The rising prevalence of different dental problems, such as tooth decay, nursing caries, and tooth sensitivity, is driving the demand for baby oral care products in the worldwide market. For instance, a study published by the World Health Organization (WHO) reveals that early childhood caries is a global problem with a prevalence estimated between 60 and 90%. Further, increased parental concern for infant oral hygiene in recent years due to the risk of various infections, such as oral thrush, cold sores, and Eruption cysts, is influencing the spending on baby oral care products. Thus, the growing knowledge of parents about the need for infant oral hygiene is expected to fuel the demand in the market studied over the medium term.

In the long term, the market is anticipated to be driven by the factors such as modern parenting supported by increased access to childcare products and services, consumer awareness campaigns organized by key brands, and government policies to promote the health and well-being of children. For instance, in the United States, the HHS (US Department of Health and Human Services) educates children and parents about oral health through the initiative called Head Start Program. The program delivers services to infants, toddlers, and families in core areas of early learning, health, and family well-being.

Baby Oral Care Market Trends

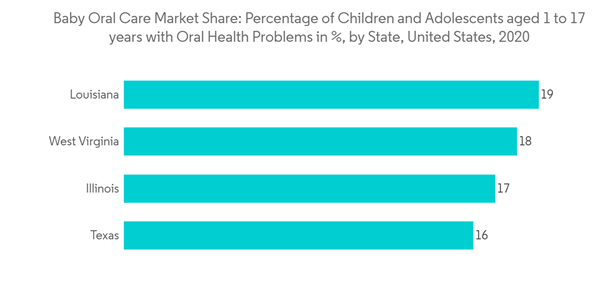

Increasing Oral Health Problems Among Kids

Modern parents are increasingly focused on preventive healthcare for their children and willing to spend on advanced products. The rising concern of various oral disorders, such as early tooth decay, bacterial infections, tongue pushing, and lip sucking, is pushing parents to use baby oral care products. For instance, the latest statistics disclosed by the Australian Dental Association in October 2022 state that by the age of 5 years, 1 in 3 children aged 5 - 6 years have already had tooth decay in a baby tooth. The government of Australia launched the 'National Oral Health Plan 2015-2024' in response to the increasing burden of poor oral health among the nation's population. The United State Government runs Medicaid and Children's Health Insurance Program (CHIP), which provides coverage for dental services, including check-ups, X-rays, fluoride treatments, dental sealants, fillings, and more to create awareness about oral health. Therefore, the rising prevalence of dental disorders, changing parenting needs, and the increasing government initiatives to promote oral health awareness are key factors driving the growth in the baby oral care market.Asia-Pacific Market is Anticipated to Register a Significant CAGR

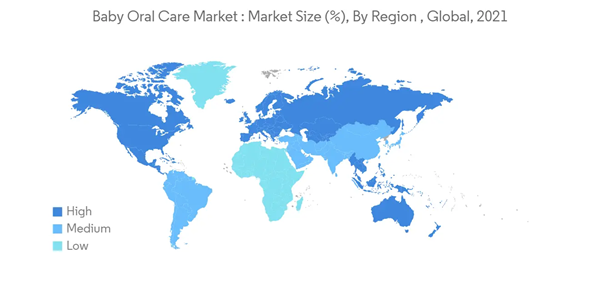

Over the past few years, the prevalence of oral disorders in children of various age groups has grown significantly in the Asia-Pacific region. For instance, according to the Directorate General of Health Services and Ministry of Health & Family Welfare, the Government of India, dental caries is a public health problem in India with a prevalence as high as 60- 80% in children. As a result, parents are now adopting baby oral care products to ensure oral hygiene and safety against bacterial infections. Thus, key brands are developing improved solutions to cater to the increase in consumer preference. For instance, in June 2020, Henry Blooms Health Products, Australia’s supplement company, expanded its product range with the launch of three new probiotic-toothpastes for kids, featuring a strain Dental-Lac. The toothpaste includes Xylitol, aloe vera, and peppermint to support the oral and dental hygiene of kids. Thus, the increasing importance of oral health among Asian parents and the availability of advanced solutions are the key factors anticipated to push the demand for baby oral care products during the forecast period.Baby Oral Care Market Competitor Analysis

The baby oral care market is highly competitive, with a large number of regional and international players. The prominent players in the market are Colgate-Palmolive, Procter & Gamble, Unilever PLC, and GlaxoSmithKline PLC, among others. The players are adopting strategic approaches such as partnerships, mergers & acquisitions, and product innovation to strengthen their market position. For instance, in July 2022, Safe-O-Kid, one of India’s fastest-growing baby product brands, launched unique Oral Care and Sensory Kits to improve children’s oral hygiene and oral motor function. The product is available for children up to 12 years.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amway

- Colgate-Palmolive Co.

- GlaxoSmithKline PLC

- Henkel AG & Co. KGaA

- Johnson and Johnson Inc.

- The Procter & Gamble Company

- Kao Corp.

- Pigeon Corporation

- Uniliver PLC

- Sunstar Suisse SA