Key Highlights

- The construction industry was deemed essential and operations were able to continue through government-imposed restrictions and lockdowns. Nonetheless, weak economic activity and uncertainty weighed heavily on the sector. However, despite the slowdown during the initial months of the COVID-19 pandemic, challenging lumber and product material prices, and shortages, the residential construction industry was a key driver in Canada’s economy in 2020.

- In the first half of 2022, housing starts were mixed across Canada’s largest urban centers. Rental construction was generally resilient, due to strong demand for this type of housing, while developers took a more cautious approach to start new condominium apartment projects, due to the higher interest-rate environment.

- Increases in construction costs and materials shortages were also felt across markets, impacting construction times and the affordability of the housing delivered. After a boom recorded in 2021, housing starts in the country's six largest census metropolitan areas (CMAs) fell 5% in the first half of 2022. The decrease in apartment construction (-9%) is the main cause of this drop. On an annualized basis, however, housing starts in the first half of 2022 remained high compared to the level of construction over the past five years.

- In the Vancouver CMA, housing starts declined by about 25% in the first half of 2022. This slowdown was mainly due to a decrease in the number of condominium apartments started, owing to the greater number of rental apartments started. Vancouver's low vacancy rate, in a more uncertain economic environment for buyers, led residential property developers to turn to the rental segment.

- After hitting historic levels in 2021, apartment starts also declined. Toronto had the largest number of housing starts in the first half of 2022 (19,520, up 7%). While the construction of apartments and row houses increased in Toronto, the construction of generally less affordable housing types (single-detached and semi-detached houses) decreased. In Ottawa, housing starts declined for almost all dwelling types.

- The decrease was particularly significant in the single-detached and condominium apartment segments, where the level of construction was very high between January and June of 2021. Rental apartments, however, recorded an increase, with low vacancy rates stimulating construction. The effects of rising interest rates and construction costs could have an even greater impact on housing starts in the coming months.

Canada Residential Construction Market Trends

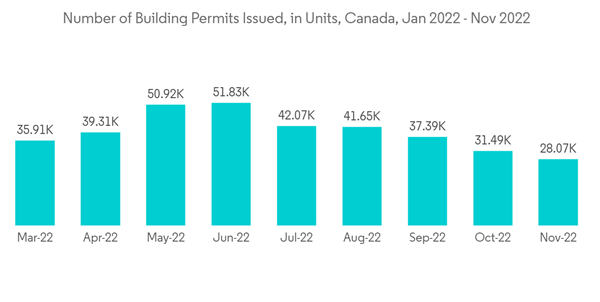

Drop in Building Permits Due to High Interest Rates

In a climate of climbing interest rates and high inflation, Canada is seeing a notable drop in building permits. According to Statistics Canada (StatCan), the value of Canada’s building permits fell by the most on record in September 2022 - a clear indication of the trying economic times. According to StatCan data, the total value of building permits for the month plummeted a dramatic 17.5% from August 2022 to USD 10.2 billion. This marks the sharpest monthly decline on record. Quarterly, the country’s building permits were down 6.3% between July and September - to USD 33.7 billion - after three consecutive quarters of increases. Year-over-year, the overall value of permits issued in September was down 2.5%. The notable drop was seen in both residential and non-residential sectors, with both sectors posting declines for the first time since September 2019. In the residential sector, permits dropped 15.6% from the previous month to USD 7.04 billion. This was weighted heavily by a drop of 21.2% in multifamily dwelling permits, a figure that is largely attributed to a 40% drop in Ontario from a record-high in August. Meanwhile, construction intentions for single-family homes dropped 7.7%, with notable declines in Ontario, Manitoba, and Alberta.Canadian building permits slipped for a second month in a row in October 2022, driven by a drop in the residential sector. The total value of building permits for October fell 1.4% from the previous month to a seasonally adjusted CAD 9.99 billion (USD 7.42 billion). On a year-over-year basis, the overall value of permits issued in October was down 6.3%. According to StatCan, building permits provide an early indication of construction activity in Canada and are based on a survey of 2,400 municipalities, representing 95% of the country's population. The issuance of a permit doesn't guarantee that construction is imminent. Intentions to build multi-family dwellings were 6.9% lower, while intentions for single-family homes were down 5.8%. The drop in permits is likely a reflection of fewer people looking to get into the market at present time, due to interest rates that render the possibility of a mortgage unrealistic to countless Canadians. In November 2022, the Bank of Canada raised its overnight lending rate by 50 points to 3.75% and indicated that it could expect even more hikes. So, it won’t be entirely surprising if a further drop in permits is seen in the months ahead.

Slow Down of Construction Cost Growth

In the third quarter of 2022, residential building construction costs increased 2.5%. The growth was slower than in the second quarter, where residential construction costs grew 5.3%. The rate of growth for residential building construction costs has notably slowed when compared to the past year and a half. Contractors attributed part of the growth in building construction costs to skilled labor shortages and high labor costs. Despite a decline in the number of vacancies for construction jobs from April to July, the vacancy rate remains high, which has kept upward pressure on wages in the industry. Labor contract renegotiations also contributed to higher labor costs in the third quarter. Additionally, higher material costs, amid the limited availability of materials and equipment, particularly concrete, steel, glass and piping, contributed to higher costs. Contractors also noted that fuel prices continue to add upward pressure on construction costs.Growth in residential building construction costs decelerated during the third quarter, with 10 of the 11 census metropolitan areas (CMAs) recording smaller quarterly increases than the previous two quarters. This slowdown was largely driven by declining softwood lumber prices that have materialized amid a downswing in US housing construction. Costs to construct residential buildings increased the most in Toronto (+4.2%) in the third quarter, followed by Vancouver (+1.9%) and St. John's (+1.7%). In Saskatoon, although high-rise residential building construction costs rose, declines in costs for single-detached houses and townhouses allowed Saskatoon to be the only CMA where residential building construction costs declined in the third quarter (-0.1%). Construction costs for residential buildings rose the most in Toronto, where costs for building low-rise apartments were the highest. By building type, high-rise apartment building construction costs recorded the greatest increase (+3.0%) in the third quarter of 2022, led by Toronto (+3.9%), and followed by Vancouver and Calgary (each up by 2.0%). Single-family homes were the buildings with the highest construction price increase in Canada in 2022.

Canada Residential Construction Industry Overview

The Canadian residential construction Market is fragmented and highly competitive, with the presence of major local and international players. However, opportunities are opening up for small and medium players due to increasing govt investments in the sector. Major players in the market include PCL Construction, EllisDon Corporation, Graham Construction, Ledcor Group of Companies, and Bird Construction Incorporated. The market presents opportunities for growth during the forecast period, which is expected to drive market competition further. Major players are competing among themselves for an increase in market share which leaves the industry with no observable levels of consolidation.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- PCL Construction

- EllisDon Corporation

- Graham Construction

- Ledcor Group of Companies

- Pomerleau Incorporated

- Bird Construction Incorporated

- Broccolini

- EBC Incorporated

- Clark Builders

- Magil Construction

- Taggart Group of Companies

- Maple Reinders Constructors Limited

- Chandos Construction

- Dawson Wallace Construction Limited

- Urban One Builders

- Buttcon Limited

- Delnor Construction Limited

- Turner Construction Company

- Marco Group of Companies

- Matheson Constructors*