Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Concern about Cattle Health Issues

Intensive cattle rearing systems are increasingly susceptible to infectious diseases such as lumpy skin disease and Bovine Respiratory Disease (BRD). For instance, a recent outbreak in India led to over 97,000 cattle deaths in just three months, highlighting the devastating impact of viral epidemics. These events not only affect animal welfare but can also trigger movement and trade bans, compounding farmer losses. The severity of such outbreaks underscores mounting pressure on livestock managers to adopt preventive health measures beyond traditional antibiotic regimens.Antimicrobial overuse in cattle - particularly for conditions like mastitis - is fueling antibiotic resistance concerns. Studies show that around 0.21% of over 400,000 raw milk samples tested positive for antibiotic residues, raising alarms about food safety and antimicrobial resistance (AMR). Additionally, over 70% of antibiotics administered in livestock globally go to farmed animals, indicating both widespread reliance and the potential for significant resistance development. These trends heighten the need for alternative health strategies in cattle nutrition.

Emerging pathogens such as Mycoplasma bovis, responsible for pneumonia and mastitis, are posing serious health challenges. In Europe alone, annual economic losses from M. bovis exceed €576 million, driven by reduced weight gain, milk output, and treatment costs. Its resistance to multiple antibiotic classes makes it particularly problematic, prompting farmers to seek herbal or phytogenic solutions that support immunity and gut health without contributing to resistance.

Together, these concerns - large-scale infectious outbreaks, rising antimicrobial residues in milk, and drug-resistant pathogens - are intensifying the drive toward natural feed additives. Cattle producers are increasingly adopting phytogenic solutions like essential oils and flavonoids to promote gut health, bolster immunity, and reduce antibiotic dependency. The shift is propelled by both consumer demand for clean animal products and regulatory efforts to curb antimicrobial use in livestock.

Key Market Challenges

Lack of Standardization and Quality Control

One of the most pressing challenges in the phytogenic feed additives market is the lack of standardization in raw materials and formulations. Phytogenic products are derived from a wide range of plant sources, and the concentration of active compounds - such as essential oils, flavonoids, or saponins - can vary significantly depending on factors like plant variety, growing conditions, harvest time, and extraction methods. This inconsistency leads to batch-to-batch variability in product performance, making it difficult for feed manufacturers and end-users to predict results or maintain consistent animal outcomes. Unlike synthetic additives, which offer precise molecular composition, phytogenics often lack uniformity in potency. As a result, nutritionists and farmers may be hesitant to incorporate them into feed formulations, especially when dealing with large-scale operations where consistency and predictable outcomes are critical for animal productivity and economic returns.Key Market Trends

Technological Advancements in Extraction & Formulation

A key trend driving growth in the phytogenic feed additives market is the rapid advancement in extraction technologies and formulation science. Traditional extraction methods often resulted in inconsistent concentrations of active compounds, reducing efficacy and reliability. However, the adoption of modern techniques such as supercritical CO₂ extraction, cold pressing, and enzymatic hydrolysis has significantly improved the purity, stability, and bioavailability of essential oils, flavonoids, and saponins. These methods help preserve the functional integrity of sensitive phytochemicals and ensure uniformity across production batches. Moreover, they reduce contamination risks and enhance the shelf life of the final product. As a result, manufacturers are now able to offer highly concentrated and standardized phytogenic ingredients that can consistently deliver targeted health and performance benefits across livestock species, fostering trust among feed formulators, farmers, and veterinarians.Key Market Players

- Cargill, Inc.

- Archer-Daniels-Midland Company

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V

- Land O’ Lakes Inc.

- Adisseo Inc.

- Nutreco N.V.

- Kemin Industries Inc.

- Natural Remedies Pvt. Ltd

- Nor Feed

Report Scope:

In this report, Global Phytogenic Feed Additives market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Phytogenic Feed Additives Market, By Type:

- Essential Oils

- Flavonoids

- Saponins

- Oleoresins

- Other Types

Phytogenic Feed Additives Market, By Livestock:

- Poultry

- Swine

- Ruminants

- Aquatic Animals

- Other Livestock

Phytogenic Feed Additives Market, By Source:

- Herbs & Spices

- Fruits & Vegetables

- Flowers

Phytogenic Feed Additives Market, By Form:

- Liquid

- Dry

Phytogenic Feed Additives Market, By Function:

- Performance Enhances

- Antimicrobial Properties

- Palatability Enhances

- Other Functions

Phytogenic Feed Additives Market, By Packaging:

- Flexible

- Other Packaging

Phytogenic Feed Additives Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in global Phytogenic Feed Additives market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cargill, Inc.

- Archer-Daniels-Midland Company

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V

- Land O’ Lakes Inc.

- Adisseo Inc.

- Nutreco N.V.

- Kemin Industries Inc.

- Natural Remedies Pvt. Ltd

- Nor Feed

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | August 2025 |

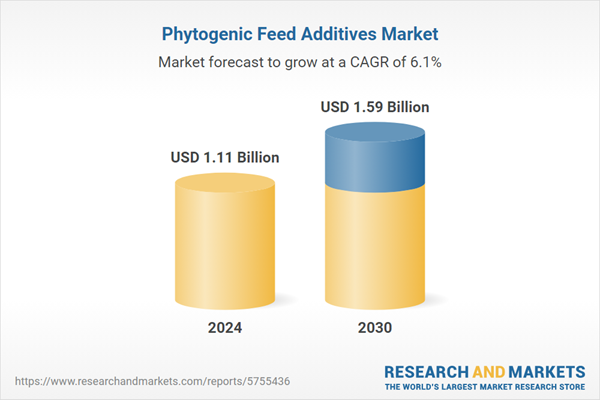

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.11 Billion |

| Forecasted Market Value ( USD | $ 1.59 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |