Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is further supported by growing awareness among farmers about the long-term benefits of feeding fermented products, especially in regions where digestive disorders and nutrient deficiencies are common in livestock. Fermentation reduces anti-nutritional factors present in traditional feed and improves palatability, making it easier for animals to digest and utilize feed effectively. Additionally, innovations in fermentation technology have made it possible to produce high-quality fermented ingredients at scale, ensuring consistent quality, longer shelf life, and cost-effectiveness. These advantages are encouraging adoption among both small and commercial livestock farmers.

Key Market Drivers

Growing Usage of Fermented products for Feeding Poultry Animals

Poultry farmers are increasingly adopting fermented feed, like corn-soy blends and wheat bran, to boost flock performance. In a 2023 trial, broiler diets supplemented with 10% fermented feed delivered significantly higher weight gains in the first three weeks. Even a 5% inclusion rate resulted in improved growth and feed conversion across the full 42-day cycle. These measurable early gains are encouraging widespread adoption within commercial poultry operations.Laying hens have also benefited: researchers observed that 20% fermented rations led to higher egg production, better eggshell strength, and stronger immune markers - such as elevated IgA, IgG, and IgM levels. This addresses critical performance and health metrics in later production stages, offering financial upside and consistency to egg producers.

The gut-health benefits of fermented feed are reshaping nutrition strategies. Fermentation breaks down anti-nutritional compounds, increases B-vitamin levels, and enriches the gut microbiome with beneficial bacteria. These attributes contribute to improved nutrient digestibility and overall bird well-being in both broilers and layers.

On smaller-scale farms, enhanced scavenging efficiency and reduced feed usage have boosted farmer confidence in fermented feed solutions. With performance gains, better bird health, and cost efficiency converging, the poultry industry is accelerating its shift toward fermented feed products across various production models.

Key Market Challenges

Limited Awareness Among Small-Scale Farmers

One of the critical challenges facing the global fermented feed ingredients market is the limited awareness among small-scale farmers about the benefits and usage of fermented feed products. Many smallholders, especially in developing regions, continue to rely on traditional feeding practices using unprocessed or raw ingredients, largely due to lack of access to training, demonstration models, and technical support.While fermented feeds offer improved digestibility, better gut health, and enhanced immunity in livestock, these advantages are often under-communicated to rural farmers who form the backbone of livestock production in several parts of the world. Furthermore, language barriers, low literacy levels, and limited exposure to scientific advancements further widen the knowledge gap. Without structured awareness campaigns and localized extension services, the market risks losing out on a large potential consumer base that could benefit significantly from adopting fermented feed solutions.

Compounding the issue is the absence of robust farmer support systems and demonstration programs that could showcase the tangible benefits of fermented feed use in real-world farm conditions. Many smallholders are risk-averse and hesitant to invest in unfamiliar feed technologies unless they have seen successful examples within their community. Additionally, misconceptions persist - some farmers mistakenly believe fermented feed is inferior or causes digestive issues, deterring adoption. This lack of trust is amplified by limited contact with veterinarians, nutritionists, or agribusiness experts who could provide accurate guidance. To address this challenge, there is a pressing need for public-private collaboration in creating on-field demonstrations, mobile advisory services, and regional training centers aimed specifically at educating and empowering small-scale farmers with practical knowledge on fermented feed ingredients and their long-term value.

Key Market Trends

Innovation in Feed Formulations

Innovation in feed formulations is a key trend reshaping the fermented feed ingredients market by enhancing animal nutrition and gut health. Producers are increasingly shifting from traditional dry fermentation to wet fermented feed, which offers superior digestibility and palatability. Wet fermentation breaks down complex carbohydrates and anti-nutritional factors more effectively, increasing nutrient bioavailability and reducing the incidence of digestive disorders. As a result, livestock consume more efficiently and maintain better growth rates - especially in poultry and swine production. This form of feed is also easier to incorporate into liquid-based feeding systems, making it a practical choice for high-intensity commercial operations.Another dimension of innovation lies in the integration of functional additives - such as probiotics, enzymes, and phytogenic compounds - into fermented feed blends. Precision fermentation techniques enable the development of customized microbial strains that deliver specific health benefits, like enhanced immune response or improved fiber digestion. These probiotic-enriched feeds can support herd resilience and reduce dependence on antibiotics. Additionally, enzyme supplementation during fermentation helps degrade structural plant components, supporting performance in ruminants. Such value-added formulations appeal to sustainability-focused producers aiming for cleaner-label and antibiotic-free production, driving demand across organic, premium, and conventional livestock markets.

Key Market Players

- BASF SE

- Balchem Inc.

- Cargill, Inc.

- Chr. Hansen A/S

- AB Vista

- Archer Daniels Midland Company

- Ajinomoto Co. Inc.

- Angel Yeast Co., Ltd.

- CJ Corp.

- Fermented Nutrition Corporation

Report Scope:

In this report, Global Fermented Feed Ingredients market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Fermented Feed Ingredients Market, By Ingredient:

- Amino Acids

- Vitamins & Minerals

- Organic Acid

- Probiotics & Prebiotics

- Others

Fermented Feed Ingredients Market, By Form:

- Liquid

- Dry

Fermented Feed Ingredients Market, By Animal Type:

- Poultry

- Swine

- Ruminant

- Aquatic

- Others

Fermented Feed Ingredients Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Global Fermented Feed Ingredients Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Balchem Inc.

- Cargill, Inc.

- Chr. Hansen A/S

- AB Vista

- Archer Daniels Midland Company

- Ajinomoto Co. Inc.

- Angel Yeast Co., Ltd.

- CJ Corp.

- Fermented Nutrition Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

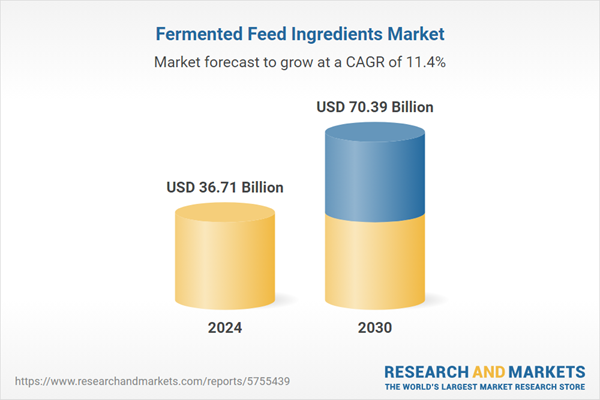

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 36.71 Billion |

| Forecasted Market Value ( USD | $ 70.39 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |