The COVID-19 epidemic had a significant effect in the US on all aspects of the investment banking industry, including bank performance, covered clients, and transaction activity. With workers being relocated to a work-from-home environment, financial institutions' investment banking (IB) divisions have also been seriously affected, creating enormous operational, cultural, and business issues. Clients of the IBs have been negatively impacted by the economy. Corporate clients needed access to credit lines to increase cash on hand and cut down on capital expenditure because they were facing major revenue and cost issues. Massive increases in redemptions and declining asset values have also had an impact on institutional investors. National governments have implemented fiscal and monetary stimulus to counteract the decline in economic activity and maintain market confidence.

Investment banks generally support significant, complex financial transactions. If the investment banker's client is considering an acquisition, merger, or sale, they might offer guidance on how much a firm is worth and the best way to organize a deal. In essence, they help sell securities, mergers, acquisitions, reorganizations, and broker trades for both institutions and individual investors, in addition to underwriting new debt and equity securities for all kinds of firms. Additionally, they might issue securities to raise money for the client groups and provide the paperwork required by the US Securities and Exchange Commission (SEC) for a firm to go public.

US Investment Banking Market Trends

Artificial Intelligence is driving the market

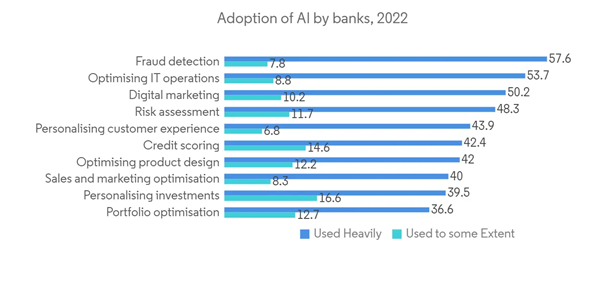

The banking and financial sector is slowly catching up with this development. Customers can organize their financial affairs with the help of chatbots, while banks use machine learning algorithms to spot patterns in cybercrime. Several fast-developing diversified AI technologies are having an impact on the banking sector, and firms are expanding their investments in AI to reach their full potential.AI can be applied in a variety of ways to analyze important data and boost organizational effectiveness. It has a variety of uses, including fraud detection, risk management, and customer service. We anticipate seeing even greater use of AI in the banking sector in 2022 as businesses look to take advantage of its many advantages.

The banking sector is being impacted by the different AI technologies that are quickly growing. Organizations are expanding their investments in AI to realize its promise for analyzing crucial data and enhancing operational effectiveness. In 2022, the investment banking sector will probably be driven by the creation and effective use of AI, opening up opportunities to engage in more consequential and transformational technology themes.

The rise of Decentralized Finance

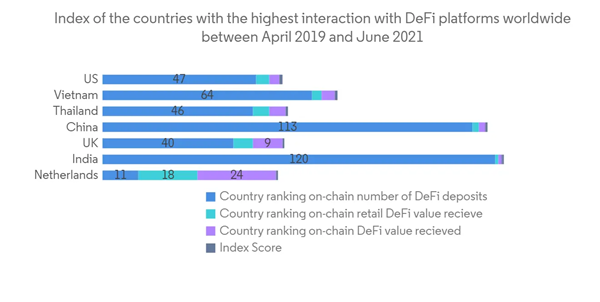

Decentralized Finance, or Defi, is currently the talk of the financial services sector. Defi is a system that enables secure, programmable, real-time transactions between holders of digital assets using blockchain and related technology. Defi is frequently referred to as "bankless finance" because there is no single organization in charge of regulating these transactions. Although this suggests more danger, it also suggests more control and reduced processing costs for participants.Goldman Sachs is one of the biggest banks in the world, and many others are starting to embrace bitcoin and other cryptocurrencies. Others in the investment banking sector are making predictions regarding the impact of blockchain on the sector. One thing is certain, though: DeFi is still in its initial phases, so keeping up with the most recent advancements in this field is essential. DeFi has a significant impact on the financial services industry.

Decentralized finance, or Defi, was most prevalent in nations like the United States and China that exchanged or transferred significant quantities of bitcoins. Contrary to a global country ranking on cryptocurrency ownership, consumers from developing countries were significantly more likely to own bitcoin than customers from industrialized nations. Defi is designed to either gain access to cryptocurrencies or move them around. Traders and institutional investors are mostly interested in the cryptocurrencies of the United States, China, the United Kingdom, and India.

US Investment Banking Industry Overview

The report includes an overview of the largest investment bankers by revenue earned and major boutique banks categorized by size, region, and industry focus operating in the market studied. Currently, some of the major players dominating the market studied, in terms of market share, are presented here, which include Goldman Sachs, Morgan Stanley, UBS, and Credit Suisse, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Morgan Stanley

- J.P Morgan Chase and co.

- Goldman Sachs

- Credit Suisse

- UBS

- Bank of America

- Evercore

- CITI

- HSBC

- Rothschild & Co.