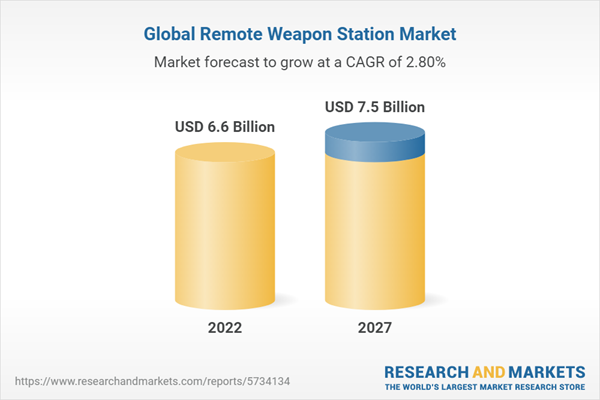

The remote weapon station market is projected to grow from USD 6.6 billion in 2022 to USD 7.5 billion by 2027 at a CAGR of 2.8% from 2022 to 2027. The market for remote weapon stations is fuelled by a number of variables, including the development in asymmetric warfare, the frequency of wars, and the military's use of offensive weapons in tactical operations. The complexity of integrating a remote weapon station with a variety of platforms, for example, could have a significant negative impact on the remote weapon station market's growth in the upcoming years.

Based on technology, the Common Remotely Operated Weapon Station segment is expected to grow at the highest CAGR during the forecast period

The remote weapon station market has been divided into close-in weapon systems, remote operated gun systems, based on technology. The remote weapon station market's Common Remotely Operated Weapon Station system segment is anticipated to experience the greatest CAGR growth over the course of the forecast period. Increased global research and development efforts for the creation of cutting-edge technologies, improved weapon system reliability, and unmanned operations are to blame for the expansion of the Common Remotely Operated Weapon Station market.

Between 2022 and 2027, the remote weapon station market is expected to be dominated by the Europe market.

During the forecast period, Europe is anticipated to dominate the remote weapon station market. The market for remote weapon stations is anticipated to grow at a faster rate in the Asia Pacific area than in Europe, which is expected to hold the top spot. The remote weapon station's main markets in Europe include the UK, France, Russia, Italy, and Germany. The market's expansion in European nations is primarily due to technological advancements, an increase in armed conflicts and the war against terrorism, as well as recent geopolitical events that Russia has sparked, which have prompted many Eastern European nations to improve their defense capabilities.

Break-up of profile of primary participants of the remote weapon station market

- By Company Type - Tier 1 - 35 %, Tier 2 - 45% and Tier 3 - 20%

- By Designation - C level - 35%, Director level - 25%, Others - 40%

- By Region - North America - 25%, Europe - 15%, APAC - 45%, RoW - 15%

Major companies profiled in the report are Elbit Systems (Israel), Kongsberg (Norway), Raytheon Technology Corporation (US), Saab AB (Sweden), Leonardo S.p.A. (Italy), Electro Optic Systems (Australia), Aselsan A.S. (Turkey), MOOG Inc. (US), Rafael Advanced Defense Systems (Israel), FN Herstal (Belgium), and Rheinmetall AG (Germany), among others.

Research Coverage:

This report presents a complete analysis of the remote weapon station market during the forecast period. The remote weapon station market has been broadly classified on the basis of application (military, homeland security), platform (land, airborne, naval), component (Stabilization Unit, Control System, sensors, human machine interface, weapons & armaments), weapon type (lethal, non-lethal), mobility (stationary, moving), technology (close-in weapon systems, Common Remotely Operated Weapon Station (CROWS)), and region.

Reasons to buy the report:

From an insight perspective, this research report has focused on various levels of analyses - industry analysis (industry trends and technology trend), market rank analysis of top players, and company profiles, which together comprise and discuss basic views on the competitive landscape, emerging, and high-growth segments of the remote weapon station market, high-growth regions and countries, and their respective regulatory policies, government initiatives, and market drivers, restraints, and opportunities.

The report provides insights into the following pointers:

- Market Penetration: Comprehensive information on remote weapon stations offered by the top 15 players in the remote weapon station market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the remote weapon station market

- Market Development: Comprehensive information about lucrative markets - the report analyses markets for remote weapon stations across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the remote weapon station market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of the leading players in the remote weapon station market

- Recession Impact Analysis: The latest version includes the impact of the recession and current scenario at regional level was considered in this overall remote weapon station market study.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

Figure 1 Remote Weapon Station Market Segmentation

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Inclusions and Exclusions

Table 1 Inclusions and Exclusions in Remote Weapon Station Market

1.5 Currency Considered

Table 2 USD Exchange Rates

1.6 Study Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Research Methodology Model

Figure 3 Remote Weapon Station Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Primary Sources

Figure 4 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.1.3 Demand-Side Analysis

2.1.4 Supply-Side Analysis

2.2 Market Size Estimation

Table 3 Segments and Subsegments

2.3 Research Approach & Methodology

2.3.1 Bottom-Up Approach

Table 4 Remote Weapon Station Market Estimation Procedure

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

2.3.2 Top-Down Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

2.4 Data Triangulation

Figure 7 Market Breakdown & Data Triangulation

2.4.1 Triangulation Through Primary and Secondary Research

2.5 Growth Rate Assumptions

2.5.1 Impact of Recession on Remote Weapon Station Market

Figure 8 Recession Impact on Revenue of Key Players

2.6 Assumptions for Research Study

2.7 Risks

3 Executive Summary

Figure 9 Land Segment Projected to Dominate Market from 2022 to 2027

Figure 10 Military Segment Anticipated to Lead Market from 2022 to 2027

Figure 11 Human Machine Interfaces Segment Projected to Lead Market from 2022 to 2027

Figure 12 Lethal Weapons Segment to Secure Largest Market Share from 2022 to 2027

Figure 13 Moving Segment Anticipated to Dominate Market from 2022 to 2027

Figure 14 Close-In Weapon Systems Segment Forecasted to Command Market from 2022 to 2027

Figure 15 Asia-Pacific to Grow at Highest CAGR from 2022 to 2027

4 Premium Insights

4.1 Attractive Growth Opportunities for Players in Remote Weapon Station Market

Figure 16 Surge in Adoption of Unmanned Systems to Drive Market Growth

4.2 Remote Weapon Station Market, by Platform

Figure 17 Land Segment Estimated to Lead Market from 2018 to 2027

4.3 Remote Weapon Station Market, by Application

Figure 18 Military Segment Projected to Dominate Market from 2018 to 2027

4.4 Remote Weapon Station Market, by Component

Figure 19 Human Machine Interfaces Segment Anticipated to Lead Market from 2018 to 2027

4.5 Remote Weapon Station Market, by Weapon Type

Figure 20 Lethal Weapons Segment Projected to Top Market from 2018 to 2027

4.6 Remote Weapon Station Market, by Mobility

Figure 21 Moving Segment Estimated to Grow at Highest CAGR from 2018 to 2027

4.7 Remote Weapon Station Market, by Technology

Figure 22 Common Remotely Operated Weapon Stations Segment Anticipated to Flourish at Maximum CAGR from 2018 to 2027

4.8 Remote Weapon Station Market, by Country

Figure 23 India Projected to be Fastest-Growing Country from 2022 to 2027

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 24 Remote Weapon Station Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Significant Investments in Remote Weapon Stations by Governments

5.2.1.2 Rise in Military Expenditure on Advanced Equipment

Table 5 Table 1: Defense Expenditure of Major Countries (USD Billion)

Figure 25 Defense Expenditure of Major Countries in Percentage

5.2.1.3 Deployment of Remote Weapon System Capabilities on Unmanned Platforms

Table 6 Remote Weapon Station for Unmanned Platforms

5.2.1.4 Increased Adoption of Asymmetric Warfare Techniques

Figure 26 Number of Fatalities Due to Terrorist Attacks Worldwide, 2010−2020

5.2.1.5 Rising Requirement for High-Precision Remote Weapon Stations

5.2.1.6 Improving Isr and Target Acquisition Capabilities of Defense Forces

5.2.2 Restraints

5.2.2.1 Survivability Challenges

5.2.2.2 Hardware and Software Malfunctions

5.2.2.3 High Investments in Early Phases

5.2.3 Opportunities

5.2.3.1 Ongoing Military Modernization Programs in Various Countries Across Globe

5.2.3.2 Surging Adoption of Unmanned Systems Across Platforms

5.2.3.3 Development of Next-Generation and Scalable Remote Weapon Systems

5.2.4 Challenges

5.2.4.1 Complexity Involved in Integration of Remote Weapon Stations with Wide Range of Platforms

5.2.4.2 Stringent Cross-Border Trading Policies

5.2.4.3 Advanced Rws Deployment Costs More Than Conventional Systems

5.3 Trends Impacting Customer Businesses

5.3.1 Revenue Shift and New Revenue Pockets for Remote Weapon Station Manufacturers

Figure 27 Revenue Shift in Remote Weapon Station Market

5.4 Recession Impact Analysis

5.4.1 Impact of Recession on Remote Weapon Station Market

Figure 28 Recession Impact Analysis on Remote Weapon Station Market

Figure 29 Factors Impacting Remote Weapon Station Market Analysis

5.5 Average Selling Price Analysis

5.5.1 Average Selling Price Trend, Land Platform

Table 7 Average Selling Price of Main Battle Tanks (USD Million)

Table 8 Average Selling Price of Infantry Fighting Vehicles (USD Million)

Table 9 Average Selling Price of Armored Personnel Carriers (USD Million)

Table 10 Average Selling Price of Mine-Resistant Ambush-Protected Vehicles (USD Million)

Table 11 Average Selling Price of Light Protected Vehicles (USD Million)

5.6 Market Ecosystem

5.6.1 Prominent Companies

5.6.2 Private and Small Enterprises

5.6.3 End-users

Figure 30 Remote Weapon Station Market Ecosystem

Table 12 Remote Weapon Station Market Ecosystem

5.7 Value Chain Analysis

Figure 31 Value Chain Analysis: Remote Weapon Station Market

5.8 Use Case Analysis

5.8.1 Use Case 1: Defender-Innovation Driven Solution to Counter Threat

Table 13 Defender-Innovation-Driven Solution to Counter Threat

5.8.2 Use Case 2: Homeland Security Using Remote Weapon Station

Table 14 Homeland Security Using Remote Weapon Station

5.8.3 Use Case 3: Norinco Naval Remote Weapon Station

Table 15 Norinco Naval Remote Weapon Station

5.8.4 Use Case 4: Smash Dragon Uav by Israel Company Smart Shooter

Table 16 Smash Dragon Uav by Israel Company Smart Shooter

5.9 Trade Analysis

5.9.1 Import Data for Land Vehicles Platform, by Region, 2017−2020

Table 17 Armored Vehicles Region-Wise Import Data (USD), 2017−2020

Table 18 Tanks and Other Armored Fighting Vehicles, Motorized, Fitted with Weapons: Country-Wise Exports, 2020−2021 (USD Thousand)

Table 19 Tanks and Other Armored Fighting Vehicles, Motorized, Fitted with Weapons: Country-Wise Imports, 2020−2021 (USD Thousand)

5.10 Porter's Five Forces Analysis

Table 20 Remote Weapon Station Market: Porter's Five Force Analysis

Figure 32 Intensity of Competitive Rivalry to be Moderate in Remote Weapon Station Market

5.10.1 Threat of New Entrants

5.10.2 Threat of Substitutes

5.10.3 Bargaining Power of Suppliers

5.10.4 Bargaining Power of Buyers

5.10.5 Intensity of Competitive Rivalry

5.11 Key Stakeholders and Buying Criteria

5.11.1 Key Stakeholders in Buying Process

Figure 33 Influence of Stakeholders in Buying Process of Three Platforms

Table 21 Influence of Stakeholders in Buying Process of Three Platforms (%)

5.11.2 Buying Criteria

Figure 34 Key Buying Criteria for Top Platforms

Table 22 Key Buying Criteria for Three Platforms

5.12 Tariff and Regulatory Landscape

Table 23 North America: Regulatory Bodies, Government Agencies, and Other Agencies

Table 24 Europe: Regulatory Bodies, Government Agencies, and Other Agencies

Table 25 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Agencies

Table 26 Middle East: Regulatory Bodies, Government Agencies, and Other Agencies

Table 27 Rest of the World: Regulatory Bodies, Government Agencies, and Other Agencies

5.13 Key Conferences and Events from October 2022 to September 2023

Table 28 Remote Weapon Station Market: Conferences & Events, 2022−2023

6 Industry Trends

6.1 Introduction

6.2 Key Technological Trends in Remote Weapon Station Market

Figure 35 Technological Trends in Remote Weapon Station Market

6.2.1 Next-Gen Unmanned Platform Developments

6.2.2 Advanced Directed Energy Weapons

6.2.3 Counter-Directed Energy Weapon Systems

6.2.4 Unified Remote Weapon Systems

6.2.5 Smart and Programmable Ammunitions

6.2.6 Next-Generation Sensors Developments

6.2.7 Advanced Gun Systems

6.2.8 Reactive Armor Technology

6.2.9 Improved Ammunition-Carrying Capability

6.2.10 Advanced Autoloaders

6.3 Impact of Megatrends

6.3.1 Digitalization and Introduction of Internet of Things

6.3.2 Operations on Integrated Battlefields with Collaborative Combat

6.3.3 Shift in Global Economic Power

6.4 Supply Chain Analysis

Figure 36 Supply Chain Analysis

6.5 Innovation and Patent Registrations

Table 29 Remote Weapon Station: Key Patents, 2017−2022

7 Remote Weapon Station Market, by Application

7.1 Introduction

Figure 37 Military Segment Projected to Grow at Higher CAGR During Forecast Period

Table 30 Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 31 Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

7.2 Military

7.2.1 Increasing Demand for Modern and Advanced Systems for Offensive Cross-Country Operations

7.3 Homeland Security

7.3.1 Increasing Use of Lavs for Border Patrolling, Isr Activities, and Defense Personnel Transportation

8 Remote Weapon Station Market, by Platform

8.1 Introduction

Figure 38 Land Platform Projected to Lead Market During Forecast Period

Table 32 Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 33 Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

8.2 Land

8.2.1 Combat Vehicles

8.2.1.1 Increasing Demand for Combat Vehicles for Offensive Cross-Country and Security Operations

8.2.1.2 Main Battle Tanks (Mbts)

8.2.1.2.1 Rising Offensive Cross-Country Operations

8.2.1.3 Infantry Fighting Vehicles (Ifvs)

8.2.1.3.1 Procurement by Emerging Countries to Benefit Market

8.2.1.4 Light Armored Vehicles (Lavs)

8.2.1.4.1 Increasing Use for Border Patrolling, Isr Activities, and Defense Personnel Transportation

8.2.1.5 Air Defense Vehicles

8.2.1.5.1 Adoption of Vehicle-Mounted Antiaircraft Guns for Air Defense Roles

8.2.1.6 Armored Amphibious Vehicles (Aavs)

8.2.1.6.1 Suitable Platforms for Conducting Full-Spectrum Ship-To-Shore Operations

8.2.1.7 Armored Mortar Carriers (Amcs)

8.2.1.7.1 Integrated with Armored Vehicles and Dedicated Compartment for Mortar Shortage

8.2.1.8 Unmanned Ground Vehicles (Ugvs)

8.2.1.8.1 Improving Functionalities and Autonomic Decision-Making Capabilities of a Robot

8.2.2 Ground Stations

8.2.2.1 Increasing Demand for Advanced Ground-Based Remote Weapon Stations for Border Security

8.3 Naval

8.3.1 Frigates

8.3.1.1 Increasing Use of Autonomous Systems on Frigates

8.3.2 Corvettes

8.3.2.1 Increasing Procurement of Corvettes Across Militaries to Increase Remote Weapon Station Demand

8.3.3 Offshore Support Vessels (Osv)

8.3.3.1 Technological Advancement in Osvs to Fuel Remote Weapon Station Requirement

8.3.4 Destroyers

8.3.4.1 Protect Large Vessels Against Small, Powerful Short-Range Attackers

8.3.5 Patrol and Mine Countermeasure Vessels

8.3.5.1 Increasing Demand for Patrol and Mine Countermeasure Vessels for Cross-Border Protection

8.3.6 Amphibious Vessels

8.3.6.1 Increasing Demand for Amphibious Warfare Ships by Various Countries

8.3.7 Unmanned Surface Vehicles (Usv)

8.3.7.1 Operate on Water Surface Without Human Support

8.4 Airborne

8.4.1 Fighter Aircraft

8.4.1.1 Increasing Modernization Programs by Militaries

8.4.2 Attack Helicopters

8.4.2.1 Play Crucial Role in Sea, Land, and Air Operations

8.4.3 Unmanned Aerial Vehicles (Uav)

8.4.3.1 Wide Range of Combat Uavs for Military Applications to Drive Segment

9 Remote Weapon Station Market, by Component

9.1 Introduction

Figure 39 Human Machine Interface Segment Projected to Record Highest CAGR During Forecast Period

Table 34 Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 35 Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

9.2 Human Machine Interfaces (Hmis)

9.3 Stabilization Unit

9.3.1 Development of Modernized Stabilization Unit to Create More Demand

9.4 Control System

9.4.1 Demand for Highly Advanced Turret Control Units to Drive Market

9.4.2 Motor Controller

9.4.3 Power Unit

9.5 Sensors

9.5.1 Detects Sound, Pressure, Heat, Light, or Motion

9.5.2 Day Imaging Systems

9.5.3 Thermal Imagers

9.5.4 Laser Rangefinders (Lrf)

9.5.5 Laser Designator

9.5.6 Laser Marker

9.6 Weapons & Armaments

9.6.1 Guns

9.6.1.1 Rising Demand for Small-Caliber Guns

9.6.2 Launchers

9.6.2.1 Discharges Medium-Caliber Projectile and Has Explosive, Smoke, or Gas Warhead

9.6.3 Direct Energy Weapons

9.6.3.1 Used in Anti-Personnel Weapon Systems and Missile Defense Systems, and to Destroy Electronic Platforms

10 Remote Weapon Station Market, by Weapon Type

10.1 Introduction

Figure 40 Lethal Weapons Segment Anticipated to Grow at Highest CAGR from 2022 to 2027

Table 36 Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 37 Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

10.2 Lethal Weapons

10.2.1 Reduce Safety Concerns of Militaries and Thoroughness of Operations

10.2.2 Small Caliber

10.2.2.1 Used for Short-Range Fires and Close Combat Operations

10.2.2.2 5.56Mm

10.2.2.3 7.62Mm

10.2.2.4 12.7Mm

10.2.3 Medium Caliber

10.2.3.1 Increasing Use in Counter-Rocket, Artillery, and Mortar Weapon Systems

10.2.3.2 20Mm

10.2.3.3 25Mm

10.2.3.4 30Mm

10.2.3.5 40Mm

10.3 Non-Lethal Weapons

10.3.1 Increasing Development of New Varieties of Non-Lethal Weapons

11 Remote Weapon Station Market, by Mobility

11.1 Introduction

Figure 41 Moving Segment to Record Highest Growth from 2022 and 2027

Table 38 Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 39 Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

11.2 Moving

11.2.1 High Adoption in Moving Remote Weapon Stations to Drive Demand

11.3 Stationary

11.3.1 Stationary Remote Weapon Station for Border Security to Drive Demand

12 Remote Weapon Station Market, by Technology

12.1 Introduction

Figure 42 Common Remotely Operated Weapon Stations Technology Segment to Grow at Highest CAGR During Forecast Period

Table 40 Remote Weapon Station Market, by Technology, 2018−2021 (USD Billion)

Table 41 Remote Weapon Station Market, by Technology, 2022−2027 (USD Billion)

12.2 Close-In Weapon Systems (Ciws)

12.2.1 Consists of Radars, Multi-Barrel Guns, Rapid-Fire Cannons, and Short-Range Missiles

12.3 Common Remotely Operated Weapon Stations (Crows)

13 Remote Weapon Station Market, by Region

13.1 Introduction

Figure 43 North America Claimed Largest Share of Remote Weapon Station Market in 2022

13.2 Regional Recession Impact Analysis

Table 42 Regional Recession Impact Analysis

Table 43 Remote Weapon Station Market, by Region, 2018−2021 (USD Billion)

Table 44 Remote Weapon Station Market, by Region, 2022−2027 (USD Billion)

13.3 North America

13.3.1 Regional Recession Impact Analysis-North America

13.3.2 PESTEL Analysis: North America

Figure 44 North America Remote Weapon Station Market Snapshot

Table 45 North America: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 46 North America: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 47 North America: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 48 North America: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

Table 49 North America: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 50 North America: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 51 North America: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 52 North America: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 53 North America: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 54 North America: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 55 North America: Remote Weapon Station Market, by Technology, 2018−2021 (USD Billion)

Table 56 North America: Remote Weapon Station Market, by Technology, 2022−2027 (USD Billion)

Table 57 North America: Remote Weapon Station Market, by Country, 2018−2021 (USD Billion)

Table 58 North America: Remote Weapon Station Market, by Country, 2022−2027 (USD Billion)

13.3.3 US

13.3.3.1 Modernization Programs and Defense Policies

Figure 45 Us: Military Spending (USD Billion) Vs. GDP (%), 2016−2021

Table 59 Us: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 60 Us: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 61 Us: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 62 Us: Remote Weapon Station Market, by Platform, 2022−2027(USD Billion)

Table 63 Us: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 64 Us: Remote Weapon Station Market, by Weapon Type, 2022−2027(USD Billion)

Table 65 Us: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 66 Us: Remote Weapon Station Market, by Component, 2022−2027(USD Billion)

Table 67 Us: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 68 Us: Remote Weapon Station Market, by Mobility, 2022−2027(USD Billion)

13.3.4 Canada

13.3.4.1 Increased R&D Investments

Figure 46 Canada: Military Spending (USD Billion) Vs. GDP (%), 2016−2021

Table 69 Canada: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 70 Canada: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 71 Canada: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 72 Canada: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 73 Canada: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 74 Canada: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 75 Canada: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 76 Canada: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 77 Canada: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 78 Canada: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.4 Europe

13.4.1 Regional Recession Impact Analysis -Europe

13.4.2 PESTLE Analysis: Europe

Figure 47 Europe Remote Weapon Station Market Snapshot

Table 79 Europe: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 80 Europe: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 81 Europe: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 82 Europe: Remote Weapon Station Market Size, by Component, 2022−2027 (USD Billion)

Table 83 Europe: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 84 Europe: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 85 Europe: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 86 Europe: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 87 Europe: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 88 Europe: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 89 Europe: Remote Weapon Station Market, by Technology, 2018−2021 (USD Billion)

Table 90 Europe: Remote Weapon Station Market, by Technology, 2022−2027 (USD Billion)

Table 91 Europe: Remote Weapon Station Market, by Country, 2018−2021 (USD Billion)

Table 92 Europe: Remote Weapon Station Market, by Country, 2022−2027 (USD Billion)

13.4.3 UK

13.4.3.1 Rapid Market Expansion Through Advanced Upgrading Programs

Figure 48 Uk: Military Spending (USD Billion) Vs. GDP (%), 2016−2020

Table 93 Uk: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 94 Uk: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 95 Uk: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 96 Uk: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 97 Uk: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 98 Uk: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 99 Uk: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 100 Uk: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 101 Uk: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 102 Uk: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.4.4 France

13.4.4.1 Procurement of New-Generation Combat Vehicles for Defense Forces

Figure 49 France: Military Spending (USD Billion) Vs. GDP (%), 2016−2020

Table 103 France: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 104 France: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 105 France: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 106 France: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 107 France: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 108 France: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 109 France: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 110 France: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 111 France: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 112 France: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.4.5 Germany

13.4.5.1 Major Global Exporter of Armored Vehicles

Figure 50 Germany: Military Spending (USD Billion) Vs. GDP (%), 2016−2020

Table 113 Germany: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 114 Germany: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 115 Germany: Remote Weapon Station Market, by Platform, 2018-2021 (USD Billion)

Table 116 Germany: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 117 Germany: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 118 Germany: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 119 Germany: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 120 Germany: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 121 Germany: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 122 Germany: Remote Weapon Station Market Size, by Component, 2022−2027 (USD Billion)

13.4.6 Poland

13.4.6.1 Procurement of Light Tanks with Ceramic-Aramid Armor-Equipped Vehicles

Table 123 Poland: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 124 Poland: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 125 Poland: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 126 Poland: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 127 Poland: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 128 Poland: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 129 Poland: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 130 Poland: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 131 Poland: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 132 Poland: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.4.7 Italy

13.4.7.1 Robust Presence of Major Defense Players

Figure 51 Italy: Military Spending (USD Billion) Vs. GDP (%), 2016-2020

Table 133 Italy: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 134 Italy: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 135 Italy: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 136 Italy: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 137 Italy: Remote Weapon Station Market, by Weapon Type, 2018-2021 (USD Billion)

Table 138 Italy: Remote Weapon Station Market, by Weapon Type, 2022-2027 (USD Billion)

Table 139 Italy: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 140 Italy: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 141 Italy: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 142 Italy: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.4.8 Rest of Europe

13.4.8.1 Significant Improvement and Strengthening of Military Power

Table 143 Rest of Europe: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 144 Rest of Europe: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 145 Rest of Europe: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 146 Rest of Europe: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 147 Rest of Europe: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 148 Rest of Europe: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 149 Rest of Europe: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 150 Rest of Europe: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 151 Rest of Europe: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 152 Rest of Europe: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.5 Asia-Pacific

13.5.1 Regional Recession Impact Analysis: Asia-Pacific

13.5.2 PESTLE Analysis: Asia-Pacific

Figure 52 Asia-Pacific: Remote Weapon Station Market Snapshot

Table 153 Asia-Pacific: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 154 Asia-Pacific: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 155 Asia-Pacific: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 156 Asia-Pacific: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

Table 157 Asia-Pacific: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 158 Asia-Pacific: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 159 Asia-Pacific: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 160 Asia-Pacific: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 161 Asia-Pacific: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 162 Asia-Pacific: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 163 Asia-Pacific: Remote Weapon Station Market, by Technology, 2018−2021 (USD Billion)

Table 164 Asia-Pacific: Remote Weapon Station Market, by Technology, 2022−2027 (USD Billion)

Table 165 Asia-Pacific: Remote Weapon Station Market, by Country, 2018−2021 (USD Billion)

Table 166 Asia-Pacific: Remote Weapon Station Market, by Country, 2022−2027 (USD Billion)

13.5.3 China

13.5.3.1 Increasing Investment to Strengthen Military Fuels Demand for Remote Weapon Station

Figure 53 China: Military Spending (USD Billion) Vs. GDP (%), 2016−2021

Table 167 China: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 168 China: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 169 China: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 170 China: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 171 China: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 172 China: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 173 China: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 174 China: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 175 China: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 176 China: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.5.4 India

13.5.4.1 Increasing Procurement of Armored Vehicles to Tackle Border Disputes

Figure 54 India: Military Spending (USD Billion) Vs. GDP (%), 2016−2021

Table 177 India: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 178 India: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 179 India: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 180 India: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 181 India: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 182 India: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 183 India: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 184 India: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 185 India: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 186 India: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.5.5 Australia

13.5.5.1 Manufacturing and Modernization of Rws and Combat Fleet

Figure 55 Australia: Military Spending (USD Billion) Vs. GDP (%), 2016−2020

Table 187 Australia: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 188 Australia: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 189 Australia: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 190 Australia: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 191 Australia: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 192 Australia: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 193 Australia: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 194 Australia: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 195 Australia: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 196 Australia: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.5.6 Japan

13.5.6.1 High-End Indigenous Military Technologies

Figure 56 Japan: Military Spending (USD Billion) Vs. GDP (%), 2016−2020

Table 197 Japan: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 198 Japan: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 199 Japan: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 200 Japan: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 201 Japan: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 202 Japan: Remote Weapon Station Market Size, by Weapon Type, 2022−2027 (USD Billion)

Table 203 Japan: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 204 Japan: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 205 Japan: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 206 Japan: Remote Weapon Station Market, by Component, 2022−2027(USD Billion)

13.5.7 South Korea

13.5.7.1 Robotics Technologies to Raise Demand for Rws in Unmanned Ground Vehicles

Figure 57 South Korea: Military Spending (USD Billion) Vs. GDP (%), 2016−2020

Table 207 South Korea: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 208 South Korea: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 209 South Korea: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 210 South Korea: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 211 South Korea: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 212 South Korea: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 213 South Korea: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 214 South Korea: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 215 South Korea: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 216 South Korea: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.5.8 Singapore

13.5.8.1 Deployment of Technologically Advanced Armored Vehicles on Battlefields

Table 217 Singapore: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 218 Singapore: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 219 Singapore: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 220 Singapore: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 221 Singapore: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 222 Singapore: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 223 Singapore: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 224 Singapore: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 225 Singapore: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 226 Singapore: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.5.9 Rest of Asia-Pacific

13.5.9.1 Unmanned Armored Vehicles to Fuel Market for Rws Market

Table 227 Rest of Asia-Pacific: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 228 Rest of Asia-Pacific: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 229 Rest of Asia-Pacific: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 230 Rest of Asia-Pacific: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 231 Rest of Asia-Pacific: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 232 Rest of Asia-Pacific: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 233 Rest of Asia-Pacific: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 234 Rest of Asia-Pacific: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 235 Rest of Asia-Pacific: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 236 Rest of Asia-Pacific: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.6 Rest of the World

13.6.1 Regional Recession Impact Analysis: Rest of the World

Table 237 Rest of the World: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 238 Rest of the World: Remote Weapon Station Market Size, by Application, 2022−2027 (USD Billion)

Table 239 Rest of the World: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 240 Rest of the World: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

Table 241 Rest of the World: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 242 Rest of the World: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 243 Rest of the World: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 244 Rest of the World: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 245 Rest of the World: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 246 Rest of the World: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 247 Rest of the World: Remote Weapon Station Market, by Technology, 2018−2021 (USD Billion)

Table 248 Rest of the World: Remote Weapon Station Market, by Technology, 2022−2027 (USD Billion)

Table 249 Rest of the World: Remote Weapon Station Market, by Country, 2018-2021 (USD Billion)

Table 250 Rest of the World: Remote Weapon Station Market, by Country, 2022-2027 (USD Billion)

13.6.2 Middle East

13.6.2.1 Social Unrest and Market Instability to Drive Demand in Middle East

Table 251 Middle East: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 252 Middle East: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 253 Middle East: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 254 Middle East: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 255 Middle East: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 256 Middle East: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 257 Middle East: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 258 Middle East: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 259 Middle East: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 260 Middle East: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

13.6.3 Latin America & Africa

13.6.3.1 Increased Demand for Unmanned Military Ground Vehicles

Table 261 Latin America & Africa: Remote Weapon Station Market, by Application, 2018−2021 (USD Billion)

Table 262 Latin America & Africa: Remote Weapon Station Market, by Application, 2022−2027 (USD Billion)

Table 263 Latin America & Africa: Remote Weapon Station Market, by Platform, 2018−2021 (USD Billion)

Table 264 Latin America & Africa: Remote Weapon Station Market, by Platform, 2022−2027 (USD Billion)

Table 265 Latin America & Africa: Remote Weapon Station Market, by Weapon Type, 2018−2021 (USD Billion)

Table 266 Latin America & Africa: Remote Weapon Station Market, by Weapon Type, 2022−2027 (USD Billion)

Table 267 Latin America & Africa: Remote Weapon Station Market, by Mobility, 2018−2021 (USD Billion)

Table 268 Latin America & Africa: Remote Weapon Station Market, by Mobility, 2022−2027 (USD Billion)

Table 269 Latin America & Africa: Remote Weapon Station Market, by Component, 2018−2021 (USD Billion)

Table 270 Latin America & Africa: Remote Weapon Station Market, by Component, 2022−2027 (USD Billion)

14 Competitive Landscape

14.1 Introduction

Table 271 Key Developments by Leading Players in Remote Weapon Station Market Between 2019 and 2022

14.2 Ranking Analysis of Key Market Players, 2022

Figure 58 Ranking Analysis of Top Five Players in Remote Weapon Station Market, 2022

14.3 Share of Key Market Players, 2022

Figure 59 Share of Top Players in Remote Weapon Station Market, 2022 (%)

Table 272 Remote Weapon Station Market: Degree of Competition

14.4 Revenue Analysis of Top Five Market Players, 2022

Figure 60 Revenue Analysis of Top Five Market Players, 2022

14.5 Company Product Footprint Analysis

Table 273 Company Product Footprint Analysis

Table 274 Company Platform Footprint Analysis

Table 275 Company Region Footprint Analysis

14.6 Competitive Evaluation Quadrant

14.6.1 Stars

14.6.2 Emerging Leaders

14.6.3 Pervasive Players

14.6.4 Participants

Figure 61 Market Competitive Leadership Mapping, 2022

14.7 Remote Weapon Station Market Competitive Leadership Mapping (Sme)

14.7.1 Progressive Companies

14.7.2 Responsive Companies

14.7.3 Starting Blocks

14.7.4 Dynamic Companies

Figure 62 Remote Weapon Station Market (Sme) Competitive Leadership Mapping, 2022

14.8 Competitive Scenario

14.8.1 Market Evaluation Framework

14.8.2 Product Launches and Developments

Table 276 Product Launches and Developments, 2019-2022

14.8.3 Deals

Table 277 Remote Weapon Station Market: Deals, January−September 2022

15 Company Profiles

15.1 Introduction

15.2 Key Players

(Business Overview, Products/Solutions/Services Offered, Recent Developments, Deals, and Analyst's View)*

15.2.1 Kongsberg

Table 278 Kongsberg: Business Overview

Figure 63 Kongsberg: Company Snapshot

Table 279 Kongsberg: Products/Solutions/Services Offered

Table 280 Kongsberg: Product Launches

Table 281 Kongsberg: Deals

15.2.2 Raytheon Technologies Corporation

Table 282 Raytheon Technologies Corporation: Business Overview

Figure 64 Raytheon Technologies Corporation: Company Snapshot

Table 283 Raytheon Technologies Corporation: Products/Solutions/Services Offered

Table 284 Raytheon Technologies Corporation: Deals

15.2.3 Elbit Systems

Table 285 Elbit Systems: Business Overview

Figure 65 Elbit Systems: Company Snapshot

Table 286 Elbit Systems: Products/Solutions/Services Offered

Table 287 Elbit Systems: Product Launches

Table 288 Elbit Systems: Deals

15.2.4 Leonardo S.P.A.

Table 289 Leonardo S.P.A.: Business Overview

Figure 66 Leonardo S.P.A.: Company Snapshot

Table 290 Leonardo S.P.A.: Products Offered

Table 291 Leonardo S.P.A.: Product Launches

Table 292 Leonardo S.P.A.: Deals

15.2.5 Thales Group

Table 293 Thales Group: Business Overview

Figure 67 Thales Group: Company Snapshot

Table 294 Thales Group: Products Offered

Table 295 Thales Group: Product Launches

Table 296 Thales Group.: Deals

15.2.6 Electro Optic Systems

Table 297 Electro Optic Systems: Business Overview

Figure 68 Electro Optic Systems: Company Snapshot

Table 298 Electro Optic Systems: Products Offered

Table 299 Electro Optic Systems: Product Launches

Table 300 Electro Optic Systems: Deals

15.2.7 Northrop Grumman Corporation

Table 301 Northrop Grumman Corporation: Business Overview

Figure 69 Northrop Grumman Corporation: Company Snapshot

Table 302 Northrop Grumman Corporation: Products Offered

Table 303 Northrop Grumman Corporation: Deals

15.2.8 Bae Systems

Table 304 Bae Systems: Business Overview

Figure 70 Bae Systems: Company Snapshot

Table 305 Bae Systems: Products Offered

Table 306 Bae Systems: Product Launches

Table 307 Bae Systems: Deals

15.2.9 Rheinmetall Ag

Table 308 Rheinmetall Ag: Business Overview

Figure 71 Rheinmetall Ag: Company Snapshot

Table 309 Rheinmetall Ag: Products Offered

Table 310 Rheinmetall Ag: Deals

15.2.10 General Dynamics Corporation

Table 311 General Dynamics Corporation: Business Overview

Figure 72 General Dynamics Corporation: Company Snapshot

Table 312 General Dynamics Corporation: Products Offered

Table 313 General Dynamics Corporation: Deals

15.2.11 St Engineering

Table 314 St Engineering: Business Overview

Figure 73 St Engineering: Company Snapshot

Table 315 St Engineering: Products Offered

15.2.12 Aselsan A.S.

Table 316 Aselsan A.S.: Business Overview

Figure 74 Aselsan A.S.: Company Snapshot

Table 317 Aselsan A.S.: Products Offered

Table 318 Aselsan A.S.: Deals

15.2.13 Saab Ab

Table 319 Saab Ab: Business Overview

Figure 75 Saab Ab: Company Snapshot

Table 320 Saab Ab: Products Offered

15.2.14 Moog Inc.

Table 321 Moog Inc.: Business Overview

Figure 76 Moog Inc.: Company Snapshot

Table 322 Moog Inc.: Products Offered

Table 323 Moog Inc.: Deals

15.2.15 Israel Aerospace Industries Ltd.

Table 324 Israel Aerospace Industries Ltd.: Business Overview

Figure 77 Israel Aerospace Industries Ltd.: Company Snapshot

Table 325 Israel Aerospace Industries Ltd.: Products Offered

15.3 Other Players

15.3.1 Nexter Group

Table 326 Nexter Group: Business Overview

15.3.2 Escribano Mechanical & Engineering

Table 327 Escribano Mechanical & Engineering: Business Overview

15.3.3 Denel Soc Ltd.

Table 328 Denel Soc Ltd.: Business Overview

15.3.4 Fn Herstal

Table 329 Fn Herstal: Business Overview

15.3.5 Norinco Group

Table 330 Norinco Group: Business Overview

15.3.6 Rafael Advanced Defense Systems Ltd.

Table 331 Rafael Advanced Defense Systems Ltd.: Business Overview

15.3.7 Merrill Technologies Group

Table 332 Merrill Technologies Group: Business Overview

15.3.8 Evpu Defence

Table 333 Evpu Defence: Business Overview

15.3.9 Krauss Maffei Wegmann

Table 334 Krauss Maffei Wegmann: Business Overview

15.3.10 Smart Shooter Ltd.

Table 335 Smart Shooter Ltd.: Business Overview

* Business Overview, Products/Solutions/Services Offered, Recent Developments, Deals, and Analyst's View Might Not be Captured in Case of Unlisted Companies.

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options

16.4 Related Reports

16.5 Author Details

Companies Mentioned

- Aselsan A.S.

- Bae Systems

- Denel Soc Ltd.

- Elbit Systems

- Electro Optic Systems

- Escribano Mechanical & Engineering

- Evpu Defence

- Fn Herstal

- General Dynamics Corporation

- Israel Aerospace Industries Ltd.

- Kongsberg

- Krauss Maffei Wegmann

- Leonardo S.P.A.

- Merrill Technologies Group

- Moog Inc.

- Nexter Group

- Norinco Group

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Rheinmetall Ag

- Saab Ab

- Smart Shooter Ltd.

- St Engineering

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | January 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 6.6 Billion |

| Forecasted Market Value ( USD | $ 7.5 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |