Key Highlights

- The coronavirus outbreak dealt a significant blow to the European economy, negatively affecting many industries and disrupting supply chains. The maritime transport industry was no exception. Container carriers have been facing port closures and congestions, leading to high numbers of skipped sailings and long waiting times at some ports. Moreover, freight rates have increased considerably since the beginning of the pandemic, leading to growing prices of consumer goods manufactured overseas.

- During COVID-19, the most seaborne cargo was handled in the ports of Rotterdam, Antwerpen, and Hamburg, making them the backbone of the maritime trade in Europe. Just the Port of Rotterdam alone accounted for nine percent of the total tonnage of cargo handled in all European ports. Moreover, the year 2019 saw the highest volume of sea freight transported in the recorded period, reaching some 979 billion tonne-kilometers according to European Commission data.

- The Europe Europe stevedoring and marine cargo handling market is anticipated to expand significantly due to increased marine traffic. Moreover, emerging nations in Europe are investing in new marine port construction. However, cargo operators are capitalizing on advanced technology equipment to reduce loading and discharging time and improve their operating efficiency. This is likely to boost the market during the forecast period.

Europe Stevedoring & Marine Cargo Handling Market Trends

Rise in Demand for Maritime Trade

According to the European Maritime Transport Environment report, maritime transport plays and will continue to play an essential role in global and European trade and economy. The EU maritime transport sector employs around 230 000 people, and European shipping accounts for over 40 % of the world’s fleet.The EU has some of the world’s largest maritime clusters. With 77% of European external trade and 35% of all trade by value between EU Member States moved by sea, maritime transport is a key part of the international supply chain. Despite a drop in shipping activity in 2020 due to the effects of the COVID-19 pandemic, the sector is expected to grow strongly over the coming decades, fueled by rising demand for primary resources and container shipping.

The Netherlands handled the largest volume of seaborne goods in the European Union (EU-27) in 2021. According to Eurostat, in the year 2021, nearly 590 million metric tons of cargo passed through Dutch ports, mainly through the Port of Rotterdam. The Port of Rotterdam is the biggest container port in Europe and one of the largest container ports in the world.

Nowadays, ships carry more than half the value of goods imported to the EU and over 40 percent of goods are exported from the EU. In 2021, about 1.1 trillion euros worth of goods were imported to the EU, and about 956 billion euros worth of cargo was exported from the EU by sea. All these activities have been increased at the port. So these factors boost the demand for the stevedoring and marine cargo handling market in Europe during the forecast period.

Increasing Container Handling Services

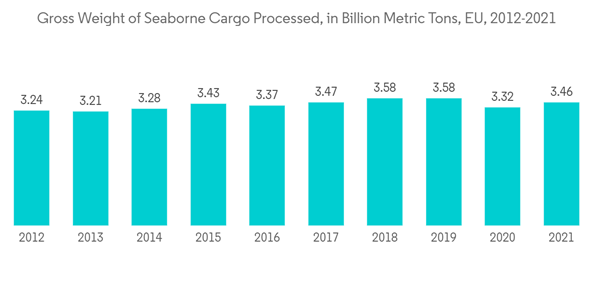

Maritime shipping has been a vital mode of transportation for European countries for centuries. This fact has not changed with the establishment of the European Union (EU) and its subsequent enlargements. On the contrary, shipping remains one of the most important means of trade for the Member States of the EU. In 2021, nearly 3.5 billion metric tons of seaborne cargo was processed at ports in the European Union (EU-27) according to Eurostat data. This represents an increase of more than four percent compared with the previous year. In 2020, only about 3.3 billion metric tons of cargo passed through the ports in the EU, reflecting the problems the global supply chain was facing amid the COVID-19 pandemic.The Port of Rotterdam in the Netherlands handles the heaviest pressure influx of European trade and commerce. Highest amongst the 10 biggest ports in Europe, Rotterdam has bulk liquid cargo handling 192 million metric tons. Total throughput of almost 437 million MT of cargo also contains 192 million MT of liquid cargo. Over 151 million MT of container goods handling is a standard demonstration of the port’s ability. The port sees an average of 28 thousand sea-going vessels and well over 90 thousand in-land vessels annually.

The stevedoring and marine cargo handling services are expected to increase during the forecast period because of the increasing size of vessels, which enhances the complexities of the stevedoring process at ports. Stevedoring operation has the largest share in terminal operations, and this segment will continue to be the revenue-generating segment for port and terminal operators.

Europe Stevedoring & Marine Cargo Handling Market Competitor Analysis

The Europe Stevedoring and Marine Cargo Handling market is fragmented in nature, with a mix of global and regional players. The market is expected to grow during the forecast period due to several factors such as e-commerce, technology integration, and growing economies. The major companies in the region have adopted various modern technologies, such as warehousing management systems, automation, drone delivery, and the transportation management system, which has enabled better planning and tracking facilities, resulting in increased productivity and increased value proposition. Some of the major players include Finnsteve Oy Ab, Holger Kristiansens Succsrs. A/S, Mainport, Schulte & Bruns GmbH & Co. KG, and Luka Koper, d.d.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

1 INTRODUCTION1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

4.1 Current Market Scenario

4.2 Value Chain/Supply Chain Analysis

4.3 Technological Trends and Automation in Ports

4.4 Government Regulations and Initiatives

4.5 Insights on Bunkering Services

4.6 Insights into Containerized and Non-containerized Shipments

4.7 Insights on Transshipment Trade

4.8 Insights on Investments in the Maritime Industry

4.9 Insights on the Number of Establishments and the Maritime Sector's Contribution to the Total Services Sector

4.10 Insights on Stevedoring Services and Charges in the Ports

4.11 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

5.1 Market Drivers

5.2 Market Restraints/Challenges

5.3 Market Opportunities

5.4 Industry Attractiveness - Porter's Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Bargaining Power of Buyers/Consumers

5.4.3 Bargaining Power of Suppliers

5.4.4 Threat of Substitute Products

5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

6.1 By Type

6.1.1 Stevedoring

6.1.2 Cargo Handling and Transportation

6.1.3 Others

6.2 By Cargo Type

6.2.1 Bulk Cargo

6.2.2 Containerized Cargo

6.2.3 Other Cargo

6.3 By Country

6.3.1 Germany

6.3.2 United Kingdom

6.3.3 France

6.3.4 Russia

6.3.5 Spain

6.3.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

7.1 Overview (Market Concentration and Major Players)

7.2 Company Profiles

7.2.1 Dr. Cap. Nicola De Cesare

7.2.2 Ership S.A.

7.2.3 Finnsteve Oy Ab

7.2.4 Holger Kristiansens Succsrs. A/S

7.2.5 Klaipeda Stevedoring Company "BEGA"

7.2.6 Mainport

7.2.7 Man-Tess Ltd

7.2.8 Mann Lines

7.2.9 Schulte & Bruns GmbH & Co. KG

7.2.10 Luka Koper, d.d. *

8 FUTURE OF THE MARKET

9 APPENDIX

9.1 Macroeconomic Indicators

9.2 Insights on Capital Flows

9.3 External Trade Statistics - Export and Import, by Product

9.4 Insights on Key Export Destinations

9.5 Insights on Key Import Origin Countries

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dr. Cap. Nicola De Cesare

- Ership S.A.

- Finnsteve Oy Ab

- Holger Kristiansens Succsrs. A/S

- Klaipeda Stevedoring Company "BEGA"

- Mainport

- Man-Tess Ltd

- Mann Lines

- Schulte & Bruns GmbH & Co. KG

- Luka Koper, d.d.