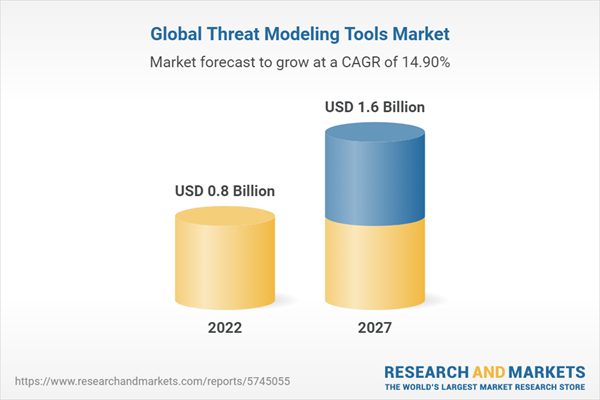

The global threat modeling tools market is expected to grow from an estimated USD 0.8 billion in 2022 to USD 1.6 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 14.9% from 2022 to 2027.

The increasing adoption of threat modeling tools is possible due to the adherence to strict regulatory compliances and the widespread availability of customizable threat modeling tools. However, limited budget, integration complexities with existing systems, and high cost associated with the installation of the threat modeling tools are expected to hinder the market growth.

By component, the solutions segment is expected to account for a larger market size during the forecast period.

Threat modeling tools are software solutions that automate the process of identifying and assessing potential threats to a system or organization. They include features such as templates for creating threat models, methods for identifying and categorizing threats, methods for evaluating the likelihood and impact of threats, and reporting and visualization capabilities. These tools can be used by security professionals, developers, and other stakeholders to identify and prioritize potential security issues and make more informed decisions about how to mitigate or respond to them. Examples of threat modeling tools include Microsoft Threat Modeling Tool, IriusRisk, and Trivy.

By vertical, healthcare to grow at a higher CAGR during the forecast period.

In the healthcare industry, sensitive information needs to be protected. These include patient medical records, personal identification information, and financial information. This makes healthcare organizations a prime target for cyber-attacks. Threat modeling tools help healthcare organizations identify potential threats to their systems and networks and determine the risk posed by those threats. An example of a threat modeling tool that is commonly used in the healthcare sector is Anomali ThreatStream. This tool allows healthcare organizations to detect and respond to cyber threats in real-time by aggregating and analyzing threat data from multiple sources, such as open-source intelligence, commercial threat intelligence, and internal systems. This tool can also integrate with other security tools and systems, such as SIEM and vulnerability management software, to provide a more comprehensive view of an organization's security posture. For example, Anomali ThreatStream allows organizations to prioritize their security efforts by identifying the most critical assets and the most likely attack scenarios. Based on this information, the tool can provide recommendations for mitigating potential threats, such as implementing specific security controls or strengthening existing ones. Additionally, the tool can be used to perform incident response and forensic investigations and to identify and track the activities of APT groups, criminal organizations, and state-sponsored actors.

By organization size, large enterprises account for a significant market size during the forecast period.

Large organizations are adopting threat modeling tools to bolster their cybersecurity defenses and ensure compliance with industry regulations. These tools enable organizations to proactively identify and analyze potential security risks and vulnerabilities in their systems, applications, and networks, and implement appropriate measures to mitigate or prevent them. By providing real-time threat intelligence, streamlining security workflows, and integrating with other security tools, these solutions enhance the organization's overall security posture and readiness to combat cyber threats. An example of a threat modeling tool that is commonly used in large enterprises is the Preempt Threat Modeling Tool. This tool is designed to help organizations identify and prioritize potential security threats and vulnerabilities in their systems, applications, and networks. It is an automated threat modeling tool that can be used to identify and evaluate potential attack scenarios and to prioritize mitigation efforts. It also guides how to mitigate or prevent identified security risks and vulnerabilities, making it accessible for organizations with limited resources. Additionally, it integrates with other security tools, such as SIEM and vulnerability management software, to provide a more comprehensive view of an organization's security posture.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the threat modeling tools market.

- By company type: Tier 1: 40%, Tier 2: 35%, and Tier 3: 25%

- By designation: C-level: 45% and Managerial: 30% and other levels:25%

- By region: North America: 35%, Asia Pacific: 30%, and Europe: 35%

Major vendors in the global threat modeling tools market Cisco (US), IBM (US), Synopsys (US), Intel (US), Microsoft (US), Varonis Systems (US), Sparx Systems (Australia), Kroll (US), Mandiant (US), Coalfire (US), Securonix (US), Security Compass (Canada), IriusRisk (Spain), Kenna Security (US), ThreatModeler (US), Toreon (Belgium), Foreseeti (Sweden), Tutamantic (UK), Cymune (India), Avocado Systems (US), Secura (Netherlands), qSEAp (India), VerSprite (Georgia) and IMQ Minded Security (Italy).

The study includes an in-depth competitive analysis of the key players in the threat modeling tools market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the threat modeling tools market and forecasts its size by component, platform, organization size, vertical, and region.

Key Benefits of Buying the Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall threat modeling tools market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered

1.5 Currency Considered

Table 1 USD Exchange Rates, 2018-2023

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Threat Modeling Tools Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Interviews

2.1.2.2 Key Industry Insights

2.2 Data Triangulation

Figure 2 Market: Research Flow

2.3 Market Size Estimation

Figure 3 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue from Solutions/Services of Threat Modeling Tool Vendors

Figure 4 Market Size Estimation Methodology - Approach 2, Top-Down Approach: Demand-Side Analysis

2.4 Market Forecast

Table 2 Factor Analysis

2.5 Recession Impact

Table 3 Recession Impact

2.6 Research Assumptions

Table 4 Research Assumptions

2.7 Limitations and Risk Assessment

Figure 5 Limitations and Risk Assessment

3 Executive Summary

Table 5 Threat Modeling Tools Market and Growth Rate, 2018-2021 (USD Million, Y-O-Y %)

Table 6 Market and Growth Rate, 2022-2027 (USD Million, Y-O-Y %)

Figure 6 Market Size and Y-O-Y Growth Rate, 2021-2027

Figure 7 North America to Account for Largest Share in 2022

4 Premium Insights

4.1 Attractive Opportunities for Players in the Threat Modeling Tools Market

Figure 8 Rising Instances of Cyberattacks and Growing Adoption of IoT and Cloud Trends

4.2 Market, by Component

Figure 9 Solutions Segment to Account for Larger Share During Forecast Period

4.3 Market, by Organization Size

Figure 10 Large Enterprises Segment to Account for Larger Share in 2022

4.4 Market, by Platform

Figure 11 Web-Based Segment to Account for Largest Share in 2022

4.5 Market, by Key Verticals and Regions

Figure 12 North America and It & Ites Segment to Account for Significant Share in 2022

4.6 Market: Investment Scenario, by Region

Figure 13 Asia-Pacific to Emerge as Best Market for Investments in Next Five Years

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

Figure 14 Threat Modeling Tools Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Growing Demand for User-Friendly Threat Modeling Tools

5.2.1.2 Rising Need for Effective Reporting and Visualization

5.2.1.3 Increasing Adoption of Customized Modeling Tools

5.2.2 Restraints

5.2.2.1 Integration Issues and Compatibility Limitations in Cloud Environment

5.2.2.2 Rising Complexities

5.2.2.3 High Costs

5.2.3 Opportunities

5.2.3.1 Rising Cyber Threats

5.2.3.2 Widespread Adoption of Cloud and IoT

5.2.3.3 Government Initiatives to Create Range of Opportunities for Vendors

5.2.4 Challenges

5.2.4.1 Data Privacy Concerns

5.2.4.2 Lack of In-House Expertise

5.3 Ecosystem Analysis

Figure 15 Ecosystem Analysis

5.4 Technology Analysis

5.4.1 Ai/Ml

5.4.2 Big Data Analytics

5.4.3 Iot

5.4.4 Cloud Computing

5.5 Regulatory Implications

5.5.1 Payment Card Industry Data Security Standard (Pci-Dss)

5.5.2 Health Insurance Portability and Accountability Act (Hipaa)

5.5.3 Federal Information Security Management Act (Fisma)

5.5.4 Gramm-Leach-Bliley Act (Glba)

5.5.5 Sarbanes-Oxley Act (Sox)

5.5.6 International Organization for Standardization (Iso) 27001

5.5.7 European Union General Data Protection Regulation (Eu Gdpr)

5.5.8 California's Privacy Rights Act (Cpra)

5.5.9 Regulatory Bodies, Government Agencies, and Other Organizations

Table 7 List of Regulatory Bodies, Government Agencies, and Other Organizations

5.6 Patent Analysis

Figure 16 Patent Analysis

5.7 Value Chain Analysis

Figure 17 Value Chain Analysis

5.8 Porter's Five Forces Analysis

Figure 18 Porter's Five Forces Analysis

Table 8 Impact of Porter's Five Forces on Threat Modeling Tools Market

5.8.1 Threat from New Entrants

5.8.2 Threat from Substitutes

5.8.3 Bargaining Power of Suppliers

5.8.4 Bargaining Power of Buyers

5.8.5 Intensity of Competitive Rivalry

5.9 Use Cases

5.9.1 Use Case 1: Iriusrisk Strengthened Axway's Threat Modeling Tool Offerings

5.9.2 Use Case 2: Security Compass Established Threat Modeling Framework Using Sd Elements

5.9.3 Use Case 3: Secura Helped Amphia Ziekenhuis Tackle Cyberattacks

5.9.4 Use Case 4: Mandiant Helped Aaa Formulate Effective Cybersecurity Strategy

5.10 Pricing Analysis

5.11 Trends and Disruptions Impacting Customers

Figure 19 Trends and Disruptions Impacting Customers

5.12 Key Stakeholders and Buying Criteria

5.12.1 Key Stakeholders in Buying Process

Figure 20 Influence of Stakeholders on Buying Process

Table 9 Influence of Stakeholders on Buying Process (%)

5.13 Key Conferences & Events, 2022-2023

Table 10 Key Conferences & Events, 2022-2023

6 Threat Modeling Tools Market, by Component

6.1 Introduction

6.1.1 Components: Market Drivers

Figure 21 Services Segment to Register Higher Growth During Forecast Period

Table 11 Market, by Component, 2018-2021 (USD Million)

Table 12 Market, by Component, 2022-2027 (USD Million)

6.1.2 Solutions

6.1.2.1 Rising Need to Identify Potential Threats

Table 13 Solutions: Market, by Region, 2018-2021 (USD Million)

Table 14 Solutions: Market, by Region, 2022-2027 (USD Million)

6.1.3 Services

6.1.3.1 Growing Concerns Regarding Protection of Critical Data

Table 15 Services: Market, by Region, 2018-2021 (USD Million)

Table 16 Services: Market, by Region, 2022-2027 (USD Million)

7 Threat Modeling Tools Market, by Platform

7.1 Introduction

7.1.1 Platforms: Market Drivers

Figure 22 Cloud-Based Segment to Register Highest Growth During Forecast Period

Table 17 Market, by Platform, 2018-2021 (USD Million)

Table 18 Market, by Platform, 2022-2027 (USD Million)

7.1.2 Web-Based

7.1.2.1 Increasing Need to Access Threat Modeling Data from Multiple Locations

Table 19 Web-Based: Market, by Region, 2018-2021 (USD Million)

Table 20 Web-Based: Market, by Region, 2022-2027 (USD Million)

7.1.3 Desktop-Based

7.1.3.1 Rising Demand to Control Internal Data and Associated Processes

Table 21 Desktop-Based: Market, by Region, 2018-2021 (USD Million)

Table 22 Desktop-Based: Market, by Region, 2022-2027 (USD Million)

7.1.4 Cloud-Based

7.1.4.1 Growing Need to Conduct Threat Modeling Remotely

Table 23 Cloud-Based: Market, by Region, 2018-2021 (USD Million)

Table 24 Cloud-Based: Market, by Region, 2022-2027 (USD Million)

8 Threat Modeling Tools Market, by Organization Size

8.1 Introduction

8.1.1 Organization Sizes: Market Drivers

Figure 23 Large Enterprises Segment to Dominate Market During Forecast Period

Table 25 Market, by Organization Size, 2018-2021 (USD Million)

Table 26 Market, by Organization Size, 2022-2027 (USD Million)

8.2 Large Enterprises

8.2.1 Surge in Demand for Real-Time Insights

Table 27 Large Enterprises: Market, by Region, 2018-2021 (USD Million)

Table 28 Large Enterprises: Market, by Region, 2022-2027 (USD Million)

8.3 Small & Medium-Sized Enterprises

8.3.1 Growing Automation of Security Workflows

Table 29 Smes: Market, by Region, 2018-2021 (USD Million)

Table 30 Smes: Market, by Region, 2022-2027 (USD Million)

9 Threat Modeling Tools Market, by Vertical

9.1 Introduction

9.1.1 Verticals: Market Drivers

Figure 24 It & Ites Segment to Lead Market in 2022

Table 31 Market, by Vertical, 2018-2021 (USD Million)

Table 32 Market, by Vertical, 2022-2027 (USD Million)

9.2 Banking, Financial Services, and Insurance (Bfsi)

9.2.1 Need for Technological Advancements to Safeguard Sensitive Financial Information

Table 33 Bfsi: Market, by Region, 2018-2021 (USD Million)

Table 34 Bfsi: Market, by Region, 2022-2027 (USD Million)

9.3 Healthcare

9.3.1 Growing Instances of Medical Record Breach

Table 35 Healthcare: Market, by Region, 2018-2021 (USD Million)

Table 36 Healthcare: Market, by Region, 2022-2027 (USD Million)

9.4 Utilities

9.4.1 Rising Need for Threat Identification and Detection

Table 37 Utilities: Market, by Region, 2018-2021 (USD Million)

Table 38 Utilities: Market, by Region, 2022-2027 (USD Million)

9.5 It & Ites

9.5.1 Increasing Adoption of Modeling Tools to Safeguard It Operations

Table 39 It & Ites: Market, by Region, 2018-2021 (USD Million)

Table 40 It & Ites: Market, by Region, 2022-2027 (USD Million)

9.6 Other Verticals

Table 41 Other Verticals: Market, by Region, 2018-2021 (USD Million)

Table 42 Other Verticals: Market, by Region, 2022-2027 (USD Million)

10 Threat Modeling Tools Market, by Region

10.1 Introduction

Figure 25 Asia-Pacific to Witness Highest Growth During Forecast Period

Table 43 Market, by Region, 2018-2021 (USD Million)

Table 44 Market, by Region, 2022-2027 (USD Million)

10.2 North America

10.2.1 North America: Market Drivers

10.2.2 North America: Regulatory Landscape

Figure 26 North America: Market Snapshot

Table 45 North America: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 46 North America: Market, by Component, 2022-2027 (USD Million)

Table 47 North America: Market, by Platform, 2018-2021 (USD Million)

Table 48 North America: Market, by Platform, 2022-2027 (USD Million)

Table 49 North America: Market, by Organization Size, 2018-2021 (USD Million)

Table 50 North America: Market, by Organization Size, 2022-2027 (USD Million)

Table 51 North America: Market, by Vertical, 2018-2021 (USD Million)

Table 52 North America: Market, by Vertical, 2022-2027 (USD Million)

Table 53 North America: Market, by Country, 2018-2021 (USD Million)

Table 54 North America: Market, by Country, 2022-2027 (USD Million)

10.2.3 US

10.2.3.1 Rising Technological and Infrastructural Advancements

Table 55 US: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 56 US: Market, by Component, 2022-2027 (USD Million)

Table 57 US: Market, by Platform, 2018-2021 (USD Million)

Table 58 US: Market, by Platform, 2022-2027 (USD Million)

Table 59 US: Market, by Organization Size, 2018-2021 (USD Million)

Table 60 US: Market, by Organization Size, 2022-2027 (USD Million)

Table 61 US: Market, by Vertical, 2018-2021 (USD Million)

Table 62 US: Market, by Vertical, 2022-2027 (USD Million)

10.2.4 Canada

10.2.4.1 Government Initiatives to Support Market Growth

Table 63 Canada: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 64 Canada: Market, by Component, 2022-2027 (USD Million)

Table 65 Canada: Market, by Platform, 2018-2021 (USD Million)

Table 66 Canada: Market, by Platform, 2022-2027 (USD Million)

Table 67 Canada: Market, by Organization Size, 2018-2021 (USD Million)

Table 68 Canada: Market, by Organization Size, 2022-2027 (USD Million)

Table 69 Canada: Market, by Vertical, 2018-2021 (USD Million)

Table 70 Canada: Market, by Vertical, 2022-2027 (USD Million)

10.3 Europe

10.3.1 Europe: Market Drivers

10.3.2 Europe: Regulatory Landscape

Table 71 Europe: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 72 Europe: Market, by Component, 2022-2027 (USD Million)

Table 73 Europe: Market, by Platform, 2018-2021 (USD Million)

Table 74 Europe: Market, by Platform, 2022-2027 (USD Million)

Table 75 Europe: Market, by Organization Size, 2018-2021 (USD Million)

Table 76 Europe: Market, by Organization Size, 2022-2027 (USD Million)

Table 77 Europe: Market, by Vertical, 2018-2021 (USD Million)

Table 78 Europe: Market, by Vertical, 2022-2027 (USD Million)

Table 79 Europe: Market, by Country, 2018-2021 (USD Million)

Table 80 Europe: Market, by Country, 2022-2027 (USD Million)

10.3.3 UK

10.3.3.1 Rise in Data and Identity Breaches

Table 81 UK: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 82 UK: Market, by Component, 2022-2027 (USD Million)

Table 83 UK: Market, by Platform, 2018-2021 (USD Million)

Table 84 UK: Market, by Platform, 2022-2027 (USD Million)

Table 85 UK: Market, by Organization Size, 2018-2021 (USD Million)

Table 86 UK: Market, by Organization Size, 2022-2027 (USD Million)

Table 87 UK: Market, by Vertical, 2018-2021 (USD Million)

Table 88 UK: Market, by Vertical, 2022-2027 (USD Million)

10.3.4 Germany

10.3.4.1 Increased Investments in Data Security Landscape

Table 89 Germany: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 90 Germany: Market, by Component, 2022-2027 (USD Million)

Table 91 Germany: Market, by Platform, 2018-2021 (USD Million)

Table 92 Germany: Market, by Platform, 2022-2027 (USD Million)

Table 93 Germany: Market, by Organization Size, 2018-2021 (USD Million)

Table 94 Germany: Market, by Organization Size, 2022-2027 (USD Million)

Table 95 Germany: Market, by Vertical, 2018-2021 (USD Million)

Table 96 Germany: Market, by Vertical, 2022-2027 (USD Million)

10.3.5 France

10.3.5.1 Growing Adoption of Data Security as a Service

Table 97 France: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 98 France: Market, by Component, 2022-2027 (USD Million)

Table 99 France: Market, by Platform, 2018-2021 (USD Million)

Table 100 France: Market, by Platform, 2022-2027 (USD Million)

Table 101 France: Market, by Organization Size, 2018-2021 (USD Million)

Table 102 France: Market, by Organization Size, 2022-2027 (USD Million)

Table 103 France: Market, by Vertical, 2018-2021 (USD Million)

Table 104 France: Market, by Vertical, 2022-2027 (USD Million)

10.3.6 Rest of Europe

Table 105 Rest of Europe: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 106 Rest of Europe: Market, by Component, 2022-2027 (USD Million)

Table 107 Rest of Europe: Market, by Platform, 2018-2021 (USD Million)

Table 108 Rest of Europe: Market, by Platform, 2022-2027 (USD Million)

Table 109 Rest of Europe: Market, by Organization Size, 2018-2021 (USD Million)

Table 110 Rest of Europe: Market, by Organization Size, 2022-2027 (USD Million)

Table 111 Rest of Europe: Market, by Vertical, 2018-2021 (USD Million)

Table 112 Rest of Europe: Market, by Vertical, 2022-2027 (USD Million)

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Market Drivers

10.4.2 Asia-Pacific: Regulatory Landscape

Figure 27 Asia-Pacific: Threat Modeling Tools Market Snapshot

Table 113 Asia-Pacific: Market, by Component, 2018-2021 (USD Million)

Table 114 Asia-Pacific: Market, by Component, 2022-2027 (USD Million)

Table 115 Asia-Pacific: Market, by Platform, 2018-2021 (USD Million)

Table 116 Asia-Pacific: Market, by Platform, 2022-2027 (USD Million)

Table 117 Asia-Pacific: Market, by Organization Size, 2018-2021 (USD Million)

Table 118 Asia-Pacific: Market, by Organization Size, 2022-2027 (USD Million)

Table 119 Asia-Pacific: Market, by Vertical, 2018-2021 (USD Million)

Table 120 Asia-Pacific: Market, by Vertical, 2022-2027 (USD Million)

Table 121 Asia-Pacific: Market, by Country, 2018-2021 (USD Million)

Table 122 Asia-Pacific: Market, by Country, 2022-2027 (USD Million)

10.4.3 China

10.4.3.1 Intensive Usage of Internet Strengthens Market for Threat Modeling Tools

Table 123 China: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 124 China: Market, by Component, 2022-2027 (USD Million)

Table 125 China: Market, by Platform, 2018-2021 (USD Million)

Table 126 China: Market, by Platform, 2022-2027 (USD Million)

Table 127 China: Market, by Organization Size, 2018-2021 (USD Million)

Table 128 China: Market, by Organization Size, 2022-2027 (USD Million)

Table 129 China: Market, by Vertical, 2018-2021 (USD Million)

Table 130 China: Market, by Vertical, 2022-2027 (USD Million)

10.4.4 Japan

10.4.4.1 Rise in Adoption of Cloud-Based Threat Modeling Tools

Table 131 Japan: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 132 Japan: Market, by Component, 2022-2027 (USD Million)

Table 133 Japan: Market, by Platform, 2018-2021 (USD Million)

Table 134 Japan: Market, by Platform, 2022-2027 (USD Million)

Table 135 Japan: Market, by Organization Size, 2018-2021 (USD Million)

Table 136 Japan: Market, by Organization Size, 2022-2027 (USD Million)

Table 137 Japan: Market, by Vertical, 2018-2021 (USD Million)

Table 138 Japan: Market, by Vertical, 2022-2027 (USD Million)

10.4.5 India

10.4.5.1 Growing Urgency for Securing Confidential Information

Table 139 India: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 140 India: Market, by Component, 2022-2027 (USD Million)

Table 141 India: Market, by Platform, 2018-2021 (USD Million)

Table 142 India: Market, by Platform, 2022-2027 (USD Million)

Table 143 India: Market, by Organization Size, 2018-2021 (USD Million)

Table 144 India: Market, by Organization Size, 2022-2027 (USD Million)

Table 145 India: Market, by Vertical, 2018-2021 (USD Million)

Table 146 India: Market, by Vertical, 2022-2027 (USD Million)

10.4.6 Rest of Asia-Pacific

Table 147 Rest of Asia-Pacific: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 148 Rest of Asia-Pacific: Market, by Component, 2022-2027 (USD Million)

Table 149 Rest of Asia-Pacific: Market, by Platform, 2018-2021 (USD Million)

Table 150 Rest of Asia-Pacific: Market, by Platform, 2022-2027 (USD Million)

Table 151 Rest of Asia-Pacific: Market, by Organization Size, 2018-2021 (USD Million)

Table 152 Rest of Asia-Pacific: Market, by Organization Size, 2022-2027 (USD Million)

Table 153 Rest of Asia-Pacific: Market, by Vertical, 2018-2021 (USD Million)

Table 154 Rest of Asia-Pacific: Market, by Vertical, 2022-2027 (USD Million)

10.5 Middle East & Africa

10.5.1 Middle East & Africa: Market Drivers

10.5.2 Middle East & Africa: Regulatory Landscape

Table 155 Middle East & Africa: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 156 Middle East & Africa: Market, by Component, 2022-2027 (USD Million)

Table 157 Middle East & Africa: Market, by Platform, 2018-2021 (USD Million)

Table 158 Middle East & Africa: Market, by Platform, 2022-2027 (USD Million)

Table 159 Middle East & Africa: Market, by Organization Size, 2018-2021 (USD Million)

Table 160 Middle East & Africa: Market, by Organization Size, 2022-2027 (USD Million)

Table 161 Middle East & Africa: Market, by Vertical, 2018-2021 (USD Million)

Table 162 Middle East & Africa: Market, by Vertical, 2022-2027 (USD Million)

Table 163 Middle East & Africa: Market, by Country, 2018-2021 (USD Million)

Table 164 Middle East & Africa: Market, by Country, 2022-2027 (USD Million)

10.5.3 Middle East

10.5.3.1 Increasing Digitalization and Innovation

Table 165 Middle East: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 166 Middle East: Market, by Component, 2022-2027 (USD Million)

Table 167 Middle East: Market, by Platform, 2018-2021 (USD Million)

Table 168 Middle East: Market, by Platform, 2022-2027 (USD Million)

Table 169 Middle East: Market, by Organization Size, 2018-2021 (USD Million)

Table 170 Middle East: Market, by Organization Size, 2022-2027 (USD Million)

Table 171 Middle East: Market, by Vertical, 2018-2021 (USD Million)

Table 172 Middle East: Market, by Vertical, 2022-2027 (USD Million)

10.5.4 Africa

10.5.4.1 Increasing Penetration of Internet

Table 173 Africa: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 174 Africa: Market, by Component, 2022-2027 (USD Million)

Table 175 Africa: Market, by Platform, 2018-2021 (USD Million)

Table 176 Africa: Market, by Platform, 2022-2027 (USD Million)

Table 177 Africa: Market, by Organization Size, 2018-2021 (USD Million)

Table 178 Africa: Market, by Organization Size, 2022-2027 (USD Million)

Table 179 Africa: Market, by Vertical, 2018-2021 (USD Million)

Table 180 Africa: Market, by Vertical, 2022-2027 (USD Million)

10.6 Latin America

10.6.1 Latin America: Market Drivers

10.6.2 Latin America: Regulatory Landscape

Table 181 Latin America: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 182 Latin America: Market, by Component, 2022-2027 (USD Million)

Table 183 Latin America: Market, by Platform, 2018-2021 (USD Million)

Table 184 Latin America: Market, by Platform, 2022-2027 (USD Million)

Table 185 Latin America: Market, by Organization Size, 2018-2021 (USD Million)

Table 186 Latin America: Market, by Organization Size, 2022-2027 (USD Million)

Table 187 Latin America: Market, by Vertical, 2018-2021 (USD Million)

Table 188 Latin America: Market, by Vertical, 2022-2027 (USD Million)

Table 189 Latin America: Market, by Country, 2018-2021 (USD Million)

Table 190 Latin America: Market, by Country, 2022-2027 (USD Million)

10.6.3 Brazil

10.6.3.1 Growing Adoption of Cybersecurity Solutions

Table 191 Brazil: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 192 Brazil: Market, by Component, 2022-2027 (USD Million)

Table 193 Brazil: Market, by Platform, 2018-2021 (USD Million)

Table 194 Brazil: Market, by Platform, 2022-2027 (USD Million)

Table 195 Brazil: Market, by Organization Size, 2018-2021 (USD Million)

Table 196 Brazil: Market, by Organization Size, 2022-2027 (USD Million)

Table 197 Brazil: Market, by Vertical, 2018-2021 (USD Million)

Table 198 Brazil: Market, by Vertical, 2022-2027 (USD Million)

10.6.4 Mexico

10.6.4.1 Increase in Cybercrimes

Table 199 Mexico: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 200 Mexico: Market, by Component, 2022-2027 (USD Million)

Table 201 Mexico: Market, by Platform, 2018-2021 (USD Million)

Table 202 Mexico: Market, by Platform, 2022-2027 (USD Million)

Table 203 Mexico: Market, by Organization Size, 2018-2021 (USD Million)

Table 204 Mexico: Market, by Organization Size, 2022-2027 (USD Million)

Table 205 Mexico: Market, by Vertical, 2018-2021 (USD Million)

Table 206 Mexico: Market, by Vertical, 2022-2027 (USD Million)

10.6.5 Rest of Latin America

Table 207 Rest of Latin America: Threat Modeling Tools Market, by Component, 2018-2021 (USD Million)

Table 208 Rest of Latin America: Market, by Component, 2022-2027 (USD Million)

Table 209 Rest of Latin America: Market, by Platform, 2018-2021 (USD Million)

Table 210 Rest of Latin America: Market, by Platform, 2022-2027 (USD Million)

Table 211 Rest of Latin America: Market, by Organization Size, 2018-2021 (USD Million)

Table 212 Rest of Latin America: Market, by Organization Size, 2022-2027 (USD Million)

Table 213 Rest of Latin America: Market, by Vertical, 2018-2021 (USD Million)

Table 214 Rest of Latin America: Market, by Vertical, 2022-2027 (USD Million)

11 Competitive Landscape

11.1 Introduction

11.2 Revenue Share Analysis of Key Players

Figure 28 Revenue Share Analysis of Leading Players, 2022

11.3 Market Share Analysis of Key Players

Table 215 Threat Modeling Tools Market: Intensity of Competitive Rivalry

11.4 Historical Revenue Analysis

Figure 29 Segmental Revenue Analysis of Top Five Players, 2018-2021 (USD Million)

11.5 Ranking of Key Players

Figure 30 Ranking of Top Six Players, 2022

11.6 Evaluation Matrix for Key Players, 2022

11.6.1 Definitions and Methodology

Figure 31 Evaluation Quadrant for Key Players: Criteria Weightage

11.6.2 Stars

11.6.3 Emerging Leaders

11.6.4 Pervasive Players

11.6.5 Participants

Figure 32 Evaluation Matrix for Key Players, 2022

11.7 Competitive Benchmarking

11.7.1 Evaluation Criteria for Key Players

Table 216 Company Vertical Footprint

11.7.2 Evaluation Criteria for Startups/SMEs

Table 217 Detailed List of Startups

11.8 Evaluation Matrix for Startups/SMEs, 2022

11.8.1 Definitions and Methodology

Figure 33 Evaluation Quadrant for Startups/SMEs: Criteria Weightage

11.8.2 Progressive Companies

11.8.3 Responsive Companies

11.8.4 Dynamic Companies

11.8.5 Starting Blocks

Figure 34 Evaluation Matrix for Startups/SMEs, 2022

11.9 Competitive Scenario

11.9.1 Product/Solution Launches

Table 218 Product/Solution Launches, 2020-2022

11.9.2 Deals

Table 219 Deals, 2020-2022

12 Company Profiles

(Business Overview, Solutions/Services Offered, Recent Developments & Analyst's View)*

12.1 Key Players

12.1.1 Cisco

Table 220 Cisco: Business Overview

Table 221 Cisco: Solutions/Services Offered

Figure 35 Cisco: Company Snapshot

Table 222 Cisco: Product Launches

Table 223 Cisco: Deals

12.1.2 IBM

Table 224 IBM: Business Overview

Figure 36 IBM: Company Snapshot

Table 225 IBM: Solutions/Services Offered

Table 226 IBM: Product Launches

Table 227 IBM: Deals

12.1.3 Synopsys

Table 228 Synopsys: Business Overview

Figure 37 Synopsys: Company Snapshot

Table 229 Synopsys: Solutions/Services Offered

Table 230 Synopsys: Product Launches

Table 231 Synopsys: Deals

12.1.4 Intel

Table 232 Intel: Business Overview

Figure 38 Intel: Company Snapshot

Table 233 Intel: Solutions Offered

Table 234 Intel: Product Launches

12.1.5 Varonis Systems

Table 235 Varonis Systems: Business Overview

Figure 39 Varonis Systems: Company Snapshot

Table 236 Varonis Systems: Solutions Offered

Table 237 Varonis Systems: Product Launches

Table 238 Varonis Systems: Deals

12.1.6 Microsoft

Table 239 Microsoft: Business Overview

Figure 40 Microsoft: Company Snapshot

Table 240 Microsoft: Solutions/Services Offered

Table 241 Microsoft: Product Launches

Table 242 Microsoft: Deals

12.1.7 Sparx Systems

Table 243 Sparx Systems: Business Overview

Table 244 Sparx Systems: Solutions Offered

Table 245 Sparx Systems: Product Launches

12.1.8 Kroll

Table 246 Kroll: Business Overview

Table 247 Kroll: Services Offered

Table 248 Kroll: Product Launches

Table 249 Kroll: Deals

12.1.9 Mandiant

Table 250 Mandiant: Business Overview

Table 251 Mandiant: Solutions/Services Offered

Table 252 Mandiant: Product Launches

Table 253 Mandiant: Deals

12.1.10 Coalfire

Table 254 Coalfire: Business Overview

Table 255 Coalfire: Solutions/Services Offered

Table 256 Coalfire: Product Launches

Table 257 Coalfire: Deals

*Details on Business Overview, Solutions/Services Offered, Recent Developments & Analyst's View Might Not be Captured in Case of Unlisted Companies.

12.2 Other Players

12.2.1 Security Compass

12.2.2 Securonix

12.2.3 Iriusrisk

12.2.4 Kenna Security

12.2.5 Threatmodeler

12.2.6 Toreon

12.2.7 Foreseeti

12.2.8 Tutamantic

12.2.9 Cymune

12.2.10 Avocado Systems

12.2.11 Secura

12.2.12 Qseap

12.2.13 Versprite

12.2.14 Imq Minded Security

13 Adjacent Markets

Table 258 Adjacent Markets and Forecasts

13.1 Limitations

13.2 Extended Detection and Response Market

Table 259 Extended Detection and Response Market, by Organization Size, 2018-2021 (USD Million)

Table 260 Extended Detection and Response Market, by Organization Size, 2022-2027 (USD Million)

Table 261 Large Enterprises: Extended Detection and Response Market, by Region, 2018-2021 (USD Million)

Table 262 Large Enterprises: Extended Detection and Response Market, by Region, 2022-2027 (USD Million)

Table 263 Smes: Extended Detection and Response Market, by Region, 2018-2021 (USD Million)

Table 264 Smes: Extended Detection and Response Market, by Region, 2022-2027 (USD Million)

13.3 Threat Intelligence Market

Table 265 Threat Intelligence Market, by Deployment Mode, 2014-2019 (USD Million)

Table 266 Post-COVID-19 Threat Intelligence Market, by Deployment Mode, 2019-2025 (USD Million)

Table 267 Cloud: Threat Intelligence Market, by Region, 2014-2019 (USD Million)

Table 268 Cloud: Post-COVID-19 Threat Intelligence Market, by Region, 2019-2025 (USD Million)

Table 269 On-Premises: Threat Intelligence Market, by Region, 2014-2019 (USD Million)

Table 270 On-Premises: Post-COVID-19 Threat Intelligence Market, by Region, 2019-2025 (USD Million)

14 Appendix

14.1 Discussion Guide

14.2 Knowledgestore: The Subscription Portal

14.3 Customization Options

Companies Mentioned

- Avocado Systems

- Cisco

- Coalfire

- Cymune

- Foreseeti

- IBM

- Imq Minded Security

- Intel

- Iriusrisk

- Kenna Security

- Kroll

- Mandiant

- Microsoft

- Qseap

- Secura

- Security Compass

- Securonix

- Sparx Systems

- Synopsys

- Threatmodeler

- Toreon

- Tutamantic

- Varonis Systems

- Versprite

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 222 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 0.8 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |