Liquid packaging cartons refer to specialized containers designed for the efficient transportation and storage of liquids. It is manufactured using paperboards, low-density polyethylene (LDPE), and aluminum that are further coated with layers of plastic to enhance their strength and preserve the contents. Liquid packaging cartons are widely used for dairy products, juices, soups, sauces, oils, liquid drugs, cosmetic products, industrial liquids, and alcoholic drinks. They are cost-effective and highly durable products that offer extended shelf life for products, efficient space utilization, tamper evidence, reduced contamination risks, and superior printability for branding.

The growing product application in the food and beverage (F&B) industry to ensure safe and efficient transportation is boosting the market growth. Furthermore, the rising demand for cost-effective packaging solutions that offer economical production, storage, and transportation are acting as another growth-inducing factor. Apart from this, the increasing product adoption owing to the evolving consumer lifestyle and rising preference for convenient, ready-to-drink (RTD) beverages is positively influencing the market growth.

Moreover, the widespread product utilization to extend the shelf life of fresh juices and dairy alternatives without preservatives is strengthening the market growth. Along with this, the rapid expansion of the e-commerce industry, which necessitates robust and versatile packaging solutions, is supporting the market growth. In addition, the increasing number of supermarkets and hypermarkets, which require visually appealing and efficient packaging, is favoring the market growth.

Liquid Packaging Cartons Market Trends/Drivers:

The changing consumer preferences for sustainable and recyclable materials

The increasing consumer awareness of the environmental impact of packaging materials is acting as a growth-inducing factor. In line with this, the growing preference for sustainable and recyclable options, such as liquid packaging cartons, which are primarily made from paperboard, is propelling the market growth. Furthermore, these cartons are designed to be eco-friendly and contribute to the reduction of emission levels.Moreover, consumers are seeking transparency in packaging and are inclined to support brands that align with their values of environmental stewardship. In addition, the increasing ecological campaigns and awareness, which further reinforce consumer choice, are supporting the market growth. Moreover, liquid packaging cartons are lightweight, recyclable, and often sourced from responsible forestry, which aligns well with consumer preferences, thus driving the market growth.

The implementation of stringent regulations

Governments and regulatory bodies across various regions are implementing stringent regulations regarding the use of packaging materials. Furthermore, these regulations are aimed at reducing the environmental impact, promoting recycling, and encouraging the use of materials that are biodegradable or derived from renewable resources. In addition, liquid packaging cartons, with their composition of paperboard and recyclable plastics, often meet these regulatory requirements, which further aids in boosting their demand.Moreover, adherence to such regulations also serves as a competitive advantage for businesses in showcasing their commitment to sustainability. Apart from this, several countries are actively discouraging or even banning certain types of non-biodegradable packaging, which is further propelling the shift towards environmentally responsible solutions, such as liquid packaging cartons.

The rapid technological advancements in manufacturing and design

Technological advancements have significantly influenced the liquid packaging cartons market by enabling enhanced functionality, design aesthetics, and manufacturing efficiency. In line with this, the innovation in materials science, which has led to the development of cartons that provide superior protection, extended shelf life, and better containment of the products, is boosting the market growth. Additionally, the recent advancements in printing technology, providing high-quality graphics and customization capabilities, which aid in enhancing brand visibility and appeal, are positively influencing the market growth.Moreover, automation in the manufacturing process, which has streamlined production and enabled precision and consistency in quality, is contributing to the market growth. Along with this, these technological enhancements have allowed liquid packaging cartons to become adaptable to various closure types, sizes, and applications, making them suitable for a wide array of products.

Liquid Packaging Cartons Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global liquid packaging market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, packaging type, technology, and end user.Breakup by Carton Type:

- Brick Liquid Cartons

- Shaped Liquid Cartons

- Gable Top Cartons

Brick liquid cartons dominate the market

The report has provided a detailed breakup and analysis of the market based on the carton type. This includes brick liquid cartons, shaped liquid cartons, and gable top cartons. According to the report, brick liquid cartons represented the largest segment.Brick liquid cartons are designed in a rectangular prism shape, which allows for optimal space utilization. This design enables efficient stacking and storage, both on store shelves and during transportation. Furthermore, this form factor also contributes to maximizing the use of space, reducing transportation costs, and enhancing overall logistics efficiency. Apart from this, these cartons are manufactured from renewable materials such as paperboard, with thin layers of plastic and aluminum for protection.

This composition aligns with the growing emphasis on sustainability and environmental consciousness among consumers and regulators. Additionally, the manufacturing process of brick liquid cartons is relatively simple and efficient, leading to reduced production costs. These savings are further passed on to consumers, making products packaged in brick liquid cartons more competitively priced.

Breakup by Packaging Type:

- Flexible Liquid Packaging

- Rigid Liquid Packaging

Flexible liquid packaging is lighter than traditional packaging solutions, which aids in reducing transportation costs and energy consumption, thus contributing to sustainability efforts. Furthermore, it conforms to the shape of the product, reducing wasted space in shipping and storage, which leads to further cost savings and logistical benefits. Moreover, flexible liquid packaging also aids in preserving the freshness and quality of the contents, thus extending the product’s shelf life.

Rigid liquid packaging provides robust protection against physical damage during transportation and handling. Its strength ensures the integrity of the product and prevents leakage or spoilage. Furthermore, it ensures stability on shelves and during transport, which prevents tipping and spilling, making handling and display more manageable. Moreover, rigid liquid packaging provides excellent barriers against moisture, oxygen, and contaminants, preserving the quality and extending the shelf life of the products.

Breakup by Shelf Life:

- Long Shelf Life Cartons

- Short Shelf Life Cartons

Long shelf life cartons dominate the market

The report has provided a detailed breakup and analysis of the market based on the shelf life. This includes long shelf life cartons and short shelf life cartons. According to the report, long shelf life cartons represented the largest market segment.Long shelf life cartons are specifically engineered to preserve the quality of the liquid content. They are constructed with layers of materials, such as paperboard, plastic, and aluminum, which work together to prevent the ingress of air and light, factors that can undermine the quality of the product. Furthermore, they ensure that the liquid remains fresh and retains its original taste, texture, and nutritional value.

Additionally, long shelf life cartons allow manufacturers to distribute their goods over long distances without the need for refrigeration. Moreover, they aid in reducing wastage at the retail level, which is an attractive feature for both retailers and consumers. Besides this, long shelf life cartons offer flexibility in consumption, as they allow consumers to purchase in bulk and store for future use without concern for rapid spoilage.

Breakup by End User:

- Liquid Dairy Products

- Non-Carbonated Soft Drinks

- Liquid Foods

- Alcoholic Beverages

Liquid dairy products dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes liquid dairy products, non-carbonated soft drinks, liquid foods, and alcoholic beverages. According to the report, liquid dairy products represented the largest market segment.Liquid dairy products such as milk, yogurt, and cream are staples in many diets around the world, which ensures a consistent demand for effective packaging solutions, such as liquid packaging cartons. Furthermore, they are perishable and require proper packaging to maintain freshness and prevent contamination. In line with this, liquid packaging cartons are designed to offer extended shelf life and preserve the quality of the content, making them a preferred choice for dairy packaging.

Additionally, the increasing focus of the dairy industry on sustainability is facilitating the demand for liquid packaging cartons that are recyclable and often made from renewable resources. Moreover, liquid packaging cartons align with modern consumer lifestyles as they are lightweight and easy to handle, making them suitable for on-the-go consumption of dairy products.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance in the market, accounting for the largest liquid packaging cartons market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represented the largest market segment.Europe is witnessing considerable growth in the market due to the imposition of stringent regulations and standards by regional governments concerning packaging materials, particularly with a focus on environmental sustainability. Furthermore, the escalating environmental consciousness among regional consumers is facilitating the demand for products packaged in sustainable and recyclable materials. Additionally, the presence of leading packaging companies in Europe that are heavily investing the developing advanced liquid packaging solutions is boosting the market growth.

Moreover, the significant growth in the food and beverage (F&B) in the region, which requires liquid packaging cartons for various products, such as juices, sauces, and dairy, is propelling the market growth. In addition, the introduction of supportive policies by governments promoting a circular economy, focusing on the life cycle of materials through reduction, recycling, and reuse, is positively influencing the market growth.

Competitive Landscape:

The top liquid packaging cartons companies are focusing on innovative materials, design, and manufacturing processes to ensure the creation of products that meet current market needs and anticipate future trends. Furthermore, major players are producing cartons from renewable, recyclable, or biodegradable materials to reduce their carbon footprint and align with global sustainability goals. Additionally, the leading companies are extending their reach by entering new markets and forming strategic partnerships or acquisitions.Moreover, several key players are adopting the latest technologies, such as automation, digital printing, and smart packaging, to enhance production efficiency, quality control, and customization. In addition, leading companies are focusing on consumer insights and feedback, which assist them in creating packaging solutions that resonate with consumer values, particularly around convenience and sustainability.

The report has provided a comprehensive analysis of the competitive landscape in the global liquid packaging cartons market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Adam Pack S.A.

- Billerud AB

- Elopak

- Greatview Aseptic Packaging Co. Ltd.

- IPI s.r.l. (Coesia S.p.A.)

- Mondi plc

- Nippon Paper Industries Co. Ltd.

- Pactiv Evergreen Inc.

- SIG Combibloc Group Ltd. (Reynolds Group Holdings)

- Smurfit Kappa Group plc

- Tetra Laval Group

- Uflex Limited

Key Questions Answered in This Report:

- What is liquid packaging?

- How big is the liquid packaging market?

- What is the expected growth rate of the global liquid packaging market during 2025-2033?

- What are the key factors driving the global liquid packaging market?

- What is the leading segment of the global liquid packaging market based on the material type?

- What is the leading segment of the global liquid packaging market based on the packaging type?

- What is the leading segment of the global liquid packaging market based on technology?

- What are the key regions in the global liquid packaging market?

- Who are the key players/companies in the global liquid packaging market?

Table of Contents

Companies Mentioned

- Amcor plc

- Berry Global Group Inc.

- Billerudkorsnas AB

- Constantia Flexibles

- Coveris

- Evergreen Packaging

- Gerresheimer AG

- LiquiBox

- Mondi plc

- Sidel (The Tetra Laval Group)

- Smurfit Kappa Group plc

- Sonoco Products Company

Table Information

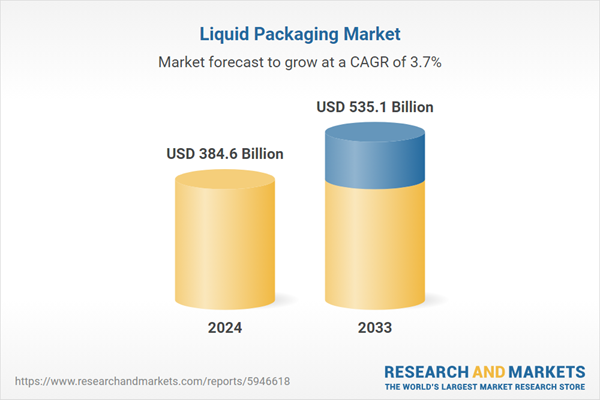

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 384.6 Billion |

| Forecasted Market Value ( USD | $ 535.1 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |