An organization's previously set security policies are used to monitor and filter incoming and outgoing network traffic through a firewall, a network security device. A firewall is essentially the barrier between a private internal network and the open Internet at its basic level. The basic function of a firewall is to let safe traffic in while blocking harmful traffic. A firewall solution called FWaaS, a cloud-based service enables businesses to streamline their IT infrastructure.

Web filtering, intrusion prevention system (IPS), advanced threat protection (ATP), and Domain Name System (DNS) security are just a few of the next-generation firewall (NGFW) features it offers. Network traffic is filtered using a firewall (FWaaS) service to protect enterprises from internal and external threats. Additionally, it offers capabilities like packet filtering, network monitoring, support for secure sockets layer virtual private networks (SSL VPN), packet filtering, and IP mapping.

Deeper content inspection capabilities of FWaaS also allow for the detection of malware attacks and other dangers. FWaaS separate the user's network and the Internet. The FWaaS solution inspects traffic as it tries to enter users' networks to find and handle dangers. The inspection examines each data packet's header to learn more about the packet's origin and any additional behaviors that can indicate malicious intent.

For telecom operators, the expert service providers provide solutions specifically suited to meet their business objectives. The providers of these services use the most recent methodologies, security developments, and expertise to meet the telecom enterprise's highest security standards. These services ensure that vendors provide top-notch service levels and security so the network can be protected. Via industry-defined procedures, vendors also provide risk assessment and assistance throughout the deployment.

COVID-19 Impact Analysis

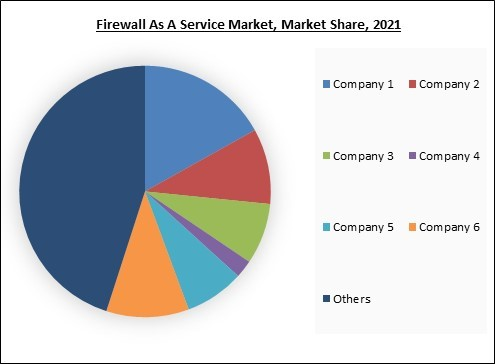

A firewall as a Service is a popular choice among businesses since it is affordable and scalable for securing remote workers. Effective network security is becoming even more important due to the rise in cyberattacks that target remote workers. Furthermore, COVID-19 has sped up the trend towards cloud-based security services, such as firewalls as a service, and is anticipated to fuel sustained market expansion in the upcoming years. Several businesses were forced to install firewalls for data protection due to the tight stay-at-home directives that led to the implementation of the work-from-home mechanism, which significantly impacted the development potential of the firewall as a service market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Market Growth Factors

Growing need for network privacy and security

The expansion of enormous data created from each subscriber's account has been facilitated by an increase in the number of internet subscribers. The raw data produced by these individual subscribers can be used for extra business or research purposes with the use of additional technologies like big data, artificial intelligence (AI), machine learning (ML), cloud computing, and the internet of things (IoT). Also, telecom carriers have built sizable network infrastructures to handle such data transactions. This helps the firewall as a service market to expand.Rising adoption of industry 4.0 and cloud computing

Firewalls are now being installed as cloud technology advances. These firewalls provide a packaged solution that guarantees a firewall is accessible on any device, manages traffic volume, and ensures that the same policies are followed throughout the organization. Furthermore, it is anticipated that cloud computing will expand significantly during the predicted period. Companies from various industries have benefited in several ways from the rising use of cloud-based technologies. As data breaches escalate, the value of organizations' valuable data is at risk without a security layer, and the need for enterprise firewalls arises, thereby surging the growth of firewalls as a service market in the upcoming years.Market Restraining Factor

Issues in current firewall systems

Firewalls may have some flaws, even though including one in the security plan is essential. A firewall vulnerability is a mistake during the firewall's design, implementation, or configuration and can be leveraged to attack the trusted network it is meant to defend. Backdoors and other internal dangers cannot be stopped by a firewall in a network. An example of collusion between an external attacker and a dissatisfied employee. Due to these firewall system vulnerability issues, the market may be constrained in the upcoming years.Type Outlook

Based on type, the firewall as a service market is divided into compliance & audit management, traffic monitoring & control, security management, reporting & log management, automation & orchestration, professional & managed services, and others. The traffic monitoring & control segment acquired a significant revenue share in the firewall as a service market in 2021. Firewall as a service aid in network traffic analysis. Based on an examination of logs obtained from various network firewalls, the traffic monitor calculates the amount of network traffic. To learn more specifically about the traffic passing via each firewall, firewall logs are gathered, kept, and analyzed.Deployment Model Outlook

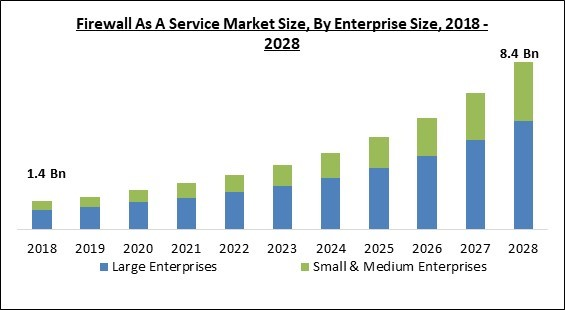

On the basis of deployment model, the firewall as a service market is fragmented into public cloud, private cloud, and hybrid cloud. The hybrid cloud segment covered a considerable revenue share in the firewall as a service market in 2021. This can be explained by the growing demand from businesses for anywhere-accessible, hybrid-based firewall-as-a-service solutions that stop cyberthreats. The need for firewall services is anticipated to rise in the coming years as virtual private networks become more widely used.Enterprise size Outlook

By enterprise size, the firewall as a service market is classified into large size enterprises and small and medium size enterprises. In 2021, the large enterprise segment dominated the firewall as a service market by generating maximum revenue share. The need to improve productivity and agility by guaranteeing firewall security and shielding enterprises from cyberattacks that might potentially interrupt business processes are some factors contributing to this market's growth.Service Model Outlook

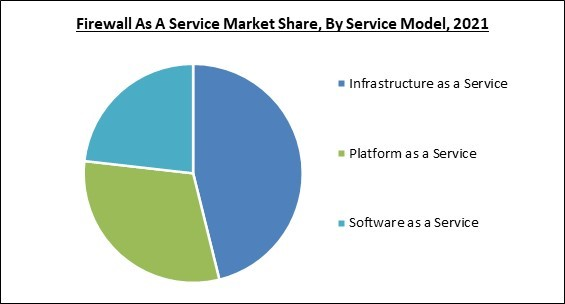

By service model, the firewall as service market is classified into infrastructure as a service, platform as a service, software as a service. In 2021, the infrastructure as a service segment held the highest revenue share in the firewall as service market. Users must reconsider and modify their security precautions in view of the migration to the cloud. It will be the responsibility of both the cloud service provider and the client to guarantee that security best practices are followed. One of the most important security elements is a firewall. Firewalls are typically made available to consumers by IaaS providers.Vertical Outlook

Based on Vertical, the firewall as a service market is divided into BFSI, retail, IT & telecommunication, healthcare, energy & utilities, government, manufacturing, education, and others. The BFSI segment generated the maximum revenue share in the firewall as a service market in 2021. The demand for the firewall as a service in the banking and finance sector is projected to be driven by the growing usage of the firewall as a service to avoid cyber-attacks on financial data on hybrid or any private-cloud platform.Regional Outlook

Region-wise, the firewall as a service market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the North America region led the firewall as a service market by generating the largest revenue share. This is because of things like an increase in banking fraud and cyberattack incidents. The region is now a leader in the firewall market thanks to the surge in internet use and smartphone adoption, and the rise in cybercrimes is the main driver of the firewall as a service market.The Cardinal Matrix - Firewall As A Service Market Competition Analysis

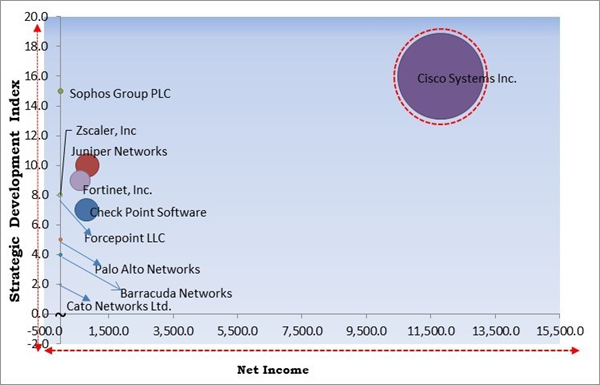

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. is the forerunner in the Firewall as A Service Market. Companies such as Juniper Networks, Inc., Fortinet, Inc., and Check Point Software Technologies Ltd. are some of the key innovators in Firewall as A Service Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Juniper Networks, Inc., Fortinet, Inc., Zscaler, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Sophos Group PLC (Thoma Bravo), Cato Networks Ltd., Forcepoint LLC (Francisco Partners), and Barracuda Networks, Inc. (Thoma Bravo)

Recent Strategies Deployed in Firewall As A Service Market

Partnerships, Collaborations and Agreements:

- Feb-2023: Fortinet, Inc. came into partnership with Dialog Enterprise, the corporate ICT solutions arm of Dialog Axiata PLC to launch Next-Generation Firewall as a Service in Sri Lanka. Through this partnership, the new virtual firewall would enable Dialog Enterprise to provide cloud-based security to any edge at any scale. Additionally, it would deliver exceptional AI-powered security performance and threat intelligence with complete visibility and secure network meeting to customers across Sri Lanka.

- Sep-2022: Palo Alto Networks joined hands with Wipro Limited, an information technology, consulting, and business process services provider, to provide managed security and network transformation solutions like SASE and cloud security. Through this collaboration, the company aimed to offer comprehensive platforms along with managed services to help its customers secure their networks, cloud, and edge in an integrated, automated, and simple manner.

- Jul-2022: Fortinet Inc. came into partnership with Alkira, a developer of a network cloud that allows businesses to build and position multi-cloud network-as-a-service in minutes. Through this partnership, Fortinet intends to integrate the new cloud security to automate the configuration and deployment of firewall services to protect inbound and outbound traffic from major cloud service providers. Moreover, Alkira mechanizes all of the network plumbing, allowing customers to insert firewall services across their Cloud Area Networking infrastructure.

- Jun-2022: Zscaler, Inc. came into partnership with Amazon web services, a company that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments. The partnership would enable both companies to deliver customers a combined solution to merge and simplify cloud security operations while assisting organizations to enhance their security architecture from ineffective legacy models to a modern Zero Trust approach designed for the cloud. Both companies share the same goal of delivering the highest quality security solutions to our joint customers and enabling them to navigate the latest cloud security requirements.

- May-2022: Zscaler, Inc. came into partnership with Siemens, a German multinational conglomerate corporation and the largest industrial manufacturing company in Europe. Through this partnership, the company intends to merge the Zscaler Zero Trust Exchange™ cloud security platform and Siemens devices to assist customers with Operational Technology (OT) infrastructures to boost their secure digital transformation initiatives. Customers would be able to securely manage, control quality assurance, and analyze production OT infrastructures and their implementation from any location. Customers would be able to digitalize their factories faster by adding a Zero Trust access layer to their OT infrastructure.

- Nov-2021: Fortinet, Inc. expanded its collaboration with Microsoft to carry the industry’s first next-generation firewall (NGFW) and Secure SD-WAN integration with Microsoft Azure Virtual WAN. Through this expanded collaboration, the company intends to deliver Azure’s secure infrastructure to customers and Fortinet’s industry-leading next-generation firewall by merging them. This amalgamation would increase the company's capacity to secure any application on any cloud and inside the cloud.

- Apr-2021: Cato Networks came into partnership with KDDI Corp, a Japanese telecommunications operator. Through this partnership, the company aimed at providing Cato SASE services across Europe, North America, and the Asia Pacific. With the help of the Cloud SASE platform, CSPs would be able to provide customers secure access to corporate resources worldwide without compromising on performance, visibility, and control.

Product Launches and Product Expansions:

- Sep-2022: Check Point Software Technologies introduced Check Point Horizon, a security operations solution and service that connects management solutions for managed prevention and response. Moreover, Horizon events provide event visibility across all Check Point products for monitoring, search, and threat hunting. It is created for security admins and analysts to explore and troubleshoot all security incidents.

- Jul-2022: Juniper Networks unveiled the new EX4100 series of enterprise-grade wired access switches, which leverage a modern microservices cloud and Mist AI to provide outstanding performance, ease, and flexibility. Through this launch, Juniper networks intend to increase its value proposition even more on campus and branch environments while also doubling down on its AI-driven advantages across the entire network lifecycle.

- Jul-2022: Fortinet has unveiled FortiCNP, a new cloud-native protection offering, designed to help clients migrate to the cloud on their own. Through this launch, FortiCNP’s Resource Risk Insights would produce context-rich, actionable insights that would assist prioritize the reduction of risks without slowing down a customer’s business.

- Mar-2022: Palo Alto Networks announced the launch of the new Palo Alto Networks Cloud NGFW for AWS, a managed Next-Generation Firewall (NGFW) service designed to simplify securing AWS deployments. The launch would enable the organization to accelerate its innovation while remaining highly secure.

- Feb-2022: Juniper Networks introduced Secure Edge, a firewall-as-a-service addition to the company's Secure Access Service Edge suite. Secure Edge provides an intrusion prevention system, anti-malware software, and secure web access capabilities. Through this launch, juniper aims to increase Security Director Cloud to bring in customers approaching SASE from a security-first perspective.

- Jul-2020: Sophos announced the launch of Sophos X-Ops, a new cross-operational unit linking SophosLabs, Sophos SecOps, and Sophos AI. Through this Launch, the company intends to assist organizations in better defending against rapidly changing and growingly complex cyberattacks. The company aims to give stronger, more high-tech protection, recognizing, and response capabilities.

Acquisitions and Mergers:

- Apr-2022: Sophos completed the acquisition of SOC.OS is an innovator of a cloud-based security alert investigation and triage automation solution. Through this acquisition, Sophos intends to expand its Adaptive Cybersecurity Ecosystem. Moreover, it would also provide Adaptive Cybersecurity Ecosystem with a wider set of third-party telemetry. This acquisition would benefit the customer as the company continues to expand.

- Feb-2022: Juniper Networks acquired WiteSand, a cloud-native zero-trust Network Access Control solutions provider. Both companies have a common goal of interrupting outdated NAC space with cloud agility and AI-driven intelligence. Moreover, Juniper customers can deliver amazing experiences to their network users, from the client to the cloud.

- Oct-2021: Forcepoint LLC completed the acquisition of Bitglass an information technology company that helps enterprises move to SaaS-based and mobile deployments securely. Through this acquisition, Forcepoint would deliver the best-in-class SSE platform presenting a modern cloud Access Security Broker (CASB), Secure Web Gateway (SWG), and Zero Trust Network Access (ZTNA).

- Jul-2021: Cisco completed the acquisition of Socio Labs, Inc. a US-based, privately held modern event technology platform designed to power the hybrid events of the future. Through this acquisition, Cisco will empower event organizers to provide the same amusing experience to both in-person and virtual attendees for events of any type, size, and format. Moreover, Socio will expand current Webex offerings beyond meetings, webinars, and webcasts to now include large-scale. With the addition of Socio, Cisco aims to provide the most flawless, comprehensive, engaging, and intelligent meeting and event attendee experience for everyone, regardless of the location or device they use to join.

- Jul-2021: Barracuda Networks, Inc. took over SKOUT Cybersecurity, a Melville, NY-based leader in cyber-as-a-service software for Managed Service Providers. Through this acquisition, Barracuda Networks expands Barracuda's suite with a powerful XDR platform for MSPs that is backed by a 24x7 SOC.

- Jul-2021: Sophos completed the acquisition of Capsule8, a pioneer and market leader of runtime visibility, noticing, and reaction for Linux production servers and containers covering on-premise and cloud workloads. Through this acquisition, the company aims to provide enterprise-grade security for Linux systems that requires placing components that are designed especially for that environment.

- Jun-2021: Cisco completed the acquisition of Sedona Systems, a technology company that offers a leading multi-vendor, cross-domain network controller. Through this acquisition, Cisco intends to bring technological strength and industry reliability to help advance the adoption of Cisco's Routed Optical Networking and provide customers with a complete and precise understanding of the network toward full automation of the merged SDN Transport network.

- May-2021: Force point LLC took over Cyberinc, a company that provides intelligent remote browser isolation (RBI) technology that offers administrators granular control that allows them to decrease risk without obstructing user productivity. The acquisition would enable the company to improve user productivity, reduce operational burdens, and eliminate traditional monolithic products.

- Feb-2021: Cisco completed the acquisition of IMImobile PLC, a leading provider of cloud communications software and services that manage business-critical customer interactions at scale, based in the United Kingdom. Through this acquisition, Cisco would provide an amazing customer experience as a service and give organizations the capacity to give better customer experiences across the entire life cycle.

- Jan-2021: Cisco took over Banzai Cloud, Zrt a privately held company headquartered in Budapest, Hungary, that specializes in deploying cloud-native applications securely. Through this acquisition, the Banzai Cloud team increases Cisco’s abilities and expertise through its demonstrated experience with complete end-to-end cloud-native application development, deployment, runtime, and security workflows. Moreover, their portfolio of open-source tools reduces friction in the development, deployment, monitoring, and management of cloud-native applications.

- Sep-2020: Check Point Software completed the acquisition of Odo Security, a cloud-based remote security company. Through this acquisition, the company would integrate remote access software with Check Point's Infinity architecture, which would help the users to connect to several applications, like web applications, remote desktops, and database servers through a unified portal with no client or software installation.

- May-2020: Zscaler, Inc., the leader in cloud security, today announced it has acquired Edgewise Networks, a pioneer in securing application-to-application communications for public clouds and data centers. Edgewise Networks significantly improves the security of east-west communication by verifying the identity of application software, services and processes to achieve a zero-trust environment which measurably reduces the attack surface and lowers the risk of application compromise and data breaches. Zscaler was founded to innovate security in a cloud-first world. We are disrupting legacy network security, reducing business risk, improving the user experience, and consolidating security point products for our customers. Edgewise is a highly innovative technology that enables application segmentation without having to do traditional network segmentation which is often done with virtual firewalls.

Scope of the Study

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Type

- Compliance & Audit Management

- Traffic Monitoring & Control

- Security Management

- Reporting & Log Management

- Automation & Orchestration

- Professional & Managed Services

- Others

By Service Model

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Vertical

- BFSI

- IT & Telecommunication

- Retail

- Education

- Healthcare & Dental

- Energy & Utilities

- Manufacturing

- Government

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Fortinet, Inc.

- Zscaler, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Group PLC (Thoma Bravo)

- Cato Networks Ltd.

- Forcepoint LLC (Francisco Partners)

- Barracuda Networks, Inc. (Thoma Bravo)

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Firewall As A Service Market, by Enterprise Size

1.4.2 Global Firewall As A Service Market, by Type

1.4.3 Global Firewall As A Service Market, by Service Model

1.4.4 Global Firewall As A Service Market, by Deployment Model

1.4.5 Global Firewall As A Service Market, by Vertical

1.4.6 Global Firewall As A Service Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition & Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Analyst's Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Market Share Analysis, 2021

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.4.2 Key Strategic Move: (Mergers and Acquisitions : 2019, Jan - 2022, Apr) Leading Players

Chapter 4. Global Firewall As A Service Market by Enterprise Size

4.1 Global Large Enterprises Market by Region

4.2 Global Small & Medium Enterprises Market by Region

Chapter 5. Global Firewall As A Service Market by Type

5.1 Global Compliance & Audit Management Market by Region

5.2 Global Traffic Monitoring & Control Market by Region

5.3 Global Security Management Market by Region

5.4 Global Reporting & Log Management Market by Region

5.5 Global Automation & Orchestration Market by Region

5.6 Global Professional & Managed Services Market by Region

5.7 Global Others Market by Region

Chapter 6. Global Firewall As A Service Market by Service Model

6.1 Global Infrastructure as a Service Market by Region

6.2 Global Platform as a Service Market by Region

6.3 Global Software as a Service Market by Region

Chapter 7. Global Firewall As A Service Market by Deployment Model

7.1 Global Public Cloud Market by Region

7.2 Global Private Cloud Market by Region

7.3 Global Hybrid Cloud Market by Region

Chapter 8. Global Firewall As A Service Market by Vertical

8.1 Global BFSI Market by Region

8.2 Global IT & Telecommunication Market by Region

8.3 Global Retail Market by Region

8.4 Global Education Market by Region

8.5 Global Healthcare & Dental Market by Region

8.6 Global Energy & Utilities Market by Region

8.7 Global Manufacturing Market by Region

8.8 Global Government Market by Region

8.9 Global Others Market by Region

Chapter 9. Global Firewall As A Service Market by Region

9.1 North America Firewall As A Service Market

9.1.1 North America Firewall As A Service Market by Enterprise Size

9.1.1.1 North America Large Enterprises Market by Country

9.1.1.2 North America Small & Medium Enterprises Market by Country

9.1.2 North America Firewall As A Service Market by Type

9.1.2.1 North America Compliance & Audit Management Market by Country

9.1.2.2 North America Traffic Monitoring & Control Market by Country

9.1.2.3 North America Security Management Market by Country

9.1.2.4 North America Reporting & Log Management Market by Country

9.1.2.5 North America Automation & Orchestration Market by Country

9.1.2.6 North America Professional & Managed Services Market by Country

9.1.2.7 North America Others Market by Country

9.1.3 North America Firewall As A Service Market by Service Model

9.1.3.1 North America Infrastructure as a Service Market by Country

9.1.3.2 North America Platform as a Service Market by Country

9.1.3.3 North America Software as a Service Market by Country

9.1.4 North America Firewall As A Service Market by Deployment Model

9.1.4.1 North America Public Cloud Market by Country

9.1.4.2 North America Private Cloud Market by Country

9.1.4.3 North America Hybrid Cloud Market by Country

9.1.5 North America Firewall As A Service Market by Vertical

9.1.5.1 North America BFSI Market by Country

9.1.5.2 North America IT & Telecommunication Market by Country

9.1.5.3 North America Retail Market by Country

9.1.5.4 North America Education Market by Country

9.1.5.5 North America Healthcare & Dental Market by Country

9.1.5.6 North America Energy & Utilities Market by Country

9.1.5.7 North America Manufacturing Market by Country

9.1.5.8 North America Government Market by Country

9.1.5.9 North America Others Market by Country

9.1.6 North America Firewall As A Service Market by Country

9.1.6.1 US Firewall As A Service Market

9.1.6.1.1 US Firewall As A Service Market by Enterprise Size

9.1.6.1.2 US Firewall As A Service Market by Type

9.1.6.1.3 US Firewall As A Service Market by Service Model

9.1.6.1.4 US Firewall As A Service Market by Deployment Model

9.1.6.1.5 US Firewall As A Service Market by Vertical

9.1.6.2 Canada Firewall As A Service Market

9.1.6.2.1 Canada Firewall As A Service Market by Enterprise Size

9.1.6.2.2 Canada Firewall As A Service Market by Type

9.1.6.2.3 Canada Firewall As A Service Market by Service Model

9.1.6.2.4 Canada Firewall As A Service Market by Deployment Model

9.1.6.2.5 Canada Firewall As A Service Market by Vertical

9.1.6.3 Mexico Firewall As A Service Market

9.1.6.3.1 Mexico Firewall As A Service Market by Enterprise Size

9.1.6.3.2 Mexico Firewall As A Service Market by Type

9.1.6.3.3 Mexico Firewall As A Service Market by Service Model

9.1.6.3.4 Mexico Firewall As A Service Market by Deployment Model

9.1.6.3.5 Mexico Firewall As A Service Market by Vertical

9.1.6.4 Rest of North America Firewall As A Service Market

9.1.6.4.1 Rest of North America Firewall As A Service Market by Enterprise Size

9.1.6.4.2 Rest of North America Firewall As A Service Market by Type

9.1.6.4.3 Rest of North America Firewall As A Service Market by Service Model

9.1.6.4.4 Rest of North America Firewall As A Service Market by Deployment Model

9.1.6.4.5 Rest of North America Firewall As A Service Market by Vertical

9.2 Europe Firewall As A Service Market

9.2.1 Europe Firewall As A Service Market by Enterprise Size

9.2.1.1 Europe Large Enterprises Market by Country

9.2.1.2 Europe Small & Medium Enterprises Market by Country

9.2.2 Europe Firewall As A Service Market by Type

9.2.2.1 Europe Compliance & Audit Management Market by Country

9.2.2.2 Europe Traffic Monitoring & Control Market by Country

9.2.2.3 Europe Security Management Market by Country

9.2.2.4 Europe Reporting & Log Management Market by Country

9.2.2.5 Europe Automation & Orchestration Market by Country

9.2.2.6 Europe Professional & Managed Services Market by Country

9.2.2.7 Europe Others Market by Country

9.2.3 Europe Firewall As A Service Market by Service Model

9.2.3.1 Europe Infrastructure as a Service Market by Country

9.2.3.2 Europe Platform as a Service Market by Country

9.2.3.3 Europe Software as a Service Market by Country

9.2.4 Europe Firewall As A Service Market by Deployment Model

9.2.4.1 Europe Public Cloud Market by Country

9.2.4.2 Europe Private Cloud Market by Country

9.2.4.3 Europe Hybrid Cloud Market by Country

9.2.5 Europe Firewall As A Service Market by Vertical

9.2.5.1 Europe BFSI Market by Country

9.2.5.2 Europe IT & Telecommunication Market by Country

9.2.5.3 Europe Retail Market by Country

9.2.5.4 Europe Education Market by Country

9.2.5.5 Europe Healthcare & Dental Market by Country

9.2.5.6 Europe Energy & Utilities Market by Country

9.2.5.7 Europe Manufacturing Market by Country

9.2.5.8 Europe Government Market by Country

9.2.5.9 Europe Others Market by Country

9.2.6 Europe Firewall As A Service Market by Country

9.2.6.1 Germany Firewall As A Service Market

9.2.6.1.1 Germany Firewall As A Service Market by Enterprise Size

9.2.6.1.2 Germany Firewall As A Service Market by Type

9.2.6.1.3 Germany Firewall As A Service Market by Service Model

9.2.6.1.4 Germany Firewall As A Service Market by Deployment Model

9.2.6.1.5 Germany Firewall As A Service Market by Vertical

9.2.6.2 UK Firewall As A Service Market

9.2.6.2.1 UK Firewall As A Service Market by Enterprise Size

9.2.6.2.2 UK Firewall As A Service Market by Type

9.2.6.2.3 UK Firewall As A Service Market by Service Model

9.2.6.2.4 UK Firewall As A Service Market by Deployment Model

9.2.6.2.5 UK Firewall As A Service Market by Vertical

9.2.6.3 France Firewall As A Service Market

9.2.6.3.1 France Firewall As A Service Market by Enterprise Size

9.2.6.3.2 France Firewall As A Service Market by Type

9.2.6.3.3 France Firewall As A Service Market by Service Model

9.2.6.3.4 France Firewall As A Service Market by Deployment Model

9.2.6.3.5 France Firewall As A Service Market by Vertical

9.2.6.4 Russia Firewall As A Service Market

9.2.6.4.1 Russia Firewall As A Service Market by Enterprise Size

9.2.6.4.2 Russia Firewall As A Service Market by Type

9.2.6.4.3 Russia Firewall As A Service Market by Service Model

9.2.6.4.4 Russia Firewall As A Service Market by Deployment Model

9.2.6.4.5 Russia Firewall As A Service Market by Vertical

9.2.6.5 Spain Firewall As A Service Market

9.2.6.5.1 Spain Firewall As A Service Market by Enterprise Size

9.2.6.5.2 Spain Firewall As A Service Market by Type

9.2.6.5.3 Spain Firewall As A Service Market by Service Model

9.2.6.5.4 Spain Firewall As A Service Market by Deployment Model

9.2.6.5.5 Spain Firewall As A Service Market by Vertical

9.2.6.6 Italy Firewall As A Service Market

9.2.6.6.1 Italy Firewall As A Service Market by Enterprise Size

9.2.6.6.2 Italy Firewall As A Service Market by Type

9.2.6.6.3 Italy Firewall As A Service Market by Service Model

9.2.6.6.4 Italy Firewall As A Service Market by Deployment Model

9.2.6.6.5 Italy Firewall As A Service Market by Vertical

9.2.6.7 Rest of Europe Firewall As A Service Market

9.2.6.7.1 Rest of Europe Firewall As A Service Market by Enterprise Size

9.2.6.7.2 Rest of Europe Firewall As A Service Market by Type

9.2.6.7.3 Rest of Europe Firewall As A Service Market by Service Model

9.2.6.7.4 Rest of Europe Firewall As A Service Market by Deployment Model

9.2.6.7.5 Rest of Europe Firewall As A Service Market by Vertical

9.3 Asia Pacific Firewall As A Service Market

9.3.1 Asia Pacific Firewall As A Service Market by Enterprise Size

9.3.1.1 Asia Pacific Large Enterprises Market by Country

9.3.1.2 Asia Pacific Small & Medium Enterprises Market by Country

9.3.2 Asia Pacific Firewall As A Service Market by Type

9.3.2.1 Asia Pacific Compliance & Audit Management Market by Country

9.3.2.2 Asia Pacific Traffic Monitoring & Control Market by Country

9.3.2.3 Asia Pacific Security Management Market by Country

9.3.2.4 Asia Pacific Reporting & Log Management Market by Country

9.3.2.5 Asia Pacific Automation & Orchestration Market by Country

9.3.2.6 Asia Pacific Professional & Managed Services Market by Country

9.3.2.7 Asia Pacific Others Market by Country

9.3.3 Asia Pacific Firewall As A Service Market by Service Model

9.3.3.1 Asia Pacific Infrastructure as a Service Market by Country

9.3.3.2 Asia Pacific Platform as a Service Market by Country

9.3.3.3 Asia Pacific Software as a Service Market by Country

9.3.4 Asia Pacific Firewall As A Service Market by Deployment Model

9.3.4.1 Asia Pacific Public Cloud Market by Country

9.3.4.2 Asia Pacific Private Cloud Market by Country

9.3.4.3 Asia Pacific Hybrid Cloud Market by Country

9.3.5 Asia Pacific Firewall As A Service Market by Vertical

9.3.5.1 Asia Pacific BFSI Market by Country

9.3.5.2 Asia Pacific IT & Telecommunication Market by Country

9.3.5.3 Asia Pacific Retail Market by Country

9.3.5.4 Asia Pacific Education Market by Country

9.3.5.5 Asia Pacific Healthcare & Dental Market by Country

9.3.5.6 Asia Pacific Energy & Utilities Market by Country

9.3.5.7 Asia Pacific Manufacturing Market by Country

9.3.5.8 Asia Pacific Government Market by Country

9.3.5.9 Asia Pacific Others Market by Country

9.3.6 Asia Pacific Firewall As A Service Market by Country

9.3.6.1 China Firewall As A Service Market

9.3.6.1.1 China Firewall As A Service Market by Enterprise Size

9.3.6.1.2 China Firewall As A Service Market by Type

9.3.6.1.3 China Firewall As A Service Market by Service Model

9.3.6.1.4 China Firewall As A Service Market by Deployment Model

9.3.6.1.5 China Firewall As A Service Market by Vertical

9.3.6.2 Japan Firewall As A Service Market

9.3.6.2.1 Japan Firewall As A Service Market by Enterprise Size

9.3.6.2.2 Japan Firewall As A Service Market by Type

9.3.6.2.3 Japan Firewall As A Service Market by Service Model

9.3.6.2.4 Japan Firewall As A Service Market by Deployment Model

9.3.6.2.5 Japan Firewall As A Service Market by Vertical

9.3.6.3 India Firewall As A Service Market

9.3.6.3.1 India Firewall As A Service Market by Enterprise Size

9.3.6.3.2 India Firewall As A Service Market by Type

9.3.6.3.3 India Firewall As A Service Market by Service Model

9.3.6.3.4 India Firewall As A Service Market by Deployment Model

9.3.6.3.5 India Firewall As A Service Market by Vertical

9.3.6.4 South Korea Firewall As A Service Market

9.3.6.4.1 South Korea Firewall As A Service Market by Enterprise Size

9.3.6.4.2 South Korea Firewall As A Service Market by Type

9.3.6.4.3 South Korea Firewall As A Service Market by Service Model

9.3.6.4.4 South Korea Firewall As A Service Market by Deployment Model

9.3.6.4.5 South Korea Firewall As A Service Market by Vertical

9.3.6.5 Singapore Firewall As A Service Market

9.3.6.5.1 Singapore Firewall As A Service Market by Enterprise Size

9.3.6.5.2 Singapore Firewall As A Service Market by Type

9.3.6.5.3 Singapore Firewall As A Service Market by Service Model

9.3.6.5.4 Singapore Firewall As A Service Market by Deployment Model

9.3.6.5.5 Singapore Firewall As A Service Market by Vertical

9.3.6.6 Malaysia Firewall As A Service Market

9.3.6.6.1 Malaysia Firewall As A Service Market by Enterprise Size

9.3.6.6.2 Malaysia Firewall As A Service Market by Type

9.3.6.6.3 Malaysia Firewall As A Service Market by Service Model

9.3.6.6.4 Malaysia Firewall As A Service Market by Deployment Model

9.3.6.6.5 Malaysia Firewall As A Service Market by Vertical

9.3.6.7 Rest of Asia Pacific Firewall As A Service Market

9.3.6.7.1 Rest of Asia Pacific Firewall As A Service Market by Enterprise Size

9.3.6.7.2 Rest of Asia Pacific Firewall As A Service Market by Type

9.3.6.7.3 Rest of Asia Pacific Firewall As A Service Market by Service Model

9.3.6.7.4 Rest of Asia Pacific Firewall As A Service Market by Deployment Model

9.3.6.7.5 Rest of Asia Pacific Firewall As A Service Market by Vertical

9.4 LAMEA Firewall As A Service Market

9.4.1 LAMEA Firewall As A Service Market by Enterprise Size

9.4.1.1 LAMEA Large Enterprises Market by Country

9.4.1.2 LAMEA Small & Medium Enterprises Market by Country

9.4.2 LAMEA Firewall As A Service Market by Type

9.4.2.1 LAMEA Compliance & Audit Management Market by Country

9.4.2.2 LAMEA Traffic Monitoring & Control Market by Country

9.4.2.3 LAMEA Security Management Market by Country

9.4.2.4 LAMEA Reporting & Log Management Market by Country

9.4.2.5 LAMEA Automation & Orchestration Market by Country

9.4.2.6 LAMEA Professional & Managed Services Market by Country

9.4.2.7 LAMEA Others Market by Country

9.4.3 LAMEA Firewall As A Service Market by Service Model

9.4.3.1 LAMEA Infrastructure as a Service Market by Country

9.4.3.2 LAMEA Platform as a Service Market by Country

9.4.3.3 LAMEA Software as a Service Market by Country

9.4.4 LAMEA Firewall As A Service Market by Deployment Model

9.4.4.1 LAMEA Public Cloud Market by Country

9.4.4.2 LAMEA Private Cloud Market by Country

9.4.4.3 LAMEA Hybrid Cloud Market by Country

9.4.5 LAMEA Firewall As A Service Market by Vertical

9.4.5.1 LAMEA BFSI Market by Country

9.4.5.2 LAMEA IT & Telecommunication Market by Country

9.4.5.3 LAMEA Retail Market by Country

9.4.5.4 LAMEA Education Market by Country

9.4.5.5 LAMEA Healthcare & Dental Market by Country

9.4.5.6 LAMEA Energy & Utilities Market by Country

9.4.5.7 LAMEA Manufacturing Market by Country

9.4.5.8 LAMEA Government Market by Country

9.4.5.9 LAMEA Others Market by Country

9.4.6 LAMEA Firewall As A Service Market by Country

9.4.6.1 Brazil Firewall As A Service Market

9.4.6.1.1 Brazil Firewall As A Service Market by Enterprise Size

9.4.6.1.2 Brazil Firewall As A Service Market by Type

9.4.6.1.3 Brazil Firewall As A Service Market by Service Model

9.4.6.1.4 Brazil Firewall As A Service Market by Deployment Model

9.4.6.1.5 Brazil Firewall As A Service Market by Vertical

9.4.6.2 Argentina Firewall As A Service Market

9.4.6.2.1 Argentina Firewall As A Service Market by Enterprise Size

9.4.6.2.2 Argentina Firewall As A Service Market by Type

9.4.6.2.3 Argentina Firewall As A Service Market by Service Model

9.4.6.2.4 Argentina Firewall As A Service Market by Deployment Model

9.4.6.2.5 Argentina Firewall As A Service Market by Vertical

9.4.6.3 UAE Firewall As A Service Market

9.4.6.3.1 UAE Firewall As A Service Market by Enterprise Size

9.4.6.3.2 UAE Firewall As A Service Market by Type

9.4.6.3.3 UAE Firewall As A Service Market by Service Model

9.4.6.3.4 UAE Firewall As A Service Market by Deployment Model

9.4.6.3.5 UAE Firewall As A Service Market by Vertical

9.4.6.4 Saudi Arabia Firewall As A Service Market

9.4.6.4.1 Saudi Arabia Firewall As A Service Market by Enterprise Size

9.4.6.4.2 Saudi Arabia Firewall As A Service Market by Type

9.4.6.4.3 Saudi Arabia Firewall As A Service Market by Service Model

9.4.6.4.4 Saudi Arabia Firewall As A Service Market by Deployment Model

9.4.6.4.5 Saudi Arabia Firewall As A Service Market by Vertical

9.4.6.5 South Africa Firewall As A Service Market

9.4.6.5.1 South Africa Firewall As A Service Market by Enterprise Size

9.4.6.5.2 South Africa Firewall As A Service Market by Type

9.4.6.5.3 South Africa Firewall As A Service Market by Service Model

9.4.6.5.4 South Africa Firewall As A Service Market by Deployment Model

9.4.6.5.5 South Africa Firewall As A Service Market by Vertical

9.4.6.6 Nigeria Firewall As A Service Market

9.4.6.6.1 Nigeria Firewall As A Service Market by Enterprise Size

9.4.6.6.2 Nigeria Firewall As A Service Market by Type

9.4.6.6.3 Nigeria Firewall As A Service Market by Service Model

9.4.6.6.4 Nigeria Firewall As A Service Market by Deployment Model

9.4.6.6.5 Nigeria Firewall As A Service Market by Vertical

9.4.6.7 Rest of LAMEA Firewall As A Service Market

9.4.6.7.1 Rest of LAMEA Firewall As A Service Market by Enterprise Size

9.4.6.7.2 Rest of LAMEA Firewall As A Service Market by Type

9.4.6.7.3 Rest of LAMEA Firewall As A Service Market by Service Model

9.4.6.7.4 Rest of LAMEA Firewall As A Service Market by Deployment Model

9.4.6.7.5 Rest of LAMEA Firewall As A Service Market by Vertical

Chapter 10. Company Profiles

10.1 Cisco Systems, Inc.

10.1.1 Company Overview

10.1.2 Financial Analysis

10.1.3 Regional Analysis

10.1.4 Research & Development Expense

10.1.5 Recent strategies and developments:

10.1.5.1 Acquisition and Mergers:

10.1.6 SWOT Analysis

10.2 Juniper Networks, Inc.

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Regional Analysis

10.2.4 Research & Development Expenses

10.2.5 Recent strategies and developments:

10.2.5.1 Product Launches and Product Expansions:

10.2.5.2 Acquisition and Mergers:

10.3 Fortinet, Inc.

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Regional Analysis

10.3.4 Research & Development Expenses

10.3.5 Recent strategies and developments:

10.3.5.1 Partnerships, Collaborations, and Agreements:

10.3.5.2 Product Launches and Product Expansions:

10.4 Zscaler, Inc.

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Regional Analysis

10.4.4 Research & Development Expense

10.4.4.1 Partnerships, Collaborations and Agreements:

10.4.4.2 Acquisition and Mergers:

10.5 Palo Alto Networks, Inc.

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Regional Analysis

10.5.4 Research & Development Expense

10.5.5 Recent strategies and developments:

10.5.5.1 Partnerships, Collaborations, and Agreements:

10.5.5.2 Product Launches and Product Expansions:

10.6 Check Point Software Technologies Ltd.

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Regional Analysis

10.6.4 Research & Development Expenses

10.6.5 Recent strategies and developments:

10.6.5.1 Product Launches and Product Expansions:

10.6.5.2 Acquisition and Mergers:

10.7 Sophos Group PLC (Thoma Bravo)

10.7.1 Company Overview

10.7.2 Recent strategies and developments:

10.7.2.1 Product Launches and Product Expansions:

10.7.2.2 Acquisition and Mergers:

10.8 Cato Networks Ltd.

10.8.1 Company Overview

10.8.2 Recent strategies and developments:

10.8.2.1 Partnerships, Collaborations, and Agreements:

10.9 Forcepoint LLC (Francisco Partners)

10.9.1 Company Overview

10.9.2 Recent strategies and developments:

10.9.2.1 Acquisition and Mergers:

10.10. Barracuda Networks, Inc. (Thoma Bravo)

10.10.1 Company Overview

10.10.2 Recent strategies and developments:

10.10.2.1 Acquisition and Mergers:

Companies Mentioned

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Fortinet, Inc.

- Zscaler, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Group PLC (Thoma Bravo)

- Cato Networks Ltd.

- Forcepoint LLC (Francisco Partners)

- Barracuda Networks, Inc. (Thoma Bravo)