Global HVDC Transmission Systems Market Analysis:

Major Market Drivers: The rising need for grid expansion and interconnection, the growing urbanization and industrialization levels, favorable government initiatives and policies, and the increasing advancement of technology are some of the major factors driving the market growth.Key Market Trends: The growing trend of automation in HVDC systems and the inflating adoption of electric vehicles to reduce carbon footprints are fueling the HVDC transmission systems market growth. Governments and utilities are investing in grid modernization initiatives, including the deployment of HVDC transmission systems, to improve the efficiency, reliability, and flexibility of power grids. These initiatives are expected to propel the growth of the HVDC transmission systems market.

Geographical Trends: According to the HVDC transmission systems market outlook, Europe acquires the dominant share. The growth of the region is driven by several factors, such as the increasing demand for renewable energy integration, grid modernization initiatives by government bodies, and the need for long-distance transmission of electricity.

Competitive Landscape: Some of the major market players in the HVDC transmission systems industry include ABB Ltd., General Electric Company, Hitachi Ltd., LS ELECTRIC Co. Ltd., Mitsubishi Electric Corporation, Nexans S.A., NKT A/S, NR Electric Co. Ltd., Prysmian Group, Siemens AG, and Toshiba Corporation, among many others.

Challenges and Opportunities: The complexity of installation, high initial cost, regulatory and permitting hurdles, and technological limitations are some of the challenges hindering the HVDC transmission system market growth. However, ongoing technological advancements in HVDC transmission systems, such as the development of VSC-based systems and innovations in converter technology, present opportunities for improved efficiency, reliability, and flexibility.

Global HVDC Transmission Systems Market Trends:

Growing Demand for Electricity

The growing population is inflating the electricity requirements, which is one of the key factors driving the HVDC transmission systems market demand. For instance, according to the United Nations, the population across the globe is anticipated to increase by nearly 2 billion in the coming 30 years and could reach 9.7 billion in 2050. Moreover, according to IEA, the demand for electricity across the world is anticipated to increase at a faster rate over the coming three years, growing at 3.4% annually through 2026. HVDC transmission systems are more efficient than traditional high voltage alternating current (HVAC) systems for transmitting electricity over long distances.This makes them ideal for transmitting power from remote power plants, such as hydroelectric or wind farms, to urban centers. As electricity demand grows, there is a need to expand and interconnect regional and national grids. HVDC transmission systems can help to facilitate grid expansion and interconnection by enabling the transmission of large amounts of electricity over long distances without significant losses. In many areas, data centers are a major factor contributing to the rise in electricity demand. For instance, according to IEA, Data centers may use more than one thousand terawatt-hours (TWh) of power in 2026. These factors are further adding to the HVDC transmission system market revenue.

Emergence of Submarine HVDC Transmission System

The emergence of submarine HVDC transmission systems represents a significant development in the field of electrical power transmission. Submarine HVDC transmission systems are used to transmit large amounts of electrical power underwater, typically over long distances, with high efficiency and reliability. The escalating focus on power trading between countries is propelling the demand for submarine electricity transmission. Moreover, offshore wind platforms also use the HVDC undersea power transmission system to send power to the coast. For instance, according to the Global Wind Energy Council, 64 GW of offshore wind was generated globally in 2022, which grew at a pace of 14% annually over the previous year.Rising Demand for Renewable sources

As countries and regions strive to reduce their carbon footprints and focus on transitioning towards more sustainable energy sources, there has been a significant increase in the development of offshore renewable energy projects, such as offshore wind farms. Submarine HVDC transmission systems play a crucial role in these projects by enabling the efficient transmission of electricity generated offshore to onshore locations where it is needed. Also, there has been a shift towards using clean, emission-free energy sources, such as HVDC systems for electricity transmission. Additionally, new projects are being approved worldwide for the transmission of renewable energy by using HVDC power supplies.Power consumption has increased significantly in the commercial, industrial, and residential domains. Besides this, the widespread adoption of high-voltage DC transmissions in grid stability and renewable energy systems, owing to their exceptional controllability and compatibility, is also augmenting the global market. For instance, TenneT granted McDermott International the largest-ever renewable energy contract in February 2022 for the 980 MW high-voltage direct current BorWin6 project. The project involved creating, producing, setting up, and commissioning an HVDC offshore converter platform on the North Sea Cluster 7 platform in Germany.

HVDC Transmission Systems Industry Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, transmission type, technology, project type, and application.Breakup by Component:

- Converter Stations

- Transmission Medium (Cables)

Currently, converter stations hold the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes converter stations and transmission medium (cables). According to the report, converter stations account for the majority of the global market share.According to the HVDC transmission systems market analysis, converter stations hold the dominant share in the HVDC transmission systems market growth. Converter stations play a crucial role in high-voltage direct current (HVDC) transmission systems, facilitating the efficient conversion of alternating current (AC) to direct current (DC) for long-distance electricity transmission and vice versa. These stations are essential components in HVDC infrastructures and are integral to the functioning of HVDC transmission systems. The market for converter stations in HVDC transmission systems is influenced by various factors, including technological advancements, government policies, energy demand, and investment in infrastructure.

Breakup by Transmission Type:

- Submarine HVDC Transmission System

- HVDC Overhead Transmission System

- HVDC Underground Transmission System

Submarine HVDC transmission system currently acquires the major share

The report has provided a detailed breakup and analysis of the market based on the transmission type. This includes submarine HVDC transmission system, HVDC overhead transmission system, and HVDC underground transmission system. According to the report, submarine HVDC transmission system accounts for the majority of the global market share.Submarine HVDC transmission systems employ submarine cables to connect offshore renewable energy sources, such as offshore wind farms, to onshore power grids, or interconnect power grids across water bodies. These systems provide better voltage stability over long transmission distances, making them suitable for interconnecting distant power grids or offshore renewable energy installations. For instance, according to the Global Wind Energy Council, 64 GW of offshore wind was generated globally in 2022, which grew at a pace of 14% annually over the previous year.

Breakup by Technology:

- Capacitor Commutated Converter (CCC)

- Voltage Source Converter (VSC)

- Line Commutated Converter (LCC)

Capacitor commutated converter (CCC), voltage source converter (VSC), and line commutated converter (LCC) are used for converting alternating current (AC) from the power grid to direct current (DC) for transmission. The choice of converter technology depends on factors, such as project requirements, grid characteristics, cost considerations, technological advancements, etc.

Breakup by Project Type:

- Point-to-Point

- Back-to-Back

- Multi-terminal

In high-voltage direct current (HVDC) transmission systems, point-to-point, back-to-back, and multi-terminal configurations are used to facilitate the efficient transmission of electrical power over long distances or between interconnected grids.

Breakup by Application:

- Bulk Power Transmission

- Interconnecting Grids

- Infeed Urban Areas

High voltage direct current (HVDC) transmission systems are used in various applications due to their ability to efficiently transmit large amounts of electricity over long distances with minimal losses.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe currently dominates the market for largest HVDC transmission systems market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounts for the largest share is the overall market.The growing penetration towards the adoption of renewable energy is fueling the demand for HVDC transmission system in Europe. Besides this, various countries in Europe, including Germany, Spain, and France, are significantly moving towards the low carbon economy, owing to surging environmental concerns. The increasing adoption of various policies, such as EU's renewable energy directive and national renewable action plants, is expected to proliferate the overall market growth. For instance, TenneT began construction on the offshore IJmuiden Ver wind area by the end of 2022. It also initiated the tender for the platform and HVDC system for the offshore Dutch IJmuiden Ver projects. Furthermore, the project is anticipated to be put into service by 2028.

Leading Key Players in the HVDC Transmission Systems Industry:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.Some of the key players in the market include:

- ABB Ltd.

- General Electric Company

- Hitachi Ltd.

- LS ELECTRIC Co. Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- NKT A/S

- NR Electric Co. Ltd.

- Prysmian Group

- Siemens AG

- Toshiba Corporation

Key Questions Answered in This Report:

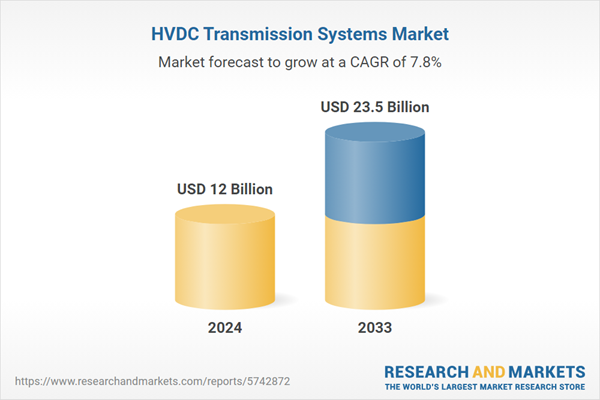

- What was the size of the global HVDC transmission systems market in 2024?

- What is the expected growth rate of the global HVDC transmission systems market during 2025-2033?

- What are the key factors driving the global HVDC transmission systems market?

- What has been the impact of COVID-19 on the global HVDC transmission systems market?

- What is the breakup of the global HVDC transmission systems market based on the component?

- What is the breakup of the global HVDC transmission systems market based on the transmission type?

- What are the key regions in the global HVDC transmission systems market?

- Who are the key players/companies in the global HVDC transmission systems market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- General Electric Company

- Hitachi Ltd.

- LS ELECTRIC Co. Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- NKT A/S

- NR Electric Co. Ltd.

- Prysmian Group

- Siemens AG

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 12 Billion |

| Forecasted Market Value ( USD | $ 23.5 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |