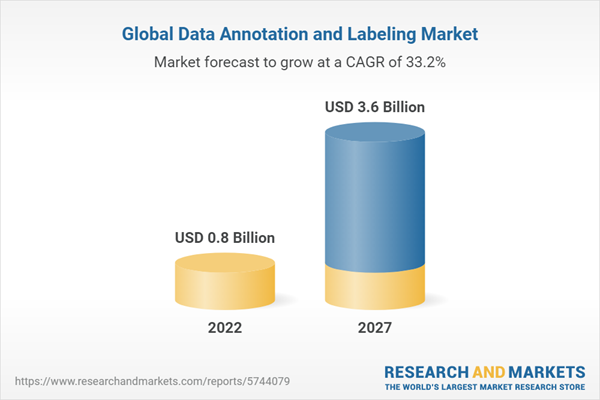

The global data annotation and labeling market is projected to grow from USD 0.8 billion in 2022 to USD 3.6 billion by 2027, at a CAGR of 33.2% during the forecast period. Any model or system that relies on a computer-driven decision-making system must annotate and label the data in order to guarantee that the decisions are accurate and pertinent. Businesses use massive amounts of datasets when building an ML model, carefully customizing them according to the model training needs. As a result, machines can detect data that has been annotated in a variety of comprehensible formats, including images, texts, and videos. This explains why AI and ML firms seek out this type of annotated data to put into their ML algorithm, training it to learn and detect recurrent patterns, and ultimately employing the same to create accurate estimates and predictions.

The major market players, such as Google, Appen, IBM, Oracle, TELUS International, Adobe, AWS have adopted numerous growth strategies, which include acquisitions, new product launches, product enhancements, and business expansions, to enhance their market shares.

By organization size, SMEs are anticipated to grow at the highest CAGR during the forecast period

The increased competitive market scenario is expected to prompt SMEs to invest in cutting-edge technologies and adopt go-to-market strategies for making informed business decisions. SMEs are more open to adopting new technology to improve and streamline business operations as well as to expand their market presence in the global economy. During the forecast period, SMEs are anticipated to grow at highest CAGR.

By application, catalogue management segment to register the highest CAGR during the forecast period

The catalogue management tool helps businesses handle enormous amounts of unstructured data across many AI and ML projects. Teams that work on data annotation need strong tools that can gather all different kinds of data and information from various sources into a single, searchable database. Companies such as LabelBox developed a data annotation tool powered by catalogue management with the intent to filter out unstructured data based on metadata properties. Among applications, catalogue management is projected to register the highest CAGR during the forecast period.

Asia Pacific market to register highest CAGR during the forecast period

The data annotation and labeling market is projected to register the highest CAGR in the Asia Pacific region during the forecast period. The rapid industrialization of the countries across the Asia Pacific and the increasing digitalization trend is leading to the production of the bulk of unstructured data. Since the Asia Pacific region has shown untapped potential in the increased adoption of data annotation and labeling solutions, most organisations are moving there to extend their market reach. Due to the expanding corporate productivity awareness and the competently designed data annotation and labeling solutions offered by the vendors in this market, the Asia Pacific has emerged as a very promising region.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the data annotation and labeling market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, D-Level Executives: 25%, and Others: 40%

- By Region: North America: 45%, Asia Pacific: 30%, Europe: 20%, Row: 5%

The report includes the study of key players offering data annotation and labeling. It profiles major vendors in the data annotation and labeling market. The major players in this market include Google (US), Appen (Australia), IBM (US), Oracle (US), TELUS International (Canada), Adobe (US), AWS (US), Alegion (US), Cogito Tech (US), Anolytics (US), AI Data Innovation (US), Clickworker (Germany), CloudFactory (UK), CapeStart (US), DataPure (US), LXT (Canada), Precise BPO Solution (India), Sigma (US), Segment.ai (US), Defined.ai (US), Dataloop (Israel), Labelbox (US), V7 (UK), LightTag (Germany), SuperAnnotate (US), Scale (US), Datasur (US), Kili Technology (France), Understand.ai (Germany), Keylabs (Israel), and Label Your Data (US)

Research Coverage

This study covers the data annotation and labeling market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as component, application, deployment mode, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall data annotation and labeling market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Data Annotation and Labeling Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

Table 1 Primary Interviews

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

Figure 2 Data Triangulation

2.3 Market Size Estimation

Figure 3 Market: Top-Down and Bottom-Up Approaches

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

Figure 4 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue from Solutions/Services of Data Annotation and Labeling Market

Figure 5 Market Size Estimation Methodology- Approach 2, Bottom-Up (Supply Side): Collective Revenue from Solutions/Services of Market

Figure 6 Market Size Estimation Methodology-Approach 3, Bottom-Up (Supply Side): Collective Revenue from Solutions/Services of Market

Figure 7 Market Size Estimation Methodology-Approach 4, Bottom-Up (Demand Side): Share of Data Annotation and Labeling Through Overall Data Annotation and Labeling Spending

2.4 Market Forecast

Table 2 Factor Analysis

2.5 Assumptions

2.6 Limitations

2.7 Recession Impact on Market

3 Executive Summary

Table 3 Global Data Annotation and Labeling Market Size and Growth Rate, 2019-2021 (USD Million, Y-O-Y %)

Table 4 Global Market Size and Growth Rate, 2022-2027 (USD Million, Y-O-Y %)

Figure 8 Solutions Segment Dominated in 2022

Figure 9 Professional Services Held Larger Market Share in 2022

Figure 10 Training and Consulting Dominated Market in 2022

Figure 11 Text Data Type Segment Led Market in 2022

Figure 12 Dataset Management Segment Held Largest Market Share in 2022

Figure 13 Manual Annotation Type Held Largest Segment in 2022

Figure 14 Large Enterprises Dominated Market in 2022

Figure 15 Cloud Segment Held Larger Market in 2022

Figure 16 Healthcare and Life Sciences Segment Grew at Highest CAGR in 2022

Figure 17 North America Held Largest Market Share and Asia-Pacific Grew at Highest CAGR in 2022

4 Premium Insights

4.1 Attractive Opportunities in Data Annotation and Labeling Market

Figure 18 Increasing Need to Improve Machine Learning Models to Drive Market Growth

4.2 Market: Top Three Applications

Figure 19 Catalogue Management Segment to Grow at Highest CAGR During Forecast Period

4.3 North America: Market, By Component and Top Three Verticals

Figure 20 Solutions Segment and Bfsi Segment Held Largest Market Shares in 2022

4.4 Market: By Region

Figure 21 North America Held the Largest Market Share in 2022

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Data Annotation and Labeling: Architecture

Figure 22 Architecture: Data Annotation and Labeling Market

5.3 Market Dynamics

Figure 23 Drivers, Restraints, Opportunities, and Challenges: Market

5.3.1 Drivers

5.3.1.1 Increasing Need to Improve Machine Learning Models and Train AI Algorithms

Figure 24 Percentage of Time Allocated to Machine Learning Project Tasks

5.3.1.2 Growing Demand for Annotated Datasets in Autonomous Mobility Technologies

Figure 25 Autonomous Driving Disclosed Deals and Equity Funding

5.3.1.3 Rising Popularity of Labeled Data in Medical Imaging

Figure 26 AI in Drug Discovery Papers Published Per Year

5.3.2 Restraints

5.3.2.1 High Costs Associated with Manual Data Annotation

5.3.2.2 Issues Associated with Poor Quality of Training Data

5.3.2.3 Failure Regarding Data Security Regulations and Compliance

5.3.3 Opportunities

5.3.3.1 Rising Efficiency of AI-Assisted Automated Data Annotation

5.3.3.2 Rapid Adoption of Computer Vision Technologies in Novel Applications

5.3.3.3 Increasing Traction of Crowdsourced Data Annotation for Improved ROI

5.3.4 Challenges

5.3.4.1 Complexity in Handling Vast Datasets Leads to Human Bias

5.3.4.2 Dearth of Skilled Data Annotators

5.4 Data Annotation and Labeling: Evolution

Figure 27 Evolution: Data Annotation and Labeling Market

5.5 Market: Ecosystem

Table 5 Market: Ecosystem

5.6 Supply Chain Analysis

Figure 28 Supply Chain Analysis: Market

5.7 Case Study Analysis

5.7.1 Healthcare and Life Sciences

5.7.1.1 Imerit to Offer AI-Driven Remote Patient Monitoring Capabilities to Cancer Centers

5.7.1.2 Mindy Support Enables a US Medtech Firm to Automate Inventory Keeping of All Surgical Equipment

5.7.2 Retail and E-Commerce

5.7.2.1 Cogitotech Helps US-based Brick and Mortar Store to Combat Growing Presence of E-commerce Stores

5.7.2.2 Dataloop Enables Standard AI to Enable Autonomous Checkout at Retail Stores

5.7.3 Agriculture

5.7.3.1 Cropin Helps 2Scale to Transform and Create Traceable Rice Value Chain Digitally

5.7.4 Automotive

5.7.4.1 Scale AI Helps Toyota to Create Large Volumes of Training Data for Autonomous Mobility

5.7.5 Media and Entertainment

5.7.5.1 Dataloop Assists Linkedin in Content Moderation

5.7.6 IT and Ites

5.7.6.1 Appen Helps Adobe to Improve Search Relevance for Its Massive Stock Image Library

5.8 Technology Analysis

5.8.1 Data Annotation and Artificial Intelligence

5.8.2 Data Annotation and Natural Language Processing

5.8.3 Data Annotation and Cloud Computing

5.8.4 Data Annotation and Internet of Things (IoT)

5.9 Porter's Five Forces Analysis

Figure 29 Data Annotation and Labeling: Porter's Five Forces Analysis

Table 6 Data Annotation and Labeling Market: Porter's Five Forces Analysis

5.9.1 Threat of New Entrants

5.9.2 Threat of Substitutes

5.9.3 Bargaining Power of Suppliers

5.9.4 Bargaining Power of Buyers

5.9.5 Intensity of Competitive Rivalry

5.10 Regulatory Landscape

5.10.1 Health Insurance Portability and Accountability Act (HIPAA)

5.10.2 General Data Protection Regulation (Gdpr)

5.10.3 Personal Information Protection and Electronic Documents Act

5.10.4 Information Security Technology- Personal Information Security Specification Gb/T 35273-2017

5.10.5 Secure India National Digital Communications Policy 2018

5.10.6 General Data Protection Law (Lgpd)

5.10.7 Law No 13 of 2016 on Protecting Personal Data

5.10.8 Nist Special Publication 800-144 - Guidelines on Security and Privacy in Public Cloud Computing

5.11 Pricing Model Analysis

Table 7 Average Selling Pricing Analysis, 2022

5.12 Patent Analysis

5.12.1 Methodology

5.12.2 Document Type

Table 8 Patents Filed, 2013-2022

5.12.3 Innovation and Patent Applications

Figure 30 Total Number of Patents Granted, 2013-2022

5.12.3.1 Top Applicants

Figure 31 Top 10 Companies with Highest Number of Patent Applications in Last 10 Years, 2013-2022

Table 9 Top 10 Patent Owners (US) in Data Annotation and Labeling Market, 2013-2022

5.13 Key Conferences and Events, 2022-2023

Table 10 Data Annotation and Labeling Market: Detailed List of Conferences and Events, 2023

5.14 Tariff and Regulatory Landscape

5.14.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 11 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Middle East and Africa: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Latin America: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.15 Trends/Disruptions Impacting Buyers/Clients of Data Annotation and Labeling Market

Figure 32 Market: Trends/Disruptions Impacting Buyers/Clients

5.16 Key Stakeholders & Buying Criteria

5.16.1 Key Stakeholders in Buying Process

Figure 33 Influence of Stakeholders on Buying Process for Top Three Applications

Table 16 Influence of Stakeholders on Buying Process for Top Three Applications

5.16.2 Buying Criteria

Figure 34 Key Buying Criteria for Top Three Applications

Table 17 Key Buying Criteria for Top Three Applications

6 Data Annotation and Labeling Market, By Component

6.1 Introduction

6.1.1 Component: Market Drivers

Figure 35 Services Segment to Grow at Highest CAGR During Forecast Period

Table 18 Market, By Component, 2019-2021 (USD Million)

Table 19 Market, By Component, 2022-2027 (USD Million)

6.2 Solutions

6.2.1 Growing Adoption of Data Annotation and Labeling Solutions to Enhance Productivity

Table 20 Solutions: Market, By Region, 2019-2021 (USD Million)

Table 21 Solutions: Market, By Region, 2022-2027 (USD Million)

6.3 Services

6.3.1 Rising Need for Cloud-based Solutions to Drive Market Growth

Figure 36 Managed Services to Grow at Higher CAGR During Forecast Period

Table 22 Market, By Service, 2019-2021 (USD Million)

Table 23 Market, By Service, 2022-2027 (USD Million)

Table 24 Services: Market, By Region, 2019-2021 (USD Million)

Table 25 Services: Market, By Region, 2022-2027 (USD Million)

6.3.2 Professional Services

Figure 37 System Integration and Implementation to Grow at Highest CAGR During Forecast Period

Table 26 Data Annotation and Labeling Market, By Professional Service, 2019-2021 (USD Million)

Table 27 Market, By Professional Service, 2022-2027 (USD Million)

Table 28 Professional Services: Market, By Region, 2019-2021 (USD Million)

Table 29 Professional Services: Market, By Region, 2022-2027 (USD Million)

6.3.2.1 Training and Consulting

6.3.2.1.1 Consulting Services to Enable Companies to Address Specific Requirements

Table 30 Training and Consulting: Market, By Region, 2019-2021 (USD Million)

Table 31 Training and Consulting: Market, By Region, 2022-2027 (USD Million)

6.3.2.2 System Integration and Implementation

6.3.2.2.1 System Integration and Implementation Enable Businesses to Reduce Complexities and Increase ROI

Table 32 System Integration and Implementation: Market, By Region, 2019-2021 (USD Million)

Table 33 System Integration and Implementation: Market, By Region, 2022-2027 (USD Million)

6.3.2.3 Support and Maintenance

6.3.2.3.1 Support and Maintenance Services to Facilitate 24/7 Assistance

Table 34 Support and Maintenance: Market, By Region, 2019-2021 (USD Million)

Table 35 Support and Maintenance: Market, By Region, 2022-2027 (USD Million)

6.3.3 Managed Services

6.3.3.1 Need to Redefine Customer Experience to Fuel Adoption of Managed Services

Table 36 Managed Services: Market, By Region, 2019-2021 (USD Million)

Table 37 Managed Services: Market, By Region, 2022-2027 (USD Million)

7 Data Annotation and Labeling Market, By Data Type

7.1 Introduction

7.1.1 Data Type: Market Drivers

Figure 38 Text Segment to Register Largest Market Size During Forecast Period

Table 38 Market, By Data Type, 2019-2021 (USD Million)

Table 39 Market, By Data Type, 2022-2027 (USD Million)

7.2 Text

7.2.1 Growing Reliance on Text-based Data to Drive Demand for Data Annotation and Labeling Solutions

Table 40 Text: Data Annotation and Labeling Market, By Region, 2019-2021 (USD Million)

Table 41 Text: Market, By Region, 2022-2027 (USD Million)

7.3 Image

7.3.1 Growing Application of Facial Recognition and Robotic Vision to Boost Demand for Image Annotation and Labeling

Table 42 Image: Market, By Region, 2019-2021 (USD Million)

Table 43 Image: Market, By Region, 2022-2027 (USD Million)

7.4 Video

7.4.1 Growing Application of Data Annotation and Labeling to Fuel Market Growth

Table 44 Video: Market, By Region, 2019-2021 (USD Million)

Table 45 Video: Market, By Region, 2022-2027 (USD Million)

7.5 Audio

7.5.1 Rising Demand for Audio Annotation to Enhance Searchability

Table 46 Audio: Market, By Region, 2019-2021 (USD Million)

Table 47 Audio: Market, By Region, 2022-2027 (USD Million)

8 Data Annotation and Labeling Market, By Deployment Type

8.1 Introduction

8.1.1 Deployment Type: Market Drivers

Figure 39 On-Premises Segment to Grow at Highest CAGR During Forecast Period

Table 48 Market, By Deployment Type, 2019-2021 (USD Million)

Table 49 Market, By Deployment Type, 2022-2027 (USD Million)

8.2 On-Premises

8.2.1 Ability to Provide Control and Security to Boost Demand for On-Premises Deployment Mode

Table 50 On-Premises: Market, By Region, 2019-2021 (USD Million)

Table 51 On-Premises: Market, By Region, 2022-2027 (USD Million)

8.3 Cloud

8.3.1 Easy Upgradeability and Accessibility to Boost Adoption of Cloud-based Solutions

Table 52 Cloud: Market, By Region, 2019-2021 (USD Million)

Table 53 Cloud: Market, By Region, 2022-2027 (USD Million)

9 Data Annotation and Labeling Market, By Organization Size

9.1 Introduction

9.1.1 Organization Size: Market Drivers

Figure 40 Small and Medium-Sized Enterprises Segment to Grow at Higher CAGR During Forecast Period

Table 54 Market, By Organization Size, 2019-2021 (USD Million)

Table 55 Market Size, By Organization Size, 2022-2027 (USD Million)

9.2 Small and Medium-Sized Enterprises

9.2.1 Growing Competitive Market Environment to Drive SMEs to Adopt Go-To-Market Strategies

Table 56 Small and Medium-Sized Enterprises: Market, By Region, 2019-2021 (USD Million)

Table 57 Small and Medium-Sized Enterprises: Market, By Region, 2022-2027 (USD Million)

9.3 Large Enterprises

9.3.1 Rising Inclination Toward Cutting Edge Technologies to Drive Demand

Table 58 Large Enterprises: Market, By Region, 2019-2021 (USD Million)

Table 59 Large Enterprises: Market, By Region, 2022-2027 (USD Million)

10 Data Annotation and Labeling Market, By Annotation Type

10.1 Introduction

10.1.1 Annotation Type: Market Drivers

Figure 41 Manual Annotation Type to Hold Largest Market Size During Forecast Period

Table 60 Market, By Annotation Type, 2019-2021 (USD Million)

Table 61 Market, By Annotation Type, 2022-2027 (USD Million)

10.2 Manual

10.2.1 Current Fast-Paced Digital Environment to Shift Demand from Manual Labeling to Automatic Labeling

Table 62 Manual: Market, By Region, 2019-2021 (USD Million)

Table 63 Manual: Market, By Region, 2022-2027 (USD Million)

10.3 Automatic

10.3.1 Ability to Self-Train Machine Learning Models to Recognize Demand for Automatic Labeling

Table 64 Automatic: Market, By Region, 2019-2021 (USD Million)

Table 65 Automatic: Market, By Region, 2022-2027 (USD Million)

10.4 Semi-Supervised

10.4.1 Integration of Automatic and Manual Data Labeling to Enhance Outcomes Cost-Effectively

Table 66 Semi-Supervised: Market, By Region, 2019-2021 (USD Million)

Table 67 Semi-Supervised: Market, By Region, 2022-2027 (USD Million)

11 Data Annotation and Labeling Market, By Application

11.1 Introduction

11.1.1 Application: Market Drivers

Figure 42 Catalogue Management Segment to Grow at Highest CAGR During Forecast Period

Table 68 Market, By Application, 2019-2021 (USD Million)

Table 69 Market, By Application, 2022-2027 (USD Million)

11.2 Dataset Management

11.2.1 Big Data Handling Capabilities to Deliver Large Volumes of Data with Ease

Table 70 Dataset Management: Market, By Region, 2019-2021 (USD Million)

Table 71 Dataset Management: Market, By Region, 2022-2027 (USD Million)

11.3 Security and Compliance

11.3.1 Stringent Data Privacy Features in Data Annotation Tools to Ensure Regulatory Compliance

Table 72 Security and Compliance: Data Annotation and Labeling Market, By Region, 2019-2021 (USD Million)

Table 73 Security and Compliance: Market, By Region, 2022-2027 (USD Million)

11.4 Data Quality Control

11.4.1 Data Quality Control Embedded in Data Annotation Tools to Deliver Accurate Machine Learning Models

Table 74 Data Quality Control: Market, By Region, 2019-2021 (USD Million)

Table 75 Data Quality Control: Market, By Region, 2022-2027 (USD Million)

11.5 Workforce Management

11.5.1 Workforce Management to Establish and Operate Fully Transparent Data Annotation Workflows

Table 76 Workforce Management: Market, By Region, 2019-2021 (USD Million)

Table 77 Workforce Management: Market, By Region, 2022-2027 (USD Million)

11.6 Content Management

11.6.1 Content Management to Bridge Information Silos and Allow for Easier Sharing of Web Content

Table 78 Content Management: Market, By Region, 2019-2021 (USD Million)

Table 79 Content Management: Market, By Region, 2022-2027 (USD Million)

11.7 Catalogue Management

11.7.1 Catalogue Management Application to Assist Enterprises in Unstructured Data Management

Table 80 Catalogue Management: Data Annotation and Labeling Market, By Region, 2019-2021 (USD Million)

Table 81 Catalogue Management: Market, By Region, 2022-2027 (USD Million)

11.8 Sentiment Analysis

11.8.1 Sentiment Analysis Application to Improve Brand Reputation

Table 82 Sentiment Analysis: Market, By Region, 2019-2021 (USD Million)

Table 83 Sentiment Analysis: Market, By Region, 2022-2027 (USD Million)

11.9 Other Applications

Table 84 Other Applications: Market, By Region, 2019-2021 (USD Million)

Table 85 Other Applications: Market, By Region, 2022-2027 (USD Million)

12 Data Annotation and Labeling Market, By Vertical

12.1 Introduction

12.1.1 Vertical: Market Drivers

12.1.2 Data Annotation and Labeling: Enterprise Use Cases

Figure 43 Healthcare and Life Sciences Segment to Grow at Highest CAGR During Forecast Period

Table 86 Market By Vertical, 2019-2021 (USD Million)

Table 87 Market, By Vertical, 2022-2027 (USD Million)

12.2 Bfsi

12.2.1 Data Labeling Solutions to Detect Financial Fraud and Improve Customer Experience

Table 88 Bfsi: Data Annotation and Labeling Market, By Region, 2019-2021 (USD Million)

Table 89 Bfsi: Market, By Region, 2022-2027 (USD Million)

12.3 Healthcare and Life Sciences

12.3.1 Healthcare Institutions to Deploy Data Annotation for Automated Diagnosis and Clinical Research

Table 90 Healthcare and Life Sciences: Market, By Region, 2019-2021 (USD Million)

Table 91 Healthcare and Life Sciences: Market, By Region, 2022-2027 (USD Million)

12.4 Telecom

12.4.1 Data Annotation Solutions to Monitor Valuable Telecom Assets

Table 92 Telecom: Market, By Region, 2019-2021 (USD Million)

Table 93 Telecom: Market, By Region, 2022-2027 (USD Million)

12.5 Government, Defense, and Public Agencies

12.5.1 Rising Need to Curb National Security Risks and Boost Precision Agriculture

Table 94 Government: Market, By Region, 2019-2021 (USD Million)

Table 95 Government: Market, By Region, 2022-2027 (USD Million)

12.6 IT and Ites

12.6.1 Data Annotation to Devise Product Launch Strategies and Reduce Employee Attrition

Table 96 IT and Ites: Data Annotation and Labeling Market, By Region, 2019-2021 (USD Million)

Table 97 IT and Ites: Market, By Region, 2022-2027 (USD Million)

12.7 Retail and Consumer Goods

12.7.1 Rising Need to Improve Shelf Management and Reduce Inventory Shrinkage to Boost Market Growth

Table 98 Retail and Consumer Goods: Market, By Region, 2019-2021 (USD Million)

Table 99 Retail and Consumer Goods: Market, By Region, 2022-2027 (USD Million)

12.8 Automotive

12.8.1 Data Annotation Powered Computer Vision to Improve Self-Driving Technologies and Reduce Driver Fatigue

Table 100 Automotive: Market, By Region, 2019-2021 (USD Million)

Table 101 Automotive: Market, By Region, 2022-2027 (USD Million)

12.9 Other Verticals

Table 102 Other Verticals: Market, By Region, 2019-2021 (USD Million)

Table 103 Other Verticals: Market, By Region, 2022-2027 (USD Million)

13 Market, By Region

13.1 Introduction

Figure 44 Asia-Pacific to Grow at Highest CAGR During Forecast Period

Figure 45 India to Grow at Highest CAGR During Forecast Period

Table 104 Market, By Region, 2019-2021 (USD Million)

Table 105 Market, By Region, 2022-2027 (USD Million)

13.2 North America

13.2.1 North America: Data Annotation and Labeling Market Drivers

13.2.2 North America: Recession Impact

Figure 46 North America: Market Snapshot

Table 106 North America: Market, By Component, 2019-2021 (USD Million)

Table 107 North America: Market, By Component, 2022-2027 (USD Million)

Table 108 North America: Market, By Service, 2019-2021 (USD Million)

Table 109 North America: Market, By Service, 2022-2027 (USD Million)

Table 110 North America: Market, By Professional Service, 2019-2021 (USD Million)

Table 111 North America: Market, By Professional Service, 2022-2027 (USD Million)

Table 112 North America: Market, By Data Type, 2019-2021 (USD Million)

Table 113 North America: Data Annotation and Labeling Market, By Data Type, 2022-2027 (USD Million)

Table 114 North America: Market, By Annotation Type, 2019-2021 (USD Million)

Table 115 North America: Market, By Annotation Type, 2022-2027 (USD Million)

Table 116 North America: Market, By Deployment Mode, 2019-2021 (USD Million)

Table 117 North America: Market, By Deployment Mode, 2022-2027 (USD Million)

Table 118 North America: Market, By Organization Size, 2019-2021 (USD Million)

Table 119 North America: Market, By Organization Size, 2022-2027 (USD Million)

Table 120 North America: Market, By Application, 2019-2021 (USD Million)

Table 121 North America: Market, By Application, 2022-2027 (USD Million)

Table 122 North America: Market, By Vertical, 2019-2021 (USD Million)

Table 123 North America: Market, By Vertical, 2022-2027 (USD Million)

Table 124 North America: Market, By Country, 2019-2021 (USD Million)

Table 125 North America: Market, By Country, 2022-2027 (USD Million)

13.2.3 US

13.2.3.1 US Emerged as Major Market to Witness Increasing Demand for Affordable Data Annotation Services

13.2.4 Canada

13.2.4.1 Canada to Witness Significant Investments in Data Annotation and Labeling Projects

13.3 Europe

13.3.1 Europe: Data Annotation and Labeling Market Drivers

13.3.2 Europe: Recession Impact

Table 126 Europe: Market, By Component, 2019-2021 (USD Million)

Table 127 Europe: Market, By Component, 2022-2027 (USD Million)

Table 128 Europe: Market, By Service, 2019-2021 (USD Million)

Table 129 Europe: Market, By Service, 2022-2027 (USD Million)

Table 130 Europe: Market, By Professional Service, 2019-2021 (USD Million)

Table 131 Europe: Market, By Professional Service, 2022-2027 (USD Million)

Table 132 Europe: Market, By Data Type, 2019-2021 (USD Million)

Table 133 Europe: Market, By Data Type, 2022-2027 (USD Million)

Table 134 Europe: Data Annotation and Labeling Market, By Annotation Type, 2019-2021 (USD Million)

Table 135 Europe: Market, By Annotation Type, 2022-2027 (USD Million)

Table 136 Europe: Market, By Deployment Mode, 2019-2021 (USD Million)

Table 137 Europe: Market, By Deployment Mode, 2022-2027 (USD Million)

Table 138 Europe: Market, By Organization Size, 2019-2021 (USD Million)

Table 139 Europe: Market, By Organization Size, 2022-2027 (USD Million)

Table 140 Europe: Market, By Application, 2019-2021 (USD Million)

Table 141 Europe: Market, By Application, 2022-2027 (USD Million)

Table 142 Europe: Market, By Vertical, 2019-2021 (USD Million)

Table 143 Europe: Market, By Vertical, 2022-2027 (USD Million)

Table 144 Europe: Market, By Country, 2019-2021 (USD Million)

Table 145 Europe: Market, By Country, 2022-2027 (USD Million)

13.3.3 UK

13.3.3.1 European Policymakers Encourage Governments to Increase Data Capture

13.3.4 Germany

13.3.4.1 Germany to Improve Both Business Results and Competitiveness By Democratizing Access to Data Annotation

13.3.5 France

13.3.5.1 Significant Potential for AI and Data Management Startups to Boost Market Growth

13.3.6 Rest of Europe

13.3.6.1 Growing Need to Gather Important Information from Unstructured Data to Boost Demand

13.4 Asia-Pacific

13.4.1 Asia-Pacific: Data Annotation and Labeling Market Drivers

13.4.2 Asia-Pacific: Impact of Recession

Figure 47 Asia-Pacific: Market Snapshot

Table 146 Asia-Pacific: Market, By Component, 2019-2021 (USD Million)

Table 147 Asia-Pacific: Market, By Component, 2022-2027 (USD Million)

Table 148 Asia-Pacific: Market, By Service, 2019-2021 (USD Million)

Table 149 Asia-Pacific: Market, By Service, 2022-2027 (USD Million)

Table 150 Asia-Pacific: Market, By Professional Service, 2019-2021 (USD Million)

Table 151 Asia-Pacific: Market, By Professional Service, 2022-2027 (USD Million)

Table 152 Asia-Pacific: Market, By Data Type, 2019-2021 (USD Million)

Table 153 Asia-Pacific: Data Annotation and Labeling Market, By Data Type, 2022-2027 (USD Million)

Table 154 Asia-Pacific: Market, By Annotation Type, 2019-2021 (USD Million)

Table 155 Asia-Pacific: Market, By Annotation Type, 2022-2027 (USD Million)

Table 156 Asia-Pacific: Market, By Deployment Mode, 2019-2021 (USD Million)

Table 157 Asia-Pacific: Market, By Deployment Mode, 2022-2027 (USD Million)

Table 158 Asia-Pacific: Market, By Organization Size, 2019-2021 (USD Million)

Table 159 Asia-Pacific: Market, By Organization Size, 2022-2027 (USD Million)

Table 160 Asia-Pacific: Market, By Application, 2019-2021 (USD Million)

Table 161 Asia-Pacific: Market, By Application, 2022-2027 (USD Million)

Table 162 Asia-Pacific: Market, By Vertical, 2019-2021 (USD Million)

Table 163 Asia-Pacific: Market, By Vertical, 2022-2027 (USD Million)

Table 164 Asia-Pacific: Market, By Country, 2019-2021 (USD Million)

Table 165 Asia-Pacific: Data Annotation and Labeling, By Country, 2022-2027 (USD Million)

13.4.3 India

13.4.3.1 Rapid Adoption of Technologies to Accelerate India's Current Transformation into a Prominent Global Powerhouse for Innovation

13.4.4 Japan

13.4.4.1 Growing Use of Cutting-Edge Technologies to Drive Growth of Market

13.4.5 China

13.4.5.1 Rapid Adoption of Innovative Technologies Across Verticals to Drive Market Demand

13.4.6 Rest of Asia-Pacific

13.4.6.1 Development of Infrastructure and Technological Capabilities to Drive Growth

13.5 Middle East and Africa

13.5.1 Middle East and Africa: Data Annotation and Market Drivers

13.5.2 Middle East and Africa: Impact of Recession

Table 166 Middle East and Africa: Market, By Component, 2019-2021 (USD Million)

Table 167 Middle East and Africa: Market, By Component, 2022-2027 (USD Million)

Table 168 Middle East and Africa: Market, By Service, 2019-2021 (USD Million)

Table 169 Middle East and Africa: Market, By Service, 2022-2027 (USD Million)

Table 170 Middle East and Africa: Market, By Professional Service, 2019-2021 (USD Million)

Table 171 Middle East and Africa: Market, By Professional Service, 2022-2027 (USD Million)

Table 172 Middle East and Africa: Market, By Data Type, 2019-2021 (USD Million)

Table 173 Middle East and Africa: Data Annotation and Labeling Market, By Data Type, 2022-2027 (USD Million)

Table 174 Middle East and Africa: Market, By Annotation Type, 2019-2021 (USD Million)

Table 175 Middle East and Africa: Market, By Annotation Type, 2022-2027 (USD Million)

Table 176 Middle East and Africa: Market, By Application, 2019-2021 (USD Million)

Table 177 Middle East & Africa: Market, By Application, 2022-2027 (USD Million)

Table 178 Middle East and Africa: Market, By Deployment Mode, 2019-2021 (USD Million)

Table 179 Middle East and Africa: Market, By Deployment Mode,2022-2027 (USD Million)

Table 180 Middle East and Africa: Market, By Organization, 2019-2021 (USD Million)

Table 181 Middle East and Africa: Market, By Organization Size, 2022-2027 (USD Million)

Table 182 Middle East and Africa: Market, By Vertical, 2019-2021 (USD Million)

Table 183 Middle East and Africa: Market, By Vertical, 2022-2027 (USD Million)

Table 184 Middle East and Africa: Market, By Region, 2019-2021 (USD Million)

Table 185 Middle East and Africa: Data Annotation and Labeling, By Region, 2022-2027 (USD Million)

13.5.3 Saudi Arabia

13.5.3.1 Government Spending on Innovative Technology to Drive Market Demand

13.5.4 UAE

13.5.4.1 Growing Ability to Embrace Emerging Technologies Across Several Verticals

13.5.5 South Africa

13.5.5.1 Untapped Market Opportunities to Drive Adoption of Advanced Technologies

13.5.6 Rest of Middle East and Africa

13.5.6.1 Presence of Various Startups and Initiatives By Government Boost Market Growth

13.6 Latin America

13.6.1 Latin America: Data Annotation and Labeling Market Drivers

13.6.2 Latin America: Impact of Recession

Table 186 Latin America: Market, By Component, 2019-2021 (USD Million)

Table 187 Latin America: Data Annotation and Labeling, By Component, 2022-2027 (USD Million)

Table 188 Latin America: Data Annotation and Labeling, By Service, 2019-2021 (USD Million)

Table 189 Latin America: Market, By Service, 2022-2027 (USD Million)

Table 190 Latin America: Market, By Professional Service, 2019-2021 (USD Million)

Table 191 Latin America: Data Annotation and Labeling, By Professional Service, 2022-2027 (USD Million)

Table 192 Latin America: Market, By Data Type, 2019-2021 (USD Million)

Table 193 Latin America: Market, By Data Type, 2022-2027 (USD Million)

Table 194 Latin America: Data Annotation and Labeling Market, By Annotation Type, 2019-2021 (USD Million)

Table 195 Latin America: Market, By Annotation Type, 2022-2027 (USD Million)

Table 196 Latin America: Market, By Application, 2019-2021 (USD Million)

Table 197 Latin America: Market, By Application, 2022-2027 (USD Million)

Table 198 Latin America: Market, By Deployment Mode, 2019-2021 (USD Million)

Table 199 Latin America: Market, By Deployment Mode, 2022-2027 (USD Million)

Table 200 Latin America: Market, By Organization Size, 2019-2021 (USD Million)

Table 201 Latin America: Market, By Organization Size, 2022-2027 (USD Million)

Table 202 Latin America: Market, By Vertical, 2019-2021 (USD Million)

Table 203 Latin America: Market, By Vertical, 2022-2027 (USD Million)

Table 204 Latin America: Market, By Country, 2019-2021 (USD Million)

Table 205 Latin America: Market, By Country, 2022-2027 (USD Million)

13.6.3 Brazil

13.6.3.1 Investment By Startups and Rapid Adoption of Technologies to Fuel Demand

13.6.4 Mexico

13.6.4.1 Growing Support to Implement Emerging Technologies and Drive Adoption Rate

13.6.5 Rest of Latin America

13.6.5.1 Growing Investment and Rapid Adoption of Technologies to Make Region Attractive for Entrepreneurs

14 Competitive Landscape

14.1 Overview

14.2 Key Player Strategies

Table 206 Overview of Strategies Adopted By Key Data Annotation and Labeling Vendors

14.3 Revenue Analysis

14.3.1 Historical Revenue Analysis

Figure 48 Historical Revenue Analysis of Top Five Players, 2019-2021 (USD Million)

14.4 Market Share Analysis

Figure 49 Data Annotation and Labeling Market Share Analysis for Key Companies, 2022

Table 207 Market: Degree of Competition

14.5 Company Evaluation Quadrant

14.5.1 Stars

14.5.2 Emerging Leaders

14.5.3 Pervasive Players

14.5.4 Participants

Figure 50 Key Market Players, Company Evaluation Quadrant, 2022

14.5.5 Competitive Benchmarking

Table 208 Market: Product Footprint Analysis of Key Players, 2022

Table 209 Data Annotation and Labeling Market: Product Footprint Analysis of Other Key Players, 2022

14.6 Startup/SME Evaluation Quadrant

14.6.1 Progressive Companies

14.6.2 Responsive Companies

14.6.3 Dynamic Companies

14.6.4 Starting Blocks

Figure 51 Startups/SMEs Data Annotation and Labeling Players, Company Evaluation Quadrant, 2022

14.6.5 Startups/SMEs Competitive Benchmarking

Table 210 Market: Detailed List of Key Startups/SMEs

Table 211 Data Annotation and Labeling Market: Product Footprint Analysis of Startups/ SMEs Players, 2022

14.7 Competitive Scenario and Trends

14.7.1 Product Launches

Table 212 Service/Product Launches, 2019-2022

14.7.2 Deals

Table 213 Deals, 2019-2022

15 Company Profiles

15.1 Introduction

15.2 Major Players

Business Overview, Products, Solutions and Services Offered, Recent Developments, Analyst's View

15.2.1 Google

Table 214 Google: Business Overview

Figure 52 Google: Company Snapshot

Table 215 Google: Products Offered

Table 216 Google: Product Launches and Enhancements

Table 217 Google: Deals

15.2.2 Appen

Table 218 Appen: Business Overview

Figure 53 Appen: Company Snapshot

Table 219 Appen: Products Offered

Table 220 Appen: Product Launches and Enhancements

Table 221 Appen: Deals

15.2.3 IBM

Table 222 IBM: Business Overview

Figure 54 IBM: Company Snapshot

Table 223 IBM: Products Offered

Table 224 IBM: Product Launches and Enhancements

Table 225 IBM: Deals

15.2.4 Oracle

Table 226 Oracle: Business Overview

Figure 55 Oracle: Company Snapshot

Table 227 Oracle: Products Offered

Table 228 Oracle: Product Launches and Enhancements

Table 229 Oracle: Deals

15.2.5 Telus International

Table 230 Telus International: Business Overview

Figure 56 Telus International: Company Snapshot

Table 231 Telus International: Products Offered

Table 232 Telus International: Product Launches and Enhancements

Table 233 Telus International: Deals

Table 234 Telus International: Others

15.2.6 Adobe

Table 235 Adobe: Business Overview

Figure 57 Adobe: Company Snapshot

Table 236 Adobe: Products Offered

Table 237 Adobe: Product Launches and Enhancements

Table 238 Adobe: Deals

15.2.7 Aws

Table 239 Aws: Business Overview

Figure 58 Aws: Company Snapshot

Table 240 Aws: Products Offered

Table 241 Aws: Product Launches and Enhancements

Table 242 Aws: Deals

15.2.8 Alegion

Table 243 Alegion: Business Overview

Table 244 Alegion: Products Offered

Table 245 Alegion: Product Launches and Enhancements

Table 246 Alegion: Deals

Table 247 Alegion: Others

15.2.9 Cogito Tech

Table 248 Cogito Tech: Business Overview

Table 249 Cogito Tech: Products Offered

Table 250 Cogito Tech: Product Launches and Enhancements

15.2.10 Anolytics

Table 251 Anolytics: Business Overview

Table 252 Anolytics: Products Offered

Details on Business Overview, Products, Services, and Solutions Offered Recent Developments, Analyst's View Might Not be Captured in Case of Unlisted Companies.

15.3 Other Key Players

15.3.1 AI Data Innovation

15.3.2 Clickworker

15.3.3 Cloudfactory

15.3.4 Capestart

15.3.5 Datapure

15.3.6 Lxt

15.3.7 Precise Bpo Solution

15.3.8 Sigma

15.3.9 Segments.AI

15.3.10 Defined AI

15.4 SMEs and Startups

15.4.1 Dataloop

15.4.2 Label Box

15.4.3 V7

15.4.4 Lighttag

15.4.5 Superannotate

15.4.6 Scale AI

15.4.7 Datasaur

15.4.8 Kili Technology

15.4.9 Understand.AI

15.4.10 Keylabs

15.4.11 Label Your Data

16 Adjacent and Related Markets

16.1 Introduction

16.2 Nlp Market - Global Forecast to 2027

16.2.1 Market Definition

16.2.2 Market Overview

16.2.2.1 Nlp Market, By Component

Table 253 Natural Language Processing Market, By Component, 2016-2021 (USD Million)

Table 254 Natural Language Processing Market, By Component, 2022-2027 (USD Million)

16.2.2.2 Nlp Market, By Type

Table 255 Natural Language Processing Market, By Type, 2016-2021 (USD Million)

Table 256 Natural Language Processing Market, By Type, 2022-2027 (USD Million)

16.2.2.3 Nlp Market, By Deployment Mode

Table 257 Natural Language Processing Market, By Deployment Mode, 2016-2021 (USD Million)

Table 258 Natural Language Processing Market, By Deployment Mode, 2022-2027USD Million)

16.2.2.4 Nlp Market, By Organization Size

Table 259 Natural Language Processing Market, By Organization Size, 2016-2021 (USD Million)

Table 260 Natural Language Processing Market, By Organization Size, 2022-2027 (USD Million)

16.2.2.5 Nlp Market, By Application

Table 261 Natural Language Processing Market, By Application, 2016-2021 (USD Million)

Table 262 Natural Language Processing Market, By Application, 2022-2027 (USD Million)

16.2.2.6 Nlp Market, By Technology

Table 263 Natural Language Processing Market, By Technology, 2016-2021 (USD Million)

Table 264 Natural Language Processing Market, By Technology, 2022-2027 (USD Million)

16.2.2.7 Nlp Market, By Vertical

Table 265 Natural Language Processing Market, By Vertical, 2016-2021 (USD Million)

Table 266 Natural Language Processing Market, By Vertical, 2022-2027 (USD Million)

16.2.2.8 Nlp Market, By Region

Table 267 Natural Language Processing Market, By Region, 2016-2021 (USD Million)

Table 268 Natural Language Processing Market, By Region, 2022-2027 (USD Million)

16.3 Artificial Intelligence Market - Global Forecast to 2027

16.3.1 Market Definition

16.3.2 Market Overview

16.3.2.1 Artificial Intelligence Market, By Offering

Table 269 Artificial Intelligence Market, By Offering, 2016-2021 (USD Billion)

Table 270 Artificial Intelligence Market, By Offering, 2022-2027 (USD Billion)

16.3.2.2 Artificial Intelligence Market, By Technology

Table 271 Artificial Intelligence Market, By Technology, 2016-2021 (USD Billion)

Table 272 Artificial Intelligence Market, By Technology, 2022-2027 (USD Billion)

16.3.2.3 Artificial Intelligence Market, By Deployment Mode

Table 273 Artificial Intelligence Market, By Deployment Mode, 2016-2021 (USD Billion)

Table 274 Artificial Intelligence Market, By Deployment Mode, 2022-2027 (USD Billion)

16.3.2.4 Artificial Intelligence Market, By Organization Size

Table 275 Artificial Intelligence Market, By Organization, 2016-2021 (USD Billion)

Table 276 Artificial Intelligence Market, By Organization, 2022-2027 (USD Billion)

16.3.2.5 Artificial Intelligence Market, By Business Function

Table 277 Artificial Intelligence Market, By Business Function, 2016-2021 (USD Billion)

Table 278 Artificial Intelligence Market, By Business Function, 2022-2027 (USD Billion)

16.3.2.6 Artificial Intelligence Market, By Vertical

Table 279 Artificial Intelligence Market, By Vertical, 2016-2021 (USD Billion)

Table 280 Artificial Intelligence Market, By Vertical, 2022-2027 (USD Billion)

16.3.2.7 Artificial Intelligence Market, By Region

Table 281 Artificial Intelligence Market, By Region, 2016-2021 (USD Billion)

Table 282 Artificial Intelligence Market, By Region, 2022-2027 (USD Billion)

17 Appendix

17.1 Discussion Guide

17.2 Knowledgestore: The Subscription Portal

17.3 Customization Options

Companies Mentioned

- Adobe

- AI Data Innovation

- Alegion

- Anolytics

- Appen

- Aws

- Capestart

- Clickworker

- Cloudfactory

- Cogito Tech

- Dataloop

- Datapure

- Datasaur

- Defined AI

- IBM

- Keylabs

- Kili Technology

- Label Box

- Label Your Data

- Lighttag

- Lxt

- Oracle

- Precise Bpo Solution

- Scale AI

- Segments.AI

- Sigma

- Superannotate

- Telus International

- Understand.AI

- V7

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 0.8 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 33.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |