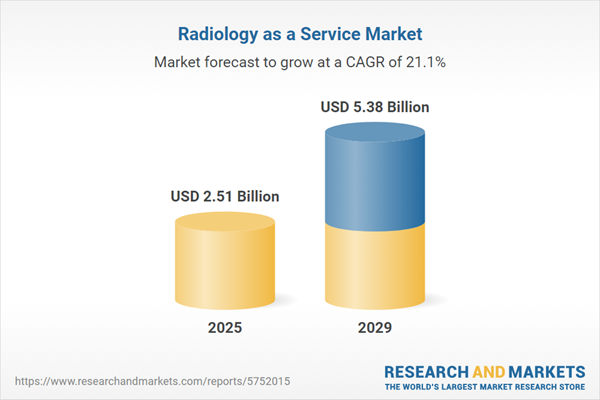

The radiology as a service market size is expected to see exponential growth in the next few years. It will grow to $5.38 billion in 2029 at a compound annual growth rate (CAGR) of 21.1%. The growth in the forecast period can be attributed to continued emphasis on cost savings, growing focus on value-based care, increasing demand for remote and telehealth solutions, integration of artificial intelligence (AI), global shortage of radiologists. Major trends in the forecast period include focus on subspecialty reporting, cybersecurity measures for image protection, mobile radiology solutions, collaboration with AI startups, value-based care integration.

The global increase in cancer cases is anticipated to drive the growth of the radiology-as-a-service market. Cancer occurs when cells in the body grow uncontrollably and spread to other areas. Medical imaging technology has revolutionized healthcare by allowing earlier cancer detection and improving patient outcomes. Consequently, the rise in cancer cases is likely to boost demand for radiology imaging services, fueling the expansion of radiology as a service. For instance, in May 2024, the National Cancer Institute, a US-based cancer research and training agency, reported that new global cancer cases per year are expected to reach 29.9 million, with 15.3 million cancer-related deaths projected by 2040. Therefore, the growing number of cancer cases is driving the radiology-as-a-service market growth.

The increasing demand for telemedicine is poised to contribute to the growth of the radiology as a service market. Telemedicine, a healthcare practice leveraging telecommunications technology to deliver medical services and consultations remotely, allows healthcare professionals to assess, diagnose, and treat patients without the need for in-person visits. In the field of radiology as a service, telemedicine facilitates the remote interpretation of medical images, enabling radiologists to analyze and diagnose patients' conditions from virtually any location. For instance, data from FAIR Health Inc., a US-based non-profit organization, indicates a 7.3% national increase in telehealth use from 5.5% of medical claim lines in December 2022 to 5.9% in January 2023. This surge in telemedicine demand is a significant driver for the growth of the radiology as a service market.

Technological advancements are significant trends gaining traction in the radiology-as-a-service market. Leading companies in this sector are concentrating on the introduction of new technologies to maintain their competitive edge. For instance, in February 2024, Yellowcross Healthcare Commerce, an India-based telemedicine practice management organization, launched a consultancy service designed to help medical groups and healthcare facilities improve their remote care capabilities. Yellowcross partners with hospitals, clinics, medical groups, and entrepreneurial physicians throughout the United States to develop targeted service offerings that address radiologist shortages and provide specialized diagnostic services.

Strategic partnerships are another focal point for major companies in the radiology-as-a-service sector, as they aim to gain a competitive edge. These partnerships involve collaborative alliances between organizations with the goal of achieving mutual benefits and pursuing common objectives. An illustration of this strategy is evident in the partnership between Radiology Partners Inc., a US-based healthcare service company, and Amazon Web Services (AWS), a US-based cloud computing company. In November 2023, they joined forces to launch RPX AI, an artificial intelligence (AI) platform. RPX AI enables the deployment of a suite of AI medical imaging tools at scale, creating value for hospitals and health systems. This collaboration transforms the radiology industry and enhances patient outcomes using AI and other advanced technologies.

In June 2023, Grovecourt Capital Partners, a private equity firm based in the US, acquired Premier Radiology Services for an undisclosed sum. This acquisition is consistent with the firm's strategy to invest in high-growth healthcare providers, and they anticipate working with Premier's team to enhance their teleradiology services. Premier Radiology Services interprets around two million medical images each year for various mobile imaging providers, occupational health centers, urgent care facilities, and outpatient clinics. Based in the US, Premier Radiology Services offers comprehensive imaging services across multiple locations.

Major companies operating in the radiology as a service market include Siemens Healthineers AG, Fujifilm Holdings Corporation, Koninklijke Philips N.V., GE HealthCare Technologies Inc., Agfa-Gevaert N.V., Mednax Inc., RadNet Inc., National Diagnostic Imaging Teleradiology, Alliance HealthCare Services Inc., US Radiology Specialists Inc., Nines Inc., Shields Health Solutions Holdings LLC., Virtual Radiologic, Everlight Radiology, Telemedicine Clinic Ltd., Medica Group plc, Onrad Inc., RamSoft Inc., Real Radiology LLC, Vesta Teleradiology, Radiology Partners Inc., Ambra Health Company, Nano-X Imaging Ltd., NightShift Radiology Inc., USARAD Holdings Inc., Telediagnostic Solutions Private Limited, Teleconsult Holding BV, Teleradiology Solutions Pvt Ltd., Bond Radiological Group, Imaging Advantage LLC, Imaging On Call LLC.

North America was the largest region in the radiology as a service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the radiology as a service market share during the forecast period. The regions covered in the radiology as a service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the radiology as a service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Radiology as a service involves providing professional and technical services for radiation oncology, radioisotope services, medical imaging, and more. This allows healthcare providers to offer patients optimal diagnoses at significantly lower costs.

Radiology as a service encompasses teleradiology, cloud-based imaging services, consulting services, and technology management services. Teleradiology involves sending radiological images to other institutions for analysis by licensed radiologists. This telemedicine approach is employed for sharing reports from imaging tests such as X-rays and MRI scans. Technologies such as computed radiology and direct digital radiology are utilized by hospitals, diagnostic imaging centers, radiology clinics, physician offices, and nursing homes.

The radiology as a service market research report is one of a series of new reports that provides radiology as a service market statistics, including radiology as a service industry global market size, regional shares, competitors with radiology as a service market share, detailed radiology as a service market segments, market trends and opportunities, and any further data you may need to thrive in the radiology as a service industry. This anomaly detection market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The radiology as a service market includes revenues earned by entities by radiation oncology, radioisotope services, medical imaging, and so on. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Radiology As a Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on radiology as a service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for radiology as a service? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The radiology as a service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service Type: Teleradiology; Cloud-based Imaging IT Services; Consulting Services; Technology Management Services2) By Technology: Computed Radiology; Direct Digital Radiology

3) By End-User: Hospitals; Diagnostic Imaging Centers; Radiology Clinics; Physician Offices; Nursing Homes

Subsegments:

1) By Teleradiology: Remote Image Interpretation; Remote Reporting Services2) By Cloud-Based Imaging IT Services: Cloud Storage Solutions; Cloud-Based Image Management

3) By Consulting Services: Workflow Optimization; Regulatory Compliance Consulting

4) By Technology Management Services: Equipment Maintenance; Imaging Software Support

Key Companies Mentioned: Siemens Healthineers AG; Fujifilm Holdings Corporation; Koninklijke Philips N.V.; GE HealthCare Technologies Inc.; Agfa-Gevaert N.V.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens Healthineers AG

- Fujifilm Holdings Corporation

- Koninklijke Philips N.V.

- GE HealthCare Technologies Inc.

- Agfa-Gevaert N.V.

- Mednax Inc.

- RadNet Inc.

- National Diagnostic Imaging Teleradiology

- Alliance HealthCare Services Inc.

- US Radiology Specialists Inc.

- Nines Inc.

- Shields Health Solutions Holdings LLC.

- Virtual Radiologic

- Everlight Radiology

- Telemedicine Clinic Ltd.

- Medica Group plc

- Onrad Inc.

- RamSoft Inc.

- Real Radiology LLC

- Vesta Teleradiology

- Radiology Partners Inc.

- Ambra Health Company

- Nano-X Imaging Ltd.

- NightShift Radiology Inc.

- USARAD Holdings Inc.

- Telediagnostic Solutions Private Limited

- Teleconsult Holding BV

- Teleradiology Solutions Pvt Ltd.

- Bond Radiological Group

- Imaging Advantage LLC

- Imaging On Call LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.51 Billion |

| Forecasted Market Value ( USD | $ 5.38 Billion |

| Compound Annual Growth Rate | 21.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |