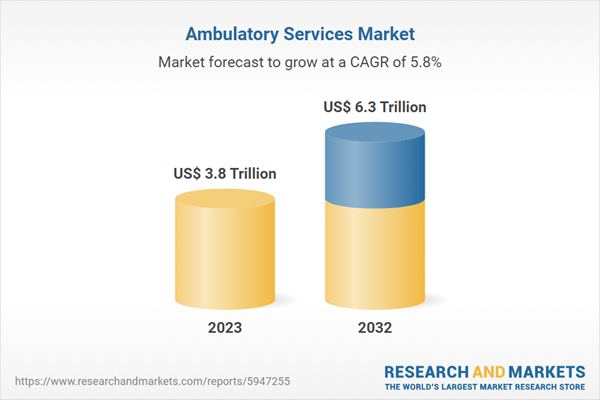

Ambulatory Services Market Analysis:

Market Growth and Size: The ambulatory services market is experiencing robust growth, attributed to the increasing demand for cost-effective healthcare solutions. This market's expansion is also fueled by the growing global elderly population, which requires frequent and accessible healthcare services.Major Market Drivers: Key drivers include the rising prevalence of chronic diseases, requiring sustained outpatient care, and the growing emphasis on patient-centered care. Additionally, cost-effectiveness, compared to inpatient services, makes ambulatory services an attractive option for both patients and healthcare providers.

Technological Advancements: The market is significantly benefiting from advancements in medical technologies, such as telehealth, minimally invasive surgical techniques, and enhanced diagnostic tools. These technologies enable ambulatory centers to offer a wider range of services, attracting more patients and broadening the market scope.

Industry Applications: Ambulatory services are increasingly used for routine medical procedures, diagnostic tests, and chronic disease management. These services cater to a diverse range of medical needs, from preventive care to complex surgical procedures, performed in an outpatient setting.

Key Market Trends: There's a noticeable trend towards the integration of AI and digital health records in ambulatory services, enhancing operational efficiency. Another trend is the increasing partnerships between ambulatory service providers and hospitals, aiming to provide a continuum of care.

Geographical Trends: The North American region, particularly the United States, dominates the ambulatory services market, largely due to its well-established healthcare infrastructure and supportive reimbursement policies. However, significant growth is also observed in the Asia-Pacific region, driven by increasing healthcare expenditures and an aging population.

Competitive Landscape: The market is characterized by a mix of large healthcare providers and small to medium-sized specialized centers. Competition is intensifying as providers focus on expanding their service offerings and geographic reach, often through mergers and acquisitions.

Challenges and Opportunities: Major challenges include regulatory compliance and managing the high operational costs of advanced medical technologies. However, these challenges present opportunities for innovation in cost management and regulatory-friendly service models, fostering further market growth.

Ambulatory Services Market Trends:

Growing Demand for Cost-Effective Healthcare Solutions

The ambulatory services market is significantly driven by the rising demand for cost-effective healthcare solutions. This sector offers a convenient and efficient alternative to hospital-based outpatient procedures, often at a lower cost. The affordability of these services, combined with their high-quality care, is particularly appealing in a healthcare landscape increasingly focused on reducing expenses while maintaining or improving patient outcomes. Ambulatory services also reduce the need for hospital stays, further cutting down healthcare costs for both providers and patients. This trend is becoming more pronounced as healthcare systems and patients alike seek more economical options for medical care, especially for routine or less complex procedures.Technological Advancements in Healthcare

Another key driver is the rapid advancement in medical technologies, which is expanding the capabilities of ambulatory services. Additionally, innovations in diagnostics, minimally invasive procedures, and telehealth are enabling ambulatory service centers to offer a broader range of services. These technological advancements enhance the efficiency and effectiveness of treatments and improve patient experiences by minimizing recovery times and increasing the convenience of receiving care. Therefore, this is positively influencing the market. With these technological improvements, procedures that once required hospitalization can be safely and effectively performed in an ambulatory setting, thus fueling the growth of this market segment.Shift Towards Patient-Centered Care

There is a growing emphasis on patient-centered care in the healthcare industry, which significantly influences the expansion of the ambulatory services market. This model prioritizes the patient's convenience, comfort, and overall experience, aligning perfectly with the nature of ambulatory services. The ability of these centers to offer personalized care, shorter wait times, and greater scheduling flexibility, as well as a more relaxed environment compared to traditional hospital settings, resonates with the increasing patient desire for more tailored and convenient healthcare experiences. This shift is encouraging more patients to choose ambulatory services for their healthcare needs, thereby contributing to the market's growth.Ambulatory Services Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2024-2032. Our report has categorized the market based on service type and department.Breakup by Service Type:

- Diagnosis

- Observation and Consultation

- Treatment

- Wellness

Rehabilitation

The report has provided a detailed breakup and analysis of the market based on the service type. This includes diagnosis, observation and consultation, treatment, wellness, and rehabilitation.The diagnostic segment of the ambulatory services market encompasses a wide range of services including imaging, blood tests, and other diagnostic procedures that can be conducted outside a traditional hospital setting. Additionally, the convenience of these services, coupled with their ability to provide rapid results, makes them highly attractive to patients seeking quick and reliable diagnoses. This sector benefits from the increasing prevalence of chronic diseases, where early and regular diagnostics play a crucial role in disease management.

The observation and consultation segment is a vital part of the ambulatory services market, focusing on patient evaluation, diagnosis, and treatment planning. Along with this, the growing telehealth and virtual consultations are enhancing this segment, offering patients remote access to healthcare professionals. This service type is crucial for managing ongoing health issues, allowing for regular monitoring and adjustments in treatment plans without the need for hospitalization.

Treatment services in the ambulatory setting include minor surgical procedures, chemotherapy, dialysis, and other therapeutic services that do not require overnight hospital stay. This segment is expanding due to advancements in medical procedures that allow for more complex treatments to be safely conducted in an outpatient environment.

The wellness and preventive services segment focuses on health promotion, disease prevention, and health maintenance. This includes routine physical examinations, vaccinations, health screenings, and lifestyle counseling. The increasing awareness about preventive healthcare, coupled with a growing focus on wellness and healthy living, is driving the demand for these services. This segment caters to a broad demographic, emphasizing the importance of early detection and prevention strategies in reducing long-term healthcare costs and improving population health.

Rehabilitation services in the ambulatory sector cover physical, occupational, and speech therapies, along with other rehabilitation programs designed for patients recovering from injuries, surgeries, or chronic conditions. The growth of this segment is propelled by the aging population and the increasing incidence of conditions like strokes, orthopedic surgeries, and sports injuries.

Breakup by Department:

- Primary Care Offices

- Outpatient Departments

- Emergency Departments

- Surgical Specialty

- Medical Specialty

Primary care offices hold the largest share in the industry

A detailed breakup and analysis of the market based on the department have also been provided in the report. This includes primary care offices, outpatient departments, emergency departments, surgical specialty, and medical specialty. According to the report, primary care offices accounted for the largest market share.As the largest segment in the ambulatory services market, primary care offices play a crucial role in providing comprehensive and continuous care to patients. This segment encompasses services such as routine check-ups, management of chronic conditions, and preventive care. The dominance of primary care offices in the market can be attributed to their pivotal role in early disease detection, ongoing patient education, and the coordination of care across different healthcare services. The accessibility and patient-centered approach of these offices make them the first point of contact for most healthcare needs, driving significant patient traffic and thereby securing their position as the market's largest segment.

Outpatient departments, often associated with hospitals or healthcare systems, offer a range of medical services that don't require hospital admission. This segment includes specialized clinics and centers for diagnostics, treatment, and follow-up care. The growth in this sector is driven by the increasing preference for outpatient care due to its convenience, cost-effectiveness, and advancement in medical procedures that allow for same-day discharge.

Emergency departments in the ambulatory services market are critical for providing immediate care for acute and urgent medical conditions. This segment is characterized by its capacity to handle a wide range of medical emergencies, from minor injuries to life-threatening conditions. The demand in this segment is driven by the need for accessible and rapid treatment for acute medical issues.

The surgical specialty segment within ambulatory services focuses on providing surgical procedures that can be performed without the need for an overnight hospital stay. This includes a variety of procedures in areas such as orthopedics, ophthalmology, and ENT (Ear, Nose, and Throat). The growth of this segment is propelled by technological advancements that enable minimally invasive surgeries, leading to quicker recovery times and reduced medical costs.

The medical specialty segment comprises specialized services in areas such as cardiology, neurology, and gastroenterology. These departments focus on diagnosing and treating specific medical conditions that require expert care. The demand in this segment is driven by the increasing prevalence of chronic diseases and the need for specialized care in managing complex health conditions.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest ambulatory services market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.As the largest segment in the ambulatory services market, North America, particularly the United States, exhibits a strong demand for outpatient care. This dominance is attributed to an advanced healthcare infrastructure, high healthcare spending, and a well-established insurance system that often covers ambulatory care services. Additionally, there is a significant focus on patient-centered care and a shift towards cost-effective healthcare solutions in the region, which further propels the growth of ambulatory services. The prevalence of chronic diseases and an aging population also contribute to the high demand for these services in North America.

The Asia-Pacific region is experiencing rapid growth in the ambulatory services market. Factors such as increasing healthcare expenditure, growing awareness about preventive care, and improvements in healthcare infrastructure are driving this growth. Additionally, the region's large and aging population, coupled with a rising prevalence of chronic diseases, necessitates accessible and efficient healthcare services. The market in this region benefits from government initiatives aimed at improving healthcare access and the gradual adoption of advanced medical technologies.

Europe's ambulatory services market is characterized by a strong network of healthcare systems, high-quality care, and substantial government support. The growth in this market is influenced by the aging population, increased prevalence of chronic diseases, and the shift towards outpatient care for cost efficiency and convenience. European countries, with their emphasis on universal healthcare coverage, also exhibit a strong demand for ambulatory services, further supported by well-established insurance systems that often cover outpatient procedures.

The Latin American ambulatory services market is growing, influenced by gradual improvements in healthcare infrastructure and an increasing focus on primary and preventive care. Despite facing challenges such as economic variability and disparities in healthcare access, the region is witnessing a rising demand for ambulatory services, driven by urbanization, a growing middle class, and a shift towards more cost-effective healthcare solutions.

In the Middle East and Africa, the ambulatory services market is emerging, with growth driven by economic development, increasing healthcare investments, and a growing awareness of health and wellness. This region also experiences a unique set of health challenges, including a high prevalence of lifestyle-related diseases, which further stimulate the demand for ambulatory care services.

Leading Key Players in the Ambulatory Services Industry:

The key players in the ambulatory services market are actively engaging in strategic collaborations, mergers, and acquisitions to expand their service offerings and geographical presence. These companies are investing in advanced medical technologies, such as telehealth and minimally invasive surgical procedures, to enhance the efficiency and scope of their services. Additionally, they are focusing on integrating electronic health records and artificial intelligence to streamline operations and improve patient care. Emphasizing patient-centered care, these players are also expanding their outpatient care facilities to accommodate a wider range of medical services, from routine check-ups to specialized treatments, catering to the growing demand for accessible and cost-effective healthcare solutions.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Envision Healthcare

- HCA Healthcare

- Healthway Medical Corporation Limited

- Medical Facilities Corporation

- Nueterra Capital

- Surgery Partners

- Surgical Care Affiliates Inc. (UnitedHealth Group Incorporated)

- Tenet Healthcare Corporation

- Terveystalo Oyj

- Universal Health Services Inc

- (Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

August 2023: HCA Healthcare and Google Cloud announced a new partnership aimed at streamlining processes on labor-intensive jobs, such clinical paperwork, using generative AI technology, freeing up doctors' and nurses' time to concentrate more on patient care.March 2023: Envision Healthcare signed a multi-year contract with Aetna, a division of CVS Health, to supply Envision doctors in areas around the country to offer in-network treatment for Medicare and commercial health insurance plan customers.

Key Questions Answered in This Report

1. What was the size of the global ambulatory services market in 2023?2. What is the expected growth rate of the global ambulatory services market during 2024-2032?

3. What are the key factors driving the global ambulatory services market?

4. What has been the impact of COVID-19 on the global ambulatory services market?

5. What is the breakup of the global ambulatory services market based on department?

6. What are the key regions in the global ambulatory services market?

7. Who are the key players/companies in the global ambulatory services market?

Table of Contents

Companies Mentioned

- Envision Healthcare

- HCA Healthcare

- Healthway Medical Corporation Limited

- Medical Facilities Corporation

- Nueterra Capital

- Surgery Partners

- Surgical Care Affiliates Inc. (UnitedHealth Group Incorporated)

- Tenet Healthcare Corporation

- Terveystalo Oyj

- Universal Health Services Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | March 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( US$ | US$ 3.8 Trillion |

| Forecasted Market Value ( US$ | US$ 6.3 Trillion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |