The global meat snacks industry is boosted by elevating customer shift towards on-the-go, high-protein snacks that cater to the health-aware, active lifestyles. Magnifying awareness regarding clean-label products and intense need for natural ingredient-derived, minimally processed snacks further aid market expansion. Moreover, product reformulations, encompassing healthier options, such as low-sodium or low-fat variants, varied formats, and unique flavors, appeal wide range of customer base. In addition to this, proliferating e-commerce and retail distribution platforms improve product availability, bolstering sales globally. Besides this, revolutionizing dietary habits and escalating disposable incomes in emerging nations contribute to the stable expansion of the global meat snacks segment.

The United States plays a critical role in the global meat snacks market, mainly impacted by robust customer need for convenient or protein-rich food options. The market heavily profits from a highly resilient retail infrastructure, encompassing e-commerce platforms, supermarkets, or convenience stores, guaranteeing comprehensive product accessibility. Moreover, boosting health consciousness has incentivized manufacturers to launch low-sodium and clean-label options, further appealing health-aware customers. Additionally, major players in the U.S. are currently emphasizing on formulating flavors and product diversification to sustain a leading competitive edge. For instance, in March 2024, Jack Link’s announced a strategic collaboration with Dr Pepper to introduce a unique flavor experience through their new Dr Pepper-inspired meat snacks. The range includes Dr Pepper infused beef jerky and Jack Link’s WILD Dr Pepper flavored meat sticks. Featuring the signature sweet and savory notes inspired by Dr Pepper, each bite offers a distinct and exciting taste sensation, blending the bold flavors of both brands in a truly innovative way. Furthermore, the accelerating momentum organic as well as premium meat snacks highlights the nation’s substantial contribution to global market growth.

Meat Snacks Market Trends:

Rising Demand for Convenient Snacking Options

Consumers increasingly favor convenient snacking options on account of their hectic schedules and inflating spending capacities, which is creating a positive outlook for the overall market. Furthermore, the escalating working population requiring ready-to-eat food options, like frozen meat snacks, is also contributing to the market growth. According to Convenience Store Products magazine, meat snacks in 2021 generated approximately USD 2.16 Billion in sales across convenience stores in the United States, with Old Trapper ranking as the third best-selling traditional jerky brand. Additionally, according to the publisher, the global ready-to-eat (RTE) food market size reached USD 181.5 Billion in 2023. Looking forward, the publisher expects the market to reach USD 262.4 Billion by 2032, exhibiting a growth rate (CAGR) of 4.18% during 2024-2032. Such a significant growth in the ready-to-eat food market indicates an impelling demand for convenient snacking options like meat snacks, which is anticipated to propel the meat snacks market share.Increasing Popularity of High Protein Snacks

Consumers are increasingly prioritizing protein-rich diets for various health benefits, including muscle building, weight management, and sustained energy levels. The International Food Information Council Foundation reports that 50% of consumers are interested in incorporating more protein into their diets, and 37% believe that protein aids in weight loss. Meat snacks, such as jerky, offer a convenient and portable source of high-quality protein, appealing to fitness enthusiasts, athletes, and health-conscious individuals alike. This, in turn, is positively impacting the meat snacks market outlook. Consumers are increasingly seeking snacks that are rich in protein and feature traditional meat offerings reimagined with sophisticated flavor profiles and formulations to project a natural product image. For example, in March 2021, Cherkizovo Group introduced a new line of meat snacks under the Cherkizovo Premium brand, available in three categories: pork, chicken, and turkey. These snacks are crafted from cured and dried meats. Moreover, the introduction of less conventional protein sources like turkey, seafood, and game meats, along with the expansion of product offerings such as power packs, bars, and deli bites in the refrigerated section, is revitalizing the category and creating new opportunities for snacking occasions, thereby creating a positive meat snacks market outlook.Emerging Preferences for Plant-Based Meat Snacks

The growing consumer interest in plant-based alternatives due to health, environmental, and ethical considerations is offering lucrative growth opportunities to the overall market. These snacks offer a meat-like experience without animal-derived ingredients, appealing to vegetarians, vegans, and flexitarians seeking protein-rich options. As a result, various leading manufacturers are now introducing plant-based meat to expand their consumer base and propel sales. For instance, in February 2022, VegaBytz launched its range of plant-based, entirely vegan meat alternatives in India. The product line includes ready-to-eat meals and curry options, such as vegan meat, chicken, and tuna, all crafted exclusively from plant ingredients. In addition to this, several firms active in this market are currently emphasizing on opting for tactical measures to attain a robust foothold in nations that host magnified population with vegan or vegetarian diet. This, in turn, is expected to bolster meat snacks market growth over the forecasted period.Meat Snacks Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global meat snacks market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, flavor, and distribution channel.Analysis by Product Type:

- Jerky

- Sticks

- Sausages

- Others

Analysis by Source:

- Pork

- Beef

- Poultry

- Others

Analysis by Flavor:

- Original

- Peppered

- Teriyaki

- Others

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Meat Snacks Market Analysis

In 2024, United States accounted for 87.60% of the market share in North America. The US meat snacks industry shows remarkable growth rates because consumers demand snacks rich in protein and convenient food choices. The wider convenience food market at USD 115.33 Billion in 2023 functions as a key factor behind this market growth. Industry projections released by the publisher Group indicate that the market will expand to USD 165.58 Billion by 2032 at a compound annual growth rate (CAGR) of 3.50% throughout the period 2024-2032. Furthermore, high-protein low-carb alternatives such as jerky and sausages are experiencing increased demand because consumers have become more health conscious. Clean-label consumption trends and increasing demand for premium meat snacks featuring organic and grass-fed products enable the market's development. Prior commitments and urban sprawl have increased the number of people who snack between meals which drives the growing demand for ready-to-eat meat snacks. In addition, population expansion together with innovations in snack formats and packaging design, along with a wider selection of superior snack tastes has driven the market’s growth trajectory. Future projections show strong growth potential for the meat snacks market because of rising demand for protein-based snacks together with rising incomes.Asia Pacific Meat Snacks Market Analysis

The growing middle-class population and rising disposable incomes in APAC are driving demand for convenient, protein-rich snack options. As reported by the World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3%. This urbanization, along with shifting consumer lifestyles, is significantly contributing to the rising popularity of meat snacks. Consumers in the region are increasingly turning to meat-based snacks as an alternative to traditional snacks, driven by a desire for more protein-packed, healthy options. Western food trends are also making their mark, with products like jerky and other processed meats gaining popularity. Health-conscious individuals are seeking snacks that align with high-protein, low-carb diets, further boosting demand. With rapid urban growth and a shift in dietary preferences, the APAC meat snacks market is poised for continued expansion, particularly in countries like China, Japan, and India.Europe Meat Snacks Market Analysis

The European meat snacks market is experiencing robust growth, driven by shifting consumer preferences and evolving dietary trends. Poultry is the most commonly consumed animal meat in the region, with 60% of European consumers including it in their meals at least once a week, according to industry reports. This preference for poultry, along with a growing demand for high-protein, low-carb snacks, is fueling the rise of meat snacks. In addition, approximately 40% of Europeans consume fish, beef, or pork at least once a week, which further supports the expansion of meat-based snack options. The demand for convenient, ready-to-eat solutions, coupled with the increasing popularity of clean-label and premium products, continues to shape the market. Consumers are increasingly seeking healthier alternatives, such as organic and grass-fed meat snacks, alongside a growing interest in local and sustainable sourcing. Innovation in flavors and packaging formats is also playing a crucial role in market growth, as manufacturers cater to the diverse tastes and preferences of European consumers. With these trends, the meat snacks sector is well-positioned for sustained growth across the region, particularly in countries like the UK, Germany, and France.Latin America Meat Snacks Market Analysis

The growing demand for convenient, protein-rich snack options in Latin America is being driven by rising disposable incomes and shifting consumer preferences. Urbanization is a key factor, with reports noting that around 80% of the population in Latin American countries now live in urban areas, a higher rate than most other regions. This urban growth has led to an increasing preference for on-the-go solutions, further fueling the meat snacks market. Consumers are also seeking healthier alternatives and local flavor options, contributing to the sector’s expansion. As urbanization continues, particularly in countries like Brazil and Mexico, the market is expected to grow substantially.Middle East and Africa Meat Snacks Market Analysis

The Middle East and North Africa (MENA) region, according to the World Bank, has already reached 64% urbanization, and this figure is expected to rise further. As urbanization progresses, demand for convenient, protein-rich snack options has surged. The growing urban population, coupled with higher disposable incomes, is driving the consumption of meat snacks. Western food trends are influencing the market, and a young, dynamic population continues to seek on-the-go snack solutions. These factors collectively support the expansion of the meat snacks sector across MENA, fostering market growth in this region.Competitive Landscape:

The global market exhibits extensive competitive, with leading players actively emphasizing on clean-label product lines, product enhancements, variety of flavor profiles, to appeal a broad range of customers, including the one with high health-consciousness. Major firms dominate through their robust brand recognition and comprehensive distribution networks. In addition to this, emerging as well as regional players also facilitate meat snacks market demand by addressing the localized preferences or tastes. Tactical collaborations, mergers, or acquisitions are highly prevalent deployed to improve product portfolios and proliferate market foothold. For instance, in May 2024, Western Smokehouse Partners, a prominent meat snack firm, announced strategic acquisition of Golden Valley Natural, a meat snack producer, to tactically proliferate its market presence as well as product lines. Besides this, innovations in preservation as well as packaging technologies have facilitated manufacturers to expand shelf life while sustaining quality, further magnifying competition in this rapidly transforming market.The report provides a comprehensive analysis of the competitive landscape in the meat snacks market with detailed profiles of all major companies, including:

- Bridgford Foods Corporation

- Conagra Brands Inc.

- General Mills Inc.

- Hormel Foods Corporation

- Jack Link's LLC

- Monogram Food Solutions LLC

- Nestlé S.A.

- Meatsnacks Group Ltd. (New World Foods Europe Limited)

- Tyson Foods Inc.

- Werner Gourmet Meat Snacks Inc.

Key Questions Answered in This Report

1. How big is the meat snacks market?2. What is the future outlook of meat snacks market?

3. What are the key factors driving the meat snacks market?

4. Which region accounts for the largest meat snacks market share?

5. Which are the leading companies in the global meat snacks market?

Table of Contents

Companies Mentioned

- Bridgford Foods Corporation

- Conagra Brands Inc.

- General Mills Inc.

- Hormel Foods Corporation

- Jack Link's LLC

- Monogram Food Solutions LLC

- Nestlé S.A.

- Meatsnacks Group Ltd. (New World Foods Europe Limited)

- Tyson Foods Inc.

- Werner Gourmet Meat Snacks Inc.

Table Information

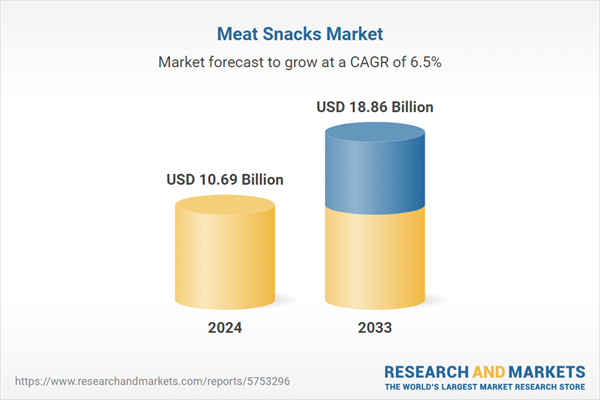

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 10.69 Billion |

| Forecasted Market Value ( USD | $ 18.86 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |