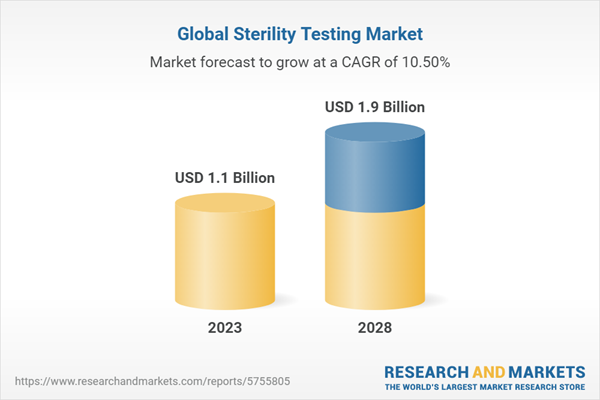

The global sterility testing market is expected to reach USD 1.9 billion in 2028 from USD 1.1 billion in 2023 at a CARG of 10.5%. Factors such as expanding pharmaceutical & biotechnology production capacities, increasing development of novel biopharmaceutical products, and rising investments in life sciences research are expected to drive market growth. However, the growing adoption of single-use technology and stringent regulatory guidelines for product approval are expected to restrain market growth to a certain extent.

During the forecast period, the kits & reagent is expected to account for the fastest-growing segment

Based on product & service, the sterility testing market is divided into kits & reagents, instruments, and services. During the forecast period (2023-2028), the kits & reagents segment is also expected to be the fastest-growing segment in the sterility testing market. Kits are widely used in the pharmaceutical and biotechnology industries as it is easy to use. Moreover, the long shelf life of these products is contributing to their rising adoption in academic institutions and contract research organizations. Sterility testing is mandatory during the clinical and commercial manufacturing of pharmaceutical & biopharmaceutical products. Pharmaceutical & biotechnology companies adopt kits & reagents for sterility testing as it is cost-effective and time-efficient.

In 2022, by application segment, pharmaceutical & biologics accounted for the biggest market share

Based on application, the sterility testing market is divided into pharmaceutical & biologics manufacturing, medical device manufacturing, and other applications. In 2022, the pharmaceutical and biologics manufacturing segment accounted for the largest share of the application segment in the sterility testing market. Factors responsible for the growth in this segment include the growing, growing pharmaceutical and biopharmaceutical production capacity across the globe.

In 2022, North America accounted for the largest regional share in this market

The market for sterility testing was dominated by North America in 2022. The presence of manufacturing facilities of major pharmaceutical and biopharmaceutical firms in the region will contribute for the huge demand for sterility testing in North America. The market for sterility testing is anticipated to grow in the region as drug approval rates rise. Also, the demand for pharmaceuticals and biopharmaceuticals in North America are rising due to the rising prevalence of diseases and the expanding patient population. Moreover, the pharmaceutical and biotechnology sectors in North America make substantial R&D investments and are anticipated to experience rapid growth in the coming years.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Respondent - Supply Side - 70%, Demand Side - 30%

- By Designation - CXOs and Directors - 30%, Executives - 25%, Mangers - 45%

- By Region - North America - 40%, Europe - 25%, APAC - 20%, RoW - 15%

The sterility testing market is dominated by a few globally established players such as Charles River Laboratories (US), Merck KGaA (Germany), bioMérieux SA (France), SGS SA (Switzerland), WuXi AppTec (China), Nelson Laboratories, LLC (US), Pacific BioLabs (US), Sartorius AG (Germany), Thermofisher Scientific Inc. (US), and Samsung Biologics (South Korea). The study includes an in-depth competitive analysis of these key players in the sterility testing market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the sterility testing market based on region (North America, Europe, Asia, and Rest of the World), by product & service (kits & reagents, instruments, and services), by test type (membrane filtration, direct inoculation, and other tests), by application (pharmaceuticals and biologicals, medical devices, and other applications), and by end user (pharmaceutical companies, biotechnology companies, and others ). The report also provides a comprehensive review of market drivers, restraints opportunities, challenges and trends in the sterility testing market.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the sterility testing market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

1.7.1 Recession Impact

2 Research Methodology

2.1 Research Data

Figure 1 Research Design

2.1.1 Secondary Research

2.1.1.1 Secondary Sources

2.1.2 Primary Research

2.1.2.1 Primary Sources

2.1.2.2 Primary Sources

2.1.2.3 Breakdown of Primaries

Figure 2 Market: Breakdown of Primaries

2.2 Market Size Estimation

Figure 3 Market Size Estimation (2022)

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Key Industry Insights

Figure 6 Market: CAGR Projection (2023-2028)

Figure 7 Market: Growth Analysis of Drivers, Restraints, Opportunities, and Challenges

2.3 Market Breakdown and Data Triangulation

Figure 8 Data Triangulation Methodology

2.4 Research Limitations

2.5 Research Assumptions

2.6 Risk Analysis

2.7 Recession Impact

Table 1 Global Inflation Rate Projection, 2021-2027 (% Growth)

3 Executive Summary

Figure 9 Sterility Testing Market, by Product & Service, 2023 vs. 2028 (USD Million)

Figure 10 Market, by Test Type, 2023 vs. 2028 (USD Million)

Figure 11 Market, by Application, 2023 vs. 2028 (USD Million)

Figure 12 Market, by End-user, 2023 vs. 2028 (USD Million)

Figure 13 Market: Geographical Snapshot

4 Premium Insights

4.1 Sterility Testing Market Overview

Figure 14 Rising Expansion of Pharmaceutical & Biopharmaceutical Production Capacities to Fuel Uptake of Sterility Testing Services

4.2 Asia: Market, by Product & Country (2022)

Figure 15 Kits & Reagents Segment Accounted for Largest Market Share in China

4.3 Market, by Region (2022)

Figure 16 Asia to Witness Highest Growth Rate During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 17 Sterility Testing Market: Drivers, Restraints, Opportunities, & Challenges

5.2.1 Drivers

5.2.1.1 Rising Expansion of Pharmaceutical & Biopharmaceutical Production Capacities

5.2.1.2 Increasing Development of Novel Biopharmaceutical Products

Table 2 Novel Drug Approvals (2022)

5.2.1.3 Rising Investments in Life Sciences Research

5.2.2 Restraints

5.2.2.1 Growing Adoption of Single-Use Technology

5.2.2.2 Stringent Regulatory Guidelines for Product Approval

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Increasing Outsourcing of Services to Sterility Testing Providers

5.2.4 Challenges

5.2.4.1 Shortage of Skilled Professionals

5.3 Tarif and Regulation

5.3.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 3 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 4 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 5 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 6 Rest of the World: Regulatory Bodies, Government Agencies, and Other Organizations

5.4 Porter's Five Forces Analysis

Table 7 Market: Porter's Five Forces Analysis

5.4.1 Threat from New Entrants

5.4.2 Threat from Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Supply Chain Analysis

Figure 18 Market: Supply Chain Analysis

5.6 Technological Analysis

5.7 Indicative Pricing

Table 8 Selling Price of Sterility Testing Products

5.8 Patent Analysis

Figure 19 Market: Patent Testing Applications (January 2012-December 2022)

5.9 Ecosystem Analysis

Table 9 Market: Supply Chain Ecosystem

5.10 Key Conferences and Events, 2023-2024

Table 10 Market: Conferences and Events (2023−2024)

5.11 Key Stakeholders and Buying Criteria

5.11.1 Key Stakeholders in Buying Process

Figure 20 Influence of Stakeholders on Buying Process for Sterility Testing Products

5.11.2 Market: Buying Criteria

Figure 21 Key Buying Criteria for End-users

5.12 Trade Analysis

Table 11 Top 10 Importers of Machinery and Apparatus for Filtering/Purifying Liquids (HS Code - 842129)

Table 12 Top 10 Exporters of Machinery and Apparatus for Filtering/Purifying Liquids (HS Code - 842129)

6 Sterility Testing Market, by Product & Service

6.1 Introduction

Table 13 Market, by Product & Service, 2021-2028 (USD Million)

6.2 Kits & Reagents

6.2.1 Rising Demand for Standard Sterility Testing to Drive Market

Table 14 Market for Kits & Reagents, by Region, 2021-2028 (USD Million)

Table 15 North America: Market for Kits & Reagents, by Country, 2021-2028 (USD Million)

Table 16 Europe: Market for Kits & Reagents, by Country, 2021-2028 (USD Million)

Table 17 Asia: Market for Kits & Reagents, by Country, 2021-2028 (USD Million)

Table 18 Rest of the World: Market for Kits & Reagents, by Country, 2021-2028 (USD Million)

6.3 Services

6.3.1 Growing Trend of Outsourcing Services to Cros to Drive Market

Table 19 Market for Services, by Region, 2021-2028 (USD Million)

Table 20 North America: Market for Services, by Country, 2021-2028 (USD Million)

Table 21 Europe: Market for Services, by Country, 2021-2028 (USD Million)

Table 22 Asia: Market for Services, by Country, 2021-2028 (USD Million)

Table 23 Rest of the World: Market for Services, by Country, 2021-2028 (USD Million)

6.4 Instruments

6.4.1 Increasing Adoption of Rapid Microbial Methods to Support Market Growth

Table 24 Market for Instruments, by Region, 2021-2028 (USD Million)

Table 25 North America: Market for Instruments, by Country, 2021-2028 (USD Million)

Table 26 Europe: Market for Instruments, by Country, 2021-2028 (USD Million)

Table 27 Asia: Market for Instruments, by Country, 2021-2028 (USD Million)

Table 28 Rest of the World: Market for Instruments, by Country, 2021-2028 (USD Million)

7 Sterility Testing Market, by Test Type

7.1 Introduction

Table 29 Market, by Test Type, 2021-2028 (USD Million)

7.2 Membrane Filtration

7.2.1 Rising Demand for Testing of Drugs in Liquid Dosage Forms to Fuel Adoption

Table 30 Market for Membrane Filtration, by Region, 2021-2028 (USD Million)

Table 31 North America: Market for Membrane Filtration, by Country, 2021-2028 (USD Million)

Table 32 Europe: Market for Membrane Filtration, by Country, 2021-2028 (USD Million)

Table 33 Asia: Market for Membrane Filtration, by Country, 2021-2028 (USD Million)

Table 34 Rest of the World: Market for Membrane Filtration, by Country, 2021-2028 (USD Million)

7.3 Direct Inoculation

7.3.1 Ability to Provide Testing for Microbial Contaminants to Drive Market

Table 35 Market for Direct Inoculation, by Region, 2021-2028 (USD Million)

Table 36 North America: Market for Direct Inoculation, by Country, 2021-2028 (USD Million)

Table 37 Europe: Market for Direct Inoculation, by Country, 2021-2028 (USD Million)

Table 38 Asia: Market for Direct Inoculation, by Country, 2021-2028 (USD Million)

Table 39 Rest of the World: Market for Direct Inoculation, by Country, 2021-2028 (USD Million)

7.4 Other Test Types

Table 40 Market for Other Test Types, by Region, 2021-2028 (USD Million)

Table 41 North America: Market for Kits & Reagents, by Country, 2021-2028 (USD Million)

Table 42 Europe: Market for Other Test Types, by Country, 2021-2028 (USD Million)

Table 43 Asia: Market for Other Test Types, by Country, 2021-2028 (USD Million)

Table 44 Rest of the World: Market for Other Test Types, by Country, 2021-2028 (USD Million)

8 Sterility Testing Market, by Application

8.1 Introduction

Table 45 Market, by Application, 2021-2028 (USD Million)

8.2 Pharmaceutical & Biologics Manufacturing

8.2.1 Growing Pharmaceutical & Biopharmaceutical Production Capacities to Drive Market

Table 46 Market for Pharmaceutical & Biologics Manufacturing, by Region, 2021-2028 (USD Million)

Table 47 North America: Market for Pharmaceutical & Biologics Manufacturing, by Country, 2021-2028 (USD Million)

Table 48 Europe: Market for Pharmaceutical & Biologics Manufacturing, by Country, 2021-2028 (USD Million)

Table 49 Asia: Market for Pharmaceutical & Biologics Manufacturing, by Country, 2021-2028 (USD Million)

Table 50 Rest of the World: Market for Pharmaceutical & Biologics Manufacturing, by Country, 2021-2028 (USD Million)

8.3 Medical Device Manufacturing

8.3.1 Rising Demand for Sterility Testing of Medical Devices to Drive Market

Table 51 Market for Medical Device Manufacturing, by Region, 2021-2028 (USD Million)

Table 52 North America: Market for Medical Device Manufacturing, by Country, 2021-2028 (USD Million)

Table 53 Europe: Market for Medical Device Manufacturing, by Country, 2021-2028 (USD Million)

Table 54 Asia: Market for Medical Device Manufacturing, by Country, 2021-2028 (USD Million)

Table 55 Rest of the World: Market for Medical Device Manufacturing, by Country, 2021-2028 (USD Million)

8.4 Other Applications

Table 56 Market for Other Applications, by Region, 2021-2028 (USD Million)

Table 57 North America: Market for Other Applications, by Country, 2021-2028 (USD Million)

Table 58 Europe: Market for Other Applications, by Country, 2021-2028 (USD Million)

Table 59 Asia: Market for Other Applications, by Country, 2021-2028 (USD Million)

Table 60 Rest of the World: Market for Other Applications, by Country, 2021-2028 (USD Million)

9 Sterility Testing Market, by End-user

9.1 Introduction

Table 61 Market, by End-user, 2021-2028 (USD Million)

9.2 Pharmaceutical Companies

9.2.1 Growing Expansion of Production Capacities and Strong Pipeline of Novel Drugs to Drive Market

Table 62 Market for Pharmaceutical Companies, by Region, 2021-2028 (USD Million)

Table 63 North America: Market for Pharmaceutical Companies, by Country, 2021-2028 (USD Million)

Table 64 Europe: Market for Pharmaceutical Companies, by Country, 2021-2028 (USD Million)

Table 65 Asia: Market for Pharmaceutical Companies, by Country, 2021-2028 (USD Million)

Table 66 Rest of the World: Market for Pharmaceutical Companies, by Country, 2021-2028 (USD Million)

9.3 Biotechnology Companies

9.3.1 Rising R&D Investments in Biotech Firms to Drive Market

Table 67 Market for Biotechnology Companies, by Region, 2021-2028 (USD Million)

Table 68 North America: Market for Biotechnology Companies, by Country, 2021-2028 (USD Million)

Table 69 Europe: Market for Biotechnology Companies, by Country, 2021-2028 (USD Million)

Table 70 Asia: Market for Biotechnology Companies, by Country, 2021-2028 (USD Million)

Table 71 Rest of the World: Market for Biotechnology Companies, by Country, 2021-2028 (USD Million)

9.4 Other End-users

Table 72 Market for Other End-users, by Region, 2021-2028 (USD Million)

Table 73 North America: Market for Other End-users, by Country, 2021-2028 (USD Million)

Table 74 Europe: Market for Other End-users, by Country, 2021-2028 (USD Million)

Table 75 Asia: Market for Other End-users, by Country, 2021-2028 (USD Million)

Table 76 Rest of the World: Market for Other End-users, by Country, 2021-2028 (USD Million)

10 Sterility Testing Market, by Region

10.1 Introduction

Table 77 Market, by Region, 2021-2028 (USD Million)

10.2 North America

Figure 22 North America: Sterility Testing Market Snapshot

Table 78 North America: Market, by Country, 2021-2028 (USD Million)

Table 79 North America: Market, by Product & Service, 2021-2028 (USD Million)

Table 80 North America: Market, by Test Type, 2021-2028 (USD Million)

Table 81 North America: Market, by Application, 2021-2028 (USD Million)

Table 82 North America: Market, by End-user, 2021-2028 (USD Million)

10.2.1 US

10.2.1.1 Rising Growth in Medical Devices Industry to Fuel Uptake

Table 83 US: Market, by Product & Service, 2021-2028 (USD Million)

Table 84 US: Market, by Test Type, 2021-2028 (USD Million)

Table 85 US: Market, by Application, 2021-2028 (USD Million)

Table 86 US: Market, by End-user, 2021-2028 (USD Million)

10.2.2 Canada

10.2.2.1 Rising Demand for Pharmaceutical & Biologics Manufacturing to Support Market Growth

Table 87 Canada: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 88 Canada: Market, by Test Type, 2021-2028 (USD Million)

Table 89 Canada: Market, by Application, 2021-2028 (USD Million)

Table 90 Canada: Market, by End-user, 2021-2028 (USD Million)

10.2.3 North America: Recession Impact

10.3 Europe

Table 91 Europe: Market, by Country, 2021-2028 (USD Million)

Table 92 Europe: Market, by Product & Service, 2021-2028 (USD Million)

Table 93 Europe: Market, by Test Type, 2021-2028 (USD Million)

Table 94 Europe: Market, by Application, 2021-2028 (USD Million)

Table 95 Europe: Market, by End-user, 2021-2028 (USD Million)

10.3.1 Germany

10.3.1.1 Favorable R&D Funding by Federal & State Governments to Fuel Uptake

Table 96 Germany: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 97 Germany: Market, by Test Type, 2021-2028 (USD Million)

Table 98 Germany: Market, by Application, 2021-2028 (USD Million)

Table 99 Germany: Market, by End-user, 2021-2028 (USD Million)

10.3.2 UK

10.3.2.1 Rising Development of Biotechnology Manufacturing Firms to Drive Market

Table 100 UK: Market, by Product & Service, 2021-2028 (USD Million)

Table 101 UK: Market, by Test Type, 2021-2028 (USD Million)

Table 102 UK: Market, by Application, 2021-2028 (USD Million)

Table 103 UK: Market, by End-user, 2021-2028 (USD Million)

10.3.3 France

10.3.3.1 Rising Government Initiatives for Biologics Manufacturing to Support Market Growth

Table 104 France: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 105 France: Market, by Test Type, 2021-2028 (USD Million)

Table 106 France: Market, by Application, 2021-2028 (USD Million)

Table 107 France: Market, by End-user, 2021-2028 (USD Million)

10.3.4 Italy

10.3.4.1 Favorable Government Support for the Establishment of Biotech Startups to Support Market Growth

Table 108 Italy: Market, by Product & Service, 2021-2028 (USD Million)

Table 109 Italy: Market, by Test Type, 2021-2028 (USD Million)

Table 110 Italy: Market, by Application, 2021-2028 (USD Million)

Table 111 Italy: Market, by End-user, 2021-2028 (USD Million)

10.3.5 Spain

10.3.5.1 Increasing Focus on Development of Apis to Fuel Uptake

Table 112 Spain: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 113 Spain: Market, by Test Type, 2021-2028 (USD Million)

Table 114 Spain: Market, by Application, 2021-2028 (USD Million)

Table 115 Spain: Market, by End-user, 2021-2028 (USD Million)

10.3.6 Rest of Europe

Table 116 Rest of Europe: Market, by Product & Service, 2021-2028 (USD Million)

Table 117 Rest of Europe: Market, by Test Type, 2021-2028 (USD Million)

Table 118 Rest of Europe: Market, by Application, 2021-2028 (USD Million)

Table 119 Rest of Europe: Market, by End-user, 2021-2028 (USD Million)

10.3.7 Europe: Recession Impact

10.4 Asia

Figure 23 Asia: Sterility Testing Market Snapshot

Table 120 Asia: Market, by Country, 2021-2028 (USD Million)

Table 121 Asia: Market, by Product & Service, 2021-2028 (USD Million)

Table 122 Asia: Market, by Test Type, 2021-2028 (USD Million)

Table 123 Asia: Market, by Application, 2021-2028 (USD Million)

Table 124 Asia: Market, by End-user, 2021-2028 (USD Million)

10.4.1 China

10.4.1.1 Favorable Government Policies to Increase Drug Manufacturing to Drive Market

Table 125 China: Market, by Product & Service, 2021-2028 (USD Million)

Table 126 China: Market, by Test Type, 2021-2028 (USD Million)

Table 127 China: Market, by Application, 2021-2028 (USD Million)

Table 128 China: Market, by End-user, 2021-2028 (USD Million)

10.4.2 Japan

10.4.2.1 Rising Investments for Cell & Gene Therapy Facilities to Support Market Growth

Table 129 Japan: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 130 Japan: Market, by Test Type, 2021-2028 (USD Million)

Table 131 Japan: Market, by Application, 2021-2028 (USD Million)

Table 132 Japan: Market, by End-user, 2021-2028 (USD Million)

10.4.3 India

10.4.3.1 Increasing Demand for Biosimilars to Drive Market

Table 133 India: Market, by Product & Service, 2021-2028 (USD Million)

Table 134 India: Market, by Test Type, 2021-2028 (USD Million)

Table 135 India: Market, by Application, 2021-2028 (USD Million)

Table 136 India: Market, by End-user, 2021-2028 (USD Million)

10.4.4 South Korea

10.4.4.1 Significant Exports of Pharmaceutical Drugs to Fuel Uptake of Sterility Testing Services

Table 137 South Korea: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 138 South Korea: Market, by Test Type, 2021-2028 (USD Million)

Table 139 South Korea: Market, by Application, 2021-2028 (USD Million)

Table 140 South Korea: Market, by End-user, 2021-2028 (USD Million)

10.4.5 Rest of Asia

Table 141 Rest of Asia: Market, by Product & Service, 2021-2028 (USD Million)

Table 142 Rest of Asia: Market, by Test Type, 2021-2028 (USD Million)

Table 143 Rest of Asia: Market, by Application, 2021-2028 (USD Million)

Table 144 Rest of Asia: Market, by End-user, 2021-2028 (USD Million)

10.5 Rest of the World

Table 145 Rest of the World: Sterility Testing Market, by Region, 2021-2028 (USD Million)

Table 146 Rest of the World: Market, by Product & Service, 2021-2028 (USD Million)

Table 147 Rest of the World: Market, by Test Type, 2021-2028 (USD Million)

Table 148 Rest of the World: Market, by Application, 2021-2028 (USD Million)

Table 149 Rest of the World: Market, by End-user, 2021-2028 (USD Million)

10.5.1 South & Central America and the Caribbean

10.5.1.1 Growing Vaccine Production to Propel Demand for Sterility Testing

Table 150 South & Central America and the Caribbean: Market, by Product & Service, 2021-2028 (USD Million)

Table 151 South & Central America and the Caribbean: Market, by Test Type, 2021-2028 (USD Million)

Table 152 South & Central America and the Caribbean: Market, by Application, 2021-2028 (USD Million)

Table 153 South & Central America and the Caribbean: Market, by End-user, 2021-2028 (USD Million)

10.5.2 Pacific and Oceania

10.5.2.1 Improving Investments in Pharmaceutical R&D to Fuel Uptake

Table 154 Pacific and Oceania: Sterility Testing Market, by Product & Service, 2021-2028 (USD Million)

Table 155 Pacific and Oceania: Market, by Test Type, 2021-2028 (USD Million)

Table 156 Pacific and Oceania: Market, by Application, 2021-2028 (USD Million)

Table 157 Pacific and Oceania: Market, by End-user, 2021-2028 (USD Million)

10.5.3 Africa

10.5.3.1 Favorable Government Support for Healthcare Infrastructure to Drive Market

Table 158 Africa: Market, by Product & Service, 2021-2028 (USD Million)

Table 159 Africa: Market, by Test Type, 2021-2028 (USD Million)

Table 160 Africa: Market, by Application, 2021-2028 (USD Million)

Table 161 Africa: Market, by End-user, 2021-2028 (USD Million)

11 Competitive Landscape

11.1 Overview

11.2 Strategies Adopted by Key Players

Table 162 Sterility Testing Market: Key Player Strategies

11.3 Market Share Analysis

Figure 24 Market: Market Share Analysis of Key Players in 2022 (Leading Four Companies)

Table 163 Market: Intensity of Competitive Rivalry

11.4 Revenue Share Analysis of Key Players

Figure 25 Market: Revenue Share Analysis of Key Players (Top Four)

11.5 Company Evaluation Quadrant

Figure 26 Market: Company Evaluation Matrix (2022)

11.5.1 Stars

11.5.2 Emerging Leaders

11.5.3 Pervasive Players

11.5.4 Participants

11.6 Company Evaluation Quadrant: Startups/SMEs

Figure 27 Market: Company Evaluation Matrix for Startups/SMEs (2022)

11.6.1 Progressive Companies

11.6.2 Starting Blocks

11.6.3 Responsive Companies

11.6.4 Dynamic Companies

11.7 Competitive Benchmarking

11.7.1 Company Product Footprint

Table 164 Market: Product Portfolio Analysis

11.7.2 Company Geographic Footprint

Table 165 Market: Geographic Analysis

11.8 Competitive Scenario

Table 166 Market: Deals (January 2019−January 2023)

Table 167 Market: Other Developments (January 2019−January 2023)

12 Company Profiles

12.1 Key Players

(Business Overview, Products/Services Offered, Recent Developments, and Analyst's View)*

12.1.1 Merck KGaA

Table 168 Merck KGaA: Business Overview

Figure 28 Merck KGaA: Company Snapshot (2021)

12.1.2 Charles River Laboratories

Table 169 Charles River Laboratories: Business Overview

Figure 29 Charles River Laboratories: Company Snapshot (2021)

12.1.3 Biomérieux SA

Table 170 Biomérieux SA: Business Overview

Figure 30 Biomérieux SA: Company Snapshot (2021)

12.1.4 Sgs SA

Table 171 Sgs SA: Business Overview

Figure 31 Sgs SA: Company Snapshot (2021)

12.1.5 Sartorius AG

Table 172 Sartorius AG: Business Overview

Figure 32 Sartorius AG: Company Snapshot (2022)

12.1.6 Thermo Fisher Scientific Inc.

Table 173 Thermo Fisher Scientific: Business Overview

Figure 33 Thermo Fisher Scientific Inc.: Company Snapshot (2022)

12.1.7 Wuxi Apptec

Table 174 Wuxi Apptec: Business Overview

12.1.8 Samsung Biologics

Table 175 Samsung Biologics: Business Overview

Figure 34 Samsung Biologics: Company Snapshot (2021)

12.1.9 Genscript

Table 176 Genscript: Business Overview

Figure 35 Genscript: Company Snapshot (2021)

12.1.10 Pacific Biolabs

Table 177 Pacific Biolabs: Business Overview

12.1.11 Nelson Laboratories, LLC

Table 178 Nelson Laboratories, LLC: Business Overview

* Business Overview, Products/Services Offered, Recent Developments, and Analyst's View Might Not be Captured in Case of Unlisted Companies.

12.2 Other Players

12.2.1 Pace Analytical

12.2.2 Rapid Micro Biosystems, Inc.

12.2.3 Tentamus

12.2.4 Singota Solutions

12.2.5 Neopharm Labs Inc.

12.2.6 Lexamed

12.2.7 Astell Scientific Ltd.

12.2.8 Himedia Laboratories

12.2.9 Pall Corporation (Part of Danaher Corporation)

12.2.10 Boston Analytical

12.2.11 Solvias AG

12.2.12 Bd

13 Appendix

13.1 Discussion Guide

Companies Mentioned

- Astell Scientific Ltd.

- BD

- Biomérieux SA

- Boston Analytical

- Charles River Laboratories

- Genscript

- Himedia Laboratories

- Lexamed

- Merck KGaA

- Nelson Laboratories, LLC

- Neopharm Labs Inc.

- Pace Analytical

- Pacific Biolabs

- Pall Corporation (Part of Danaher Corporation)

- Rapid Micro Biosystems, Inc.

- Samsung Biologics

- Sartorius AG

- Sgs SA

- Singota Solutions

- Solvias AG

- Tentamus

- Thermo Fisher Scientific Inc.

- Wuxi Apptec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | March 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |