Key Highlights

- The Apartments and Condominiums markets were impacted by the COVID-19 pandemic in several ways. On the one hand, lockdowns and the increased use of remote working practices are expected to increase the demand, and accommodative monetary policies are anticipated to improve its affordability. The economic downturn and increases in unemployment are expected to weigh negatively on demand. Due to lockdowns, most of the construction activity and property transactions came to a halt during the pandemic. In 2021, as soon as the lockdown relaxation took place, the apartment and condominiums market surged.

- The steady state of the Italian housing market is due to the high demand. But the situation is now dire due to rising prices, a declining economy, continued political unrest, and the negative effects of Russia's invasion of Ukraine.

- According to real estate portal Idealista, national property prices increased by a negligible 1.4% to an average of EUR 1,827 (USD 1,868) per square meter (sq. m.) over the year leading up to Q2 2022. Inflation-adjusted, house prices actually decreased by 6%.

- In Q2 2022, the average price of a residence in Rome, the capital and largest city of Italy, was EUR 3,008 (USD 3,074) per square meter, up barely 0.9% from the previous quarter but down 6.5% when adjusted for inflation.

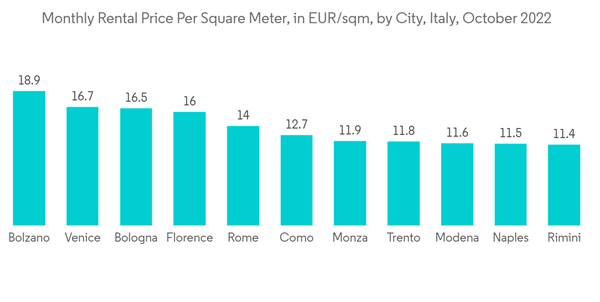

- The most costly housing in the nation is found in Milan, Bolzano, and Venice, where typical house prices currently stand at EUR 4,828 (USD 4,935), EUR 4,479 (USD 4,580), and EUR 4,394 (USD 4,493) per square meter, respectively.

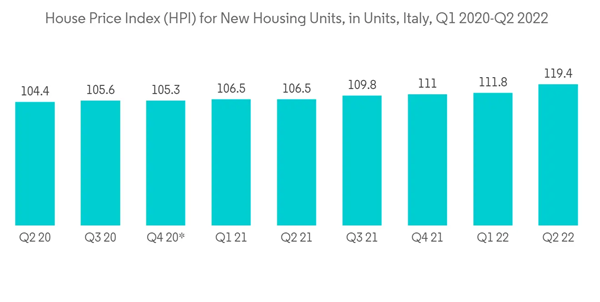

- According to the most recent data from the National Institute of Statistics (ISTAT), the national house price index increased overall by 4.6 percent from Q1 2022 to Q1 2023, but declined by approximately one percent when adjusted for inflation. In the same time frame: The price of new homes increased by 4.98% (-0.66% inflation adjusted), Existing home price increases were 4.51% (-1.1% adjusted for inflation).

- According to the national listing portal Idealista, Milan, the second-most populated city in Italy, has surpassed Venice as the most expensive city in the nation, with an average property price of EUR 4,828 (USD 4,941) per sq. m. in June 2022, up 5.7% from a year earlier. The average housing price in Venice, the "City of Canals" and one of Italy's most gorgeous towns, dropped by 1.3% year over year to EUR 4,419 (USD 4,522) per square meter during the same time frame.

Italy Condominiums and Apartments Market Trends

Despite skyrocketing living expenses fueled by high inflation, average home prices in Italy rose.

The COVID-19 pandemic has dealt another blow to Italy's still-fragile economy, which has never fully recovered from the 2008-2009 global financial crisis. The Italian economy was expanding slowly prior to the financial crisis, with average GDP growth of 1.2% from 2001 to 2007. Since then, it has been a horrible ten years. 2008 had a 1% decline in the economy, while 2009 saw a further 5.3% decline. According to the data, the nation's growth returned to 1.7% in 2010 and 0.7% in 2011, but it declined by 3% in 2012 and 1.8% in 2013.The Italian economy steadied in 2014, then expanded marginally by 0.8%, 1.3%, 1.7%, and 0.9% in the following years. Italy's economy expanded by a pitiful 0.5% in 2019, despite trade disputes and dim investment prospects.

During the Covid-19 pandemic's beginning in 2020, the economy saw a severe 9% recession. When pandemic-related limitations were eased, the economy grew by 6.6% last year; nonetheless, this was not enough to completely make up for the previous year's significant fall.

According to projections made public by the European Commission, real GDP growth is expected to be 2.9% this year and 0.9% in 2023 for the third-largest economy in the eurozone.Italy's average home prices rose once more in the first quarter of 2022, despite the country's skyrocketing inflation-fueled cost of living.

According to figures from Italy's national statistics organization Istat, housing prices in Italy increased by 1.7 percent from the previous quarter and by 4.6 percent from the same time last year. Both new and used homes are affected by the price increase.The cost of new residences increased by 5%, which is a small slowdown from the 5.3 % increase in the previous quarter in 2021

Private letting is unattractive due to low rental yields.

For Italian landlords, private renting is not appealing. Rent regulations and other limitations result in low profits on rental properties. According to a recent study by the Global Property Guide in June 2022, gross rental yields-the return generated on the purchase price of a rental property, before taxation, vacancy expenses, and other costs-range from 2.9% to 5.5% in the historical districts of Rome, Milan, and Venice.In Rome, the monthly rent for a 120-square-meter apartment ranges from EUR 1,500 (USD 1,528) to EUR 2,700 (USD 2,750). In Milan, the monthly rent for a 120-square-meter apartment ranges from EUR 2,100 (USD 2,139) to EUR 3,600 (USD 3,666). In Venice, the monthly rent for a similar-sized apartment ranges from EUR 2,000 (USD 2,037) to EUR 2,600 (USD 2,648). For flats measuring 120 square meters, the monthly rent in Florence ranges from EUR 2,100 (USD 2,139) to EUR 2,500 (USD 2,546).

The predatory taxation structure in Italy makes things worse, as round-trip transaction expenses for residential real estate can be substantial. The typical rental agreement permits free negotiation of the first rent but binds the landlord to a four-year agreement with the tenant's right to renew for an additional four years. Rent increases are limited to 75% of the cost of living index per year; for example, if inflation is 2%, your rent rise is limited to 1.5%.

Due to these limitations rent increases, the majority of landlords prefer to "frontload" lengthy rental agreements in order to account for projected future rent increases, inflation, and capital value appreciation. Frontloading further raises rents for new contracts artificially.

Despite this, since the middle of the 1990s, average rents have fallen behind inflation. From 2000 to 2008, home prices increased by an average of 6.3%, although rentals only increased by an average of 2.5% throughout that time. The disparity has, however, been closing recently due to the weak housing market, with house prices declining a total of 1.2% (-2.3% inflation-adjusted) between 2011 and 2021.

Italy Condominiums and Apartments Industry Overview

The Italy condominiums and apartments market is fragmented with the presence of a large number of local and regional players, as well as global players. The major players include Salini Costruttori SPA, Impresa Pizzarotti & C. SPA, Sicim SPA, C.M.B. Societa' Cooperativa Muratori E Braccianti Di Carpi, Rizzani De Eccher SPA and many others.The demand for affordable housing and multi-family residential real estate is driving the market and the existing players need to invest in this segment to sustain in the market. While local players can hold a good share of the market by investing in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Salini Costruttori SPA

- Impresa Pizzarotti & C. SPA

- Sicim SPA

- C.M.B. Societa' Cooperativa Muratori E Braccianti Di Carpi

- Rizzani De Eccher SPA

- Consorzio Integra Soc Coop

- IGEFI SRL

- Takenaka Europe Gmbh

- Impresa Tonon SPA

- Techbau SPA

- Facile Ristrutturare SPA

- Impresa Percassi SPA

- IREM SPA*