Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Government Policy Support and Net-Zero Goals

One of the most influential drivers of the United Kingdom’s EV charging infrastructure market is the strong policy push from the government toward achieving net-zero carbon emissions by 2050. The UK government has set ambitious targets to ban the sale of new petrol and diesel cars by 2035, which is creating an urgent need for a robust, reliable, and widespread charging infrastructure. The Office for Zero Emission Vehicles (OZEV) has introduced various schemes such as the EV Chargepoint Grant and the Local EV Infrastructure Fund to encourage the installation of home, workplace, and public charging points. These funding mechanisms have provided both individuals and local authorities the financial support needed to accelerate charging network deployment.Moreover, the Automated and Electric Vehicles Act mandates that motorway service areas must install charging stations, reinforcing policy commitment to long-distance travel convenience. Such regulatory frameworks are not only catalyzing demand but also ensuring a structured and consistent rollout of charging points across the UK. As of 2024, the Zero Emission Vehicle (ZEV) mandate requires that 10% of all new van sales be zero-emission, with this target set to rise each year. This regulation is a significant driver of the United Kingdom’s EV charging infrastructure market, as it accelerates the demand for reliable and widespread charging solutions

Key Market Challenges

Uneven Geographic Distribution of Charging Infrastructure

One of the primary challenges facing the UK’s EV charging infrastructure market is the uneven geographic distribution of charging stations across the country. While metropolitan areas like London, Manchester, and Birmingham have seen significant investment and development in charging networks, rural and remote regions continue to lag behind. This disparity creates a “charging gap” that discourages EV adoption in less populated areas, where range anxiety remains a significant concern. Without convenient access to charging stations, potential users in these regions may hesitate to transition from internal combustion engine vehicles to electric alternatives.Furthermore, this imbalance undermines the government’s broader goal of inclusive and nationwide electrification. Local councils in rural areas often struggle with limited funding, planning constraints, and lower commercial viability for charging station installations, further exacerbating the disparity. Addressing this challenge requires targeted public funding, innovative mobile or shared charging solutions, and stronger collaboration between central authorities and local governments.

Key Market Trends

Expansion of Rapid and Ultra-Rapid Charging Networks

One of the most prominent trends in the UK EV charging infrastructure market is the growing emphasis on rapid and ultra-rapid charging stations. As electric vehicle adoption increases, users are demanding faster and more convenient charging experiences. In response, several infrastructure providers are rolling out high-speed chargers capable of delivering 100 kW to 350 kW, significantly reducing the time it takes to charge an EV. These rapid chargers are being strategically installed along major motorways, in retail parks, and at service stations to support long-distance travel and minimize downtime.Companies like Gridserve, BP Pulse, and Ionity are actively expanding their networks with ultra-rapid hubs that feature multiple high-powered units, solar integration, and on-site amenities. This shift toward faster charging options is critical to alleviating range anxiety and making EVs a practical choice for both urban and intercity drivers. It also reflects a broader market evolution toward matching the convenience levels of traditional refueling infrastructure. As of study, in february 2025 industry report highlighted a 37% surge in UK public EV charging points in 2024, reaching 73,334 units. While 57% remained slow chargers, rapid and ultra-rapid infrastructure grew significantly.

Key Market Players

- Chargemaster Limited (BP Pulse)

- SWARCO UK (ChargePlace Scotland)

- ChargeYourCar Ltd.

- Fastned UK Limited

- GRIDSERVE UK OMM Limited

- Tesla Inc.

- Shell International B.V.

- Pod Point Limited

- ABB Ltd.

- Instavolt Limited

Report Scope:

In this report, the United Kingdom Electric Vehicle Charging Infrastructure Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Electric Vehicle Charging Infrastructure Market, By Vehicle Type:

- Two- Wheeler

- Passenger Car

- Commercial Vehicle

United Kingdom Electric Vehicle Charging Infrastructure Market, By Type:

- AC

- DC

United Kingdom Electric Vehicle Charging Infrastructure Market, By Charging Mode:

- Plug-in

- Wireless

United Kingdom Electric Vehicle Charging Infrastructure Market, By Installed Location:

- Commercial

- Residential

United Kingdom Electric Vehicle Charging Infrastructure Market, By Connector Type:

- Type 1

- Type 2

- UK 3-Pin

- CHAdeMO

- CCS

- Others

United Kingdom Electric Vehicle Charging Infrastructure Market, By Region:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Electric Vehicle Charging Infrastructure Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Chargemaster Limited (BP Pulse)

- SWARCO UK (ChargePlace Scotland)

- ChargeYourCar Ltd.

- Fastned UK Limited

- GRIDSERVE UK OMM Limited

- Tesla Inc.

- Shell International B.V.

- Pod Point Limited

- ABB Ltd.

- Instavolt Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | August 2025 |

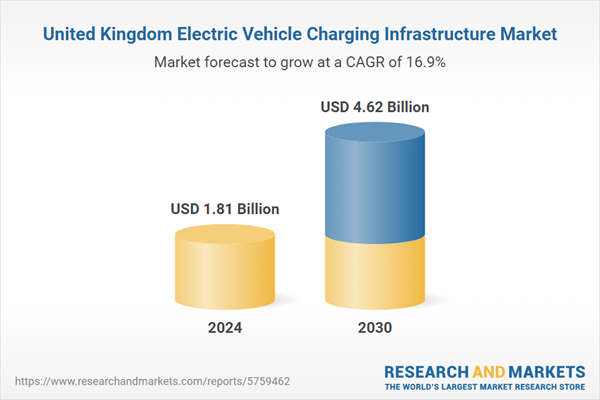

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.81 Billion |

| Forecasted Market Value ( USD | $ 4.62 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |