Over the recent past, the COVID-19 pandemic has been associated with surges in hospitalization and infection hotspots around the country. The pandemic led to a growth in demand for Renal Replacement Therapy (RRT) in the country, owing to the higher prevalence of comorbid conditions, such as Chronic Kidney Diseases (CKD), diabetes, and hypertension. The demand for dialysis machines surged significantly during this period. As per a research study published in the American Society of Nephrology, the demand for dialysis machines required to manage cases of AKI amplified by 279% over baseline during the spring of 2020 in New York City.

Moreover, the rising prevalence of End-stage Renal Disease (ESRD) is likely to propel the market. For instance, according to USRDS, in 2020, there was an increase of 2.5% in people suffering from ESRD. A total of 130,400 new patients were registered who were treated for ESRD which accounted increase of 14.84% of people suffering from ESRD from 2010-2019.

U.S. Hemodialysis And Peritoneal Dialysis Market Report Highlights

- Based on type, hemodialysis segment dominated the market in terms of value with a share of 88.70% in 2022 and is expected to grow at the highest CAGR of 6.19% during the forecast period. The rising number of ESRD patients, surge in geriatric population suffering from kidney diseases, are significant factors driving the segment growth.

- Based on product, service segment dominated the market in 2022 with a share of 68.00%. The growing number of providers offering dialysis services coupled with the higher penetration of the latest technology in developed countries is contributing to the segment growth.

- In end-use scope, hospital-based segment dominated the market with a share of 79.39% in 2022, owing to the increased focus of players in establishing independent dialysis centers, and the growing preference of patients to opt for treatment in in-center dialysis

Table of Contents

Chapter 1 Methodology And Scope1.1 Market Segmentation And Scope

1.1.1 Type

1.1.2 Product

1.1.3 End-Use

1.1.4 Regional Scope

1.1.5 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database:

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.2 Volume Price Analysis (Model 2)

1.6.2.1 Approach 2: Volume Price Analysis

1.7 List Of Secondary Sources

1.8 List Of Primary Sources

1.9 List Of Abbreviations

1.10 Objectives

1.10.1 Objective 1

1.10.2 Objective 2

1.10.3 Objective 3

1.10.4 Objective 4

Chapter 2 Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Insights

Chapter 3 U.S. Hemodialysis And Peritoneal Dialysis Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Ancillary Market Outlook

3.2 Penetration & Growth Prospect Mapping

3.3 User Perspective Analysis

3.3.1 Consumer Behavior Analysis

3.3.2 Market Influencer Analysis

3.4 List Of Key End-Users

3.5 Market Dynamics

3.5.1 Market Driver Analysis

3.5.1.1 Increasing Prevalence Of Acute Kidney Injury (Aki) And Associated Chronic Kidney Diseases

3.5.1.2 Increasing Incidence And Prevalence Of Esrd

3.5.1.3 Introduction To Technologically Advanced Products

3.5.1.4 Growing Geriatric Population

3.5.1.5 Increase In Number Of Diabetes Patient

3.5.2 Market Restraints Analysis

3.5.2.1 Risk And Complications Associated With Dialysis

3.5.2.2 Issues With Product Approval & Commercialization

3.5.3 Market Opportunities Analysis

3.5.3.1 Increased Demand For Home Care Dialysis Services

3.5.3.2 Growing Government Initiatives And Recommendations For Efficient Kidney Disease Management

3.6 Hemodialysis And Peritoneal Dialysis: Market Analysis Tools

3.6.1 Industry Analysis - Porter’s

3.6.2 Swot Analysis, By Pest

3.7 Impact Of Covid-19 On Market & Post Pandemic Recovery Analysis

Chapter 4 U.S. Hemodialysis And Peritoneal Dialysis Market: Segment Analysis, By Type, 2018 - 2030 (USD Million)

4.1 Definition And Scope

4.2 Type Market Share Analysis, 2022 & 2030

4.3 Segment Dashboard

4.4 U.S. Hemodialysis And Peritoneal Dialysis Market, By Type, 2018 To 2030

4.5 Market Size & Forecasts And Trend Analysis, 2018 To 2030

4.5.1 Hemodialysis

4.5.1.1 Hemodialysis Market, 2018 - 2030 (USD Million)

4.5.1.2 Conventional

4.5.1.2.1 Conventional Market, 2018 - 2030 (USD Million)

4.5.1.3 Short Daily Hemodialysis

4.5.1.3.1 Short Daily Hemodialysis Market, 2018 - 2030 (USD Million)

4.5.1.4 Nocturnal Hemodialysis

4.5.1.4.1 Nocturnal Hemodialysis Market, 2018 - 2030 (USD Million)

4.5.2 Peritoneal Dialysis

4.5.2.1 Peritoneal Dialysis Market, 2018 - 2030 (USD Million)

4.5.2.2 Continuous Ambulatory Peritoneal Dialysis (Capd)

4.5.2.2.1 continuous Ambulatory Peritoneal Dialysis (Capd) Market, 2018 - 2030 (USD Million)

4.5.2.3 Nocturnal Hemodialysis

4.5.2.3.1 Nocturnal Hemodialysis Market, 2018 - 2030 (USD Million)

Chapter 5 Hemodialysis And Peritoneal Dialysis Market: Segment Analysis, By Product, 2018 - 2030 (USD Million)

5.1 Definition And Scope

5.2 Product Market Share Analysis, 2022 & 2030

5.3 Segment Dashboard

5.4 U.S. Hemodialysis And Peritoneal Dialysis Market, By Product, 2018 To 2030

5.5 Market Size & Forecasts And Trend Analysis, 2018 To 2030

5.5.1 Device

5.5.1.1 Device Market, 2018 - 2030 (USD Million)

5.5.1.2 Machine

5.5.1.2.1 Machine Market, 2018 - 2030 (USD Million)

5.5.1.3 Water Treatment System

5.5.1.3.1 Water Treatment System Market, 2018 - 2030 (USD Million)

5.5.1.4 Dialyzers

5.5.1.4.1 Dialyzers Market, 2018 - 2030 (USD Million)

5.5.1.5 Others

5.5.1.5.1 Others Market, 2018 - 2030 (USD Million)

5.5.2 Consumables

5.5.2.1 Consumables Market, 2018 - 2030 (USD Million)

5.5.2.2 Bloodlines

5.5.2.2.1 Bloodlines Market, 2018 - 2030 (USD Million)

5.5.2.3 Concentrates

5.5.2.3.1 Concentrates Market, 2018 - 2030 (USD Million)

5.5.2.4 Catheters

5.5.2.4.1 Catheters Market, 2018 - 2030 (USD Million)

5.5.2.5 Others

5.5.2.5.1 Others Market, 2018 - 2030 (USD Million)

5.5.3 Service

5.5.3.1 Service Market, 2018 - 2030 (USD Million)

Chapter 6 U.S. Hemodialysis And Peritoneal Dialysis Market: Segment Analysis, By End-Use, 2018 - 2030 (USD Million)

6.1 Definition And Scope

6.2 End-Use Market Share Analysis, 2022 & 2030

6.3 Segment Dashboard

6.4 U.S. Hemodialysis And Peritoneal Dialysis Market, By End-Use, 2018 To 2030

6.5 Market Size & Forecasts And Trend Analysis, 2018 To 2030

6.5.1 Home-Based

6.5.1.1 Home-Based Market, 2018 - 2030 (USD Million)

6.5.2 Hospital-Based

6.5.2.1 Hospital-Based Market, 2018 - 2030 (USD Million)

Chapter 7 U.S. Hemodialysis And Peritoneal Dialysis Market - Competitive Analysis

7.1 Recent Developments & Impact Analysis, By Key Market Participants

7.2 Company Categorization

7.2.1 Innovators

7.2.2 Market Leaders

7.3 Company Profiles

7.3.1 Fresenius Medical Care Ag & Co. Kgaa

7.3.1.1 Company Overview

7.3.1.2 Financial Performance

7.3.1.3 Product Benchmarking

7.3.1.4 Strategic Initiatives

7.3.2 Baxter International

7.3.2.1 Company Overview

7.3.2.2 Financial Performance

7.3.2.3 Product Benchmarking

7.3.2.4 Strategic Initiatives

7.3.3 B. Braun Avitum Ag

7.3.3.1 Company Overview

7.3.3.2 Financial Performance

7.3.3.3 Product Benchmarking

7.3.3.4 Strategic Initiatives

7.3.4 Nipro Corporation

7.3.4.1 Company Overview

7.3.4.2 Financial Performance

7.3.4.3 Product Benchmarking

7.3.4.4 Strategic Initiatives

7.3.5 Medtronic

7.3.5.1 Company Overview

7.3.5.2 Financial Performance

7.3.5.3 Product Benchmarking

7.3.5.4 Strategic Initiatives

7.3.6 Nikkiso Co., Ltd.

7.3.6.1 Company Overview

7.3.6.2 Financial Performance

7.3.6.3 Product Benchmarking

7.3.6.4 Strategic Initiatives

7.3.7 Asahi Kasei Corporation

7.3.7.1 Company Overview

7.3.7.2 Financial Performance

7.3.7.3 Product Benchmarking

7.3.7.4 Strategic Initiatives

7.3.8 Cantel Medical Corporation

7.3.7.1 Company Overview

7.3.7.2 Financial Performance

7.3.7.3 Product Benchmarking

7.3.7.4 Strategic Initiatives

7.3.9 DaVita Inc.

7.3.9.1 Company Overview

7.3.9.2 Financial Performance

7.3.9.3 Product Benchmarking

7.3.9.4 Strategic Initiatives

7.3.10 Becton, Dickinson and Company

7.3.10.1 Company Overview

7.3.10.2 Financial Performance

7.3.10.3 Product Benchmarking

7.3.10.4 Strategic Initiatives

List of Tables

Table 1. List of secondary sources

Table 2. List of abbreviation

Table 3. Products in Clinical Trials

Table 4. Dialysis clinics market share

Table 5. Summary of results for RRT in AKI

Table 6. The pros and cons of various forms of currently available dialysis therapies

List of Figures

Fig. 1 U S hemodialysis and peritoneal dialysis market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market outlook (2022)

Fig. 10 Segment outlook

Fig. 11 Strategy framework

Fig. 12 Penetration & growth prospect mapping

Fig. 13 Consumer behavior analysis

Fig. 14 Market driver relevance analysis (Current & future impact)

Fig. 15 Market restraint relevance analysis (Current & future impact)

Fig. 16 Porter’s five forces analysis

Fig. 17 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 18 U S hemodialysis and peritoneal dialysis market: Type movement analysis

Fig. 19 Segment dashboard

Fig. 20 U.S. hemodialysis and peritoneal dialysis market type outlook: Key takeaways

Fig. 21 Hemodialysis market, 2018 - 2030 (USD Million)

Fig. 22 Conventional market, 2018 - 2030 (USD Million)

Fig. 23 Short daily hemodialysis market, 2018 - 2030 (USD Million)

Fig. 24 Nocturnal hemodialysis market, 2018 - 2030 (USD Million)

Fig. 25 Peritoneal dialysis market, 2018 - 2030 (USD Million)

Fig. 26 Continuous Ambulatory Peritoneal Dialysis (CAPD) market, 2018 - 2030 (USD Million)

Fig. 27 Short daily hemodialysis market, 2018 - 2030 (USD Million)

Fig. 28 U.S. hemodialysis and peritoneal dialysis market: Product movement analysis

Fig. 29 Segment dashboard

Fig. 30 U.S. hemodialysis and peritoneal dialysis market product outlook: Key takeaways

Fig. 31 Device market, 2018 - 2030 (USD Million)

Fig. 32 Machine market, 2018 - 2030 (USD Million)

Fig. 33 Water treatment system market, 2018 - 2030 (USD Million)

Fig. 34 Others market, 2018 - 2030 (USD Million)

Fig. 35 Consumables market, 2018 - 2030 (USD Million)

Fig. 36 Bloodlines market, 2018 - 2030 (USD Million)

Fig. 37 Concentrates market, 2018 - 2030 (USD Million)

Fig. 38 Catheters market, 2018 - 2030 (USD Million)

Fig. 39 Others market, 2018 - 2030 (USD Million)

Fig. 40 U.S. Hemodialysis and peritoneal dialysis market: End-use movement analysis

Fig. 41 Segment dashboard

Fig. 42 U.S. Hemodialysis and peritoneal dialysis market end-use outlook: Key takeaways

Fig. 43 Hospital-based market, 2018 - 2030 (USD Million)

Fig. 44 Home-based market, 2018 - 2030 (USD Million)

Fig. 45 Company market share analysis, 2022

Fig. 46 Market differentiators

Fig. 47 Consumer behavior analysis

Companies Mentioned

- Fresenius Medical Care Ag & Co. Kgaa

- Baxter International

- B. Braun Avitum Ag

- Nipro Corporation

- Medtronic

- Nikkiso Co., Ltd.

- Asahi Kasei Corporation

- Cantel Medical Corporation

- DaVita Inc.

- Becton, Dickinson and Company

Table Information

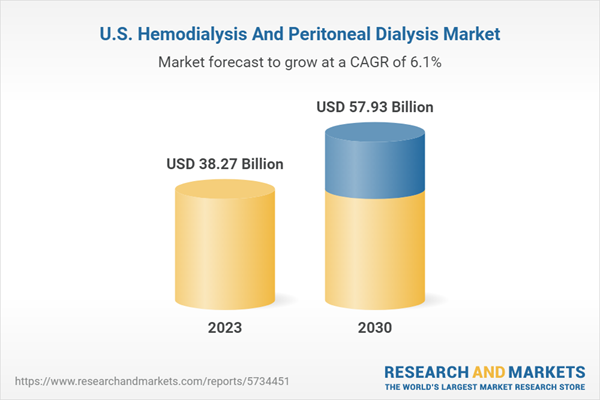

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | January 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 38.27 Billion |

| Forecasted Market Value ( USD | $ 57.93 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |