Oleochemicals are a group of chemicals derived from natural oils and fats, primarily sourced from plants and animals. They are available as fatty acids, glycerin, fatty alcohols, and esters and are obtained from various chemical processes like hydrolysis or esterification of triglycerides found in oils and fats. They are versatile compounds that have sustainable and eco-friendly characteristics and reduce environmental pollution. As a result, oleochemicals are widely utilized in the cosmetics, pharmaceuticals, soaps and detergents, plastics, rubber, and paper industries across the globe.

At present, the rising utilization of glycerin in various skincare and pharmaceutical formulations is supporting the growth of the market. Besides this, the increasing employment of fatty acids, as they serve as essential building blocks for surfactants that are used in detergents and emulsifiers, is strengthening the growth of the market. Additionally, the growing demand for oleochemicals, as various industries are rapidly seeking alternatives to petroleum-based chemicals, is positively influencing the market. Apart from this, the rising focus on healthier and natural ingredients among individuals is offering lucrative growth opportunities to industry investors. Furthermore, the increasing preference for oleochemicals, as they are cost-effective compared to traditional petrochemicals, is contributing to the growth of the market. In line with this, the wide availability of a variety of feedstock around the world is impelling the growth of the market.

Oleochemicals Market Trends/Drivers:

Rising environmental concerns for maintaining sustainability

The rising environmental concern for maintaining sustainability among individuals is strengthening the growth of the market. People are increasingly preferring sustainable products due to the rapid climate change and environmental degradation. In addition, oleochemicals are rapidly utilized in various sectors as they are a sustainable and eco-friendly alternative. Apart from this, they are derived from renewable sources, primarily natural oils and fats, which makes them inherently biodegradable and less harmful to the environment as compared to their petrochemical counterparts. This aligns with the trend of reducing carbon footprints and adopting green technologies. Furthermore, consumers are increasingly becoming environmentally conscious and are actively seeking products with minimal ecological impact, which is offering a positive market outlook.Increasing demand for bio-based products

The rising demand for bio-based products among the masses across the globe is bolstering the growth of the market. Consumers are increasingly preferring bio-based products as they are becoming more environmentally conscious. In line with this, the rising preference for natural and bio-based alternatives among individuals in their daily lives is supporting the growth of the market. Oleochemicals are plant-based and biodegradable products that do not pose any harm to the body. Apart from this, there is an increase in the demand for cosmetics and personal care products, such as moisturizers and emollients, that contain natural ingredients. Similarly, bio-based surfactants are widely utilized by consumers who prioritize eco-friendly cleaning solutions.Favorable government initiatives for renewable chemicals

Governing agencies of numerous countries are implementing stringent regulations and policies regarding environmental standards to reduce carbon emissions. They are also taking several initiatives to encourage the adoption of bio-based and renewable chemicals that do not emit any harmful gases, which is offering a favorable market outlook. In line with this, various other measures often include tax incentives, subsidies, and mandates to encourage manufacturers to adopt sustainable practices. Apart from this, oleochemicals are known for their eco-friendliness and biodegradability and are a suitable solution that aligns with these stringent regulations. Furthermore, the increasing consumer demand for safe and natural products is propelling the growth of the market.Oleochemicals Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with the oleochemicals market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type, form, application, and feedstock.Breakup by Type:

- Fatty Acids

- Fatty Alcohols

- Glycerine

- Others

Fatty acids represent the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes fatty acids, fatty alcohols, glycerine, and others. According to the report, fatty acids represented the largest segment. Fatty acids are organic acids that are derived from natural oils and fats. Fatty acids are classified based on their carbon chain length and are widely available as lauric, stearic, and oleic acid. Lauric acid is typically sourced from coconut and palm kernel oils and is known for its surfactant properties that are used in soap and detergent production. Stearic acid is often derived from animal and vegetable fats and is a versatile ingredient in various industries, such as cosmetics, plastics, and rubber. Oleic acid is found in olive oil and other vegetable oils and is renowned for its moisturizing properties.Breakup by Form:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

Liquid accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid and solid (flakes, pellets, beads, and others). According to the report, liquid represented the largest segment. Liquid oleochemicals are characterized by their physical state as liquids at room temperature. They are typically derived from natural oils and fats through various processes like hydrolysis or esterification. It offers enhanced versatility and is widely employed in diverse industries, such as pharmaceuticals, food and beverage (F&B), and personal care and cosmetics. In the pharmaceutical sector, they assist in improving the solubility and bioavailability of certain drugs. In personal care and cosmetics, they are commonly used in the formulation of skincare products, hair care products, and cosmetics. They can act as emollients, humectants, or surfactants that enhance the texture and performance of these products. Besides this, in the food and beverage (F&B) industry, they may serve as food additives, flavor carriers, or emulsifiers in various processed foods and beverages.Breakup by Application:

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

Soaps and detergents hold the biggest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes soaps and detergents, plastics, paper, lubricants, rubber, coatings and resins, personal care products, and others. According to the report, soaps and detergents represented the largest segment. Fatty acids and glycerin are essential components in the production of both traditional soap and detergent formulations. In soap production, fatty acids derived from natural oils and fats serve as the core raw materials. They provide the cleansing and lathering properties necessary for effective soap. On the other hand, glycerin is often retained in soap formulations for its moisturizing benefits. For detergents, oleochemical-based surfactants are key ingredients. Surfactants help break down oils and grease, which makes them effective cleaning agents. They are preferred in detergent manufacturing due to their biodegradability and reduced environmental impact as compared to synthetic alternatives.Breakup by Feedstock:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

Palm dominates the market segment

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others. According to the report, palm represented the largest segment. Palm oil and its derivatives serve as a primary source for a wide range of oleochemical products. Palm oil is extracted from the fruit of oil palm trees, which is abundant and cost-effective. It is rich in triglycerides, which can be hydrolyzed into fatty acids and glycerin. It is used in various applications, such as food additives, personal care products, and industrial processes. In line with this, there is a rise in the demand for sustainable and certified palm oil that encourages responsible sourcing practices.Breakup by Region

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific exhibits a clear dominance, accounting for the largest oleochemicals market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, Asia Pacific accounted for the largest market share.Asia Pacific held the biggest market share as it is one of the major palm-oil producers. Apart from this, the rising demand for oleochemical-based items among individuals due to their eco-friendliness is contributing to the growth of the market in the region. In line with this, the presence of advanced manufacturing facilities is propelling the growth of the market. Besides this, the rising awareness among individuals about sustainable products is bolstering the growth of the market in the Asia Pacific region.

Competitive Landscape:

Several manufacturers are investing in research and development (R&D) activities to innovate and develop new products and processes. They are improving the efficiency of oleochemical production, discovering novel applications, and enhancing the performance of existing products. In addition, many companies are focusing on sustainable practices by ensuring responsible sourcing of raw materials, particularly palm oil. They are also seeking to obtain certifications like roundtable on sustainable palm oil (RSPO) to demonstrate their commitment to environmentally friendly production methods. Besides this, key players are diversifying their portfolios by producing a wide range of oleochemical derivatives, such as fatty acids, glycerin, surfactants, and more, to meet specific industry demands.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Akzo Nobel N.V.

- BASF SE

- Cargill, Incorporated

- Emery Oleochemicals Group

- Evonik Industries AG

- Evyap Oleo

- Godrej & Boyce Mfg. Co. Ltd.

- Kao Corporation

- KLK Oleo

- Myriant Technologies

- Oleon NV

- Procter & Gamble Company

- PTT Global Chemical Public Company Limited

- Corbion N.V.

- Wilmar International Ltd.

Key Questions Answered in This Report

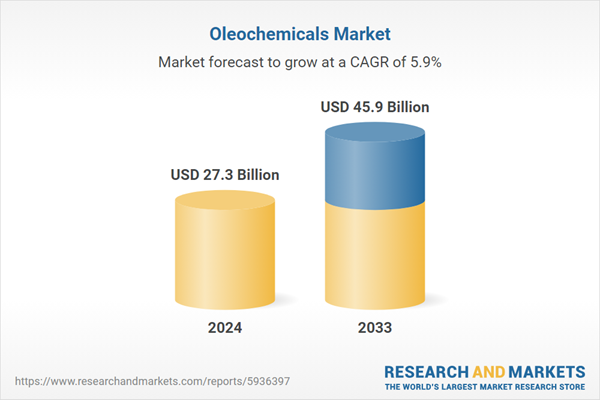

1. What was the size of the global oleochemicals market in 2024?2. What is the expected growth rate of the global oleochemicals market during 2025-2033?

3. What are the key factors driving the global oleochemicals market?

4. What has been the impact of COVID-19 on the global oleochemicals market?

5. What is the breakup of the global oleochemicals market based on the type?

6. What is the breakup of the global oleochemicals market based on the form?

7. What is the breakup of the global oleochemicals market based on the application?

8. What is the breakup of the global oleochemicals market based on the feedstock?

9. What are the key regions in the global oleochemicals market?

10. Who are the key players/companies in the global oleochemicals market?

Table of Contents

Companies Mentioned

- Akzo Nobel N.V.

- BASF SE

- Cargill

- Incorporated

- Emery Oleochemicals Group

- Evonik Industries AG

- Evyap Oleo

- Godrej & Boyce Mfg. Co. Ltd.

- Kao Corporation

- KLK Oleo

- Myriant Technologies

- Oleon NV

- Procter & Gamble Company

- PTT Global Chemical Public Company Limited

- Corbion N.V.

- Wilmar International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 27.3 Billion |

| Forecasted Market Value ( USD | $ 45.9 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |