Railway System Market Analysis:

- Market Growth and Size: The global railway system market is experiencing steady growth, driven by factors such as urbanization, environmental sustainability, and government initiatives. The market is witnessing steady growth due to increasing demand for efficient and sustainable transportation.

- Major Market Drivers: Urbanization propels the demand for railway systems as cities seek efficient mass transit solutions to address congestion and pollution. Besides this, environmental sustainability initiatives drive a shift towards railways, offering a greener alternative for both passenger and freight transport.

- Technological Advancements: Ongoing technological advancements include the adoption of high-speed rail, intelligent transportation systems, and automation, enhancing safety, efficiency, and passenger experience. Moreover, electrification, smart signaling, and predictive maintenance technologies contribute to the modernization of railway infrastructure.

- Industry Applications: Railway systems serve both freight and passenger transport needs, offering cost-effective and sustainable solutions for the movement of goods and the daily commute.

- Key Market Trends: The increasing integration of advanced auxiliary power systems, information systems, safety systems, heating, ventilating, and air conditioning (HVAC) systems, and on-board vehicle control technologies reflects a trend toward more efficient and connected railway systems.

- Geographical Trends: In Europe, the focus is on sustainability, with robust investments in modernizing rail infrastructure and promoting modal shifts. Concurrently, Asia Pacific witnesses rapid growth due to urbanization, population density, and government investments in expanding and modernizing rail networks.

- Competitive Landscape: Major players dominate the market, engaging in strategic initiatives and technological innovations to maintain a competitive edge. In confluence with this, partnerships, mergers, and acquisitions play a crucial role in shaping the competitive dynamics of the industry.

- Challenges and Opportunities: Challenges include the need for substantial investment, regulatory complexities, and addressing evolving cybersecurity threats. Opportunities lie in developing sustainable solutions, embracing emerging technologies, and capitalizing on the global push for efficient and eco-friendly transportation alternatives.

Railway System Market Trends:

Increasing urbanization

Urbanization is a key factor driving the global railway system market. As the world experiences rapid urbanization, there is an increasing demand for efficient and sustainable transportation systems to connect growing urban centers. Railways provide a viable solution to address the challenges associated with urban congestion, traffic jams, and pollution. The convenience of rail transport, especially in densely populated areas, makes it an attractive option for commuters, strengthening the market growth. Moreover, the surge in population density has made railways a more space-efficient mode of transportation compared to individual vehicles. The ability of railways to transport a large number of passengers or goods over long distances with minimal environmental impact is further bolstering its demand.Ongoing technological advancements

The railway industry is undergoing significant technological advancements that contribute to its growth and efficiency. Automation, digitization, and the implementation of smart technologies have transformed traditional railway systems into modern, high-tech networks. In line with this, the adoption of advanced signaling systems, predictive maintenance technologies, and real-time monitoring enhances the safety, reliability, and overall performance of railway infrastructure, aiding in market expansion. Additionally, the advent of high-speed rail systems, magnetic levitation (maglev) trains, and the development of intelligent transportation systems are providing an impetus to the market growth. Apart from this, the integration of communication technologies enabling real-time tracking of trains, optimizing scheduling, and reducing delays is propelling the market forward.The global push toward environmental sustainability

The escalating environmental concerns and the need to reduce carbon emissions have positioned railways as a sustainable mode of transportation. Compared to road and air transport, trains are more energy-efficient and produce lower emissions per unit of transported goods or passengers. As a result, governments and organizations worldwide are increasingly prioritizing trains as environmentally friendly transportation solutions to address climate change and air pollution, which is contributing to the market expansion. Furthermore, the electrification of rail networks, the use of renewable energy sources, and the development of energy-efficient rolling stock further enhancing the overall sustainability of the railway system are impelling the market growth.Favorable government initiatives

Supportive government initiatives play a crucial role in shaping the railway system market, as governments recognize the societal and economic benefits of investing in robust railway infrastructure. The implementation of numerous policies and investments aimed at expanding and modernizing rail networks is fostering market expansion. Moreover, increasing public-private partnerships (PPPs), with governments often providing financial incentives, subsidies, and regulatory support to encourage private sector participation in railway projects is fueling the market growth. In line with this, the extensive investment in expanding and modernizing rail networks through high-speed rail lines, electrification initiatives, and the development of intelligent transportation systems is creating a positive outlook for market expansion.Railway System Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on transit type, system type, and application.Breakup by Transit Type:

- Conventional

- Diesel Locomotive

- Electric Locomotive

- Electro-Diesel Locomotive

- Coaches

- Rapid

- Diesel Multiple Unit (DMU)

- Electric Multiple Unit (EMU)

- Light Rail/Tram

Conventional accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the transit type. This includes conventional (diesel locomotive, electric locomotive, electro-diesel locomotive, and coaches) and rapid (diesel multiple unit (DMU), electric multiple unit (EMU), and light rail/tram). According to the report, conventional represented the largest segment.The demand for railway systems, particularly in the conventional transit segment encompassing diesel locomotives, electric locomotives, electro-diesel locomotives, and coaches, is primarily driven by the imperative for energy efficiency and reduced environmental impact. The electrification of rail networks and the adoption of technologically advanced locomotives align with global efforts to transition to greener transportation alternatives, minimizing dependence on fossil fuels and promoting sustainable practices in the rail transit sector.

On the other hand, the rising popularity of rapid transit railway systems, encompassing DMU, EMU, and light rail/tram, is primarily fueled by the need for efficient and swift urban transportation solutions. As cities continue to grow, there is an increasing emphasis on rapid transit systems that provide quick and reliable connectivity. These systems address urban mobility challenges, offering a sustainable alternative to traditional modes of transport and contributing to the development of smart and interconnected urban environments.

Breakup by System Type:

- Auxiliary Power System

- Train Information System

- Propulsion System

- Train Safety System

- HVAC System

- On-Board Vehicle Control

Propulsion system holds the largest share in the industry

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes auxiliary power system, train information system, propulsion system, train safety system, HVAC system, and on-board vehicle control. According to the report, propulsion system accounted for the largest market share.The demand for railway systems based on propulsion systems is driven by the ongoing shift towards more advanced and sustainable technologies. Concurrent with this, the electrification of railway networks, coupled with the adoption of efficient propulsion systems, to reduce environmental impact and operational costs is presenting lucrative opportunities for market expansion. Moreover, this shift aligns with the global commitment to sustainability, emphasizing the importance of cleaner and energy-efficient transportation solutions within the railway industry, further bolstering the market growth.

In addition to this, the demand for railway systems with auxiliary power systems is fueled by the need for reliable power supply to support various onboard functions, enhancing operational efficiency and passenger comfort.

Furthermore, the rising demand for train information systems catering to the growing demand for real-time passenger information schedules, delays, and more, to ensure a seamless travel experience is strengthening the market growth.

Along with this, train safety systems play a critical role in meeting stringent safety standards and regulations. The increasing emphasis on passenger safety and the prevention of accidents is fueling the demand for advanced safety technologies, such as collision avoidance systems and automatic train protection systems.

Concurrently, HVAC systems are also integral to enhance the overall passenger experience and provide a comfortable travel environment during train journeys.

Apart from this, the increasing demand for automation and efficient operation of trains is boosting the adoption of on-board vehicle control systems to improve reliability, reduce operational costs, and enhance safety features in the railway industry.

Breakup by Application:

- Freight Transportation

- Passenger Transportation

Freight transportation represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes freight transportation and passenger transportation. According to the report, freight transportation represented the largest segment.The demand for railway systems in freight transport is propelled by the increasing need for sustainable and cost-effective cargo movement. Railways offer an efficient and environmentally friendly alternative for freight transportation, with the capacity to carry large volumes over long distances. The market is further supported by the ability of railways to alleviate road congestion and reduce carbon emissions, making them a preferred choice for companies seeking reliable and eco-friendly logistics solutions.

In contrast, the demand for railway systems in passenger transport is primarily driven by the growing urban population and the need for efficient, reliable, and sustainable mass transit solutions. Railways provide a cost-effective and environmentally friendly mode of transportation, catering to the increasing demand for seamless connectivity within urban areas. As cities expand and congestion worsens, the appeal of passenger railway systems lies in their ability to offer a swift, convenient, and eco-friendly alternative for daily commuting.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest railway system market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.Europe’s commitment to sustainable transportation, stringent environmental regulations, and the ongoing focus on modal shift from road to rail is creating a positive outlook for market expansion. With high population density and urbanization, efficient rail networks address congestion and reduce carbon emissions. Moreover, European governments actively invest in modernizing railway infrastructure, embracing advanced technologies, and promoting interoperability, all contributing to the increased demand for robust and sustainable railway systems across the region.

Besides this, the escalating need for efficient freight transport in North America is acting as another significant growth-inducing factor, as rail offers a cost-effective and environmentally friendly solution.

Additionally, rapid urbanization and population growth in the Asia Pacific are driving the demand for railway systems, addressing the challenges of congestion and pollution. Along with this, governments in the region are investing heavily in expanding rail networks to enhance connectivity and promote sustainable transportation.

Moreover, Latin America’s growing focus on enhancing connectivity and reducing road congestion is presenting lucrative opportunities for market expansion. In line with this, the increasing efforts toward modernizing rail infrastructure to create efficient transportation networks are boosting market expansion.

Apart from this, the increasing urbanization and economic development in the Middle East and Africa is propelling the demand for railway systems in the region to diversify transportation options, reduce congestion, and foster sustainable development.

Leading Key Players in the Railway System Industry:

The global railway system market features a highly competitive landscape with key players vying for market share through strategic initiatives, technological advancements, and extensive investments in infrastructure. Major companies dominate the market, leveraging their global presence and diversified product portfolios. These companies focus on research and development (R&D) to introduce innovative technologies like high-speed trains, automated systems, and sustainable solutions, enhancing their competitiveness. Additionally, partnerships, mergers, and acquisitions play a crucial role in shaping the competitive dynamics, allowing companies to broaden their offerings and market reach. The market is characterized by the presence of both established players with a legacy in the industry and emerging players introducing disruptive technologies, contributing to the overall dynamism and competitiveness of the global railway system market.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- ABB Ltd.

- Alstom

- American Equipment Company

- Bombardier Inc.

- Calamp Corporation

- Construcciones y Auxiliar de Ferrocarriles

- CRRC Corporation Ltd.

- Fuji Electric

- General Electric Company

- Hitachi Ltd.

- Hyundai Rotem Company

- Ingeteam Power Technology

- Medcom

- Mitsubishi Heavy Industries Ltd.

- Siemens Aktiengesellschaft

- Škoda Transportation

- Strukton Groep N.V.

Key Questions Answered in This Report

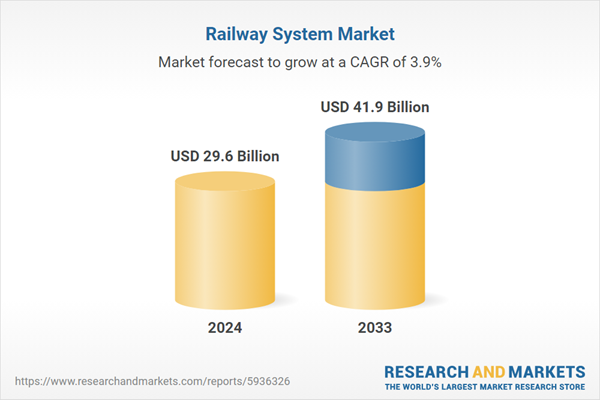

1. What was the size of the global railway system market in 2024?2. What is the expected growth rate of the global railway system market during 2025-2033?

3. What are the key factors driving the global railway system market?

4. What has been the impact of COVID-19 on the global railway system market?

5. What is the breakup of the global railway system market based on the transit type?

6. What is the breakup of the global railway system market based on the system type?

7. What is the breakup of the global railway system market based on the application?

8. What are the key regions in the global railway system market?

9. Who are the key players/companies in the global railway system market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- Alstom

- American Equipment Company

- Bombardier Inc.

- Calamp Corporation

- Construcciones y Auxiliar de Ferrocarriles

- CRRC Corporation Ltd.

- Fuji Electric

- General Electric Company

- Hitachi Ltd.

- Hyundai Rotem Company

- Ingeteam Power Technology

- Medcom

- Mitsubishi Heavy Industries Ltd.

- Siemens Aktiengesellschaft

- Škoda Transportation

- Strukton Groep N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 29.6 Billion |

| Forecasted Market Value ( USD | $ 41.9 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |