The global connected mining market is mainly propelled by magnifying requirement for safety in mining operations and superior operational efficacy. Enhancements in cloud computing, IoT, and artificial intelligence (AI) technologies facilitate improved resource management, real-time assessment, and predictive maintenance, lowering both costs and downtime. Escalating global mineral need, combined with the demand for automated sustainable and automated services, is further bolstering adoption. Moreover, stricter regulatory needs for environmental adherence as well as worker safety are incentivizing heavy investments in connected technologies. In addition, the incorporation of automation and analytics in mining applications aids in decision-making, upgrading both profitability and productivity across the industry, thereby aiding in connected mining market growth.

The United States is a crucial player in the global connected mining market, actively utilizing cutting-edge technologies to improve sustainability, safety, and operational efficacy in the mining segment. With a well-structured mining sector and substantial reserves of certain rare earth metals, coal, copper, and gold, the nation has constantly leveraged data analytics, IoT, or automation to advance resource management as well as extraction. For instance, according to the U.S. Energy Information Administration, as of January 1, 2024, the demonstrated reserve base was estimated at 469 billion short tons of coal, making U.S. coal reserves more abundant than the nation’s remaining oil and natural gas resources. In addition, the robust establishment of technology providers and beneficial regulatory policies further boost advancements and deployment of connected services. Furthermore, the U.S. market heavily profits from increasing investments in digital infrastructure, establishing it as a key country in modernizing mining operations across the world.

Connected Mining Market Trends:

Technological Advancements in Mining Operations

A primary factor propelling the connected mining market share is the rapid advancement in technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). According to the government of UK, the firms providing machine learning-based services or products across industries has elevated to 35% in 2023 from 21% in 2022. These technologies play a pivotal role in transforming traditional mining operations into more efficient, automated, and data-driven processes. The integration of IoT devices allows for real-time monitoring of equipment and environmental conditions, leading to improved safety and productivity. AI and ML algorithms enable predictive maintenance, reducing downtime and operational costs. Additionally, advanced data analytics tools are used for optimizing resource allocation and enhancing decision-making processes. As mines become more digitized, the demand for cybersecurity solutions to protect sensitive data and operations also increases, further driving technological investments in the mining sector, thus creating a positive connected mining market outlook.Increasing Focus on Safety and Sustainability

The growing emphasis on safety and environmental sustainability in mining operations is resulting in connected mining market demand. Connected technologies enable real-time monitoring of mine sites, improving worker safety by predicting hazardous situations and reducing accident risks. These technologies also facilitate remote operations, which can minimize the need for human presence in dangerous environments. Moreover, sustainability concerns are leading to the adoption of systems that can monitor and reduce the environmental impact of mining activities. For example, technologies that track energy consumption and emissions help in adhering to environmental regulations and reducing carbon footprints. According to the IEA, energy-related CO2 emissions increased by 0.9% in 2022, surpassing 36.8 Gigatons. The use of connected technologies in water and waste management ensures more sustainable resource usage. Governments and regulatory bodies are increasingly mandating the use of such technologies, which further drives the connected mining market demand.Operational Efficiency and Cost Reduction

The pursuit of operational efficiency and cost reduction is another major factor enhancing the connected mining market outlook. Connected mining technologies offer significant improvements in operational efficiency by enabling better resource management, optimizing mine planning, and reducing wastage. Real-time data collection and analysis lead to more informed and timely decisions, streamlining various mining processes. Automation of repetitive and routine tasks not only increases efficiency but also reduces labor costs and minimizes human errors. Additionally, predictive analytics help in anticipating equipment failures and scheduling maintenance, thereby avoiding costly unplanned downtimes. In an industry where profit margins can be significantly impacted by operational costs, these technologies provide a competitive advantage by enhancing productivity and reducing expenses, making them an essential investment for mining companies. For instance, as per industry reports, geospatial data analytics is a crucial component of the connected mining ecosystem, that can aid in significant 10%-15% costs reduction.Connected Mining Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, equipment type, software and services type, mining type, and solution type.Analysis by Component:

- Equipments

- Software

- Services

Analysis by Equipment Type:

- Automated Mining Excavators

- Load Haul Dump

- Drillers and Breakers

- Others

On the other hand, load haul dump units in connected mining are crucial for efficient material handling and transportation within mining sites. Enhanced with connectivity, these vehicles can be remotely operated, reducing the risk to human operators in hazardous conditions. The integration of LHDs with IoT and data analytics optimizes their routing and scheduling, enhancing operational efficiency.

Moreover, drillers and breakers equipped with advanced technology, are essential for efficient and precise resource extraction. Connectivity allows for real-time monitoring of drilling and breaking operations, ensuring optimal performance and reducing resource wastage. These tools also contribute to enhanced safety by providing immediate feedback on operation conditions and potential hazards.

Analysis by Software and Services Type:

- Data/Operations/Asset Management and Security Software

- Support and Maintenance Services

- System Integration and Deployment Services

- Others

Analysis by Mining Type:

- Surface Mining

- Underground Mining

Analysis by Solution Type:

- Connected Assets and Logistics Solutions

- Connected Control Solutions

- Connected Safety and Security Solutions

- Remote Management Solutions

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Connected Mining Market Analysis

In 2024, United States accounted for 61.70% of the market share in North America. The connected mining market in the United States is currently experiencing growth driven by the adoption of advanced IoT solutions tailored to enhance real-time monitoring and predictive maintenance across mining operations. According to the Bureau of Labor Statistics, in 2023, the mining sector accounted for approximately 606.9 Thousand jobs, representing 0.5% of the total nonfarm workforce, while contributing 1.4% to the national GDP. Mining companies are actively integrating automation technologies, including autonomous vehicles and drones, to optimize resource extraction and improve safety standards. The deployment of advanced analytics platforms is enabling the continuous analysis of operational data, helping to reduce equipment downtime and improve decision-making processes. Companies are increasingly leveraging edge computing solutions to manage and process data in remote mining locations with limited connectivity. Additionally, stringent environmental regulations are pushing firms to adopt connected solutions that monitor emissions and ensure compliance. The rising demand for mineral resources essential for clean energy technologies, such as lithium and cobalt, is encouraging the integration of connected systems to maximize yield and operational efficiency in critical mining projects.North America Connected Mining Market Analysis

In North America, the market is driven by the region's advanced technological infrastructure and the presence of major mining companies. The United States and Canada, with their vast mineral resources, are increasingly adopting these solutions to enhance operational efficiency and worker safety. For instance, according to the Government of Canada, the nation leads the world in potash production and is among the top 5 global producers of diamonds, uranium, gemstones, niobium gold, platinum group metals, indium, and titanium concentrate. Additionally, it ranks as the 4th largest producer of primary aluminum globally. In addition, the focus on sustainable mining practices, along with stringent regulations regarding environmental conservation, is pushing the mining industry towards smart and connected solutions. Moreover, significant investments in R&D by major players in the region are leading to innovations in mining technology, further propelling the market's growth.Europe Connected Mining Market Analysis

The connected mining market in Europe is witnessing notable growth due to various specific drivers. Mining companies are increasingly adopting advanced IoT and AI technologies to monitor equipment health and optimize operational efficiency in real-time. According to the European Commission, the mining and quarrying sector within the European Union achieved a net turnover of €101.9 Billion (USD 105.7 Billion) in 2021, reflecting a significant growth of nearly 40% compared to the previous year. Governments are implementing stringent regulations on environmental sustainability, encouraging mining operators to deploy connected solutions for emission monitoring and waste management. Companies are integrating predictive maintenance tools, minimizing downtime and amplifying the lifespan of critical machinery. The industry is actively leveraging 5G connectivity to enhance communication and data transfer between remote mining sites and central control hubs. Additionally, the rising focus on worker safety is driving the adoption of wearable devices and connected monitoring systems that detect hazardous conditions.Latin America Connected Mining Market Analysis

The connected mining market in Latin America is witnessing growth due to mining companies actively adopting IoT solutions for real-time monitoring of equipment and resource usage. According to the International Trade Administration, the revenue of Brazil's mining sector experienced a significant growth of 62% in 2021. Operators are deploying advanced connectivity technologies, such as LTE and 5G networks, to improve operational efficiency in remote mines. In addition to this, governments are implementing regulations to ensure sustainable mining practices, encouraging digital adoption.Middle East and Africa Connected Mining Market Analysis

The connected mining market in the Middle East and Africa is growing due to the increasing adoption of IoT solutions to optimize resource extraction and equipment performance. Moreover, companies are leveraging advanced analytics for real-time monitoring for mining activities to improve safety and lower downtime. According to the UAE Ministry of Energy and Infrastructure, the government launched the first Mineral Resources Strategy in the UAE. It aims to raise the number of mining companies in the UAE. Additionally, governments are actively promoting digital transformation in the mining bolster both sustainability and efficacy. Furthermore, rising investments in autonomous vehicles and smart machinery are addressing labor shortages and improving operational precision across key mining projects.Competitive Landscape:

The market is witnessing substantial expansion, driven by the active incorporation of leading-edge technologies, generally encompassing big data analytics, IoT, and AI, into mining operations. This incorporation significantly improves decision-making abilities, operational efficacy, and safety. Leading companies are actively emphasizing on offering integrated, extensive solutions customized to the particular demands of the mining sector. In addition to this, the market is highlighted by a blend of emerging companies specialized in digital services, established technology providers, and mining equipment producers. Moreover, acquisitions and collaborations are also being witnessed increasingly that are positively influencing the competitiveness. For instance, in July 2024, BHP, a leading mining firm that actively leverages connected mining solutions for its operations, and Lundin Mining Corporation announced the strategic acquisition of Filo Corp.'s 100% common share collaboratively. Upon the completion, Lundin Mining and BHP will establish a 50/50 joint venture. Consequently. the competitive landscape is spontaneous, with various firms striving to provide cutting-edge solutions that enhance both sustainability and productivity in mining applications.The connected mining market research report provides a comprehensive analysis of the competitive landscape in the connected mining market with detailed profiles of all major companies, including:

- ABB Group

- Accenture Plc

- Alastri

- Cisco Systems Inc.

- Hexagon AB

- Intellisense.Io

- Rockwell Automatio

- SAP SE

- Symboticware Inc.

- Trimble Inc.

Key Questions Answered in This Report

1. How big is the connected mining market?2. What is the future outlook of connected mining market?

3. What are the key factors driving the connected mining market?

4. Which region accounts for the largest connected mining market share?

5. Which are the leading companies in the global connected mining market?

Table of Contents

Companies Mentioned

- ABB Group

- Accenture Plc

- Alastri

- Cisco Systems Inc.

- Hexagon AB

- Intellisense.Io

- Rockwell Automation

- SAP SE

- Symboticware Inc. Trimble Inc.

Table Information

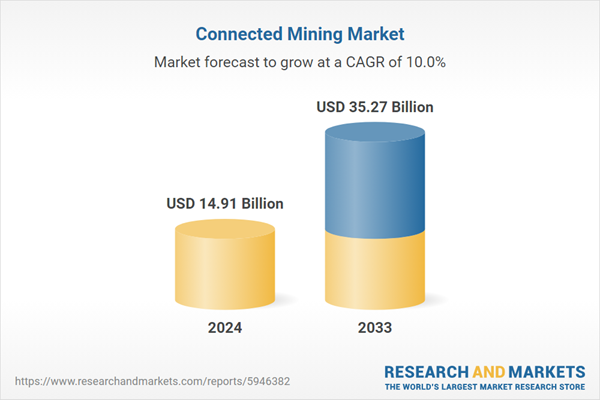

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 14.91 Billion |

| Forecasted Market Value ( USD | $ 35.27 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |