The global stepper system market growth is primarily driven by the increasing industrial automation which is boosting demand for precise motion control solutions in manufacturing and logistics. In addition, the growth in robotics adoption across industries such as automotive, electronics, and healthcare is fueling stepper motor usage and aiding the market growth. For example, Mercedes-Benz has invested in Texas-based robotics company Apptronik and is testing humanoid robots in manufacturing tasks, reflecting a shift toward automation in the automotive industry. Moreover, the rising demand for medical devices requiring high-precision motors, such as imaging systems and robotic-assisted surgeries, is contributing to the market expansion. Besides this, advancements in semiconductor manufacturing are increasing the need for stepper systems in wafer processing, providing an impetus to the market. Also, the expanding electric vehicle (EV) production is driving demand for efficient motor control systems, further impelling the market growth.

The United States stepper system market, accounting for 91.30% of the global share, is driven by the strong aerospace and defense sector demands for precise motion control for satellite positioning, avionics, and military robotics. In line with this, the expansion of smart factories with Industry 4.0 adoption is increasing the need for automated motion control solutions and supporting the market growth. Moreover, the growth in 3D printing and computer numerical control (CNC) machining is fostering the need for stepper motors in precision manufacturing. Concurrently, the increasing demand for renewable energy (RE) systems like solar tracking mechanisms is driving adoption and boosting the stepper system market demand. In confluence with this, the rising investments in biotech and pharmaceutical automation are expanding applications in laboratory equipment and providing an impetus to the market. Furthermore, the continuous advancements in consumer electronics manufacturing are creating new opportunities for compact, high-torque stepper systems, thereby propelling the market forward.

Stepper System Market Trends:

Significant Growth in the Robotics Industry Driving Market Expansion

The rapid expansion of the robotics industry is a major factor boosting the stepper system market share. The International Federation of Robotics reports that worldwide operational robot units reached 3.9 million units representing the escalating market need for automated systems. Industrial machine and robot manufacturers require stepper motors because they deploy easily and perform better in automated equipment implementations to increase efficiency. Reports also indicate that the global robotics industry will expand at an annual growth rate of 16.35% between 2025 to 2033 and reach USD 178.7 billion. The market started 2024 at USD 53.2 billion. As a result, the combination of automated requirements and industrial development creates new opportunities for stepper systems to spread throughout different sectors.Development of Miniaturized Motors Enhancing Product Adoption

The development of miniaturized stepper motors has significantly expanded their adoption in applications requiring high precision, torque, and speed control. Industries such as robotics, medical devices, and consumer electronics increasingly rely on compact stepper motors for efficiency and performance. These motors offer enhanced operational accuracy, making them ideal for precision equipment, automated machinery, and space-constrained applications. For instance, in 2024, Kollmorgen launched the POWERMAX II® M and P Series stepper motors, delivering high torque in a compact design, catering to applications requiring precision and space efficiency. The increasing need for high-performance, lightweight motors has spurred innovation, and energy efficiency and torque density have consequently improved. With industries going all out to miniaturize without sacrificing performance, next-generation stepper motors with sophisticated design capabilities are poised to see greater traction. This shift is significantly enhancing the stepper system market outlook.Technological Advancements in Stepper Motors Creating a Positive Market Outlook

Innovations in stepper motor technology, including the integration of input/output (I/O) terminals, have enhanced their efficiency, making them more cost-effective and suitable for compact machinery. These advancements provide superior performance in applications with spatial constraints, enabling greater flexibility in industrial automation. For example, in 2024, Siemens' introduction of a fully electronic e-Starter using semiconductor technology has further improved motor efficiency and reliability, supporting the trend toward compact and advanced motor control solutions. The continuous evolution of stepper motor designs, including improved torque-to-size ratios and digital control capabilities, is driving their adoption across industries. Additionally, rapid industrialization and extensive R&D initiatives are influencing the stepper system market trends. As manufacturers focus on enhancing precision, energy efficiency, and durability, stepper motors are becoming increasingly vital in automated manufacturing, medical equipment, and high-performance machinery, shaping the future of motion control technology.Stepper System Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global stepper system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component type and end-use.Analysis by Component Type:

- Stepper Motors

- Stepper Drivers

Analysis by End-Use:

- Industrial Machinery

- Medical Devices

- Semiconductor Machinery

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

North America Stepper System Market Analysis

The North America stepper system market is steadily growing because of expanding industrial automation across manufacturing sectors, healthcare systems, and robotic applications. The United States along with Canada possesses an advanced industrial foundation that leads to escalating needs for precise motion control technologies. For instance, Honeywell announced plans to split into three independent companies, aiming to enhance focus on automation and aerospace sectors, potentially increasing demand for precise motion control solutions. Moreover, industrial sectors, medical institutions, and automotive companies are progressively adopting stepper motors for their applications. Besides this, the improved performance and efficiency are driven by the miniature motor development and integrated control technology advancements. Government programs that promote industrial automation and smart manufacturing are also impelling the market growth. As a result, the market demonstrates strong growth potential through continuous technological development and R&D investments.United States Stepper System Market Analysis

The United States stepper system market is expanding driven by semiconductor manufacturing companies, medical device developers, and robotic manufacturers. Stepper systems serve diverse precision motion control requirements due to their ability to deliver precise positioning and speed control. Moreover, the industries are increasingly accepting automation technologies, which is strengthening the market share. Besides this, the semiconductor market expansion drives market growth through its booming sector because stepper systems are essential for semiconductor fabrication operations. According to the Semiconductor Industry Association, The CHIPS Act initiated more than 90 new semiconductor manufacturing projects which received nearly USD 450 Billion worth of investments across 28 states during August 2024. The increasing semiconductor production will create substantial growth opportunities for stepper systems used in precise motion control systems. Additionally, the market players release upgraded stepper systems equipped with controller units along with efficient motors and improved torque functions to fulfill modern customer needs. Furthermore, increasing stepper system applications in 3D printing, aerospace, and laboratory equipment are providing an impetus to the market. As a result, continued technological development and industrial automation expansion will drive substantial growth of the United States stepper system market throughout the upcoming years.Europe Stepper System Market Analysis

The Europe stepper system market is growing, driven by the region's strong focus on industrial automation and advanced manufacturing technologies. Stepper systems are widely utilized in the automotive, electronics, and healthcare sectors for precision motion control applications. The increasing adoption of automated production lines and robotic systems is boosting market demand. According to the European Commission, the robotics market is set to exceed 90 Billion EUR by 2030, further supporting the demand for stepper systems as essential components in robotic applications. Market players are offering high-performance stepper motors with enhanced durability and precision to cater to various industrial needs. Additionally, the rising trend of miniaturized electronic devices and customized motion control systems is supporting market expansion. With the ongoing digital transformation in industries and the escalating investment in automation technologies, the Europe stepper system market is expected to witness steady growth in the foreseeable future.Asia Pacific Stepper System Market Analysis

The stepper system market within Asia Pacific demonstrates strong expansion because of regional electronics manufacturing industries, automotive sector, and robotics industries. These countries play a significant role in market expansion because the rising demand for automation technologies together with precision motion control systems continues to support their growth. Consumer electronics and medical devices gain popularity at a time that boosts market demand. The International Federation of Robotics reported that China's factories now operate 1,755,132 industrial robots in their facilities while also experiencing a 17% rise which demonstrates the region's expanding automation needs. The rising market demand encourages manufacturers to introduce affordable stepper systems with advanced features suitable for industrial applications. The Asia Pacific stepper system market will experience substantial growth during the next few years due to fast industrialization together with technological improvements and rising industrial robot adoption.Latin America Stepper System Market Analysis

The Latin America stepper system market is gradually expanding, supported by the region's growing automotive, medical devices, and packaging industries. The increasing adoption of industrial automation technologies in manufacturing sectors is boosting the demand for stepper systems. The rising focus on factory automation and precision motion control solutions is further accelerating market growth. For instance, Brazil's factory automation and industrial controls market size reached USD 10.5 Billion in 2024, with expectations to reach USD 17.8 Billion by 2033, exhibiting a CAGR of 5.94% during 2025-2033, according to the publisher. Market players are offering compact and energy-efficient stepper systems to meet the diverse requirements of industries. Additionally, the growing investment in smart manufacturing solutions and the increasing need for automated motion control applications are contributing to market expansion.Middle East and Africa Stepper System Market Analysis

The Middle East and Africa stepper system market is witnessing gradual growth, driven by the increasing demand for automated systems across the healthcare, oil and gas, and manufacturing sectors. Stepper systems play a vital role in laboratory equipment, robotic systems, and industrial machinery, enabling precise motion control and positioning in various applications. The rising adoption of smart manufacturing technologies and automated laboratory instruments is supporting market expansion. Saudi Arabia's smart manufacturing market size reached USD 3.32 billion in 2024, and is projected to reach USD 10.97 billion by 2033, exhibiting a CAGR of 14.2% during 2025-2033 according to the publisher. This growing focus on industrial automation and technological innovation is further boosting the demand for advanced stepper systems.Competitive Landscape:

Market participants in the stepper system market are actively engaging in investments in technological developments, including integrated control systems, improved torque efficiency, and miniaturized designs to provide greater performance. Firms are also emphasizing strategic alliances and mergers to diversify their global footprint and consolidate supply chains. The increasing adoption of smart manufacturing and Industry 4.0 is compelling manufacturers to create stepper motors with improved connectivity and real-time monitoring features. In addition, companies are ramping up R&D spending to support new applications in robotics, electric vehicles, and medical devices. As demand rises, most players are boosting production capacities in the Asia Pacific to take advantage of cost benefits and serve regional demand. Sustainability efforts, such as energy-efficient motor designs, are also becoming popular among major market players.The report provides a comprehensive analysis of the competitive landscape in the stepper system market with detailed profiles of all major companies, including:

- ABB

- Beckhoff Automation

- MinebeaMitsumi

- Nidec Corporation

- Nippon Pulse Motor Co. Ltd.

- Oriental Motor Co. Ltd.

- Parker Hannifin

- Sanyo Denki Co. Ltd.

- Schneider Electric SE

Key Questions Answered in This Report

1. How big is the stepper system market?2. What is the future outlook of the stepper system market?

3. What are the key factors driving the stepper system market?

4. Which region accounts for the largest stepper system market share?

5. Which are the leading companies in the global stepper system market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Stepper System Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Component Type

6.1 Stepper Motors

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Stepper Drives

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by End-Use

7.1 Industrial Machinery

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Medical Devices

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Semiconductor Machinery

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Region

8.1 North America

8.1.1 United States

8.1.1.1 Market Trends

8.1.1.2 Market Forecast

8.1.2 Canada

8.1.2.1 Market Trends

8.1.2.2 Market Forecast

8.2 Asia Pacific

8.2.1 China

8.2.1.1 Market Trends

8.2.1.2 Market Forecast

8.2.2 Japan

8.2.2.1 Market Trends

8.2.2.2 Market Forecast

8.2.3 India

8.2.3.1 Market Trends

8.2.3.2 Market Forecast

8.2.4 South Korea

8.2.4.1 Market Trends

8.2.4.2 Market Forecast

8.2.5 Australia

8.2.5.1 Market Trends

8.2.5.2 Market Forecast

8.2.6 Indonesia

8.2.6.1 Market Trends

8.2.6.2 Market Forecast

8.2.7 Others

8.2.7.1 Market Trends

8.2.7.2 Market Forecast

8.3 Europe

8.3.1 Germany

8.3.1.1 Market Trends

8.3.1.2 Market Forecast

8.3.2 France

8.3.2.1 Market Trends

8.3.2.2 Market Forecast

8.3.3 United Kingdom

8.3.3.1 Market Trends

8.3.3.2 Market Forecast

8.3.4 Italy

8.3.4.1 Market Trends

8.3.4.2 Market Forecast

8.3.5 Spain

8.3.5.1 Market Trends

8.3.5.2 Market Forecast

8.3.6 Russia

8.3.6.1 Market Trends

8.3.6.2 Market Forecast

8.3.7 Others

8.3.7.1 Market Trends

8.3.7.2 Market Forecast

8.4 Latin America

8.4.1 Brazil

8.4.1.1 Market Trends

8.4.1.2 Market Forecast

8.4.2 Mexico

8.4.2.1 Market Trends

8.4.2.2 Market Forecast

8.4.3 Others

8.4.3.1 Market Trends

8.4.3.2 Market Forecast

8.5 Middle East and Africa

8.5.1 Market Trends

8.5.2 Market Breakup by Country

8.5.3 Market Forecast

9 SWOT Analysis

9.1 Overview

9.2 Strengths

9.3 Weaknesses

9.4 Opportunities

9.5 Threats

10 Value Chain Analysis

11 Porters Five Forces Analysis

11.1 Overview

11.2 Bargaining Power of Buyers

11.3 Bargaining Power of Suppliers

11.4 Degree of Competition

11.5 Threat of New Entrants

11.6 Threat of Substitutes

12 Price Indicators

13 Competitive Landscape

13.1 Market Structure

13.2 Key Players

13.3 Profiles of Key Players

13.3.1 ABB

13.3.1.1 Company Overview

13.3.1.2 Product Portfolio

13.3.1.3 Financials

13.3.1.4 SWOT Analysis

13.3.2 Beckhoff Automation

13.3.2.1 Company Overview

13.3.2.2 Product Portfolio

13.3.2.3 Financials

13.3.3 MinebeaMitsumi

13.3.3.1 Company Overview

13.3.3.2 Product Portfolio

13.3.3.3 Financials

13.3.3.4 SWOT Analysis

13.3.4 Nidec Corporation

13.3.4.1 Company Overview

13.3.4.2 Product Portfolio

13.3.4.3 Financials

13.3.4.4 SWOT Analysis

13.3.5 Nippon Pulse Motor Co. Ltd.

13.3.5.1 Company Overview

13.3.5.2 Product Portfolio

13.3.6 Oriental Motor Co. Ltd.

13.3.6.1 Company Overview

13.3.6.2 Product Portfolio

13.3.7 Parker Hannifin

13.3.7.1 Company Overview

13.3.7.2 Product Portfolio

13.3.7.3 Financials

13.3.7.4 SWOT Analysis

13.3.8 Sanyo Denki Co. Ltd.

13.3.8.1 Company Overview

13.3.8.2 Product Portfolio

13.3.8.3 Financials

13.3.9 Schneider Electric SE

13.3.9.1 Company Overview

13.3.9.2 Product Portfolio

13.3.9.3 Financials

List of Figures

Figure 1: Global: Stepper System Market: Major Drivers and Challenges

Figure 2: Global: Stepper System Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Stepper System Market: Breakup by Component Type (in %), 2024

Figure 4: Global: Stepper System Market: Breakup by End-Use (in %), 2024

Figure 5: Global: Stepper System Market: Breakup by Region (in %), 2024

Figure 6: Global: Stepper System Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 7: Global: Stepper System (Stepper Motors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 8: Global: Stepper System (Stepper Motors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 9: Global: Stepper System (Stepper Drives) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Stepper System (Stepper Drives) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Stepper System (Industrial Machinery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Stepper System (Industrial Machinery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Stepper System (Medical Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Stepper System (Medical Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Stepper System (Semiconductor Machinery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Stepper System (Semiconductor Machinery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Stepper System (Other End-Uses) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Stepper System (Other End-Uses) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: North America: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: North America: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: United States: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: United States: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Canada: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Canada: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Asia Pacific: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Asia Pacific: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: China: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: China: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Japan: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Japan: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: India: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: India: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: South Korea: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: South Korea: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Australia: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Australia: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Indonesia: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Indonesia: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Others: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Others: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Europe: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Europe: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Germany: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Germany: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: France: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: France: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: United Kingdom: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: United Kingdom: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Italy: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Italy: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Spain: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Spain: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Russia: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Russia: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Others: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Others: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Latin America: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Latin America: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Brazil: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Brazil: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: Mexico: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: Mexico: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: Others: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: Others: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: Middle East and Africa: Stepper System Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: Middle East and Africa: Stepper System Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Global: Stepper System Industry: SWOT Analysis

Figure 68: Global: Stepper System Industry: Value Chain Analysis

Figure 69: Global: Stepper System Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Stepper System Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Stepper System Market Forecast: Breakup by Component Type (in Million USD), 2025-2033

Table 3: Global: Stepper System Market Forecast: Breakup by End-Use (in Million USD), 2025-2033

Table 4: Global: Stepper System Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 5: Global: Stepper System Market: Competitive Structure

Table 6: Global: Stepper System Market: Key Players

Companies Mentioned

- ABB

- Beckhoff Automation

- MinebeaMitsumi

- Nidec Corporation

- Nippon Pulse Motor Co. Ltd.

- Oriental Motor Co. Ltd.

- Parker Hannifin

- Sanyo Denki Co. Ltd.

- Schneider Electric SE.

Table Information

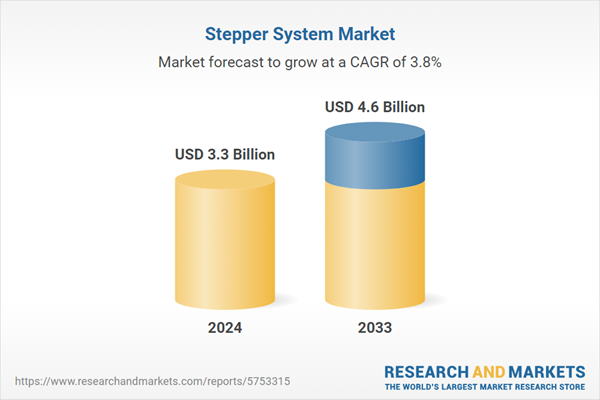

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |