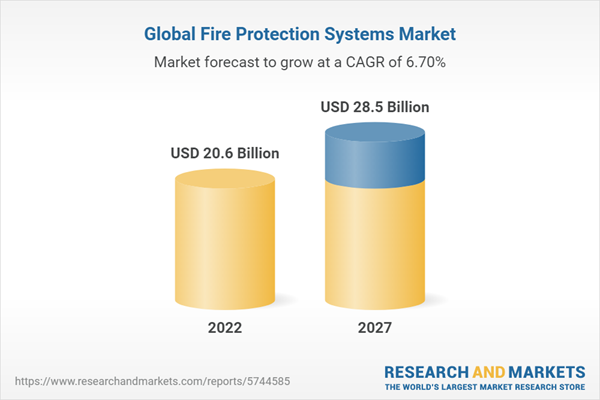

The fire protection system pipes market size is projected to reach USD 28.5 billion by 2027 at a CAGR of 6.7% from USD 20.6 billion in 2022. The steel pipes, by material segment is estimated to account for the largest share of the fire protection system pipes market in 2022.

Welded pipes, by type accounted for the largest segment of fire protection system pipes market

The welded segment accounted for the larger share of the market in 2021. The higher demand for welded pipes is mainly attributed to their lower price when compared to seamless pipes. Asia Pacific is the fastest-growing region for welded pipes in the fire protection system pipes market. The growth of this market is attributed to the rising demand from the domestic market and rapid growth in end-use industries, such as oil & gas, marine, and construction.

Steel pipes, by material accounted for the largest segment of fire protection system pipes market

The steel pipes segment accounted a largest share in the fire protection system pipes market and thus dominated the market. Steel pipes have high demand from the chemical, oil & gas, petrochemical, automotive, and mechanical & engineering industries, owing to which these tubes account for a higher market share. The increasing demand from the commercial vertical is expected to drive the segment. Asia Pacific is the fastest-growing market for steel pipes. The growth is attributed to the high demand for steel in the region and relatively lower prices than in other regions. The rapidly increasing demand from maintenance applications, especially in China and South Korea, further increases the demand for steel pipes.

Fire sprinkler system, by application accounted for the largest segment of fire protection system pipes market

Based on application, the fire sprinkler system segment is expected to account for the larger share of the market during the forecast period. The fire sprinkler system segment market size was USD XX million in 2021 and is projected to reach USD XX million by 2027, at a CAGR of XX%, in terms of value, between 2022 and 2027. Rise in commercial buildings, smart buildings, and industries is boosting the demand of fire sprinkler system and hence driving the fire protection system pipes market. The wet fire sprinklers segment is expected to account for the largest share of the fire sprinklers market during the forecast period. This large share can be attributed to the growth of the industrial sector, where the probability of a fire disaster is more due to the presence of flammable materials, such as oil and gas.

Industrial, by end-use industry accounted for the largest segment of fire protection system pipes market

Based on end-use industry, the industrial segment is expected to account for the largest share of the market during the forecast period. Fire breakouts in offshore oil platforms, oil pumping stations, refineries, gasoline storage tanks, compressor stations, gas processing plants, and liquefied natural gas receiving facilities could become unmanageable due to harsh environments and remote locations. Thus, the industrial segment has a high demand for the installation of these systems in the oil & gas sector to prevent such fire breakouts

North America, by region is forecasted to be the largest segment of fire protection system pipes market during the forecast period

North America has been leading the fire protection systems pipes market due to a rise in strategic collaboration and innovation among market participants and demand from various end-use industries such as residential, commercial, and industrial. The US is expected to account for the largest share of the fire protection system pipes market in North America during the forecast period. Supportive government regulations, the adoption of advanced fire protection technologies, and a rise in concerns related to fire protection are driving the market. The US government has laid down certain norms for building fire protection systems, which real estate developers and construction companies must follow. This factor is propelling the fire protection system pipes market in the US.

Breakdown of Primary Interviews:

• By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

• By Designation: C Level - 27%, D Level - 10%, and Others -55%

• By Region: Asia Pacific - 55%, North America - 18%, Europe - 9%, South America- 9%, and the Middle East & Africa - 9%

The key companies profiled in this report are Johnson Controls (Ireland), Tata Steel (India), Simona AG (Germany), Astral Pipes (India), China Lesso (China).

Research Coverage:

The fire protection system pipes market has been segmented based on by Type (Seamless Pipes, Welded Pipes), By Material (Steel, CPVC, Copper, Others), By Application (Fire Suppression System, Fire Sprinkler System), By End-use Industry (Residential, Industrial, Commercial), and by Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on fire protection system pipes offered by top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for epoxy adhesives across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Market Inclusions

1.2.2 Market Exclusions

1.3 Market Segmentation

1.3.1 Regions Covered

1.4 Years Considered

1.5 Currency Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Research Design

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.2.4 Primary Data Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

Figure 2 Market Size Estimation: Bottom-Up Approach

2.2.2 Top-Down Approach

Figure 3 Market Size Estimation: Top-Down Approach

2.3 Factor Analysis

Figure 4 Major Factors Responsible for Global Recession

2.4 Data Triangulation

Figure 5 Fire Protection System Pipes Market: Data Triangulation

2.5 Assumptions & Limitations

Table 1 Research Assumptions

Table 2 Research Limitations

Table 3 Risk Analysis

3 Executive Summary

Table 4 Fire Protection System Pipes Market Snapshot, 2021 Vs. 2027

Figure 6 Welded Pipes to be Larger Segment Type of Fire Protection System Pipes Market, 2022-2027

Figure 7 Steel Pipes Segment to Dominate Global Fire Protection System Pipes Market During Forecast Period

Figure 8 Fire Sprinkler System Pipes to Dominate Global Fire Protection System Pipes Market During Forecast Period

Figure 9 Industrial End-Use Industry Segment to Dominate Global Fire Protection System Pipes Market During Forecast Period

Figure 10 North America Accounted for Largest Share of Fire Protection System Pipes Market in 2021

4 Premium Insights

4.1 Attractive Opportunities for Players in Fire Protection System Pipes Market

Figure 11 Asia-Pacific to Drive Fire Protection System Pipes Market

4.2 Fire Protection System Pipes Market, by Type

Figure 12 Welded Pipes to be Larger Type Segment of Fire Protection System Pipes Market During Forecast Period

4.3 Fire Protection System Pipes Market, by End-Use Industry

Figure 13 Industrial Segment to Dominate Market in 2027

4.4 Fire Protection System Pipes Market, by Commercial End-Use Industry

Figure 14 Healthcare Segment to Account for Largest Share in 2027

4.5 Fire Protection System Pipes Market, by Industrial End-Use Industry

Figure 15 Oil & Gas and Mining Segment to Account for Largest Share in 2027

4.6 Fire Protection System Pipes Market in North America, by End-Use Industry and Country

Figure 16 Industrial Segment and Us Accounted for Largest Market Shares in North America in 2021

4.7 Fire Protection System Pipes Market, by Key Country

Figure 17 Market in China to Grow at Highest CAGR During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 18 Drivers, Restraints, Opportunities, and Challenges in Fire Protection System Pipes Market

5.2.1 Drivers

5.2.1.1 Increasing Urbanization and Infrastructure Development

5.2.1.2 Rising Number of Fire Incidents

5.2.1.3 Strict Government Regulations Pertaining to Fire Protection

5.2.1.4 Growing Adoption of Wireless Technology in Fire Detection Systems

5.2.1.5 Technological Advancements and Innovations in Construction Industry

5.2.2 Restraints

5.2.2.1 High Installation and Maintenance Costs

5.2.2.2 Issues of False Alarms and Detection Failures

5.2.2.3 High Cost of Smart Detectors

5.2.3 Opportunities

5.2.3.1 Periodic Revision of Regulatory Compliance to Increase Fire Safety

5.2.4 Challenges

5.2.4.1 Lack of Integration and Configuration in Fire Protection Solutions

5.2.4.2 Design and Maintenance of Fire Sprinklers

5.3 Value Chain Overview

Figure 19 Fire Protection System Pipes Market: Value Chain Analysis

5.3.1 Research & Development

5.3.2 Raw Material

5.3.2.1 Steel

5.3.2.2 Cpvc

5.3.2.3 Copper

5.3.3 Manufacturing Process

5.3.3.1 Seamless Pipe

5.3.3.2 Welded Pipe

5.3.4 End-Use Industries

5.3.4.1 Residential

5.3.4.2 Commercial

5.3.4.3 Industrial

5.4 Porter's Five Forces Analysis

Figure 20 Porter's Five Forces Analysis

Table 5 Fire Protection System Pipes Market: Porter's Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Key Stakeholders & Buying Criteria

5.5.1 Key Stakeholders in Buying Process

Figure 21 Influence of Stakeholders on Buying Process

Table 6 Influence of Stakeholders on Buying Process for Top Industries (%)

5.5.2 Buying Criteria

Figure 22 Key Buying Criteria for Fire Protection System Pipes

Table 7 Key Buying Criteria for Fire Protection System Pipes

5.6 Macroeconomic Indicators

5.6.1 Introduction

5.6.2 Gdp Trends and Forecast

Table 8 Gdp Trends and Forecast, Percentage Change

5.6.3 Trends and Forecast of Global Construction Industry

Figure 23 Global Spending in Construction Industry, 2014-2035

5.7 Supply Chain Crisis Since COVID-19 Pandemic

5.8 Global Scenarios

5.8.1 China

5.8.1.1 China's Debt Problem

5.8.1.2 Australia-China Trade War

5.8.1.3 Environmental Commitments

5.8.2 Europe

5.8.2.1 Political Instability in Germany

5.8.2.2 Energy Crisis in Europe

5.9 Ecosystem Analysis

Figure 24 Fire Protection System Pipes Market: Ecosystem Analysis

Table 9 Fire Protection System Pipes Market: Supply Chain Ecosystem

5.10 Trends/Disruptions Impacting Customer Business

Figure 25 Trends in End-Use Industries Impacting Strategies of Manufacturers of Fire Protection Systems

5.11 Technology Analysis

5.11.1 Internet of Things (Iot)

5.12 Case Study Analysis

5.12.1 Saracen Fire Protection Limited Provided Fire System for Food Processing Plants in England

5.13 Global Regulatory Framework and Its Impact on Market

Table 10 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 11 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Rest of the World: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.13.1 Standards

Table 14 Codes and Standards Related to Fire Detection

Table 15 Codes and Standards Related to Fire Suppression

5.14 Key Conferences & Events in 2023-2024

Table 16 Fire Protection System Pipes Market: Detailed List of Conferences & Events

6 Fire Protection System Pipes Market, by Type

6.1 Introduction

Figure 26 Welded Pipes to Dominate Fire Protection System Pipes Market

Table 17 Fire Protection System Pipes Market Size, by Type, 2020-2027 (USD Million)

6.2 Seamless

6.2.1 High Strength and Pressure Handling Capacity to Boost Demand

6.3 Seamless Pipes

Table 18 Characteristics of Seamless Fire Protection System Pipes

Table 19 Seamless: Fire Protection System Pipes Market Size, by Region, 2020-2027 (USD Million)

6.4 Welded Pipes

6.4.1 Longitudinal Seam and Spiral Weld to Drive Market

Table 20 Properties of Welded Fire Protection System Pipes

Table 21 Welded: Fire Protection System Pipes Market Size, by Region, 2020-2027 (USD Million)

7 Fire Protection System Pipes Market, by Material

7.1 Introduction

Figure 27 Steel Segment to Dominate Fire Protection System Pipes Market in 2027

Table 22 Fire Protection System Pipes Market, by Material, 2020-2027 (USD Million)

7.2 Steel

7.2.1 Superior Rigidity and High-Pressure Handling Capacity of Steel to Increase Demand

Table 23 Characteristics of Steel Fire Protection System Pipes

7.3 Carbon Steel

7.3.1 Residential and Commercial Sectors to Increase Demand for Pipes Made from Carbon Steel

7.4 Stainless Steel

7.4.1 Excellent Chemical and Corrosion Resistance of Steel Pipes to Drive Demand

7.5 Alloy Steel

7.5.1 Excellent Properties of Alloy Steel to Drive Demand

Table 24 Steel: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

7.6 Cpvc

7.6.1 Cpvc Pipes in Light Hazardous Occupancies to Boost Demand

Table 25 Characteristics of Cpvc Fire Protection System Pipes

Table 26 Cpvc: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

7.7 Copper

7.7.1 High Rigidity and Lightweight Properties to Increase Demand for Cooper Pipes

Table 27 Characteristics of Copper Fire Protection System Pipes

Table 28 Copper: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

7.7.2 Others

Table 29 Others: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

8 Fire Protection System Pipes Market, by Application

8.1 Introduction

Figure 28 Fire Sprinkler System Application to Dominate Market

Table 30 Fire Protection System Pipes Market, by Application, 2020-2027 (USD Million)

8.2 Fire Suppression System

8.2.1 Different Fire Suppressor Materials Used Based on Fire Type

8.2.2 Fire Suppression Reagents

8.2.2.1 Chemical Fire Suppression Reagents

8.2.2.1.1 Dry Chemical System

8.2.2.1.2 Wet Chemical System

8.2.2.2 Gaseous System

8.2.2.2.1 Clean Agent Fire Suppression System

8.2.2.2.2 Carbon Dioxide (Co2) Clean Agent Fire Suppression System

8.2.2.2.3 Fm-200 Clean Agent Fire Suppression System

8.2.2.2.4 Other Clean Agent Fire Suppression Systems

8.2.2.3 Water System

8.2.2.4 Foam System

Table 31 Fire Protection System Pipes Market in Fire Suppression System, by Region 2020-2027 (USD Million)

8.3 Fire Sprinkler System

8.3.1 Rise in Commercial Buildings, Smart Buildings, and Industries to Boost Demand

Table 32 Characteristics of Fire Sprinkler System

8.3.2 Wet Fire Sprinkler System

Table 33 Advantages and Disadvantages of Wet Fire Sprinkler Systems

8.3.3 Dry Fire Sprinkler System

Table 34 Advantages and Disadvantages of Dry Fire Sprinkler Systems

8.3.4 Pre-Action Fire Sprinkler System

Table 35 Advantages and Disadvantages of Pre-Action Fire Sprinkler Systems

8.3.5 Deluge Fire Sprinkler System

Table 36 Advantages of Deluge Fire Sprinkler System

8.3.6 Other Sprinkler Systems

Table 37 Fire Protection System Pipes Market in Fire Sprinkler System, by Region, 2020-2027 (USD Million)

9 Fire Protection System Pipes Market, by End-Use Industry

9.1 Introduction

Figure 29 Industrial Fire Protection System Pipes to Lead Market Between 2022 and 2027

Table 38 Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

9.2 Residential

9.2.1 Stringent Regulations for Residential Applications to Drive Market

Table 39 Residential: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

9.3 Commercial

9.3.1 Growing Concerns Over Fire Hazards to Drive Market

Table 40 Commercial: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

9.3.2 Educational Institutes

9.3.2.1 Water-Based Fire Sprinkler Systems Used in Educational Institutes to Drive Market

Table 41 Commercial: Fire Protection System Pipes Market for Educational Institutes, by Region, 2020-2027 (USD Million)

9.3.3 Office Buildings

9.3.3.1 Growing Urbanization to Support Market Growth

Table 42 Commercial: Fire Protection System Pipes Market for Office Buildings, by Region, 2020-2027 (USD Million)

9.3.4 Healthcare

9.3.4.1 Growing Need for Enhanced Safety of Patients to Boost Demand

Table 43 Commercial: Fire Protection System Pipes Market for Healthcare, by Region, 2020-2027 (USD Million)

9.3.5 Hospitality

9.3.5.1 Growing Use of Water-Based Fire Protection Systems in Hotels to Drive Market

Table 44 Commercial: Fire Protection System Pipes Market for Hospitality, by Region, 2020-2027 (USD Million)

9.3.6 Others

Table 45 Commercial: Fire Protection System Pipes Market for Other Industries, by Region, 2020-2027 (USD Million)

9.4 Industrial

9.4.1 Oil& Gas and Mining and Energy & Power to Support Market

Table 46 Industrial: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

9.4.2 Energy & Power

9.4.2.1 High Demand for Fire Protection Systems for Safety of Workforce and Properties to Drive Market

Table 47 Industrial: Fire Protection System Pipes Market for Energy & Power, by Region, 2020-2027 (USD Million)

9.4.3 Government

9.4.3.1 Extensive Use of Gaseous and Water Mist Sprinklers in Public Facilities to Drive Market

Table 48 Industrial: Fire Protection System Pipes Market for Government, by Region, 2020-2027 (USD Million)

9.4.4 Manufacturing

9.4.4.1 Evolving Regulations to Drive Market

Table 49 Industrial: Fire Protection System Pipes Market for Manufacturing, by Region, 2020-2027 (USD Million)

9.4.5 Oil & Gas and Mining

9.4.5.1 High Use of Gas-Based Suppression Systems and Sprinkler Systems to Increase Demand

Table 50 Industrial: Fire Protection System Pipes Market for Oil & Gas and Mining, by Region, 2020-2027 (USD Million)

9.4.6 Transportation & Logistics

9.4.6.1 Increasing Demand for Swift and Competent Response to Fire Incidents to Augment Market Growth

Table 51 Industrial: Fire Protection System Pipes Market for Transportation & Logistics, by Region, 2020-2027 (USD Million)

9.4.7 Others

Table 52 Industrial: Fire Protection System Pipes Market for Other End-Use Industries, by Region, 2020-2027 (USD Million)

10 Fire Protection System Pipes Market, by Region

10.1 Introduction

Figure 30 Asia-Pacific to be Fastest-Growing Fire Protection System Pipes Market

Table 53 Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

10.2 North America

Figure 31 North America: Fire Protection System Pipes Market Snapshot

Table 54 North America: Fire Protection System Pipes Market, by Country, 2020-2027 (USD Million)

Table 55 North America: Fire Protection System Pipes Market, by Type, 2020-2027 (USD Million)

Table 56 North America: Fire Protection System Pipes Market, by Material, 2020-2027 (USD Million)

Table 57 North America: Fire Protection System Pipes Market, by Application, 2020-2027 (USD Million)

Table 58 North America: Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 59 North America: Commercial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 60 North America: Industrial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

10.2.1 US

10.2.1.1 Rising Awareness About Benefits of Fire Protection Systems

10.2.2 Canada

10.2.2.1 Growing Adoption of Advanced Fire Protection Systems in New Constructions

10.2.3 Mexico

10.2.3.1 Investments in Infrastructure Development

10.3 Europe

Figure 32 Europe: Fire Protection System Pipes Market Snapshot

Table 61 Europe: Fire Protection System Pipes Market, by Country, 2020-2027 (USD Million)

Table 62 Europe: Fire Protection System Pipes Market, by Type, 2020-2027 (USD Million)

Table 63 Europe: Fire Protection System Pipes Market, by Material, 2020-2027 (USD Million)

Table 64 Europe: Fire Protection System Pipes Market, by Application, 2020-2027 (USD Million)

Table 65 Europe: Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 66 Europe: Commercial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 67 Europe: Industrial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

10.3.1 Germany

10.3.1.1 End-Use Industries to Drive Demand

10.3.2 UK

10.3.2.1 Government Regulations to Boost Demand

10.3.3 France

10.3.3.1 Stringent Fire Safety Regulations to Drive Market

10.3.4 Rest of Europe

10.4 Asia-Pacific

Figure 33 Asia-Pacific: Fire Protection System Pipes Market Snapshot

Table 68 Asia-Pacific: Fire Protection System Pipes Market, by Country, 2020-2027 (USD Million)

Table 69 Asia-Pacific: Fire Protection System Pipes Market, by Type, 2020-2027 (USD Million)

Table 70 Asia-Pacific: Fire Protection System Pipes Market, by Material, 2020-2027 (USD Million)

Table 71 Asia-Pacific: Fire Protection System Pipes Market, by Application, 2020-2027 (USD Million)

Table 72 Asia-Pacific: Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 73 Asia-Pacific: Commercial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 74 Asia-Pacific: Industrial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

10.4.1 China

10.4.1.1 Mandatory Installation of Fire Protection Systems to Increase Demand

10.4.2 Japan

10.4.2.1 Rising Public Awareness About Fire Safety to Increase Demand

10.4.3 South Korea

10.4.3.1 Government Regulations on Fire Safety to Drive Market

10.4.4 Rest of Asia-Pacific

10.5 South America

Figure 34 Brazil to Witness Significant Growth During Forecast Period

Table 75 South America: Fire Protection System Pipes Market, by Country, 2020-2027 (USD Million)

Table 76 South America: Fire Protection System Pipes Market, by Type, 2020-2027 (USD Million)

Table 77 South America: Fire Protection System Pipes Market, by Material, 2020-2027 (USD Million)

Table 78 South America: Fire Protection System Pipes Market, by Application, 2020-2027 (USD Million)

Table 79 South America: Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 80 South America: Commercial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 81 South America: Industrial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

10.5.1 Brazil

10.5.1.1 Public Safety Regulations to Support Market

10.5.2 Argentina

10.5.2.1 Mining Segment to Continue Driving Market

10.5.3 Rest of South America

10.6 Middle East & Africa

Figure 35 Middle East to Dominate Region

Table 82 Middle East & Africa: Fire Protection System Pipes Market, by Region, 2020-2027 (USD Million)

Table 83 Middle East & Africa: Fire Protection System Pipes Market, by Type, 2020-2027 (USD Million)

Table 84 Middle East & Africa: Fire Protection System Pipes Market, by Material, 2020-2027 (USD Million)

Table 85 Middle East & Africa: Fire Protection System Pipes Market, by Application, 2020-2027 (USD Million)

Table 86 Middle East & Africa: Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 87 Middle East & Africa: Commercial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

Table 88 Middle East & Africa: Industrial Fire Protection System Pipes Market, by End-Use Industry, 2020-2027 (USD Million)

10.6.1 Middle East

10.6.1.1 High Demand from Oil & Gas Industry to Drive Market

10.6.2 Africa

10.6.2.1 Growing Urbanization to Support Market Growth

11 Competitive Landscape

11.1 Overview

Table 89 Overview of Strategies Adopted by Key Fire Protection System Pipes Players (2018-2022)

11.2 Market Share Analysis

Figure 36 Market Share Analysis of Key Players, 2021

Table 90 Fire Protection System Pipes Market: Intensity of Competitive Rivalry

11.2.1 Market Ranking Analysis

Figure 37 Ranking of Key Players, 2021

11.2.2 Tata Steel

11.2.3 Johnson Controls

11.2.4 Jindal Industries Pvt. Ltd.

11.2.5 Simona Ag

11.2.6 Astral Ltd.

11.3 Company Revenue Analysis

Figure 38 Revenue Analysis for Key Companies, 2018-2022

11.4 Company Evaluation Quadrant Matrix, 2021

11.4.1 Stars

11.4.2 Emerging Leaders

11.4.3 Pervasive Players

11.4.4 Participants

Figure 39 Fire Protection System Pipes Market: Company Evaluation Quadrant Matrix, 2021

11.5 Small & Medium-Sized Enterprises (Smes) Matrix, 2021

11.5.1 Progressive Companies

11.5.2 Dynamic Companies

11.5.3 Starting Blocks

11.5.4 Responsive Companies

Figure 40 Fire Protection System Pipes Market: Smes Matrix, 2021

11.6 Strength of Product Portfolio

Figure 41 Product Portfolio Analysis of Top Players in Fire Protection System Pipes Market

11.7 Competitive Benchmarking

Table 91 Fire Protection System Pipes Market: Detailed List of Key Startups/Smes

11.7.1 Market Evaluation Framework

Table 92 Strategic Developments, by Company

Table 93 Highest Adopted Strategies

Table 94 Number of Growth Strategies Adopted, by Key Company

11.7.2 Market Evaluation Matrix

Table 95 Company Industry Footprint

Table 96 Company Regional Footprint

Table 97 Company Footprint

11.8 Competitive Situation & Trends

Table 98 Fire Protection System Pipes Market: Deals, 2018-2022

12 Company Profiles

(Business Overview, Products Offered, Recent Developments, Analyst's View)*

12.1 Key Players

12.1.1 Johnson Controls

Table 99 Johnson Controls: Business Overview

Figure 42 Johnson Controls: Company Snapshot

12.1.2 Tata Steel

Table 100 Tata Steel: Business Overview

Figure 43 Tata Steel: Company Snapshot

12.1.3 Simona Ag

Table 101 Simona Ag: Business Overview

Figure 44 Simona Ag: Company Snapshot

12.1.4 Astral Ltd.

Table 102 Astral Ltd.: Business Overview

Figure 45 Astral Ltd.: Company Snapshot

12.1.5 China Lesso

Table 103 China Lesso: Business Overview

Figure 46 China Lesso: Company Snapshot

12.1.6 Octal Steel

Table 104 Octal Steel: Business Overview

12.1.7 Jindal Industries Pvt. Ltd.

Table 105 Jindal Industries Pvt. Ltd.: Business Overview

12.1.8 Aquatherm

Table 106 Aquatherm: Business Overview

12.1.9 Zekelman Industries

Table 107 Zekelman Industries: Business Overview

12.1.10 Tpmcsteel

12.1.11 Federal Steel Supply

Table 108 Federal Steel Supply Se: Business Overview

12.2 Other Players

12.2.1 Weifang East Steel Pipe

Table 109 Weifang East Steel Pipe: Business Overview

12.2.2 Triangle Fire Systems

Table 110 Triangle Fire Systems: Business Overview

12.2.3 Borusan Mannesmann

Table 111 Borusan Mannesmann: Business Overview

12.2.4 Jakob Eschbach

Table 112 Jakob Eschbach: Business Overview

12.2.5 Zinchitalia Spa

Table 113 Zinchitalia Spa: Business Overview

12.2.6 Rawhide Fire Hose LLC

Table 114 Rawhide Fire Hose LLC: Business Overview

12.2.7 Bull Moose Tube Company

Table 115 Bull Moose Tube Company: Business Overview

12.2.8 Newage Fire Protection Industries Pvt. Ltd.

Table 116 Newage Fire Protection Industries Pvt. Ltd.: Business Overview

12.2.9 Mercedes Textiles

Table 117 Mercedes Textiles: Business Overview

12.2.10 Guardian Fire Equipment Inc.

Table 118 Guardian Fire Equipment, Inc.: Business Overview

12.2.11 Kan-Therm GmbH

Table 119 Kan-Therm GmbH: Business Overview

12.2.12 Minimax

Table 120 Minimax: Business Overview

12.2.13 Engineered Fire Piping

Table 121 Engineered Fire Piping: Business Overview

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View Might Not be Captured in Case of Unlisted Companies.

13 Appendix

13.1 Discussion Guide

13.2 Knowledgestore: The Subscription Portal

13.3 Customization Options

Companies Mentioned

- Aquatherm

- Astral Ltd.

- Borusan Mannesmann

- Bull Moose Tube Company

- China Lesso

- Engineered Fire Piping

- Federal Steel Supply

- Guardian Fire Equipment Inc.

- Jakob Eschbach

- Jindal Industries Pvt. Ltd.

- Johnson Controls

- Kan-Therm GmbH

- Mercedes Textiles

- Minimax

- Newage Fire Protection Industries Pvt. Ltd.

- Octal Steel

- Rawhide Fire Hose LLC

- Simona Ag

- Tata Steel

- Tpmcsteel

- Triangle Fire Systems

- Weifang East Steel Pipe

- Zekelman Industries

- Zinchitalia Spa

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 202 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 20.6 Billion |

| Forecasted Market Value ( USD | $ 28.5 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |