The presence of Public-Private Partnerships (PPP) in the U.S., Europe, and the Middle East is anticipated to open new avenues for investments in the bariatric beds market. The Ministry of Health (MOH) of Turkey announced about 95,000 new hospital beds including bariatric beds are required by the year 2023. Also, rising funding by various government bodies and medical equipment manufacturers toward R&D is expected to promote market growth.

The adoption of innovative platforms from the manufacturers/traders for the sale of DME such as online portals that help end users find equipment/device that suits their requirements is anticipated to boost the sale of bariatric beds. Additionally, supportive technological infrastructure in the U.S., U.K., Germany, India, China, and Japan is expected to assist in the market growth during the forecast period.

An increasing number of obese people across the globe is anticipated to surge the demand for bariatric beds during the forecast period. For instance, as per the Harvard School of Public Health, nearly 40% of American adults aged 20 and above are obese. And around 71.6% of adults aged 20 and above are overweight, including obesity.

Bariatric Beds Market Report Highlight

- 500-700 lbs segment held the largest market share in 2022 as they are widely preferred and used by patients across the globe.

- Hospital segment held a significant market share in 2022 owing to the increasing number of surgeries specifically for obese patients across all hospitals.

- North America is the leading region in 2022 owing to the high economic development and presence of advanced research centers, hospitals, and medical device manufacturers.

- Asia Pacific is anticipated to grow at the fastest growth rate during the forecast period due to high research expenditure by public and private entities, and the availability of technologically advanced products.

This product will be delivered within 1-3 business days.

Table of Contents

Chapter 1. Methodology and Scope1.1. Market Segmentation & Scope

1.1.1. Weight Capacity

1.1.2. End-use

1.1.3. Regional scope

1.1.4. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in North America

1.3.5.2. Data for primary interviews in Europe

1.3.5.3. Data for primary interviews in Asia Pacific

1.3.5.4. Data for primary interviews in Latin America

1.3.5.5. Data for Primary interviews in MEA

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.6.3. Volume price analysis (Model 2)

1.6.4. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Weight Capacity outlook

2.2.2. End-use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Bariatric Beds Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Rising prevalence of obesity

3.4.1.2. Increasing number of bariatric surgeries

3.4.1.3. Increasing consumption of unhealthy food in young generation

3.4.2. Market restraint analysis

3.4.2.1. High cost associated with bariatric beds

3.5. Bariatric Beds Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier product

3.5.1.2. Buyer product

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

3.5.3. Major Deals & Strategic Alliances Analysis

3.5.4. Market Entry Strategies

Chapter 4. Bariatric Beds Market: Weight Capacity Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. 500-700 lbs

4.1.2. 700-1000 lbs

4.1.3. >1000 lbs

4.2. Weight Capacity Market Share, 2022 & 2030

4.3. Segment Dashboard

4.4. Global Bariatric Beds Market by Weight Capacity Outlook

4.5. Market Size & Forecasts and Trend Analysis, 2018 to 2030 for the following

4.5.1. 500-700 lbs

4.5.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.5.2. 700-1000 lbs

4.5.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.5.3. >1000 lbs

4.5.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

Chapter 5. Bariatric Beds Market: End-use Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Hospitals

5.1.2. Nursing Homes

5.1.3. Others

5.2. End-use Market Share, 2021 & 2030

5.3. Segment Dashboard

5.4. Global Bariatric Beds Market by End-use Outlook

5.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5.1. Hospitals

5.5.1.1. Market estimates and forecast 2018 to 2030 (USD million)

5.5.2. Nursing Homes

5.5.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.5.3. Others

5.5.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

Chapter 6. Bariatric Beds Market: Regional Estimates & Trend Analysis

6.1. Regional market share analysis, 2022 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Regional Market Share and Leading Players, 2022

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Latin America

6.4.5. Middle East and Africa

6.5. SWOT Analysis, by Factor (Political & Legal, Economic and Technological)

6.5.1. North America

6.5.2. Europe

6.5.3. Asia Pacific

6.5.4. Latin America

6.5.5. Middle East and Africa

6.6. Market Size, & Forecasts, Volume and Trend Analysis, 2018 to 2030:

6.7. North America

6.7.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.7.2. U.S.

6.7.2.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.7.3. Canada

6.7.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8. Europe

6.8.1. U.K.

6.8.1.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.2. Germany

6.8.2.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.3. France

6.8.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.4. Italy

6.8.4.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.5. Spain

6.8.5.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.6. Norway

6.8.6.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.7. Sweden

6.8.7.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.8.8. Denmark

6.8.8.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.9. Asia Pacific

6.9.1. China

6.9.1.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.9.2. Japan

6.9.2.1. Market estimates and forecast, 2018 - 2030 (Volume, Thousand)

6.9.3. India

6.9.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.9.4. South Korea

6.9.4.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.9.5. Australia

6.9.5.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.9.6. Thailand

6.9.6.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.10. Latin America

6.10.1. Brazil

6.10.1.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.10.2. Mexico

6.10.2.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.10.3. Argentina

6.10.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.11. MEA

6.11.1. Saudi Arabia

6.11.1.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.11.2. South Africa

6.11.2.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.11.3. UAE

6.11.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

6.11.4. Kuwait

6.11.4.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.2.1. Innovators

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2022

7.3.4. Invacare Corporation

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. Hill-Rom Holdings

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Arjo

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Drive DeVilbiss Healthcare

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. GF Health Products, Inc.

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Zhangjiagang Medi

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. COBI REHAB

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. ALERTA

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. ROTEC INTERNATIONAL

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 North America bariatric beds market, by region, 2018 - 2030 (USD Million)

Table 3 North America bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 4 North America bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 5 U.S. bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 6 U.S. bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 7 Canada bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 8 Canada bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 9 Europe bariatric beds market, by region, 2018 - 2030 (USD Million)

Table 10 Europe bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 11 Europe bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 12 Germany bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 13 Germany bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 14 U.K. bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 15 U.K. bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 16 France bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 17 France bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 18 Italy bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 19 Italy bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 20 Spain bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 21 Spain bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 22 Norway bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 23 Norway bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 24 Sweden bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 25 Sweden bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 26 Denmark bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 27 Denmark bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 28 Asia Pacific bariatric beds market, by region, 2018 - 2030 (USD Million)

Table 29 Asia Pacific bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 30 Asia Pacific bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 31 China bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 32 China bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 33 Japan bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 34 Japan bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 35 India bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 36 India bariatric beds market, by end-use, (USD Million) 2018-203

Table 37 South Korea bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 38 South Korea bariatric beds market, by end-use, (USD Million) 2018-203

Table 39 Australia bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 40 Australia bariatric beds market, by end-use, (USD Million) 2018-203

Table 41 Thailand bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 42 Thailand bariatric beds market, by end-use, (USD Million) 2018-203

Table 43 Latin America bariatric beds market, by region, 2018 - 2030 (USD Million)

Table 44 Latin America bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 45 Latin America bariatric beds market, by end-use, (USD Million) 2018-203

Table 46 Brazil bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 47 Brazil bariatric beds market, by end-use, (USD Million) 2018-203

Table 48 Mexico bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 49 Mexico bariatric beds market, by end-use, (USD Million) 2018-203

Table 50 Argentina bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 51 Argentina bariatric beds market, by end-use, (USD Million) 2018-203

Table 52 Middle East and Africa bariatric beds market, by region, 2018 - 2030 (USD Million)

Table 53 Middle East and Africa bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 54 Middle East and Africa bariatric beds market, by end-use, (USD Million) 2018-203

Table 55 South Africa bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 56 South Africa bariatric beds market, by end-use, (USD Million) 2018-203

Table 57 Saudi Arabia bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 58 Saudi Arabia bariatric beds market, by end-use, (USD Million) 2018-203

Table 59 UAE bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 60 UAE bariatric beds market, by end-use, 2018 - 2030 (USD Million)

Table 61 Kuwait bariatric beds market, by weight capacity, 2018 - 2030 (USD Million)

Table 62 Kuwait bariatric beds market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Bariatric Beds market: Market outlook

Fig. 14 Bariatric Beds market: Competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Bariatric beds market driver impact

Fig. 20 Bariatric beds market restraint impact

Fig. 21 Bariatric beds market strategic initiatives analysis

Fig. 22 Bariatric beds market: Weight capacity movement analysis

Fig. 23 Bariatric beds market: Weight capacity outlook and key takeaways

Fig. 24 500-700 lbs market estimates and forecast, 2018 - 2030

Fig. 25 700-1000 lbs market estimates and forecast, 2018 - 2030

Fig. 26 >1000 lbs market estimates and forecast, 2018 - 2030

Fig. 27 Bariatric beds market: End-use movement analysis

Fig. 28 Bariatric beds market: End-use outlook and key takeaways

Fig. 29 Hospitals market estimates and forecast, 2018 - 2030

Fig. 30 Nursing homes market estimates and forecast, 2018 - 2030

Fig. 31 Others estimates and forecast, 2018 - 2030

Fig. 32 Global bariatric beds market: Regional movement analysis

Fig. 33 Global bariatric beds market: Regional outlook and key takeaways

Fig. 34 Global bariatric beds market share and leading players

Fig. 35 North America market share and leading players

Fig. 36 Europe market share and leading players

Fig. 37 Asia Pacific market share and leading players

Fig. 38 Latin America market share and leading players

Fig. 39 Middle East & Africa market share and leading players

Fig. 40 North America: SWOT

Fig. 41 Europe SWOT

Fig. 42 Asia Pacific SWOT

Fig. 43 Latin America SWOT

Fig. 44 MEA SWOT

Fig. 45 North America, by country

Fig. 46 North America

Fig. 47 North America market estimates and forecast, 2018 - 2030

Fig. 48 U.S.

Fig. 49 U.S. market estimates and forecast, 2018 - 2030

Fig. 50 Canada

Fig. 51 Canada market estimates and forecast, 2018 - 2030

Fig. 52 Europe

Fig. 53 Europe market estimates and forecast, 2018 - 2030

Fig. 54 U.K.

Fig. 55 U.K. market estimates and forecast, 2018 - 2030

Fig. 56 Germany

Fig. 57 Germany market estimates and forecast, 2018 - 2030

Fig. 58 France

Fig. 59 France market estimates and forecast, 2018 - 2030

Fig. 60 Italy

Fig. 61 Italy market estimates and forecast, 2018 - 2030

Fig. 62 Spain

Fig. 63 Spain market estimates and forecast, 2018 - 2030

Fig. 64 Norway

Fig. 65 Norway market estimates and forecast, 2018 - 2030

Fig. 66 Sweden

Fig. 67 Sweden market estimates and forecast, 2018 - 2030

Fig. 68 Denmark

Fig. 69 Denmark market estimates and forecast, 2018 - 2030

Fig. 70 Asia Pacific

Fig. 71 Asia Pacific market estimates and forecast, 2018 - 2030

Fig. 72 China

Fig. 73 China market estimates and forecast, 2018 - 2030

Fig. 74 Japan

Fig. 75 Japan market estimates and forecast, 2018 - 2030

Fig. 76 India

Fig. 77 India market estimates and forecast, 2018 - 2030

Fig. 78 South Korea

Fig. 79 South Korea market estimates and forecast, 2018 - 2030

Fig. 80 Australia

Fig. 81 Australia market estimates and forecast, 2018 - 2030

Fig. 82 Thailand

Fig. 83 Thailand market estimates and forecast, 2018 - 2030

Fig. 84 Latin America

Fig. 85 Latin America market estimates and forecast, 2018 - 2030

Fig. 86 Brazil

Fig. 87 Brazil market estimates and forecast, 2018 - 2030

Fig. 88 Mexico

Fig. 89 Mexico market estimates and forecast, 2018 - 2030

Fig. 90 Argentina

Fig. 91 Argentina market estimates and forecast, 2018 - 2030

Fig. 92 Middle East and Africa

Fig. 93 Middle East and Africa market estimates and forecast, 2018 - 2030

Fig. 94 South Africa

Fig. 95 South Africa market estimates and forecast, 2018 - 2030

Fig. 96 Saudi Arabia

Fig. 97 Saudi Arabia market estimates and forecast, 2018 - 2030

Fig. 98 UAE

Fig. 99 UAE market estimates and forecast, 2018 - 2030

Fig. 100 Kuwait

Fig. 101 Kuwait market estimates and forecast, 2018 - 2030

Fig. 102 Participant Categorization- Bariatric beds market

Fig. 103 Market share of key market players- Bariatric beds market

Companies Mentioned

- Invacare Corporation

- Hill-Rom Holdings

- Arjo

- Drive DeVilbiss Healthcare

- GF Health Products, Inc.

- Zhangjiagang Medi

- COBI REHAB

- ALERTA

- ROTEC INTERNATIONAL

Methodology

LOADING...

Table Information

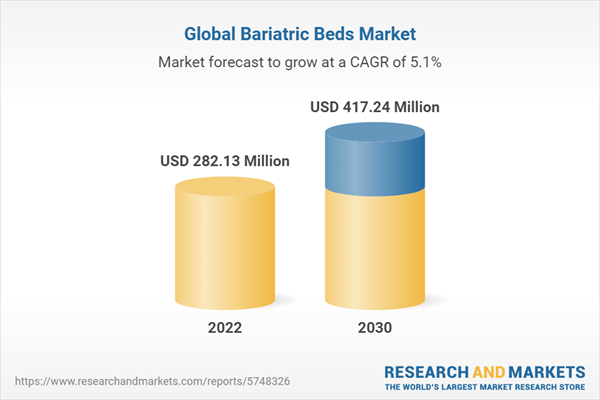

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | February 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 282.13 Million |

| Forecasted Market Value ( USD | $ 417.24 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |