Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Patent Expiry of Biologics Encouraging Biosimilar Development

The expiration of patents on many blockbusters biologic drugs has created a significant opportunity for biosimilar development, directly driving the demand for contract manufacturing organizations (CMOs) that specialize in biosimilar production. Biologics such as trastuzumab, bevacizumab, and adalimumab have either lost or are nearing the expiration of their exclusivity periods in multiple regions including the U.S., Europe, and parts of Asia. This opens the door for biosimilar manufacturers to introduce more cost-effective alternatives.CMOs play a pivotal role in facilitating this transition by providing the infrastructure, expertise, and regulatory guidance required to bring these complex products to market efficiently. According to the U.S. Food and Drug Administration (FDA), as of 2024, over 40 biosimilars have been approved in the United States, a marked increase compared to just 11 approvals five years earlier.

The European Medicines Agency (EMA) also reports steady growth in biosimilar approvals since its first authorization in 2006, reflecting a regulatory climate conducive to biosimilar uptake. The challenge of producing biologics - due to their complexity, the need for sterile environments, and sophisticated analytical testing - makes contract manufacturing a strategic choice for many biosimilar developers. Rather than investing in costly facilities and process development, pharmaceutical companies are increasingly outsourcing CMOs that already possess these capabilities, thus speeding up time-to-market and reducing capital expenditure.

Key Market Challenges

High Complexity and Cost of Biosimilar Manufacturing

Despite their economic appeal, biosimilars are biologically complex molecules that require sophisticated manufacturing infrastructure, highly skilled personnel, and rigorous quality control systems. Developing biosimilars involves extensive comparative analytical studies and process validation steps to ensure therapeutic equivalence to the original biologic, which significantly increases development time and cost. Even with outsourcing to CMOs, the cost of manufacturing biosimilars can be prohibitively high, particularly for smaller biotech firms or those targeting niche therapeutic areas. Governments such as the U.S. FDA and EMA require a comprehensive dossier of quality, safety, and efficacy data before approving a biosimilar, further increasing regulatory and financial burdens.Moreover, CMOs must make substantial upfront investments in specialized bioreactors, cell culture facilities, and cleanroom environments to accommodate biosimilar projects. These capital-intensive requirements limit the number of CMOs equipped to handle large-scale biosimilar contracts, creating a bottleneck in supply and potentially slowing market growth.

Key Market Trends

Rise of Single-Use Bioprocessing Technologies in Biosimilar Manufacturing

One of the most prominent trends reshaping the biosimilar contract manufacturing landscape is the widespread adoption of single-use bioprocessing technologies. Single-use systems - comprising disposable bioreactors, mixing systems, and filtration units - offer significant advantages over traditional stainless-steel equipment, including reduced contamination risk, lower cleaning validation costs, and faster turnaround times between batches.These benefits are particularly relevant in the biosimilar space, where cost efficiency and speed to market are critical. CMOs are increasingly incorporating single-use technologies to enhance their operational flexibility and meet the unique production needs of multiple clients simultaneously. According to the U.S. Department of Commerce, biopharmaceutical manufacturers who adopt single-use systems report a 30-50% reduction in production costs, making this approach especially attractive for biosimilar developers operating on tight margins.

Furthermore, these technologies support small and medium-sized batches, aligning well with the growing trend of personalized medicine and targeted biosimilars. The ability to quickly scale up or down based on demand also makes contract manufacturing more agile and responsive to fluctuating market needs.

Key Market Players

- Catalent, Inc.

- Boehringer Ingelheim GmbH

- Alcami Corporation, Inc.

- Almac Group

- Lonza Group AG

- Biocon Limited

- Avid Bioservice, Inc.

- Rentschler Biopharma SE

- Fujifilm Kyowa Kirin Biologics Co., Ltd.

- WuXi Biologics, Inc.

Report Scope:

In this report, the Global Biosimilar Contract Manufacturing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Biosimilar Contract Manufacturing Market, By Product:

- Recombinant Non-glycosylated Proteins

- Recombinant Glycosylated Proteins

Biosimilar Contract Manufacturing Market, By Technology:

- Mammalian

- Non-Mammalian

Biosimilar Contract Manufacturing Market, By Application:

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Chronic & Autoimmune Disorders

- Rheumatoid Arthritis

- Others

Biosimilar Contract Manufacturing Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Biosimilar Contract Manufacturing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Catalent, Inc.

- Boehringer Ingelheim GmbH

- Alcami Corporation, Inc.

- Almac Group

- Lonza Group AG

- Biocon Limited

- Avid Bioservice, Inc.

- Rentschler Biopharma SE

- Fujifilm Kyowa Kirin Biologics Co., Ltd.

- WuXi Biologics, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

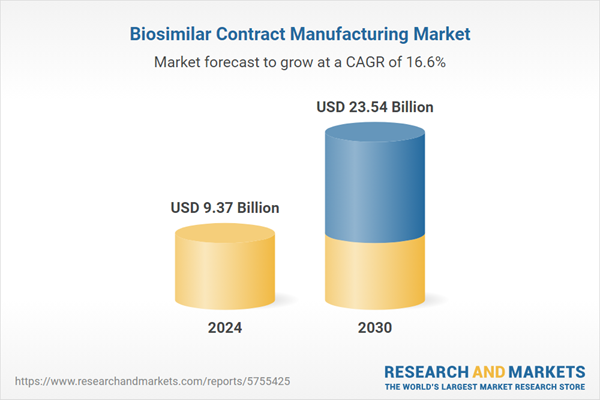

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.37 Billion |

| Forecasted Market Value ( USD | $ 23.54 Billion |

| Compound Annual Growth Rate | 16.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |