic

- Norway

- Denmark

- Sweden

- Others

- Central & Eastern Europe

- Russia

- Poland & Austria

- Other CEE Countries

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

COMPETITIVE LANDSCAPE

Systemair, Johnson Controls, Zehnder, Ostberg, and Aldes are some of the key players in the global HVAC market. Other players operating in the global HVAC market include LG, Panasonic, Carrier, Regal, and others. The prominent vendors focus on developing advanced HVAC and investing in R&D initiatives to enlarge their product line and gain a competitive advantage in the market.Other attractive prospects in the form of IoT are expected to change the industry's working as they connect all components and create an environment where the device operation can be managed efficiently using smart management solutions. Moreover, because of a highly competitive industry, R&D investments in the HVAC market are limited and have substantial investments, mainly from large vendors. Moreover, the short time-to-market and narrow acceptance of new technologies add to market challenges for HVAC vendors. R&D investments are more focused on cost reduction of the production process and improvement of the existing product technology for value addition than developing new products. As a result, a lot of mergers & acquisitions are taking place to develop and enhance the offerings and attributes to survive in the global HVAC market.

Key Company Profiles

- Systemair

- Johnson Controls

- Zehnder

- Ostberg

- Aldes

- Bosch

- Daikin

- Samsung

- Mitsubishi Electric

Other Prominent Vendors

- LG

- Panasonic

- Carrier

- Midea

- Regal

- Raytheon Technologies

- Honeywell

- Flakt Group

- Beijer Ref

- Flexit

- Grundfos

- Swegon

- VTS

- Nuaire

- Nortek

- Alfa Laval

- Hitachi

- Lu-Ve

- Vent-Axia

- Rosenberg

- S & P

- WOLF

- CIAT

- AL-KO

- DynAIR

- Danfoss

- Lennox

- Backer Springfield

- Dunham-Bush

- TCL

- TROX

- Vaillant Group

- Ingersoll Rand

- Camfil

KEY QUESTIONS ANSWERED:

1. How big is the HVAC market?2. What is the growth rate of the global HVAC market?

3. What are the significant trends in the global HVAC market?

4. Who are the key players in the global HVAC market?

5. Which region holds the most prominent global HVAC market share?

6. What is the market size of the global Residential HVAC market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of Study

4.4 Market Segmentation

4.4.1 Market Segmentation by Equipment

4.4.2 Market Segmentation by Heating Equipment

4.4.3 Market Segmentation by Air Conditioning Equipment

4.4.4 Market Segmentation by Ventilation Equipment

4.4.5 Market Segmentation by End-user

4.4.6 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

7 Market at a Glance

8 Introduction

8.1 Overview

8.1.1 Advantages of Smart Hvac Systems

8.1.2 Disadvantages of Smart Hvac Systems

8.1.3 Initiatives for Better Risk Management

8.1.4 Measures to Improve Profit Margins

8.1.5 Challenges Associated with Hvac Systems for Residential and Commerical Use

8.1.6 Recent Mergers & Acquisitions and Product Development Initiatives

8.1.7 Development of Environment-Friendly Hvac Equipment

8.1.8 Impact of Residential Construction Projects

8.1.9 Impact of Non-Residential Construction Projects

8.1.10 Challenges Associated with Hvac Equipment for Residential and Commerical Use

8.2 Repowereu Plan

8.3 Benefits of Ira for Heating Equipment

8.4 Value Chain

8.4.1 Raw Material Suppliers & Components

8.4.2 Manufacturers

8.4.3 Dealers /Distributors

8.4.4 Retailers

8.4.5 End-users

8.5 Impact of COVID-19

9 Market Opportunity & Trends

9.1 Replacement of Existing Hvac Equipment with Energy-Efficient Products

9.2 Emergence of IoT and Product Innovations to Aid Replacements

9.3 Adverse Climatic Conditions & High Demand for Hvac Systems

10 Market Growth Enablers

10.1 Growth of Global Construction Industry

10.2 Surge in Airport Modernization Projects Worldwide

10.3 Rise in Demand for Vrf Systems

11 Market Restraints

11.1 Low Availability of Skilled Labor

11.2 Stringent Regulatory Environments Worldwide

11.3 Implications of COVID-19 Outbreak

12 Market Landscape

12.1 Market Overview

12.1.1 Highlights

12.2 Market Size & Forecast

12.2.1 Value

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Equipment

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.2.1 Key Insights

13.3 Heating

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.3.4 Heat Pumps: Market Size & Forecast

13.3.5 Boiler Units: Market Size & Forecast

13.3.6 Furnaces: Market Size & Forecast

13.3.7 Other Heating Equipment: Market Size & Forecast

13.4 Air Conditioning

13.4.1 Market Overview

13.4.2 Key Takeaways

13.4.3 Market by Geography

13.4.4 Rac: Market Size & Forecast

13.4.5 Cac: Market Size & Forecast

13.4.6 Chillers: Market Size & Forecast

13.4.7 Heat Exchanger: Market Size & Forecast (Includes Cooling Towers)

13.4.8 Other Air Conditioning Equipment: Market Size & Forecast

13.5 Ventilation

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

13.5.4 Air Handling Units: Market Size & Forecast

13.5.5 Air Filters: Market Size & Forecast

13.5.6 Humidifiers & Dehumidifiers: Market Size & Forecast

13.5.7 Fan Coil Units: Market Size & Forecast

13.5.8 Other Ventilation Equipment: Market Size & Forecast

14 End-user

14.1 Market Snapshot & Growth Engine (Value)

14.2 Market Overview

14.3 Residential

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Commercial

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

14.4.4 Office Spaces: Market Size & Forecast

14.4.5 Airports & Public Utilities: Market Size & Forecast

14.4.6 Hospitality: Market Size & Forecast

14.4.7 Hospitals: Market Size & Forecast

14.4.8 Industrial and Others: Market Size & Forecast

15 Geography

15.1 Market Snapshot & Growth Engine (Value)

15.2 Geography Overview

16 APAC

16.1 Market Overview

16.1.1 Growth Factors:

16.2 Market Size & Forecast

16.3 Equipment

16.3.1 Market Size & Forecast

16.4 Heating

16.4.1 Market Size & Forecast

16.5 Air Conditioning

16.5.1 Market Size & Forecast

16.6 Ventilation

16.6.1 Market Size & Forecast

16.7 End-user

16.7.1 Market Size & Forecast

16.8 Commercial Application

16.8.1 Market Size & Forecast

16.9 Key Countries

16.9.1 China: Market Size & Forecast

16.9.2 Japan: Market Size & Forecast

16.9.3 India: Market Size & Forecast

16.9.4 Australia: Market Size & Forecast

17 Europe

17.1 Market Overview

17.2 Equipment

17.2.1 Market Size & Forecast

17.3 Heating

17.3.1 Market Size & Forecast

17.4 Air Conditioning

17.4.1 Market Size & Forecast

17.5 Ventilation

17.5.1 Market Size & Forecast

17.6 End-user

17.6.1 Market Size & Forecast

17.7 Commercial Application

17.7.1 Market Size & Forecast

18 Western Europe

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Equipment

18.3.1 Market Size & Forecast

18.4 End-user

18.4.1 Market Size & Forecast

18.5 Key Countries

18.5.1 Germany: Market Size & Forecast

18.5.2 France: Market Size & Forecast

18.5.3 Uk: Market Size & Forecast

18.5.4 Italy: Market Size & Forecast

18.5.5 Netherlands: Market Size & Forecast

19 Nordic

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Equipment

19.3.1 Market Size & Forecast

19.4 End-user

19.4.1 Market Size & Forecast

19.5 Key Countries

19.5.1 Norway: Market Size & Forecast

19.5.2 Denmark: Market Size & Forecast

19.5.3 Sweden: Market Size & Forecast

19.5.4 Other Nordic Countries: Market Size & Forecast

20 Central & Eastern Europe (Cee)

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Equipment

20.3.1 Market Size & Forecast

20.4 End-user

20.4.1 Market Size & Forecast

20.5 Key Countries

20.5.1 Russia: Market Size & Forecast

20.5.2 Poland & Austria: Market Size & Forecast

20.5.3 Other Cee Countries: Market Size & Forecast

21 North America

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Equipment

21.3.1 Market Size & Forecast

21.4 Heating

21.4.1 Market Size & Forecast

21.5 Air Conditioning

21.5.1 Market Size & Forecast

21.6 Ventilation

21.6.1 Market Size & Forecast

21.7 End-user

21.7.1 Market Size & Forecast

21.8 Commercial Application

21.8.1 Market Size & Forecast

21.9 Key Countries

21.10 Market Snapshot & Growth Engine (Value)

21.10.1 Us: Market Size & Forecast

21.10.2 Canada: Market Size & Forecast

22 Latin America

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Equipment

22.3.1 Market Size & Forecast

22.4 Heating

22.4.1 Market Size & Forecast

22.5 Air Conditioning

22.5.1 Market Size & Forecast

22.6 Ventilation

22.6.1 Market Size & Forecast

22.7 End-user

22.7.1 Market Size & Forecast

22.8 Commercial Application

22.8.1 Market Size & Forecast

22.9 Key Countries

22.10 Market Snapshot & Growth Engine (Value)

22.10.1 Brazil: Market Size & Forecast

22.10.2 Mexico: Market Size & Forecast

22.10.3 Argentina: Market Size & Forecast

23 Middle East & Africa

23.1 Market Overview

23.2 Market Size & Forecast

23.3 Equipment

23.3.1 Market Size & Forecast

23.4 Heating

23.4.1 Market Size & Forecast

23.5 Air Conditioning

23.5.1 Market Size & Forecast

23.6 Ventilation

23.6.1 Market Size & Forecast

23.7 End-user

23.7.1 Market Size & Forecast

23.8 Commercial Application

23.8.1 Market Size & Forecast

23.9 Key Countries

23.10 Market Snapshot & Growth Engine (Value)

23.10.1 Saudi Arabia: Market Size & Forecast

23.10.2 Uae: Market Size & Forecast

23.10.3 South Africa: Market Size & Forecast

24 Competitive Landscape

24.1 Competition Overview

25 Key Company Profiles

25.1 Systemair

25.1.1 Business Overview

25.1.2 Product Offerings

25.1.3 Key Strategies

25.1.4 Key Strengths

25.1.5 Key Opportunities

25.2 Johnson Controls

25.2.1 Business Overview

25.2.2 Product Offerings

25.2.3 Key Strategies

25.2.4 Key Strengths

25.2.5 Key Opportunities

25.3 Zehnder

25.3.1 Business Overview

25.3.2 Product Offerings

25.3.3 Key Strategies

25.3.4 Key Strengths

25.3.5 Key Opportunities

25.4 Ostberg

25.4.1 Business Overview

25.4.2 Product Offerings

25.4.3 Key Strategies

25.4.4 Key Strengths

25.4.5 Key Opportunities

25.5 Aldes

25.5.1 Business Overview

25.5.2 Product Offerings

25.5.3 Key Strategies

25.5.4 Key Strengths

25.5.5 Key Opportunities

25.6 Bosch

25.6.1 Business Overview

25.6.2 Product Offerings

25.6.3 Key Strategies

25.6.4 Key Strengths

25.6.5 Key Opportunities

25.7 Daikin

25.7.1 Business Overview

25.7.2 Product Offerings

25.7.3 Key Strategies

25.7.4 Key Strengths

25.7.5 Key Opportunities

25.8 Samsung

25.8.1 Business Overview

25.8.2 Product Offerings

25.8.3 Key Strategies

25.8.4 Key Strengths

25.8.5 Key Opportunities

25.9 Mitsubishi Electric

25.9.1 Business Overview

25.9.2 Product Offerings

25.9.3 Key Strategies

25.9.4 Key Strengths

25.9.5 Key Opportunities

26 Other Prominent Vendors

26.1 Lg

26.1.1 Business Overview

26.1.2 Product Offerings

26.2 Panasonic

26.2.1 Business Overview

26.2.2 Product Offerings

26.3 Carrier

26.3.1 Business Overview

26.3.2 Product Offerings

26.4 Midea

26.4.1 Business Overview

26.4.2 Product Offerings

26.5 Regal Rexnord Corporation

26.5.1 Business Overview

26.5.2 Product Offerings

26.6 Raytheon Technologies Corporation

26.6.1 Business Overview

26.6.2 Product Offerings

26.7 Honeywell

26.7.1 Business Overview

26.7.2 Product Offerings

26.8 Flakt Group

26.8.1 Business Overview

26.8.2 Product Offerings

26.9 Beijer Ref

26.9.1 Business Overview

26.9.2 Product Offerings

26.10 Flexit

26.10.1 Business Overview

26.10.2 Product Offerings

26.11 Grundfos

26.11.1 Business Overview

26.11.2 Product Offerings

26.12 Swegon

26.12.1 Business Overview

26.12.2 Product Offerings

26.13 Vts

26.13.1 Business Overview

26.13.2 Product Offerings

26.14 Nuaire

26.14.1 Business Overview

26.14.2 Product Offerings

26.15 Nortek

26.15.1 Business Overview

26.15.2 Product Offerings

26.16 Alfa Laval

26.16.1 Business Overview

26.16.2 Product Offerings

26.17 Hitachi

26.17.1 Business Overview

26.17.2 Product Offerings

26.18 Lu-Ve

26.18.1 Business Overview

26.18.2 Product Offerings

26.19 Vent-Axia

26.19.1 Business Overview

26.19.2 Product Offerings

26.20 Rosenberg

26.20.1 Business Overview

26.20.2 Product Offerings

26.21 S & P

26.21.1 Business Overview

26.21.2 Product Offerings

26.22 Wolf

26.22.1 Business Overview

26.22.2 Product Offerings

26.23 Ciat

26.23.1 Business Overview

26.23.2 Product Offerings

26.24 Al-Ko

26.24.1 Business Overview

26.24.2 Product Offerings

26.25 Dynair

26.25.1 Business Overview

26.25.2 Product Offerings

26.26 Danfoss

26.26.1 Business Overview

26.26.2 Product Offerings

26.27 Lennox

26.27.1 Business Overview

26.27.2 Product Offerings

26.28 Backer Springfield

26.28.1 Business Overview

26.28.2 Product Offerings

26.29 Dunham Bush

26.29.1 Business Overview

26.29.2 Product Offerings

26.30 Tcl

26.30.1 Business Overview

26.30.2 Product Offerings

26.31 Trox

26.31.1 Business Overview

26.31.2 Product Offerings

26.32 Vaillant Group

26.32.1 Business Overview

26.32.2 Product Offerings

26.33 Ingersoll Rand

26.33.1 Business Overview

26.33.2 Product Offerings

26.34 Camfil

26.34.1 Business Overview

26.34.2 Product Offerings

27 Report Summary

27.1 Key Takeaways

27.2 Strategic Recommendations

28 Quantitative Summary

28.1 Market by Geography

28.1.1 Market Size & Forecast

28.2 Market by Equipment

28.2.1 Market Size & Forecast

28.3 Market by Air Conditioning Equipment

28.3.1 Market Size & Forecast

28.4 Market by Heating Equipment

28.4.1 Market Size & Forecast

28.5 Market by Ventilation Equipment

28.5.1 Market Size & Forecast

28.6 Market by End-user

28.6.1 Market Size & Forecast

28.7 Market by Commercial Application

28.7.1 Market Size & Forecast

29 Appendix

29.1 Abbreviations

Companies Mentioned

- Systemair

- Johnson Controls

- Zehnder

- Ostberg

- Aldes

- Bosch

- Daikin

- Samsung

- Mitsubishi Electric

- LG

- Panasonic

- Carrier

- Midea

- Regal

- Raytheon Technologies

- Honeywell

- Flakt Group

- Beijer Ref

- Flexit

- Grundfos

- Swegon

- VTS

- Nuaire

- Nortek

- Alfa Laval

- Hitachi

- Lu-Ve

- Vent-Axia

- Rosenberg

- S & P

- WOLF

- CIAT

- AL-KO

- DynAIR

- Danfoss

- Lennox

- Backer Springfield

- Dunham-Bush

- TCL

- TROX

- Vaillant Group

- Ingersoll Rand

- Camfil

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

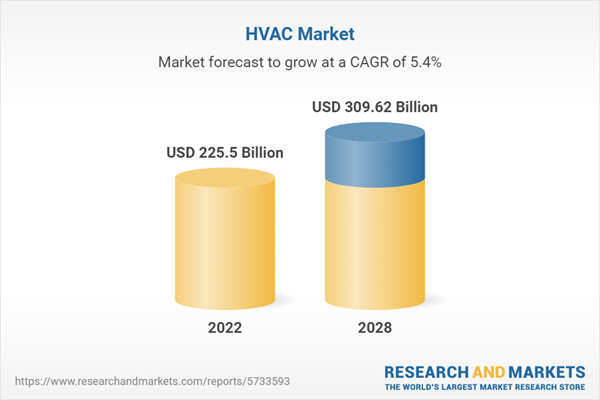

| Report Attribute | Details |

|---|---|

| No. of Pages | 344 |

| Published | February 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 225.5 Billion |

| Forecasted Market Value ( USD | $ 309.62 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 43 |