Increase in Medical Applications Fuels North America Medical Tubing Market

Medical tubing is utilized in various medical and pharmaceutical applications, including fluid management, drainage, anesthesiology, respiratory equipment, intravenous (IV) administration, catheters, peristaltic pumps, dialysis, feeding tubes, and biopharmaceutical laboratory equipment. Medical interventions that involve specialized medical tubing are often needed in the management of chronic diseases, such as diabetes, cardiovascular diseases, and cancer. In 2022, the American Cancer Society estimated 26,380 new cases of stomach cancer (gastric cancer) in the US.According to the Global Cancer Statistics published in 2022 by GLOBOCAN, the category of trachea, bronchus, and lung cancer was the most common cancer condition worldwide, followed by breast cancer and colorectal cancer, respectively. As per the International Agency for Research on Cancer (IARC), nearly 1 in 5 people would develop cancer during their lifetime, and ~ 1 in 9 men and ~1 in 12 women succumb to the disease. With the rising prevalence of chronic diseases, healthcare systems continuously seek medical devices such as infusion devices, catheters, and IV administration systems using tubing to effectively manage these conditions.

Companies such as RAUMEDIC AG and Saint-Gobain offer a wide range of medical tubing systems for drug delivery devices, infusion devices, internal feeding systems, and peristaltic pumps. RAUMEDIC's silicone tubing is ideal for use in medical pump devices. Patients suffering from chronic diseases often require hospitalization, wherein treatment processes such as catheterization, drainage, and infusion involve the use of medical tubing. Patients with serious chronic conditions may also need surgical interventions, making medical tubing products invincible. Reliable and effective medical tubing solutions significantly contribute to patient safety and the success of treatments.

Crohn's disease (a gastrointestinal disease associated with trauma), bowel obstruction, microscopic colitis, short bowel syndrome, and ulcerative colitis are a few of the common gastrointestinal disorders. Patients suffering from these conditions are provided with enteral nutrition, which utilizes feeding tubes, as consuming food orally is not feasible. In September 2023, Cardinal Health launched a novel Kangaroo OMNI enteral feeding pump with a Kangaroo feeding tube featuring IRIS Technology. The pump is equipped with a camera to assist in the placement of small-bore feeding tubes.

Developed with a focus on patient safety and innovation, this advanced pump delivers nutrition and hydration for individuals from different age groups, whether in hospitals, at home, or elsewhere. Therefore, an increase in the medical applications of tubing, coupled with a surge in the number of chronic disease cases, drives the medical tubing market toward growth.

North America Medical Tubing Market Overview

Investors are increasingly focusing on companies that produce high-quality medical tubing, a critical requirement for healthcare applications such as anesthesia delivery and fluid management. Innovative materials such as specialty polymers and biocompatible plastics drive medical device performance and safety. For instance, in June 2020, Nordson Corporation acquired Fluortek, Inc., an Easton, Pennsylvania-based precision plastic extrusion manufacturer that serves the medical device industry with custom-dimensioned tubing. As Nordson MEDICAL continues expanding differentiated product offerings, the acquisition of Fluortek enhances the ability to deliver critical components that make customers' most complex medical device innovations possible.This offering further deepens Nordson MEDICAL's position as a component and device manufacturing capability provider for OEMs throughout the interventional, minimally invasive, and surgical medical device landscape. The higher rate of early adoption of emerging medical technology advancements in the future, coupled with the rising prevalence of chronic diseases, is likely to increase the demand for medical tubing solutions. As healthcare delivery continues to focus on efficiency and patient safety, investing in this area is expected to reap good returns and form an attractive channel of investing for growth-driven investors across the US.

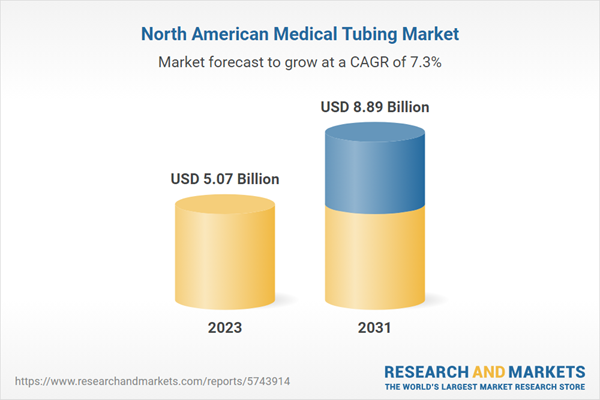

North America Medical Tubing Market Revenue and Forecast to 2031 (US$ Million)

North America Medical Tubing Market Segmentation

The North America medical tubing market is categorized into type, structure, application, end users, and country.- By type, the North America medical tubing market is segmented into polyvinyl chloride (PVC), polyimide or nylons, PTFE or thermoplastic elastomers (TPES), thermoplastic polyurethanes (TPUS), polyvinylidene fluoride (PVDF), polypropylene and polyethylene, silicone, and others. The polyvinyl chloride (PVC) segment held the largest share of the North America medical tubing market share in 2023.

- In terms of structure, the North America medical tubing market is segmented into single-lumen, multi-lumen, multi-layer extruded tubing, tapered or bump tubing, braided tubing, balloon tubing, corrugated tubing, heat shrink tubing, and others. The single-lumen segment held the largest share of the North America medical tubing market share in 2023.

- Based on application, the North America medical tubing market is segmented into bulk disposable tubing, catheters and cannula, drug delivery systems, and others. The bulk disposable tubing segment held the largest share of the North America medical tubing market share in 2023.

- By end users, the North America medical tubing market is segmented into hospital and clinics, ambulatory care centers, medical labs, and others. The hospital and clinics segment held the largest share of the North America medical tubing market share in 2023.

- Based on country, the North America medical tubing market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America medical tubing market in 2023.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America medical tubing market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America medical tubing market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America medical tubing market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Medical Tubing Market include:- Accu-Tube LLC

- Axiom Medical Inc

- Boston Scientific Corp

- Compagnie de Saint Gobain SA

- DuPont de Nemours Inc

- Freudenberg Medical LLC

- MicroLumen Inc

- Nordson Corp

- Polyzen Inc

- Raumedic AG

- TE Connectivity Ltd

- TEKNI-PLEX

- Teleflex Inc

- The Lubrizol Corporation

- Trelleborg AB

- W L Gore and Associates Inc

- Zeus Industrial Products Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 201 |

| Published | March 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 5.07 Billion |

| Forecasted Market Value ( USD | $ 8.89 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 18 |