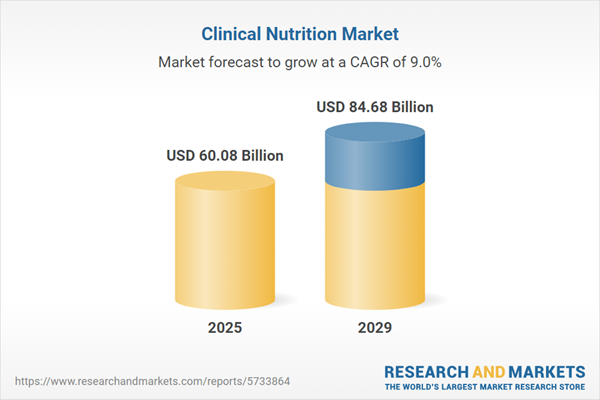

The clinical nutrition market size has grown strongly in recent years. It will grow from $56.07 billion in 2024 to $60.08 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to aging population, increasing prevalence of chronic disease, increasing awareness of the importance of nutrition, government support for nutrition programs.

The clinical nutrition market size is expected to see strong growth in the next few years. It will grow to $84.68 billion in 2029 at a compound annual growth rate (CAGR) of 9%. The growth in the forecast period can be attributed to personalized nutrition, growing use of nutrigenomics, population health management, global healthcare expansion. Major trends in the forecast period include digital health and telehealth, functional foods and nutraceuticals, probiotics and prebiotics, plant-based and sustainable nutrition, mental health nutrition.

The increasing elderly population is expected to accelerate the expansion of the clinical nutrition market. Several factors influence the nutritional requirements of older adults, such as specific health issues and related organ system impairments, activity levels, energy expenditure, and caloric needs. Additionally, individual capabilities in accessing, preparing, consuming, and digesting food, along with personal dietary choices, play a significant role. For example, a report released by the United Nations in November 2022 indicated that the proportion of the global population aged 65 and older is projected to rise from 10% in 2022 to 16% by 2050. By that year, it is estimated that there will be twice as many individuals aged 65 and older compared to those under 5 years old, and nearly as many as those under 12. As a result, the expanding geriatric demographic is expected to contribute to the growth of the clinical nutrition market.

Leading players in the clinical nutrition sector are opting for strategic partnerships to broaden their market influence and provide comprehensive solutions. These partnerships leverage mutual strengths and resources for mutual benefits. For instance, Hologram Sciences Inc. collaborated with Maeil Dairies Co. Ltd., aiming to emphasize personalized nutrition's importance in the global health and wellness market. This strategic partnership seeks to deliver tailored nutrition solutions to the Korean market, highlighting the rising significance of personalized nutrition in the industry.

Companies in the clinical nutrition sphere are innovating with technological solutions like TechVantage to cater to escalating demands for functional foods and beverages, setting themselves apart from competitors. TechVantage, a functionally optimized nutrient technology platform, offers specialized nutrient solutions targeting immune health, cognitive health, and sports performance. Glanbia Nutritionals Inc.'s launch of TechVantage in April 2022 provides an extensive nutrient portfolio with optimized functionality, improved bioavailability, and convenient processing capabilities, delivering added value to customers seeking specific functional attributes in their nutritional choices.

In September 2022, Nutrisens, a prominent agrifood group headquartered in France, completed the acquisition of Glutamine, a clinical nutritional supplement provider based in Portugal. The transaction amount remains undisclosed. This strategic acquisition by Nutrisens is designed to achieve several objectives, including the expansion of its geographical presence, the reinforcement of its product and service portfolio, and the augmentation of its market share within the clinical nutritional supplements sector.

Major companies operating in the clinical nutrition market include Abbott Laboratories, Nestlé S.A., Baxter Healthcare Ltd., B. Braun Melsungen AG, Perrigo Company plc, Fresenius Kabi AG, Danone S.A., Pfizer Inc., Mead Johnson Nutrition Company, Hero Nutritionals, Gentiva Health Services Inc., H.J. Heinz Company, Ajinomoto Co. Inc., Lonza Group Ltd., GlaxoSmithKline plc, BASF SE, Kendal Nutricare, DuPont Nutrition & Health, American HomePatient, Reckitt Benckiser Group plc, Vivante Health.

Clinical nutrition is a specialized field that delves into preventing, diagnosing, and treating nutritional and metabolic irregularities associated with acute and chronic ailments, along with disorders arising from imbalances in nutrients and energy. Its primary focus is assessing an individual's nutrient intake and providing the appropriate nourishment essential for overall health.

Within the realm of clinical nutrition, key product categories include infant nutrition, parental nutrition, and enteral nutrition. Infant nutrition caters specifically to the distinctive requirements of infants and toddlers, aiming to kickstart their lives with essential nutrients. These nutritional solutions encompass various administration methods like oral, enteral, and parenteral routes, serving individuals facing conditions such as cancer, neurological diseases, gastrointestinal disorders, metabolic irregularities, and other health concerns. The application of these nutrition products spans across pediatric care, adult nutrition, and geriatric health management.

The clinical nutrition market research report is one of a series of new reports that provides clinical nutrition market statistics, including global market size, regional shares, competitors with a clinical nutrition market share, detailed clinical nutrition market segments, clinical nutrition market trends and opportunities, and any further data you may need to thrive in the clinical nutrition industry. This clinical nutrition market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the clinical nutrition market in 2024. The regions covered in the clinical nutrition market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the clinical nutrition market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The clinical nutrition market includes revenues earned by entities by managing nutritional changes in patients linked to chronic diseases and by understanding the needs of individuals and groups for energy and nutrients. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Clinical Nutrition Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on clinical nutrition market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for clinical nutrition ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The clinical nutrition market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Infant Nutrition; Parental Nutrition; Enteral Nutrition2) By Route of Administration: Oral; Enteral; Parenteral

3) By Application: Cancer; Neurological Diseases; Gastrointestinal Disorders; Metabolic Disorders; Other Applications

4) By End User: Pediatric; Adults; Geriatric

Subsegments:

1) By Infant Nutrition: Infant Formula; Baby Foods; Nutritional Supplements2) By Parenteral Nutrition: Amino Acid Solutions; Lipid Emulsions; Carbohydrate Solutions

3) By Enteral Nutrition: Standard Formulas; Specialized Formulas; Disease-Specific Formulas

Key Companies Mentioned: Abbott Laboratories; Nestlé S.a.; Baxter Healthcare Ltd.; B. Braun Melsungen AG; Perrigo Company plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Clinical Nutrition market report include:- Abbott Laboratories

- Nestlé S.A.

- Baxter Healthcare Ltd.

- B. Braun Melsungen AG

- Perrigo Company plc

- Fresenius Kabi AG

- Danone S.A.

- Pfizer Inc.

- Mead Johnson Nutrition Company

- Hero Nutritionals

- Gentiva Health Services Inc.

- H.J. Heinz Company

- Ajinomoto Co. Inc.

- Lonza Group Ltd.

- GlaxoSmithKline plc

- BASF SE

- Kendal Nutricare

- DuPont Nutrition & Health

- American HomePatient

- Reckitt Benckiser Group plc

- Vivante Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 60.08 Billion |

| Forecasted Market Value ( USD | $ 84.68 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |