Key Highlights

- The SMEs in the local shipping sector are adopting robotic processes in day-to-day operations. Going forward, drones could be used to transport small packages such as medicine or documents to and from ships docked in Singapore's ports.

- On January 2021, Singapore’s parliament introduced an amendment to the current Electronic Transactions Act, which could allow cross-border trade documents to be digitized. This is an important development for Singapore which is a shipping and finance hub.

- A shipping agency will usually take care of all the routine tasks of a shipping company quickly and efficiently. They ensure that essential supplies, crew transfers, customs documentation, and waste declarations are all arranged with the port authorities without delay. Due to increased activity in the Singapore port, the demand for shipping agency services also increased during the forecast period.

- Singapore has crossed the 100,000 mark for crew change carried out at the port during the ongoing COVID-19 pandemic, according to the Maritime and Port Authority of Singapore. Since 27 March 2020, MPA has facilitated 100,000 sign-on and sign-off crew of all nationalities from ships of different flags involving more than 5,000 companies and 6,700 ships.

- Singapore has retained its position as the world’s second-busiest container port and the number one bunkering port in 2020, as well as facilitated crew change for more than 80,000 seafarers amid the COVID-19 pandemic.

Singapore Shipping Agency Services Market Trends

Raise in Harbor Activity Provides Opportunities for Shipping Agency Services

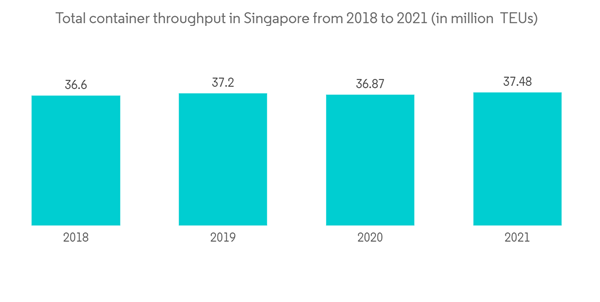

According to port data, the throughput of the Port of Singapore fell from January to August 2022 by 3.3% year over year to 388.66 million tonnes. Dry bulk freight handling reached 13 million tonnes (-18%) while oil cargo handling reached 126 million tonnes (-1.6%). To 24.9 million TEU, the port's cargo throughput decreased by 0.4%.The city-state of Singapore is situated on an archipelago in South-East Asia. The harbor moved 599 million tonnes of cargo in 2021. The container throughput in Singapore amounted to approximately 37.48 million shipping containers, or Twenty-foot Equivalent Units (TEUs), in 2021. The shipping agency services slightly increased compared to 2020 and reached an all-time high this year due to increased harbor activity at the port.

Singapore has been the busiest port in the world in terms of shipping tonnage, with an annual average of 140,000 vessel calls. It is the focal point for some 200 shipping lines with links to more than 600 ports in over 120 countries worldwide.

Customs clearance is an important step in importing or exporting products. Shipping agents can help ensure that the products arrive without delays or complications related to customs regulations. Moreover, major shipping agencies do basic Inward/Outward CIQP clearance as a mandatory service sea port agent does, which covers all activities to comply with local regulations from pre-arrival to post-departure of a vessel.

The need for shipping agency activities like arranging for shipping and receiving services, picking and packing items for shipping, preparing shipping documents, tracking packages, etc has increased. Being a transshipment hub, the companies in Singapore enjoy the flexibility of choosing the best and quickest way to get their goods delivered to customers.

Raise in Maritime Industry is Driving the Market

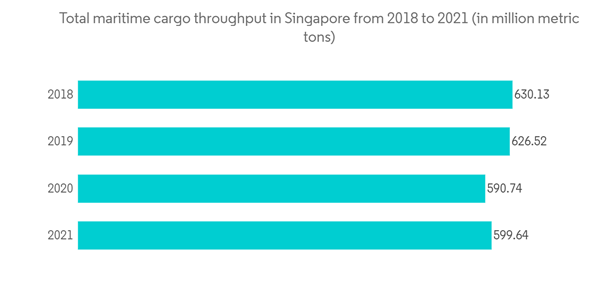

Total cargo throughput in Singapore amounted to 599.64 million metric tons in 2021. This represents a slight increase in the total volume of cargo unloaded and loaded at the port compared to the previous year. Over the measured period, the highest cargo throughput was reached in 2018, with over 630 million metric tons.As a premier Global Hub Port, Singapore is linked to 600 ports in over 120 countries, and its maritime connections to the rest of the world form an important part of its economic growth because more than 80% of the world's trade comes from the sea.

In terms of international cargo load and unloaded, the country also ranks second behind Indonesia in ASEAN. This central role of the country on a global scale is facilitated by its strategic location on the Strait of Malacca, being the first container port built in the region.

The main services at the port include arranging customs clearance, cargo loading/unloading, and inspection; handling the consignment and transshipment of goods and containers; undertaking cargo canvassing/ booking, signing transportation contracts, bills of lading, collecting freight, drafting documentation and settling payment, handling the related business of passengers transport by sea. All these activities are taken care of by the shipping agency.

The maritime sector now continues to be a significant engine of growth for Singapore’s economy, making up 7% of the nation’s GDP and employing more than 170,000 people in various technical and commerce-related functions.

Bunkering services have also continued to grow in recent years at Singapore Port, reaching 49.9 million metric tons sold in 2021. These factors drive the Singapore shipping agency services market.

Singapore Shipping Agency Services Market Competitor Analysis

The report covers major players operating in the Singapore shipping agency services market. The market is highly fragmented and competitive, with large companies claiming significant market share.Leading players in the market include Sinoda Shipping Agency Pte Ltd, Nortrans, Singapore Shipping Corporation Limited, Capital Shipping Agency (S) Pte Ltd, Trinity Shipping Agency (S) Pte Ltd, AlfaShip Agencies (Singapore) Pte Ltd, Singapore Maritime Services, ASP Crew Management, Golden Harvest Shipping Agency, Straits Link Ship Agencies & Management Pte Ltd, etc.,

As the shipping agency service market is growing steadily and there exists abundant opportunity, the players need to embrace technologies, become more digitized, and increase the scale and efficiency of their operations. Having a strong network spanning the globe is important for companies.

To even better service their customers, many players are expanding beyond traditional ship agency services and offer freight forwarding and documentation reporting, cargo supervision, KPI tracking, logistical support services, and transportation consulting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Sinoda Shipping Agency Pte Ltd

- Nortrans

- Singapore Shipping Corporation Limited

- Capital Shipping Agency (S) Pte Ltd

- Trinity Shipping Agency (S) Pte Ltd

- AlfaShip Agencies (Singapore) Pte Ltd

- Singapore Maritime Services

- ASP Crew Management

- Golden Harvest Shipping Agency

- Straits Link Ship Agencies & Management Pte Ltd