The ammonia market is evolving with increasing demand across agriculture, industrial applications, and clean energy initiatives. Fertilizer production remains the primary driver, as ammonia-based compounds such as urea and ammonium nitrate are essential for improving crop yields. Rising global food demand and pressure on arable land are pushing governments and agricultural sectors to maximize efficiency, further fueling market expansion. Beyond fertilizers, ammonia is seeing rising adoption in industrial applications, including refrigeration, plastics, and explosives manufacturing. Additionally, the shift toward low-carbon energy solutions is positioning ammonia as a key hydrogen carrier, driving investments in green ammonia production using renewable energy sources.

In the United States, ammonia demand is largely driven by the country’s robust agricultural sector, with major fertilizer consumption supporting crop production for both domestic use and exports. The U.S. also plays a significant role in industrial ammonia applications, particularly in chemicals and refrigerants. As per ammonia market forecast, the market dynamics are shifting with growing investments in green ammonia projects to align with national decarbonization goals. For instance, in September 2024, Ohmium International partnered with Ten08 Energy to supply green hydrogen for a 500MW clean ammonia project in Texas. The initiative aims to produce 1.4 million metric tons of clean ammonia annually, combining blue and green ammonia to meet growing global energy demands. Moreover, government policies and incentives promoting clean energy, along with advancements in carbon capture technologies, are further influencing the market’s development and long-term growth trajectory.

Ammonia Market Trends:

Increasing Demand for Green Ammonia

The global ammonia market is undergoing a notable inclination towards green ammonia, fueled by heightening environmental concerns and strict regulations on carbon emissions. According to a research article published in May 2024, the European ammonia sector is responsible for 36 million tons of carbon dioxide emission annually. Green ammonia is an eco-friendly alternative to traditionally produced ammonia as it is generated using renewable energy sources. As a result, major companies are rapidly investing in green ammonia production to reduce their carbon footprints. For instance, in July 2024, Aslan Energy Capital signed MoU to acquire 35,000 Hectors of land in Mexico for developing solar-based green ammonia production facility. The first phase is projected to produce around 600,000 Tons of green ammonia per year. The capacity is planned to double in phase two in 2030. This shift aligns with global decarbonization goals, further supported by regional incentives for green hydrogen and ammonia projects. Additionally, partnerships between energy and fertilizer companies are accelerating pilot projects and commercial-scale adoption worldwide.Rising Product Demand for Fertilizer Production

Ammonia’s crucial role as a source of nitrogen in fertilizer production primarily drives the market growth. With the increase in global population, the food demand is propelling, necessitating elevation of agricultural production. Consequently, this drives the demand for ammonia-based fertilizers. According to the data provided by The Mosaic Company, a producer of potash and phosphate for agricultural applications, more than 80% of the ammonia produced is leveraged as fertilizer. Major agricultural economies, including Brazil and India, are heavily investing to expand the production capacity for fertilizer. This trend reinforces a stable ammonia market demand, highlighting its critical role in aiding global agricultural sustainability and food security, and emphasize the need for nitrogen-rich fertilizers to sustain crop yields globally. Furthermore, government-led agricultural subsidy programs are increasing the affordability and access to ammonia-based fertilizers in developing regions.Advancements in Ammonia Synthesis Technology

The ammonia market outlook indicates expanding opportunities due to advancements in ammonia synthesis technology. The development of more effective and cost-efficient production techniques, including catalytic and electrochemical processes, is improving ammonia synthesis capabilities. Such advancements aid in carbon emission and energy consumption reduction. For instance, in March 2024, Jupiter Ionics secured USD 9 million to expand its electrochemical green ammonia technology, which uses an electrolysis process to produce ammonia with zero carbon emissions. With major companies rapidly adopting such advanced technologies, the market witnesses enhanced sustainability and productivity. This trend reflects the industry’s obligation to efficiency and innovation, bolstering competitiveness and growth in the ammonia market share. Research institutions are actively collaborating with private players to fast-track the commercialization of these novel technologies. Moreover, supportive regulatory frameworks in Europe and Asia are fostering a favorable environment for innovation and deployment.Ammonia Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global ammonia market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on physical form, application, and end use industry.Analysis by Physical Form:

- Liquid

- Powder

- Gas

Analysis by Application:

- MAP and DAP

- Urea

- Nitric Acid

- Ammonium Sulfate

- Ammonium Nitrate

- Others

Analysis by End Use Industry:

- Agrochemical

- Industrial Chemical

- Mining

- Pharmaceutical

- Textiles

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Ammonia Market Analysis

In 2024, United States accounted for 83.70% of the market share in North America. The ammonia market in the United States is driven by several key factors, with agriculture being the dominant sector. According to a 2019 report by the US Department of Agriculture (Economic Research Service), the country consumes three major categories of fertilizers: nitrogen solution (43%), urea (28%), and ammonia-based fertilizers such as anhydrous, aqua, nitrate, and sulfate (28%). Ammonia, primarily used in these fertilizers, plays a vital role in meeting the growing demand for agricultural productivity. As the US remains one of the largest producers of crops like corn, wheat, and soybeans, the need for ammonia-based fertilizers continues to rise. Additionally, the petrochemical industry significantly contributes to ammonia demand, as it is used in the production of plastics, explosives, and chemicals. The shift toward sustainable agricultural practices and the adoption of more efficient fertilizers, such as controlled-release formulations, are further driving ammonia consumption. The US government’s support through subsidies and initiatives promoting sustainable farming practices strengthens ammonia demand. The well-established ammonia production infrastructure in the US ensures a reliable supply, not only to meet domestic needs but also to support exports. These factors position the US as a key player in the global ammonia market, with ongoing demand from both agriculture and industry fueling growth.North America Ammonia Market Analysis

The North American ammonia market is influenced by strong agricultural demand, particularly for fertilizers, alongside growing industrial applications. The region benefits from abundant natural gas supplies, which serve as a key feedstock, ensuring competitive production costs. Moreover, market dynamics are shaped by fluctuations in raw material prices, regulatory pressures, and advancements in environmentally sustainable technologies such as green ammonia. Producers are focusing on improving efficiency and reducing emissions to meet sustainability targets. For instance, in July 2024, CF Industries and POET collaborated to pilot low-carbon ammonia fertilizer in U.S. corn production, aiming to reduce ethanol’s carbon intensity. The initiative used green ammonia produced with renewable energy to decarbonize both fertilizer and ethanol production. Additionally, regional trade policies, infrastructure developments, and evolving environmental standards play critical roles in shaping ammonia supply and demand within the broader North American landscape.Europe Ammonia Market Analysis

The ammonia market in Europe is influenced by several key factors, with agriculture remaining the primary driver. Ammonia, a vital component of nitrogen fertilizers, supports the region's agricultural industry, which is crucial for food security and competitiveness. According to IFOAM Organics Europe, in 2022, the EU's total area of farmland under organic production grew to 16.9 Million Hectares, and the number of organic producers increased by 10.8% to 419,112 compared to 2021. This growth reflects a rising demand for sustainable farming practices, which, in turn, is driving the use of ammonia-based fertilizers designed for organic and efficient farming. Additionally, the petrochemical industry’s demand for ammonia in the production of chemicals, plastics, and explosives also supports market growth. Europe's focus on reducing its carbon footprint and adopting green technologies is further shaping ammonia production trends, with innovations in green ammonia and low-emission processes becoming increasingly important. As sustainability continues to be a priority, the ammonia market in Europe is evolving with an emphasis on environmentally friendly and high-efficiency solutions. These factors, coupled with government regulations and agricultural demand, position Europe for continued growth in ammonia consumption.Asia Pacific Ammonia Market Analysis

The ammonia market in the Asia-Pacific (APAC) region is primarily driven by the agricultural sector, which remains a major consumer of ammonia-based fertilizers. According to the International Labour Organization (ILO), in 2.02 trillion people were employed in agriculture in the APAC region, underscoring the sector's significance. As the demand for food increases due to the rapidly growing population, ammonia remains essential for enhancing agricultural productivity, particularly through nitrogen-based fertilizers. In addition, the region's expanding industrial base, including chemicals and petrochemicals, further drives ammonia consumption for applications such as plastics and explosives. The adoption of modern farming practices and the need for high-efficiency fertilizers are also fueling ammonia demand. Furthermore, growing environmental concerns and the push for sustainable agriculture are leading to innovations in ammonia production and fertilizer technologies. With major agricultural markets like China and India continuing to focus on boosting crop yields, the ammonia market in APAC is poised for significant growth.Latin America Ammonia Market Analysis

The ammonia market in Latin America is driven by the region's strong agricultural sector, with Brazil being a key player. The country’s fertilizers market is projected to exhibit a compound annual growth rate (CAGR) of 7.20% from 2024 to 2032, reflecting increasing demand for ammonia-based fertilizers to support crop production. As Brazil remains one of the world’s leading producers of soybeans, corn, and sugarcane, the need for efficient fertilizers is expected to rise. Additionally, the region's expanding industrial base, including chemicals and petrochemicals, further boosts ammonia consumption, supporting long-term market growth in Latin America.Middle East and Africa Ammonia Market Analysis

The ammonia market in the Middle East and Africa is influenced by the agricultural sector, especially in regions like North Africa, where ammonia-based fertilizers are essential for improving crop yields. According to OPEC, the member countries in the Middle East and North Africa (MENA) collectively hold 840 Billion Barrels of proven crude oil reserves, which provides a reliable source of natural gas for ammonia production. This access to abundant feedstock supports both domestic fertilizer needs and ammonia exports. The growing emphasis on sustainable farming practices and expanding infrastructure is expected to further drive ammonia demand across the region.Competitive Landscape:

The ammonia market competitive landscape is represented by the presence of major companies that are dominating the market through large-scale production capacities and strategic partnerships. For instance, in May 2024, Johnson Matthey (JM) and thyssenkrupp Uhde signed MoU to develop a fully integrated blue ammonia solution. As per the agreement, the duo will merge thyssenkrupp Uhde’s ammonia process and JM’s LCH technology to produce blue ammonia with up to 99% of carbon dioxide capture. Heightening demand for the product in industrial and agricultural applications further accelerates competition and expands business opportunities in the ammonia market. Moreover, market participants are actively investing in superior technologies and sustainable processing practices to improve effectiveness and lower adverse impacts on environment. In addition, strategic mergers are common, targeting to strengthen market position and amplify geographic reach.The report provides a comprehensive analysis of the competitive landscape in the ammonia market with detailed profiles of all major companies, including:

- Achema AB

- BASF SE

- CF Industries Holdings Inc.

- Koch Industries Inc.

- Linde plc

- Nutrien Ltd

- OCI N.V.

- Orica Limited

- PJSC Togliattiazot

- Saudi Basic Industries Corporation

- Yara International ASA.

Key Questions Answered in This Report

1. How big is the ammonia market?2. What is the future outlook of ammonia market?

3. What are the key factors driving the ammonia market?

4. Which region accounts for the largest ammonia market share?

5. Which are the leading companies in the global ammonia market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Ammonia Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Physical Form

6.1 Liquid

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Powder

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Gas

6.3.1 Market Trends

6.3.2 Market Forecast

7 Market Breakup by Application

7.1 MAP and DAP

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Urea

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Nitric Acid

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Ammonium Sulfate

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Ammonium Nitrate

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Others

7.6.1 Market Trends

7.6.2 Market Forecast

8 Market Breakup by End Use Industry

8.1 Agrochemical

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Industrial Chemical

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Mining

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Pharmaceutical

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Textiles

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia-Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Achema AB

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.2 BASF SE

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 CF Industries Holdings Inc.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.3.4 SWOT Analysis

14.3.4 Koch Industries Inc.

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.4.3 SWOT Analysis

14.3.5 Linde plc

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 Financials

14.3.6 Nutrien Ltd

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.7 OCI N.V.

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.8 Orica Limited

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

14.3.9 PJSC Togliattiazot

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 Saudi Basic Industries Corporation

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.10.3 Financials

14.3.10.4 SWOT Analysis

14.3.11 Yara International ASA

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.11.3 Financials

14.3.11.4 SWOT Analysis

List of Figures

Figure 1: Global: Ammonia Market: Major Drivers and Challenges

Figure 2: Global: Ammonia Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Ammonia Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 4: Global: Ammonia Market: Breakup by Physical Form (in %), 2024

Figure 5: Global: Ammonia Market: Breakup by Application (in %), 2024

Figure 6: Global: Ammonia Market: Breakup by End Use Industry (in %), 2024

Figure 7: Global: Ammonia Market: Breakup by Region (in %), 2024

Figure 8: Global: Ammonia (Liquid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Ammonia (Liquid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Ammonia (Powder) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Ammonia (Powder) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Ammonia (Gas) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Ammonia (Gas) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Ammonia (MAP and DAP) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Ammonia (MAP and DAP) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Ammonia (Urea) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Ammonia (Urea) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Ammonia (Nitric Acid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Ammonia (Nitric Acid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Ammonia (Ammonium Sulfate) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Ammonia (Ammonium Sulfate) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Ammonia (Ammonium Nitrate) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Ammonia (Ammonium Nitrate) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Ammonia (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Ammonia (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Ammonia (Agrochemical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Ammonia (Agrochemical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Ammonia (Industrial Chemical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Ammonia (Industrial Chemical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Ammonia (Mining) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Ammonia (Mining) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Ammonia (Pharmaceutical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Ammonia (Pharmaceutical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Ammonia (Textiles) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Ammonia (Textiles) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Ammonia (Other End Use Industries) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Ammonia (Other End Use Industries) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: North America: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: North America: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: United States: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: United States: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Canada: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Canada: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Asia-Pacific: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Asia-Pacific: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: China: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: China: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Japan: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Japan: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: India: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: India: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: South Korea: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: South Korea: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Australia: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Australia: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Indonesia: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Indonesia: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Others: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Others: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Europe: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Europe: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Germany: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Germany: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: France: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: France: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: United Kingdom: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: United Kingdom: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Italy: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Italy: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Spain: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Spain: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Russia: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Russia: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Latin America: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Latin America: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Brazil: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Brazil: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Mexico: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Mexico: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Others: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Others: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Middle East and Africa: Ammonia Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Middle East and Africa: Ammonia Market: Breakup by Country (in %), 2024

Figure 86: Middle East and Africa: Ammonia Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 87: Global: Ammonia Industry: SWOT Analysis

Figure 88: Global: Ammonia Industry: Value Chain Analysis

Figure 89: Global: Ammonia Industry: Porter's Five Forces Analysis

List of Tables

Table 1: Global: Ammonia Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Ammonia Market Forecast: Breakup by Physical Form (in Million USD), 2025-2033

Table 3: Global: Ammonia Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Ammonia Market Forecast: Breakup by End Use Industry (in Million USD), 2025-2033

Table 5: Global: Ammonia Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Ammonia Market: Competitive Structure

Table 7: Global: Ammonia Market: Key Players

Companies Mentioned

- Achema AB

- BASF SE

- CF Industries Holdings Inc.

- Koch Industries Inc.

- Linde plc

- Nutrien Ltd

- OCI N.V.

- Orica Limited

- PJSC Togliattiazot

- Saudi Basic Industries Corporation

- Yara International ASA.

Table Information

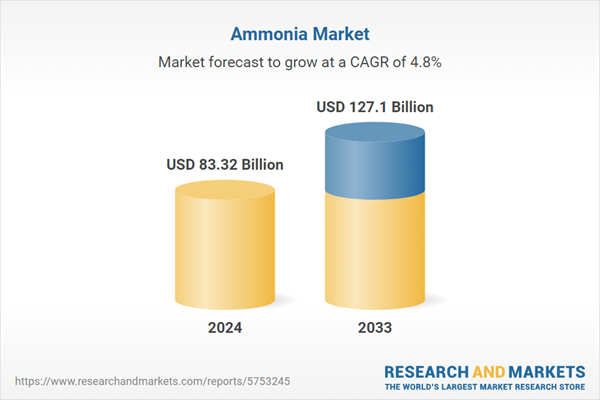

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 83.32 Billion |

| Forecasted Market Value ( USD | $ 127.1 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |