A metering pump is a precision instrument that accurately and consistently delivers fluids in precise quantities. It operates by displacing a specific volume of liquid with each stroke or rotation to ensure a highly controlled and reliable flow rate. It is designed to handle a wide range of viscosities, such as thin chemicals and highly viscous fluids, and is known for its enhanced repeatability and durability. As it is suitable for applications where precise dosing or proportional mixing of chemicals is critical, the demand for metering pump is increasing across the globe.

At present, the rising adoption of metering pumps, as they can handle corrosive and abrasive fluids efficiently, is supporting the growth of the market. Besides this, the increasing need for precise dosing and maintaining product quality in the pharmaceutical industry is strengthening the growth of the market. Additionally, the growing demand for metering pumps in the healthcare industry in diagnostic equipment for safe and accurate patient outcomes is positively influencing the market. Apart from this, various innovations in metering pump technology to enhance their efficiency, reliability, and ease of integration into various processes are providing lucrative growth opportunities to industry investors. Furthermore, the rising need for accurate fluid control systems, along with the increasing popularity of automation in several sectors, is bolstering the growth of the market.

Metering Pump Market Trends/Drivers:

Rising number of oil and gas exploration and production activities

The rising number of oil and gas exploration and production activities around the world is strengthening the growth of the market. The oil and gas industry relies on these pumps for a wide range of applications, such as injecting chemicals into drilling operations, enhancing oil recovery, and controlling corrosion in pipelines and refineries. In line with this, these pumps play a vital role in providing precision dosing of chemicals and optimizing these processes. Besides this, the rising adoption of metering pumps due to the increasing demand for energy is bolstering the growth of the market. In addition, there is an increase in awareness about the importance of accurate chemical injection.Increasing demand for specialty chemicals

The increasing need for specialty chemicals that are tailored to meet specific requirements of various sectors is contributing to the growth of the market. These chemicals can range from high-performance additives and coatings to unique pharmaceutical intermediates and serve sectors, such as electronics, automotive, and healthcare. In line with this, these pumps offer accurate dosing of various chemicals during production processes. They also ensure precise and consistent dosing for catalysts, colorants, or reactive agents, which is critical for maintaining product quality and minimizing waste. Apart from this, the rising demand for specialty chemicals in the personal care and cosmetic sector to develop innovative and high-quality products is offering a positive market outlook.Growing need for precise and controlled dosing of various food ingredients

The growing need for precise and controlled dosing in the food and beverage (F&B) sector is propelling the growth of the market. These pumps play a vital role in the accurate dosing of various ingredients, additives, and flavorings during food and beverage production. In addition, these pumps ensure consistency in taste, texture, and quality of food products. The rising consumer demand for customized and unique products, such as beverages, sauces, and processed foods, is bolstering the growth of the market. These pumps enable manufacturers to experiment with new flavors and ingredients and offer versatility in product development. Moreover, stringent hygiene and food safety regulations encourage accurate dosing of preservatives to minimize waste.Metering Pump Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and application.Breakup by Type:

- Diaphragm Pumps

- Piston Pumps

- Others

Diaphragm pumps represent the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes diaphragm pumps, piston pumps, and others. According to the report, diaphragm pumps represented the largest segment. Diaphragm pumps are known for their enhanced reliability and precision in delivering fluids in a wide range of industries. They operate using a flexible diaphragm that moves back and forth, while creating a chamber to draw in and expel the fluid. This design ensures that the fluid remains isolated from the mechanical components and prevents contamination and leaks. These pumps are especially valued for their ability to handle corrosive, abrasive, and viscous fluids with ease, which makes them suitable for applications in chemical processing, water treatment, and the oil and gas industry.Breakup by Application:

- Water & Wastewater Treatment

- Oil & Gas

- Chemical Processes

- Pharmaceuticals

- Food & Beverages

- Paper & Pulp

- Others

Water & wastewater treatment accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes water & wastewater treatment, oil & gas, chemical processes, pharmaceuticals, food & beverages, paper & pulp, and others. According to the report, water and wastewater treatment represented the largest segment. Water and wastewater treatment is a critical process that involves the use of metering pumps for precise chemical dosing to maintain water quality and meet stringent environmental standards. In addition, these pumps accurately inject chemicals, such as chlorine for disinfection, coagulants for flocculation, and potential of hydrogen (pH) adjusters. This precise dosing ensures that contaminants are effectively removed or neutralized, which makes water safe for consumption and discharge. In wastewater treatment, metering pumps play a vital role in the removal of pollutants and contaminants from industrial and municipal wastewater streams.Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest metering pump market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific held the biggest market share due to the increasing number of infrastructure development projects. In addition, the rising consumption and demand for clean water among the masses is strengthening the growth of the market in the region. Apart from this, the growing awareness about the importance of sustainability among individuals is positively influencing the market. In line with this, increasing investments in efficient fluid handling technologies to minimize waste are supporting the growth of the market in the Asia Pacific region.

Competitive Landscape:

Various players are creating more efficient, accurate, and versatile pump models. They are developing pumps that can handle a broader range of fluids, improving dosing precision, and enhancing pump durability. In line with this, major manufacturers are offering customizable metering pump solutions tailored to specific industry needs. Moreover, modular designs allow clients to configure pumps to their exact requirements and provide enhanced flexibility and efficiency. Besides this, companies are incorporating smart features, such as remote monitoring, predictive maintenance, and integration with control systems to enhance pump efficiency and reduce downtime. They are also developing eco-friendly pump designs and promoting efficient chemical dosing to minimize environmental impact.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Grundfos

- IDEX Corporation

- LEWA (Nikkiso Co. Ltd.)

- Mcfarland-Tritan LLC

- Milton Roy Company (Ingersoll Rand)

- ProMinent GmbH

- Seepex GmbH

- Seko S.P.A

- SPX Flow Technology Norderstedt GmbH

- Swelore Engineering Private Limited

- Vereder Group

- Watson-Marlow Fluid Technology Group (Spirax-Sarco Engineering)

Key Questions Answered in This Report

1. What was the size of the global metering pump market in 2024?2. What is the expected growth rate of the global metering pump market during 2025-2033?

3. What are the key factors driving the global metering pump market?

4. What has been the impact of COVID-19 on the global metering pump market?

5. What is the breakup of the global metering pump market based on the type?

6. What is the breakup of the global metering pump market based on the application?

7. What are the key regions in the global metering pump market?

8. Who are the key players/companies in the global metering pump market?

Table of Contents

Companies Mentioned

- Grundfos

- IDEX Corporation

- LEWA (Nikkiso Co. Ltd.)

- Mcfarland-Tritan LLC

- Milton Roy Company (Ingersoll Rand)

- ProMinent GmbH

- Seepex GmbH

- Seko S.P.A

- SPX Flow Technology Norderstedt GmbH

- Swelore Engineering Private Limited

- Vereder Group

- Watson-Marlow Fluid Technology Group (Spirax-Sarco Engineering)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | January 2025 |

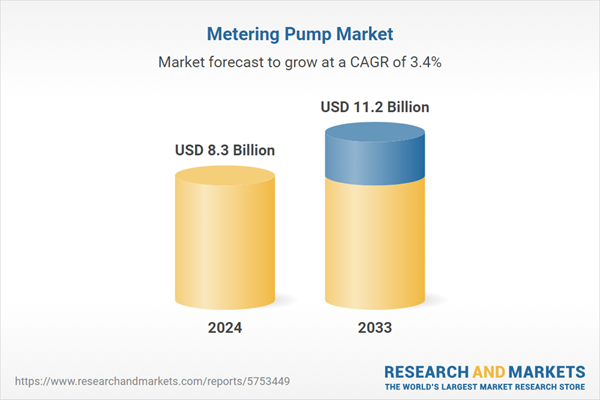

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 11.2 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |